4 Budget 2024 initiatives that don’t seem to make sense

- 87Shares

- Facebook70

- Twitter4

- LinkedIn4

- Email4

- WhatsApp5

Guess who’s back with another budget article?

Yes, yes, we know we’re late, but that just means you guys had plenty of time to head out to the mamak for that preliminary budget discussion lah kan… Heck, you’re probably better experts than us, at this point! *wink wink*

On a more serious note, Budget 2024 is nothing too new. It’s more of a follow-up from last year’s edition, with a couple of tweaks and upgrades here and there. We’ll say that’s good news, since it implies the government is letting their policies settle in for the long term.

That said, try combing through a 140 page document and you’re bound to find some interesting stuff. And find them we did! At first glance, these were things that either had us going, Yep, sounds good or Ugh, but why… The closer we looked though, we felt like they left us with more questions than answers. So without further ado, let’s dive right in.

No service tax hike for F&B… but food prices will rise anyway

Fun fact, Anwar actually mentioned ‘the rakyat’ 54 times in his speech last Friday.

The emphasis was probably because one of the main goals of the budget this year is to improve the rakyat’s well being. So when he proposed raising the service tax from 6% to 8%, Anwar specifically mentioned that the hike won’t include the food and beverage industry, nor telco— that way, the rakyat wouldn’t be burdened. On paper, that is.

As we all know, inflation, price hikes and taxes usually trickle down the consumer chain. Experts have weighed in and they agree— one way or another, with the cost of logistics and supplies going up, the new SST rate will make its way into food prices.

What’s more, with the ceiling price of eggs and chicken now lifted, we’re going to feel that pinch in our wallets a lot sooner. Just to give you an idea how high those prices will jump, get this– the government was spending RM200 million PER MONTH on subsidies for chickens and eggs alone. It’s a lot, but we gotta say, lifting this limit is probably for the best, since subsidies were the main reason we had such severe shortages both this year and last.

In any case, just eat less eggs and chicken, then settle already lah. 🗣️Nexxxxxt…

Gomen take away T20 electric subsidy… but want us to drive more electric cars???

One thing’s for sure, there’s a whole lot of green in this new budget… in more ways than one. As per tradition, this year’s belanjawan is the biggest thus far, capping at RM398.3 billion. And apart from actual environmental policies, it seeeeeems the government is trying to encourage the use of electric vehicles. Oh, how did we guess? Well, just take a look at some of these incentives:

- 180 brand spanking new EV charging stations will be installed throughout the country.

- Those earning under RM120k a year will get a RM2,400 rebate should they buy electric motorcycles.

- 150 electric buses will be used in the new LRT3 projects.

- Government will extend tax relief and tax deductions for using EV facilities

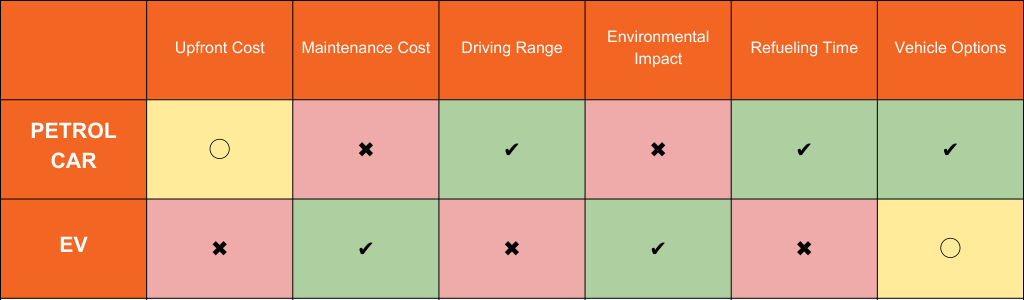

These are some pretty generous incentives ofc, but owning an electric car isn’t as straightforward as walking into a dealership and rolling out in your handy dandy Myvi. First of all, an EV itself can cost 2.5 to 3 times more, and that’s on the lower end of things. There are also hidden costs to consider, like maintenance fees and charging tools, which aren’t as easily available or budget-friendly in our part of the world. Safe to say, EVs in Malaysia are for those who take home a sliiiiightly more atas salary.

But what’s interesting is that in other electric-related Budget 2024 news, the top 10% of electricity consumers will no longer be enjoying government subsidies. Now we don’t have the info on the tariff rates yet, but unless you live in a mansion and have 31 airconds and you’ve just bought 5 EVs in one go… chances are, an electric car will probably not deprive you of your subsidies, though it will definitely add quite a bit to your bill.

Alternatively, you could simply not buy a car and just run and/or jog and/or crawl everywhere. 🗣️Nexxxxxt…

The new luxury tax can potentially beban the poor more than the rich

Some of you guys may remember that Anwar had in fact brought up the idea of a luxury tax during Budget 2023. And we can see why– it’s basically an untapped goldmine in revenue. Imagine: a 10% tax on a RM100,000 fancy watch can get you (the gomen) RM10,000 in just one go! Except, concerns were raised last year that a too high tax might deter foreign tourists from buying these luxury goods in our country.

Now in his proposal this year, Anwar has thrown the idea into the washing machine, spun it around and has it all cleaned up. He’s keeping the tax, but has exempted foreigners from it. We don’t have the full details yet, but apparently this tax will cover jewellery and watches, among other things. And while it makes sense at first, since mostly the rich will be the ones spending on luxury items, in hindsight, that’s not really the case.

Show of hands, how many you buy gold as a form of investment?

Yeah, exactly what we thought. Many people actually buy gold, whether to keep or pass on, because it maintains value over time. So a luxury tax might not be such a good idea after all, since it would make gold very unaffordable to a large group of people– specifically, people who are outside the target group of this tax. And that’s not even mentioning married couples who do kinda expect a ring or two when they exchange their vows. At the end of the day, the rich can just head overseas to buy their stuff at a lower price, and then no one will be benefitting from this luxury tax!

So perhaps the challenge for our government here would be to work out the finer details of this whole thing, so that no one is quite left out, while they (the gomen) get their steady flow of income. 🗣️Nexxxxxt…

Rationalize diesel subsidy? Great! ………….how does it work?

This one is really just us with our hands open, going:

For those who don’t know, rationalizing a subsidy basically means redistributing it so that only those who need it will get it. In other words, we support subsidy rationalization. But you may be wondering why diesel, of all things…? Well, there’s reason to believe our diesel is being smuggled out, simply because it’s so cheap. So now the government is going to remove the subsidy and everyone has to start paying the full price of diesel at RM3.75 per liter, EXCEPT freight transport– so busses, lorries etc.

Andddddd that’s where the information on the government’s side ends.

As it stands right now, no one has explained how this rationalization will be implemented. Will it be the petrol station that has 2 pumps of subsidised and unsubsidised diesel? Does everyone still pay the same price at the station, but we keep our receipts and submit them when we file our taxes? Honestly, we have no clue, and it sounds so messy it’s hard to imagine how this will all work out. We’re not the only ones to think so either. Khairul Annuar, the president of the Petrol Dealers Association of Malaysia (PDAM), has also asked for clarification.

“If it’s direct subsidy payment to diesel subsidy recipients, then in theory everybody pays the same price at the stations. If not, we need to know the mechanism to comment further,” — Khairul Annuar, via The Malaysian Reserve

🗣️NEXX And that’s about all the interesting stuff we found. Now that we’ve reached the end though, we do wanna mention that we took some liberties with our interpretations of these policies. None of us are the big brained highly skilled economists who came up with the Budget in the first place, so do let us know if we got anything wrong. Also, if you’re looking to procrastinate on some highly urgent work, feel free to idly scroll through all 140 pages of Budget 2024.

- 87Shares

- Facebook70

- Twitter4

- LinkedIn4

- Email4

- WhatsApp5