Heh? 32% of Malaysians don’t want inheritance?! Weird facts from our survey

- 1.0KShares

- Facebook884

- Twitter16

- LinkedIn14

- Email17

- WhatsApp90

Do you know someone who is rich? So kaya that they walk around smelling like spreadable pandan and coconut? Always seem to have sotong nasi kandar crumbs on their shirt?

When someone’s that rich, we’d often chalk it up to them having rich parents, but that’s not necessarily the truth. Recently, we partnered with Sun Life Malaysia – a life insurance and family takaful provider that offers comprehensive protection – and put out the Berdiri Sendiri Survey to find out, among other things, the kind of background Malaysians grew up in and how that affected their financial status today.

After four weeks (17 July – 13 August) of intense surveying, 1,108 people shared their experiences (thanks!). Here are their vital stats:

- Slightly more men (55.6%) than women (43.2%) contributed

- They’re mostly between 20-39 years old (74%)

- They’re mostly from Selangor, Putrajaya and KL (71%), but we’ve got respondents from every state

- Most respondents are bilingual. 38% primarily speak Chinese dialects, 37% speak Malay (37%), 7% speak Indian dialects, 3.1% speak other languages, and 81% speak English as well.

Now that the background stuff is done, we’ll start off by confirming a suspicion.

1) No, growing up rich doesn’t guarantee you’ll be rich as well

When we asked our respondents to compare themselves to their parents financially,

- 46.6% are doing better

- 29.7% are doing worse

- 22.8% feel that they’re about the same as their parents

- and 0.9% don’t have parents to compare themselves too

Looking closer at the data, it seems that those who grew up poor are more likely to be doing better than their parents now, with more (76.6%) of them picking that option. On the other hand, those who grew up rich are more likely to say they’re doing worse than their parents, with more (75.3%) of them picking that option than average.

Even if we only look at those above 30 years old, the trend is the same, so it’s not really because they’re younger. So why is this? An explanation would be that if you have poor parents, the bar is lower so it’s easier to do better than them financially, whereas rich parents are harder to top. Based on the data, here are the current average monthly incomes of those doing better than their parents, according to background:

- Grew up poor: about RM11,000

- Grew up middle-class: about RM14,000

- Grew up rich: about RM19,000

So the bar for poor people to do better is closer to RM11k, while for rich people it’s closer to RM19k. But that’s just earnings. Can’t talk about rich backgrounds without mentioning inheritance, right? Well…

2) Less than 20% of our respondents expect to inherit something

So little? Those expecting some kind of inheritance only make up 18.5% of our pool: for the rest (81.5%), inheritance isn’t even part of their plans.

- 31.8% said they’re not hoping for inheritance because they’re strong, financially independent people

- 28.8% said ‘what inheritance?’

- 20.9% said that if they don’t inherit debt, they’re lucky already

Going by background, only 9.8% of those who grew up poor are expecting inheritance, whereas for the rich, the number is higher at 47.1%. Still, that’s less than half, so we can perhaps safely say that not all rich people get inheritance.

Even though many are not expecting inheritance themselves, a big chunk (48.5%) of our respondents do plan to leave something behind for their kids.

- 37.8% hope they can save enough money to leave behind, and

- 10.7% already have their wills written and ready.

In the same vein, 24.4% of our respondents haven’t thought about legacy planning yet. The question also doesn’t apply to 19.4% of our respondents, as they’re not planning to have children; and for the remainder, only 6.2% flat out won’t leave something behind, saying “No, they have to know suffering“, while 1.4% are planning to leave behind their debt instead. Yeesh.

Well, if you’re part of the group who wants to leave inheritance but don’t know where to start, our friends at Sun Life Malaysia have this free calculator for legacy planning. You’ll probably want to try it out, because it’s hard to save money without a plan. As how Raymond Lew, CEO and President/Country Head of Sun Life Malaysia puts is,

“Cultivating a legacy goes far beyond the simple act of distributing your lifetime wealth to your loved ones. It’s about ensuring an enduring heritage for generations to come by actively making well-informed financial choices. Our insurance and takaful protection plans can help you secure financial peace of mind and build a legacy that stands the test of time.” – Raymond Lew, CEO and President/Country Head of Sun Life Malaysia.

And speaking of savings…

3) Of our respondents, 1 in 10 can’t save any money at all

For many Malaysians, they save money either to prepare for emergencies (22.3%), have a certain kind of lifestyle (14.5%), or to have the money to make more money (14.1%).

However, most of our respondents can only save less than 30% of their income every month:

- 37.9% can save between 11-30% of their income

- 28.6% can only save less than 10%

- 9.5% cannot save at all

When it comes to our respondents’ saving habits, their upbringing seems to affect them somewhat. For example, about a third of those who save more than 30% each month had parents who taught them good financial habits. Those who grew up poor seem more likely to find saving easy. And for those who can’t save at all:

- 33.8% never learned how to control their finances growing up, as they didn’t have much money then

- 28.6% were spoiled by their parents as a child, so they never learned the value of money

Regardless of background, the top reasons why our respondents find it hard to save money are quite reasonable: so many bills to pay (26.1%) and so little gaji to pay them with (25.6%).

As if that’s not depressing enough…

4) Most (81%) Malaysians are also supporting someone else with their gaji

If a chunk of your pay every month is going towards feeding extra mouths, you’re not alone: almost 81% are using a portion of their hard-earned gaji to support someone else. While most (47.2%) of them give away less than 1/5 of their gaji, some are spending even more:

- 12.4% are spending between 21-30% of their pay

- 12% are spending between 31-50% of their pay

- 9.2% are spending more than 51% of their pay (wah die lor)

Of these kesian people who spend more than half their gaji on other people, many don’t have enough money left over to build their own savings: 43.2% can only save less than 10% each month, while 25% can’t save at all. Because of this, they’re twice as likely to say they can tahan at most one week if they lose their incomes, and to add insult to injury, they’re also 1.7 times more likely to have no one who can help financially if that happens.

Generally for Malaysians, parents are the most common (46.4%) party being supported, and yeah, the sandwich generation is real: Almost half (46%) of those with children to support are also supporting their parents at the same time.

Those from poor backgrounds are more likely to be supporting other people. Compared to the average, they are:

- 1.3 times more likely to be supporting their parents

- 2 times more likely to be supporting their siblings (and other relatives)

- 4 times more likely to be supporting their in-laws

The only thing they’re less likely to support seem to be pets – only 14.6% do, compared to the average 21.1%. Meanwhile, on the flip side..

5) 1 in 5 Malaysians don’t have anyone to turn to in times of need

Basically, we asked our respondents: if you were to lose all your money today, who can you turn to? The top three answers are:

- Their parents (51.8%)

- Their spouse/partner (32%)

- Their siblings (29.9%)

Their children are the most unlikely people to turn to, with only 2.2% picking that option. Unsurprisingly, it’s our older respondents – especially those between 50-59 years old – who would pick this, but even then they’re far more likely to rely on their spouse/partner rather than their kids.

Sadly, 21.2% of our respondents don’t have anyone else to turn to. Those with poor backgrounds are twice more likely (40.5%) than average to pick this option.

With that in mind, it’s important to have savings, right? It’s recommended to have around three to six months of savings stored away for emergencies, and 16% of our respondents have enough for that. On the other hand, a whopping 39.3% of our respondents claim they have enough to last more than 6 months, with 21.6% claiming they can last for 1-2 years on their savings.

Wah so stable! Apparently, those who save money because they grew up poor and whose parents instilled good financial habits in them are slightly more likely to be in this stable group.

For the rest,

- 18.1% can tahan between 2 and 3 months

- 14.7% can tahan for just one month

- 11.8% can only tahan for one week, like telur di hujung tanduk liddat

Remember those who have no one to turn to if they lose all their money today? Significantly more of them can only tahan for one week on their savings (19.9%) compared to other groups (11.3%).

Whew! So far, the results have been quite depressing, so let’s move on to something more gossipy…

6) Can you guess what Malaysians regret spending money on the most?

No, it’s not getting married, although it is on the list. Besides the 8.8% who have no regrets whatsoever when it comes to their money (ugh so nice), here’s a ranked list of financial regrets among our respondents.

- Making bad investments (38.5%)

- Spending on fashion items (20.5%)

- Buying a car/vehicle (16.9%)

- Buying a house/property (16.3%)

- Getting a degree/higher education (8.6%)

- An expensive wedding (6.8%)

- Just getting married in general (5.8%)

- Wasting money (5.6%)

- Getting loans or credit cards (3.5%)

- Having kids (3.1%)

- Not saving money (2.6%)

- Not investing money (2.3%)

As a side note, answers 8, 9, 11 & 12 weren’t even in our original list, but over 300 respondents manually provided the answers in the “Others” option, thus we tabulated it. The actual numbers might have been higher otherwise.

The list might seem surprising, but we suppose it boils down to the returns you get when you spend money. Even if you regret paying for a car, at least now you have something to drive. A bad investment basically leaves you with nothing, and some things do go out of fashion eventually.

While we’re on the topic of financial regret, based on what we’ve seen so far…

We can’t change our circumstances, but we can change our future

With the economy being what it is, we often find ourselves worrying about the future. And it seems we’re not the only ones worrying.

While it’s convenient to think that our current money situation is due to our backgrounds, we can’t change the past for ourselves. However, we can change how the future will be for us (by preparing for retirement) or for our children (by preparing an inheritance or through insurance). In fact, our survey found out that many of us do want to leave something behind:

- 37.8% want to leave an inheritance, and they hope they can save enough

- 10.7% already have their wills prepared

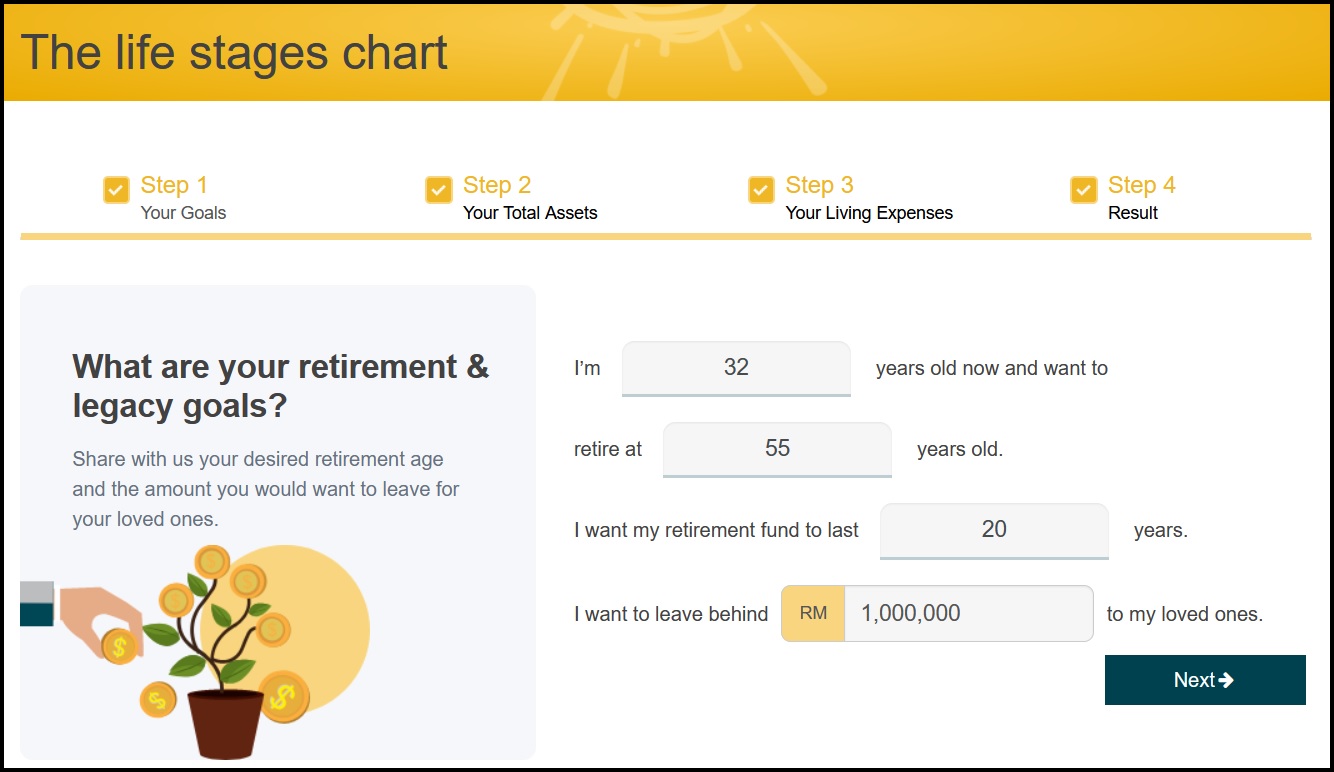

So if you’re not sure whether it’s possible for you to save up enough for retirement or have something to leave behind, don’t worry: Sun Life Malaysia’s got your back with this nifty calculator tool!

To use it, all you need to know is:

- when you plan to retire,

- how long do you need the money to last,

- how much money you plan to leave behind, and

- your current assets and liabilities.

Input those into the form provided, and the calculator will tell you how much money you still need to reach your goals, and how much you need to save up each month. And it’s totally free to use!

Besides, if you’d like to diversify your savings portfolio and have additional money ready for your old age, Sun Life Malaysia also offers hassle free ways to do it. You can check out their services in this link.

As usual, for those who love numbers, we’ll end this article with some interesting stats from our survey that we can’t fit anywhere else in the article.

- Food is the most likely (59.7%) thing Malaysians will spend money on when stressed, followed by a holiday trip (32.6%), fashion items (18.7%), and a massage or spa day (18.6%).

- Indian dialect-speaking households are more likely to teach their children not to lend or borrow money (50% vs average of 35.4%) and the importance of having insurance or takaful (24.3% vs average of 13.9%) compared to other language-speaking households.

- Men are more likely to stress-spend by getting new gadgets and video games, while women are more likely to get food, fashion items, or going for a massage or spa day.

- Malay-speaking households regret buying a car or vehicle more, Chinese dialect-speaking households regret bad investments and having children more, and Indian dialect-speaking households regret expensive weddings, getting married, and getting a degree or diploma more.

- Almost 1 in 5 of our respondents are not planning to have children at all.

- 8.2% of our respondents’ main motivation to save money is simply the pleasure of seeing their bank account balance grow. Women are more likely than men (10.7% vs 5.9%) to be in this group.

- The number of people admitting to using cable to get their first jobs is surprisingly little, at only 6.4%.

- When asked whether they would prefer a high-risk, high-paying job vs a stable, low-paying job, the choice leans slightly for the high-paying one (56.2% vs 43.8%). These people tend to be guys and people below 40 years old.

Thanks for reading!

- 1.0KShares

- Facebook884

- Twitter16

- LinkedIn14

- Email17

- WhatsApp90