Reducing diesel subsidy can make Malaysia a developed country. Here’s how

- 108Shares

- Facebook90

- Twitter5

- LinkedIn4

- Email4

- WhatsApp5

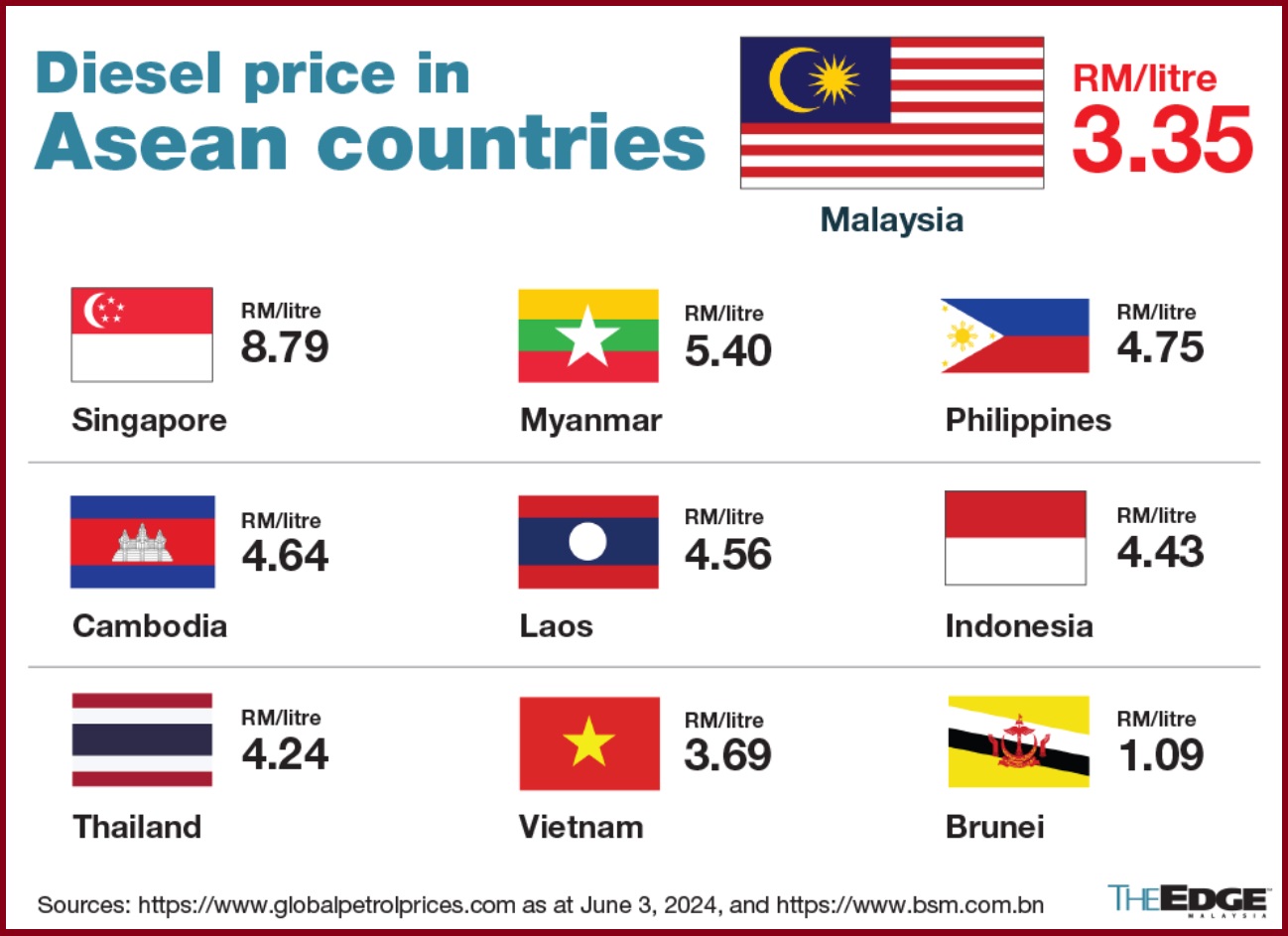

The buzz around the diesel subsidy in Malaysia has been building up lately. It started with PM Anwar floating the idea, then came the new fleet card system, and now we’ve seen the diesel price jump from RM2.15 to RM3.35 per litre.

As you’d expect, the price hike hit hard and plenty of Malaysians have been voicing their frustrations. But according to Bank Muamalat Malaysia’s chief economist, Afzanizam Rashid, this shift in subsidies is actually a good sign for the country, especially when it comes to attracting investments.

“The targeted diesel subsidy rollout could lead to an upgrade in Malaysia’s sovereign credit rating as it shows the government is serious about economic reforms and fiscal consolidation,” — Afzanizam Rashid via FMT

Now, that’s a lot to unpack so let’s go through it all one by one, starting with the reason behind the diesel subsidies.

Cutting the diesel subsidy is part three of the government’s money-saving plan

If you’ve been keeping up with the news, you may have noticed that this isn’t the first subsidy cut that the government has enacted. A while back it was electricity tariff adjustments, and way before that, we had the discussion about floating chicken and egg prices. Both those moves have saved us RM4.5 billion and RM1.2 billion respectively.

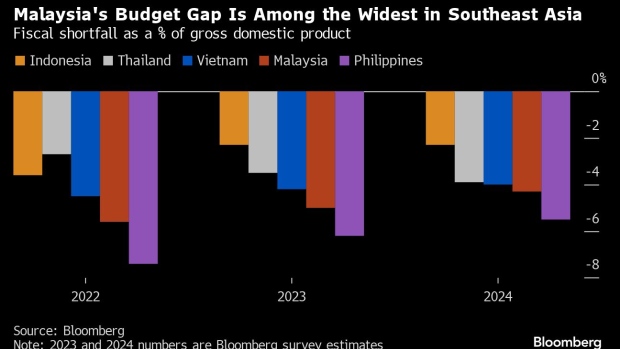

To put it simply, Anwar wants to switch from broad subsidies (which cost Malaysia a staggering RM81 billion last year) to more targeted help. The aim? To cut the budget deficit from 5% in 2023 to 4.3% in 2024. Just FYI, a budget deficit is when government spending exceeds government revenue.

Still, those who genuinely depended on the subsidy are going to start feeling the pinch. But no need to panic just yet — there’s a safety net! The Budi Madani program offers RM200 a month to eligible vehicle owners and businesses to help offset the higher costs.

Coming back to the point of rationalizing and retargeting subsidies, reducing the budget deficit and thus saving money is a pretty straightforward reason. But there’s another less obvious benefit that’s come to light, and that’s the potential to boost Malaysia’s sovereign credit rating.

What’s a sovereign credit rating and why does it matter?

A sovereign credit rating is essentially a report card for countries. Better grades (ratings) means the country can borrow money at lower interest rates. According to Afzanizam, the push for subsidy rationalization sends a strong message to international credit rating agencies.

“When governments demonstrate financial discipline, they will get a good review from rating agencies. We are now rated as ‘stable’ but if fiscal consolidation gains more traction, I won’t be surprised if our rating moves from ‘stable’ to ‘positive’,” — Afzanizam via FMT

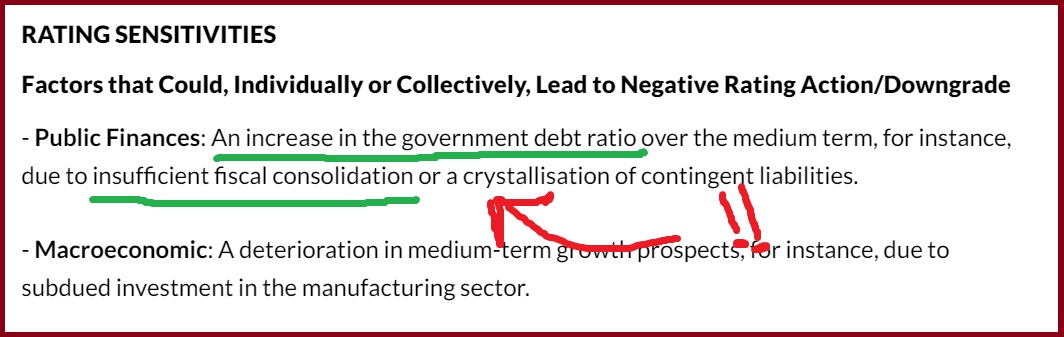

The crucial part here is that credit rating agencies like Moody’s, Fitch, and S&P Global have all pointed out the importance of reducing the country’s subsidy bill.

In the long run, countries with higher credit ratings are viewed as less risky by investors. This means they can borrow money at lower interest rates in the global bond market, which essentially makes it cheaper for the government to finance its operations and projects. All in all, the significance of our subsidy cuts are beyond mere numbers.

The money saved from the diesel subsidy can be better used for development

According to University Malaya senior economics lecturer, Goh Lim Thye, Malaysia’s huge subsidy bill is a major hurdle to becoming a developed nation. Because instead of investing all that money on the country’s economic development, we’re only increasing our debts.

On that note, the retargeting of the diesel subsidy will save Malaysia about RM4 billion annually. That, combined with the overall reduction in subsidy and other social aid is projected to decrease Malaysia’s expenditure by RM11.4 billion!

“This policy shift is part of the 2024 budget, which projects a reduction in spending on subsidies and social assistance from RM64.2 billion in 2023 to RM52.8 billion in 2024, underscoring a strategic focus on improving the country’s fiscal health,” — Goh Lim Thye, via FMT

- 108Shares

- Facebook90

- Twitter5

- LinkedIn4

- Email4

- WhatsApp5