4 out of 5 Msians say scam alerts helped them avoid scammers

It’ll be really rare for you to open a banking app without seeing a scam alert, whether warning you on the latest scam or providing basic advice to avoid them.

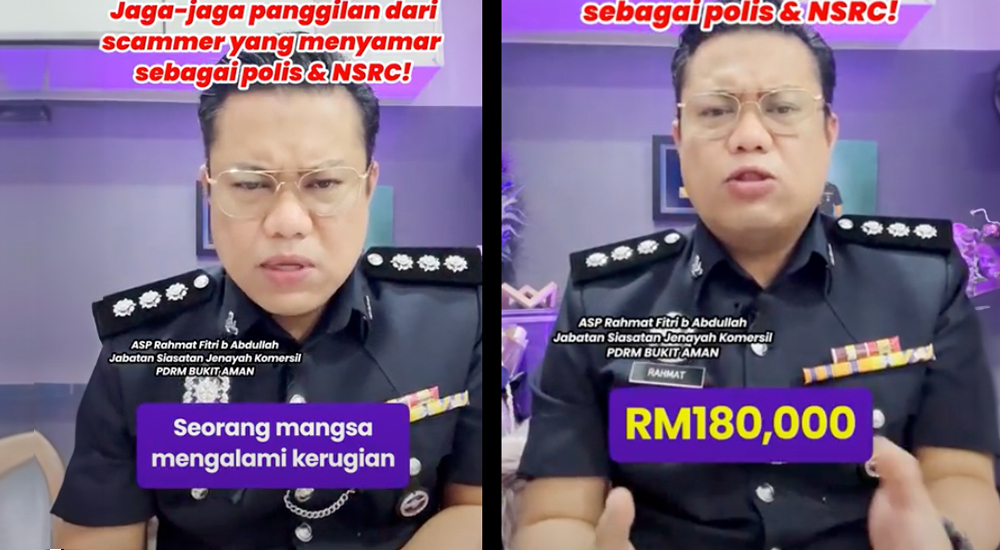

With scammers getting more sophisticated in their methods, it’s getting tougher to avoid being scammed or phished by just banking on the fact that it won’t happen to you. And because you risk losing your entire life savings from just one scam, it’s not something you’d wanna brush off as a ‘live and learn’ moment.

The scam alerts you’ve been seeing on your bank website and app came as a result of a unified effort between members of The Association of Banks in Malaysia (ABM) and The Association of Islamic Banking and Financial Institutions Malaysia (AIBIM). These alerts come alongside other protective steps such as enhanced security measures and killswitches in your banking app.

But… do the scam alerts work?

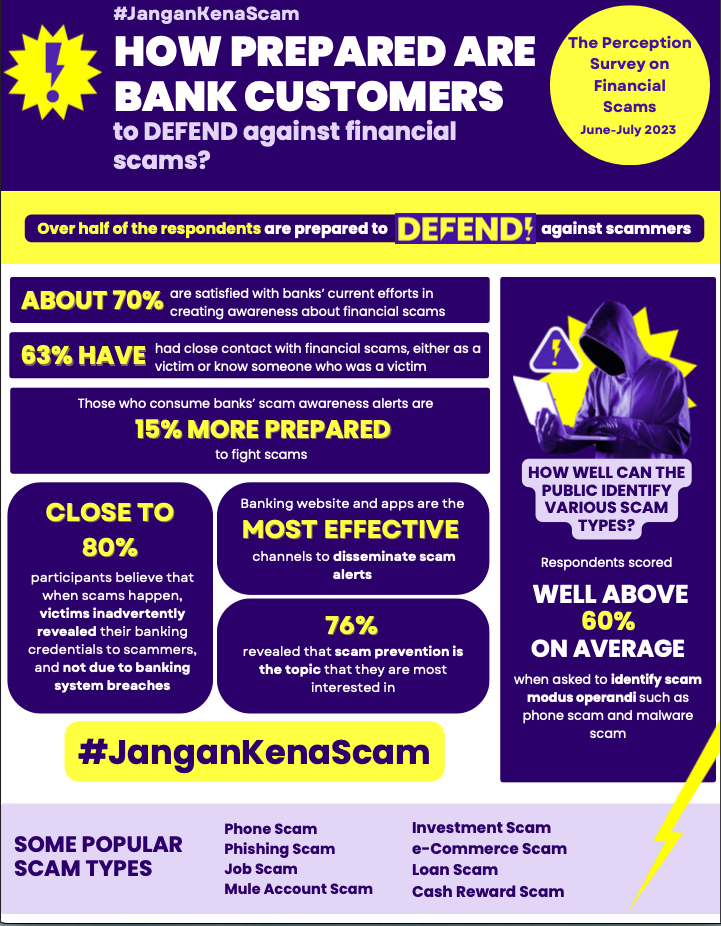

This is something ABM wanted to know as well, so they engaged Rakuten Insights to conduct a survey that was participated by over 1,200 Malaysian bank customers in June 2023. Here are some of the more interesting findings:

- 63% of respondents had close contact with financial scams, either as a victim or knowing someone who was a victim

- Close to 80% of respondents believe that scams happen because victims inadvertently reveal their banking information to scammers

- Over 50% of respondents feel they’re able to manage and handle financial scams

- Those who always read scam awareness alerts are 15% more prepared to fight scams

In all, about 70% of the respondents say they were satisfied with the effort banks put into creating awareness and education on financial scams. Additionally, 76% also said scam prevention is a topic they’re most interested in.

When asked to identify scam types and tactics, most respondents scored above 60% for 11 scam types, including phone and malware scams.

On top of that, the survey also highlighted areas of improvement for banks. While banking websites and push notifications were the most effective ways to deliver scam alerts compared to emails and social media posts, these digital methods did not reach many of the elderly and the less technologically-savvy.

And so, the banks got together to make scam education more accessible to these groups and families.

The #JanganKenaScam Fest is coming to a town near you!

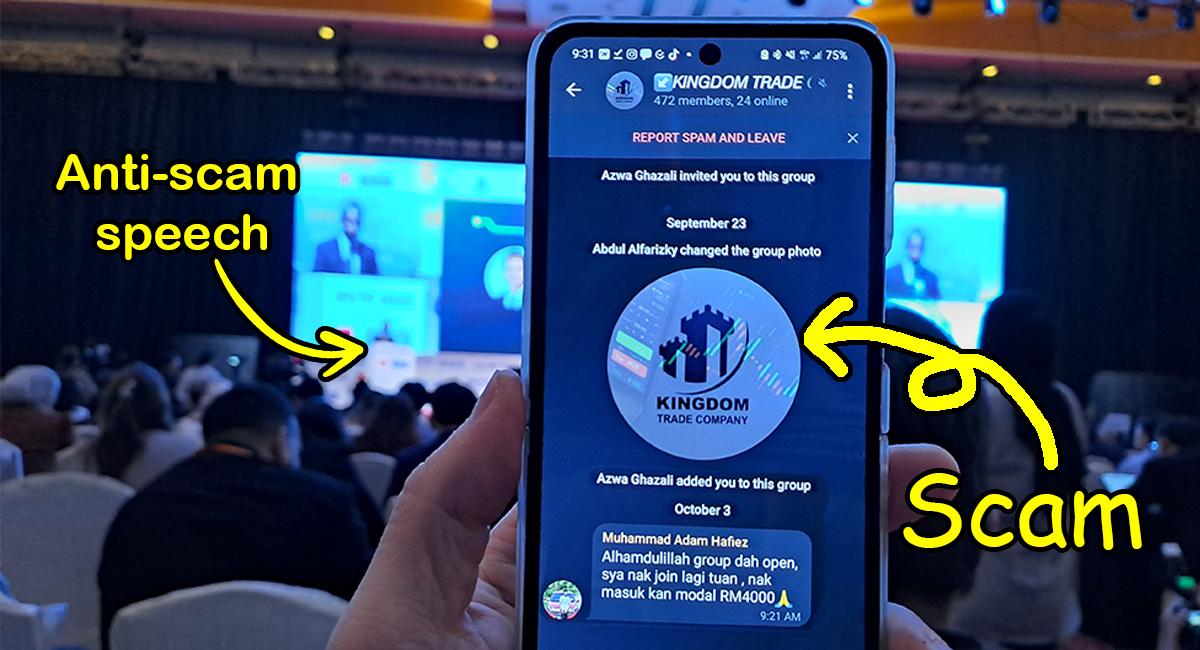

If JanganKenaScam sounds familiar, it’s because this is a refresh of the 2022 campaign, but on a much greater scale than before.

There will be a nationwide roll-out of the #JanganKenaScam Fest in urban and suburban areas, featuring experiential booths and informational exhibitions to equip Malaysians with practical anti-scam knowledge so they can easily identify and protect themselves from scam tactics.

The latest location at time of writing is 1Utama Shopping Center (LG Oval Concourse), from November 15 to 19 2023. You’ll be able to win exclusive merchandise and stand to meet festival ambassador Hairul Azreen as well as celebrities such as Arwind Kumar, Amelia Henderson, and Ceddy on selected days.

We got to try some of the activities at their event launch and let’s just say it’s something you’d want to bring your kids and maybe your I-will-click-on-every-link-my-friend-chat-group-shares family members (Hi Dad).

For more information on the campaign and upcoming #JanganKenaScam Fest locations and dares, head on over to their website linked here.