Malaysia’s minimum wage may increase to RM1500… Here’s why that might not help

- 2.5KShares

- Facebook2.4K

- Twitter6

- LinkedIn5

- Email6

- WhatsApp11

Although it did not experience any growth last year, Malaysia’s minimum wage could stand to increase to RM1,500 in an upcoming review slated for the end of 2022. However, some analysts are in disagreement, saying that the move could ‘derail the economy’:

“The new minimum wage will push up the cost of goods and services. Operational costs will definitely increase, so this is not the right time.” – Datuk Dr Syed Hussain Syed Husman, President of the Malaysian Employers Federation (MEF)

This news comes at a critical time; amidst rising food prices, basic nutritional requirements now make up 35.3% of the minimum wage (a 0.8% increase from last year), as this study by e-commerce brand Picodi shows.

But is fixing the economy really as simple as raising the minimum wage? We went deeper into the study to see how other countries’ minimum wages compared to us to see if there are any lessons to be learned…

In Nigeria, the minimum wage is not even enough for a modest basket of food products

Quite a shock, considering that Nigeria is one of the countries listed under ‘MINT’ (Mexico, Indonesia, Nigeria, Turkey), classifying them as a country of ‘favorable demographics and positive economic prospects over the next two decades’. But amidst natural disasters, and constant civil and political unrest, its annual inflation peaked at 18% last year, with food inflation reaching 23%.

Despite having an annual economic growth rate of 7% per year, Picodi’s study shows that Nigerians have to spend 136% of their minimum wage for a basket of food products. In fact, things have gotten so bad there that it’s now being called a ‘sachet economy’. Why? Because sanitary pads are being sold in sachets of twos, as often times that’s all that they can afford. And if you’re an adult woman (or know one), you’ll know two is nowhere near enough when it’s the time of the month:

“I used to buy things in cartons so they last longer. Now I’ve started to buy whatever (sanitary pad) sachet is cheapest.” – Chika Adetoye, Nigerian mother

But with Nigeria being Africa’s largest economy and largest oil producer, one has to wonder why 85 million Nigerians don’t even have access to grid electricity. Well, experts point to a misappropriation of funds, with profits being funneled to civil servants and corrupt politicians. Adding to all this is their government’s encouragement of import consumption rather than local production, as well as the constant attacks by terrorist group Boko Haram.

Oh well. At least they’ve got a decent football team, as this ball-juggling chap will tell you:

But Picodi’s study also yielded some other interesting results in the rest of the English-speaking world too. For instance…

The UK had the lowest basic food cost relative to minimum wage (but it’s not that simple)

As any Brit (or Malaysian living abroad) will tell you, buying a house in the UK is a pain: as of November 2021, the average house price there was £271,000 (RM1,529,751.01), a 10% rise in the same year. And after that, you’ve got to deal with the headache of the notoriously complicated UK housing tax system.

But that’s not all; while the UK had the lowest basic food costs-to-minimum wage ratio for a ‘basket of groceries’ according to the study (6.6%), this number may be relative. Because in fact, British consumers are struggling with the fastest food inflation rates in 30 years, with an ‘alarming rise’ in food banks:

“There may be some people facing a choice between heating or eating. We’re losing customers to hunger… Some of our customers only have £25 a week to spend on food, so they’re already struggling to make ends meet.” – Richard Walker, Managing Director of Iceland Foods

With rising prices for housing, energy, gas, food, and even furniture and clothes, British people may not have to spend as much of their minimum wage on food as most other countries do, but that doesn’t mean the amount they have to spend is affordable for every Brit. Plus, like we said earlier, UK residents have to pay an exorbitant amount of taxes; just take it from this Malaysian working in the UK:

“The basic wage is £8.36 per hour for someone over 21. 40 hours a week works out to £16,266 a year, excluding student loans, income tax, and national insurance tax (NHS). You even have to pay a congestion tax of £15 per entry into London!” – Evangel Cheah, corporate sales executive based in the UK

But it’s not all doom and gloom for 2022 though; turns out, there are countries who did well. And for that, we have to go to the Balkans, because…

The highest minimum wage growth was recorded in… Montenegro (103% growth)

We’ll be honest, when this writer asked our office if anyone knew about Montenegro, the best answer he got was: “Didn’t it use to be two countries?”

Well, yes it was. Formerly part of Yugoslavia, and then Serbia & Montenegro, this now-independent mountainous country’s economic boost was largely spurred by their tourism boom, which grew its economy by 10.8% last year.

But Montenegro’s rise wasn’t all smooth sailing: they were politically and economically isolated after their role in as part of the former Yugoslavia after a decade of bloody civil war and ethnic cleansing, with sanctions resulting in a 20% decline of Serbia and Montenegro’s economy. Even after their independence in 2006, they entered recession in 2008-2010, and went through it again in 2020 due to a loss of tourists because of C-19.

However, with tourists flocking back into the country, Montenegro are now on course for a 4.8% increase in economic output next year. Sure, they still struggle with issues like unemployment, but with them racing towards EU membership by 2025, Montenegro is focusing on reforms that could maintain their upward trend.

Minimum wage is not the be-all-end-all when it comes to economic growth

Malaysia placed 45th out of 64 countries on the list, with 35.3% of our minimum wage going towards basic food necessities. Which admittedly, isn’t great, but isn’t terrible either, especially if you compare it to countries like Nigeria. But at the same time, those numbers don’t really tell the whole story; it’s actually a combination of factors between minimum wage and other costs such as cost of food, housing, services, and taxes.

At the end of the day, while the government has announced plans for a possible minimum wage increase very soon, that might not help the situation if they fail to control inflation of goods and services. Adding to that is of course the potential loss of jobs and economic derailment that may come with a minimum wage increase, as since businesses have to pay out more wages, some employees may have to be let go as a result.

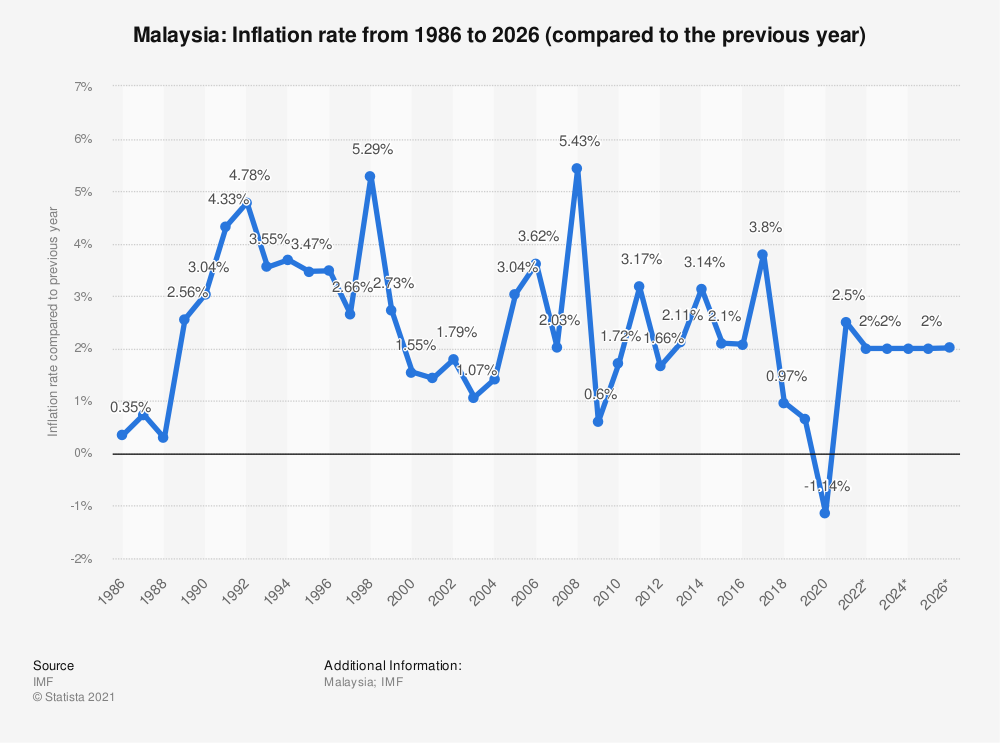

On the other hand, some have jumped to the defense of the proposed increase, saying that inflation was at a higher level before the introduction of minimum wage back in 2010:

“… any objection to minimum wage hikes, is also reducing spending on consumable goods, therefore, affecting businesses, especially the small medium enterprises (SME).” – Andrew Lo, Sarawak Malaysian Trades Union Congress (MTUC) Secretary

Whatever approach is taken, hopefully all the pros and cons are taken into consideration.

- 2.5KShares

- Facebook2.4K

- Twitter6

- LinkedIn5

- Email6

- WhatsApp11