FUYOH! M’sian gomen pumping RM20 billion to save economy?! Sure ONOT!?

- 1.1KShares

- Facebook1.1K

- Twitter1

- WhatsApp2

By now most of ugaiz would know our Ringgit isn’t very strong atm. We talked about our economy and currency in a bit more detail in a previous article and we mentioned that while there are economic factors, there also could be political factors that is causing our Ringgit to slide. Add in the whole 1MDB fiasco and we have ourselves in some pretty challenging times la.

And despite our PM saying that we’re prepared to handle the economic downturn, no one likes their currency to fall la, even our gomen. And so recently, our PM recently announced that the gomen is gonna pump in RM20 billion into the economy to strengthen it. That is not a typo. It’s RM20 billion, not million.

RM20,000,000,000.

But that’s not all.

Yeap, we not be to kidding of you. The RM20 billion is going into a company that sounds like an affordable bottle cap manufacturer more than anything else. Ladies & gentlemen, presenting ValueCap.

Don’t worry if you’ve never heard of it, none of us at the CILISOS office heard of it prior to this story. But when we heard about this, we were quick to try and find out. Joining us on is once again, Alvin Vong, Director of EquitiesTracker.com, who’s helped us before.

But first…

Tot gomen running out of money… Where is the money coming from??

Before we get into that, let’s put into perspective just how much this RM20b is. A transcript of our PM’s 2015 budget speech puts the country’s budget for 2015 at RM273.9b:- RM223.4 billion is for Operating Expenditure while RM50.5 billion for Development Expenditure. If you take into account the RM5.5 billion worth of budget cuts, we would be left with RM264.8 billion.

So if you do the math, RM20b is about 7.5% of the budget for the whole of Malaysia! And that much money is going into just ONE company.

Yep… but as we ALSO covered before in a previous article, there are signs that the gomen isn’t exactly pimping it right now. Before we even begin to talk about the company that’s getting RM20billion, let’s deal with the elephant in the room first la k? Where does a country, that has a company with RM42 billion worth of debt, get another RM20 billion to give to another company?

First & foremost, we must give the official answer from our gomen.

“The money will come from the shareholders (of ValueCap) and will not be an allocation from the government.” – Minister in the Prime Minister’s Department Datuk Seri Abdul Wahid Omar, as quoted by The Edge Markets.

According to ValueCap’s website, it is equally owned by 3 government-linked-companies (GLC).

- Khazanah Nasional Berhad – The ORIGINAL sovereign wealth fund, that invested in Axiata, Telekom Malaysia, Tenaga Nasional, CIMB Group, PLUS Expressways, Malaysia Airlines, Malaysia Airports and UEM Land.

- Kumpulan Wang Persaraan (KWAP) – It’s like KWSP (which anyone paying EPF should know), but for gomen civil servants.

- Permodalan Nasional Berhad (PNB) – Which owns Amanah Saham Nasional Berhad (ASNB) and is the biggest fund manager in Malaysia.

Pandan MP, Rafizi Ramli mentioned that ValueCap only had about RM3 billion in assets. A quick look at ValueCap’s 2013 financial report (they didn’t have one for 2014) showed that they did have RM2.7 billion listed under ‘available-for-sale financial assets’ amongst other things. But from what we can understand from it, they do not anything close to RM20b on their own la. (Please do let us know if we’ve understood it wrongly.)

Which means that even if they sold off all their assets (and they probably won’t) and pooled together all their resources, we don’t think it will be enough. Its 3 owners would still have to fork out a few billion at least.

Do they have the money?

Because according Khazanah’s 2014 & KWAP’s 2013 financial reports (we were unable to find PNB’s reports), they showed that these 2 companies did have assets that could be sold to raise funds (current assets, totalling about RM12.9b between them). And if these two companies are capable of raising that amount, it wouldn’t be totally absurd for 3 companies to raise RM20b right?

But does that mean that they won’t be directly touching gomen money?

….

Each of these companies (Khazanah, PNB, & KWAP) mention that they are, in some way, gomen investment funds with different purposes.

“It’s like the government digging into their piggy bank.” – Alvin Vong

So despite our gomen saying that the money will not affect our annual budget, the gomen is using its savings. Meaning that it is, in some way, still funded by the gomen! But just say la, they don’t raise the money from their assets or using their own money, Rafizi Ramli mentioned that the 3 GLCs could possibly turn to bonds to raise the money but that such a move will come with a drawback.

So despite our gomen saying that the money will not affect our annual budget, the gomen is using its savings. Meaning that it is, in some way, still funded by the gomen! But just say la, they don’t raise the money from their assets or using their own money, Rafizi Ramli mentioned that the 3 GLCs could possibly turn to bonds to raise the money but that such a move will come with a drawback.

What’s a bond? Well, it’s kinda like an IOU card that pays interest. But just like an IOU, you also gotta see who’s lending you the money.

“There is a risk in this. If the value of the investments drop or fail to go up, the funds will be left owing the bond market the money.” – Rafizi Ramli as quoted by The Rakyat Post.

And we know that if that were to happen, it wouldn’t be the first time a gomen-linked company struggled to repay a bond.

But what is one company gonna do with RM20 billion???!!

Here’s a little back story of this one company that’s gonna get RM20b from the gomen.

ValueCap was actually set up in 2003. It’s purpose? Support underperforming shares. Asia Sentinel describes it as Malaysia’s version of Hong Kong’s Tracker Fund, a powerful device which is used to support the stock market. However, ValueCap’s own website doesn’t state very clearly what it actually does. If anything, it’s constantly changing.

But what the gomen wants it to do now is to go to the stock market and…

Nah we kid, not all the undervalued stock la. Just some Malaysian ones. According to Investopedia, undervalued stocks are stocks that are a 3rd of their intrinsic value. Meaning they are potentially worth more using some complex calculation la. You can read about it in more detail here.

But back to ValueCap. Apparently, this isn’t the first time that ValueCap has been tasked by the gomen to do big money dealings. According to MalaysiaKini media statement by Lim Kit Siang, ValueCap started with RM10 billion worth of funds to help various SMEs. Then in 2008, it was reported that it got an additional RM5 billion from the gomen.

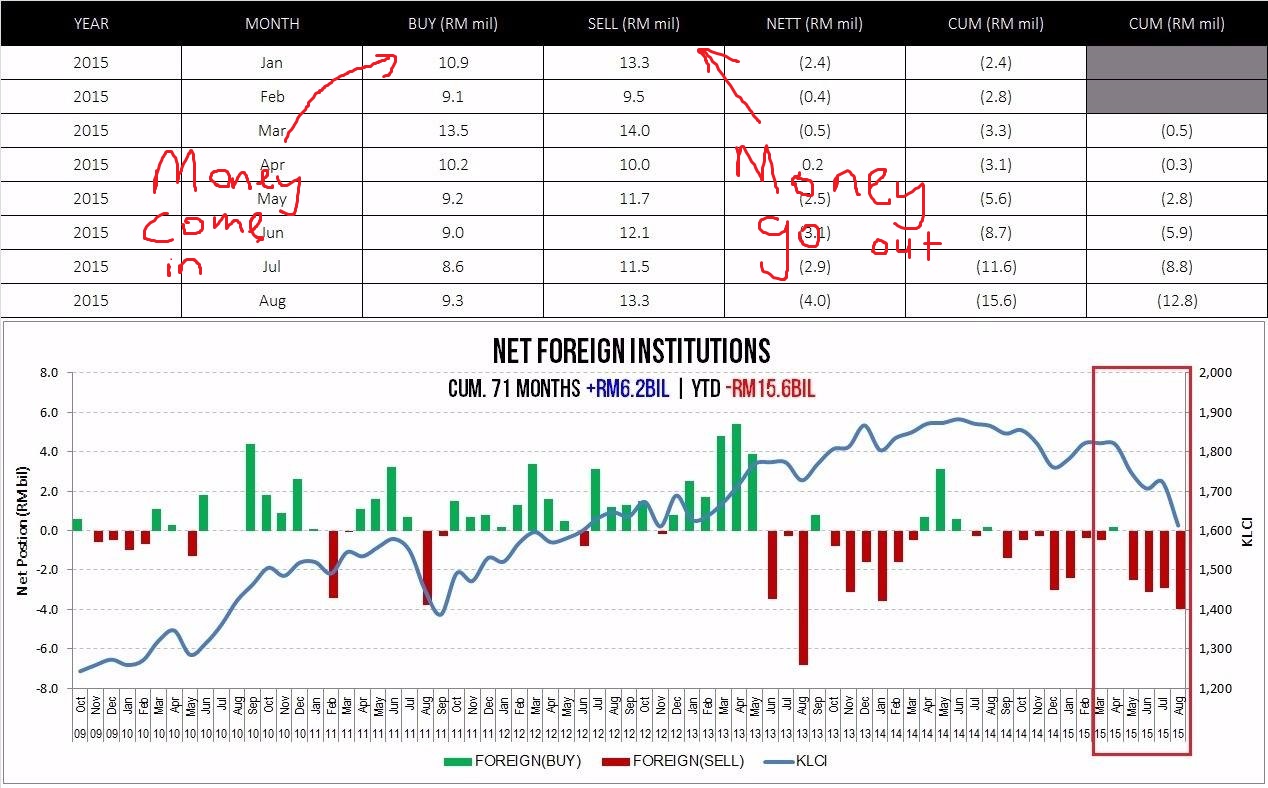

But the money isn’t to buy stocks for the sake of just buying stuff. Various analysts have mentioned that this RM20 billion injection was likely done to boost investor confidence (links here, here, & here). Why? Because foreign investors have been taking their money out of Malaysia.

This graph given to us by Alvin based off statistics from Bursa Malaysia indicate that foreign investors have been selling more than they’ve been buying, and when there is a greater demand to sell than a demand to buy, prices will fall. And thus this RM20b is meant to help build confidence so investors won’t be inclined to sell their shares.

But just how much can we trust this company to use the money wisely?

[interaction id=”55fef45266f2b66b49d83d91″]

So we tried to find out if ValueCap did a good job last time. We won’t lie. The background check wasn’t pretty la. Asia Sentinel actually wrote one whole long article about it.

The article mentions that one controversy that surrounded it was news that ValueCap was unable to repay a loan of RM5.1b. What happened next was that the Employees Provident Fund (EPF, where all your retirement money is) was gonna invest RM5b in Value Cap. So RM5.1b & RM5b you instantly connect the dots la. People instantly thought that the gomen was gonna use EPF money to bail out ValueCap.

EPF later said that the RM5b they gave ValueCap would NOT be used to repay their loans, but the money still went to ValueCap. We’ve honestly tried very hard to find out if ValueCap has since repaid their loans but the trail stops with an article by Reuters that stated that the deadline was extended to 2012.

In regards to the EPF money, we found article that claims that the money loaned to ValueCap had no government guarantee as with 13 other loans they approved. But as far as the gomen goes, they have said that ValueCap has generated high returns for its shareholders.

So is this RM20b gonna save our economy or is it another waste of money?

We know we’ve just talked about the not so great stories associated with ValueCap but you know what? Since the gomen announced this whole RM20 billion injection, our Ringgit has recovered slightly.

The Malay Mail Online reported on Sept 17 that Bursa Malaysia closed higher than the previous day for 3 consecutive days due to the gomen’s measures AND an increase in oil prices worldwide. The Star on the other hand, reported that the Ringgit improved to around RM4.25 per USD (yea not very high but better than RM4.31 per USD at the beginning of the week).

[Update] The Ringgit is falling again, we repeat, the Ringgit is falling again!

And though The Star mentions that the money has not yet been given to ValueCap, The Edge reports that PART of the reason for the Ringgit going up is because of the announce of the RM20b.

While we mentioned that analysts have said that this RM20b was done to boost confidence, and it probably has, Alvin told us that the RM20b is a temporary measure. Some analysts mention the same thing.

“My sense is that the (Malaysia) measures are more to try and prevent a sharp fall than to get the market to rally.” – Rahul Bajoria, Asia regional economist at Barclays, as quoted by Financial Times.

“I think the goal (in Malaysia) is to shore up confidence in the currency, given that the stock market has had significant outflows.” – Euben Paracuelles, an analyst at Nomura, as quoted by Financial Times.

Alvin also brought up how countries like China & the US have been pumping money into their economy and how these measures may not be the most effective. Why? Because the they don’t allow market forces to determine the economy.

We were also able to find a few articles that talk about why the government’s involvement in the economy may not be the best solution here, here, here, & here albeit using the US as an example.

TLDR: Stop messing with the market, and let people decide how Malaysia’s economy really is.

But if this RM20b is not the answer to our problems, what is???!!

An analyst mentions that to determine whether pumping in this RM20b was a good move or not depended on which would last longer: our pockets or the negative sentiments towards the country’s economy.

We believe that in other words, this means that pumping in money into our economy is a good thing as long as we have enough to last the negative sentiments towards our country. And that actually just means one thing:

We gotta do stuff that will restore the confidence laa!

Alvin tells us if we want to restore our economy in the long run, we would need to have a couple of things such as a growing middle class, good governance, & an environment that encourages innovation. This article by The Star mentions that certain sectors of our economy need to be more competitive. Lim Kit Siang says that other, potentially less popular, measures need to be put into place like reducing our budget & raising taxes.

There are many opinions la, and they all may work. But WSJ has gone further to say that investors are waiting to see how our political situation pans out before deciding whether to invest in Malaysia. If that is the case, then it is no longer an economic thing la.

There are probably other things that need to be fixed besides our economy

Yea you probably knew this already. Our economy needs some help la, regardless of whether our fundamentals are strong or not.

About a month earlier, our deputy finance minister also asked that Malaysians spend locally while a professor asked that students study in Malaysia to help the economy. Besides that, The Star reports that the RM20b is one of a few measures our gomen is implementing to save our economy. In the same article, they mention that he encourages companies to take the profit they’ve made overseas and invest in local projects.

But we can’t help but feel a bit amused by DAP’s reply to these calls to spend more money locally.

We mentioned earlier than investors could be waiting for our politicial situation to settle, but here’s what the BBC had to say about the RM20billion.

“The Malaysian Prime Minister, Najib Razak, has announced a multi-billion-dollar plan to help revitalise the country’s struggling economy. He’s facing slower growth and a currency that has lost nearly a fifth of its value against the US dollar since the beginning of the year. The prime minister is also no doubt keen to refocus attention on the economy, as he deals with allegations of corruption.” – BBC News

WAHLAU. If you’re an investor reading this in the London paper, would you want to invest!? There are so many holes in the Malaysian economic story now, that economic factors may not be the only thing that the gomen needs to consider. Even our very own governor of Bank Negara, Zeti Aziz said that some domestic issues have affected the sentiment & confidence in our economy.

“We have some domestic issues that have affected sentiment and confidence. These are the things that need to be resolved.” – Zeti Aziz, Bank Negara, to NST.

And if the woman who signs every Ringgit note is saying that, then 20 billion notes isn’t going to make a lasting difference.

[Update 21/9/15] Tan Sri Zeti Aziz said today that the Ringgit can recover once the 1MDB issue is resolved, and that people deserve to get the answers to their questions about it.

“We don’t need another scandal. We don’t need political instability. All the issues regarding 1MDB need to be resolved, only then can we see the Ringgit rise again.” – Translated quote from Tan Sri Zeti Aziz as quoted by Astro Awani.

She also said that besides a resolution of our country’s domestic issues, other factors that could help our economy included an eventual decision by the US Federal Reserve to raise interest rates, a recovery in global commodity and energy prices and an improvement in China’s economy.

- 1.1KShares

- Facebook1.1K

- Twitter1

- WhatsApp2

4 Comments