5 types of savings accounts in Malaysia that’ll payung your hujan

- 388Shares

- Facebook312

- Twitter11

- LinkedIn6

- Email13

- WhatsApp46

Whether it’s cuz you had to involuntarily switch from a higher paying job to a lower paying one, or you had to shell out hella cash for an emergency, you’ve probably felt the financial burn in the last two years and realized that you need some form of savings to get through tough times. At the same time, you wanna see your money grow and be able to afford atas latte instead of 3-in1 coffee.

That’s where investments come in. However, while some people manage to thrive off the resulting profits, others end up losing money or avoiding it altogether. But what if we told you that you could do both at the same time? Yep, despite the two things sounding like they clash, it’s entirely possible, and we’ll explain how in a lil bit.

To start, let’s check out the differences between savings and investments first.

Savings accounts are zero risk with (almost) zero effort

Like we mentioned earlier, not everyone chooses to invest for a myriad of reasons – first off, you gotta figure out which avenue of investment you should pursue, be it stocks, property, NFTs or others. Then there’s the whole song and dance of understanding how the investment works, and subsequently keeping an eye on how it’s doing every so often. That’s a LOT of work.

After that comes the risk factor. Depending on which investment you’ve chosen, the potential returns could be much higher than just letting your money sit in a savings account; but one misstep and you could end up like these people who lost their entire fortune to the stock market crash in 2008.

Lastly, there’s the question of liquidity, which boils down to how quickly you can sell off your investment for cash. If you urgently need money, something like a condo unit can be hard to sell off quickly, leaving you in a financial pickle.

Having a savings account, on the other hand, is much more “passive” compared to investing. The only effort required is to look for a financial institute of your choice, open an account, deposit your money and wait for the interest payments to roll in. It also helps that more banks are going digital nowadays, so you can check your balance, open up new accounts, and do other bank stuff without going to a branch in person.

Risk wise, there’s basically none when it comes to putting your money in savings accounts cuz:

A) Chances are VERY, VERY minimal for major banks to chaplap; and

B) If a member bank does go chaplup (touch wood), PIDM automatically protects your savings up to RM250k per depositor per member bank, but scam cases aren’t covered ah.

Liquidity isn’t usually an issue; most savings accounts we’re gonna talk about below allow cash withdrawals in one form or another. The one “downside” of savings accounts is that they tend to yield lower profits compared to most types of investments. You can, however, expect consistent returns over a longer period of time and peace of mind knowing that your money is safe, for the most part.

Now that we’ve covered the groundwork…

Not all savings accounts are created equal

‘Kay, we’re gonna briefly go over the salient points for some of the most common and reliable accounts Malaysians have access to – from the more clear cut ones like a basic savings account and fixed deposits; to principal-guaranteed investment vehicles (you never lose your initial capital) like Amanah Saham Bumiputera.

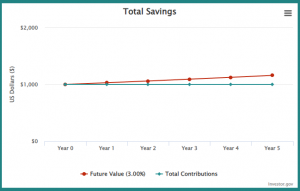

We’ll also see what the returns are like for each of them, with the assumption that:

- You stick RM1k into any given account for 5 years

- The interest rate doesn’t change.

So let’s start with….

1. Savings account

We’re starting off with the good ol’ savings account cuz every Malaysian adult has one. With a savings account, you have the freedom to withdraw from it at any time, giving it an edge over a fixed deposit account in terms of liquidity. Interest rates differ from bank to bank and how much you have in the account.

Most banks seem to offer 0.25%-0.30% per annum – we actually checked Maybank, Hong Leong Bank, HSBC, and Public Bank’s websites to make sure. The one outlier we came across was the One Account offered by UOB (up to 2.65% per annum), but it comes with its own terms and conditions.

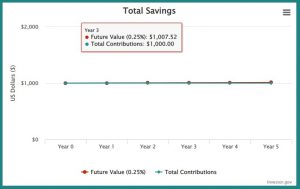

So, how much can you earn with a basic savings account (interest rate at 0.25% per annum)?

At the end of year 5, you’ll see RM1,012.56. Honestly, that’s not much, but if you have a larger sum in the account or if you start saving early on, the returns will be more significant. As an aside, some banks have apps with neat features like letting you set a spending limit so you don’t go ham whenever your salary comes in, and even tabungs you can set up for specific purposes, like marriage or for the down payment of a new house.

2. Fixed deposit account

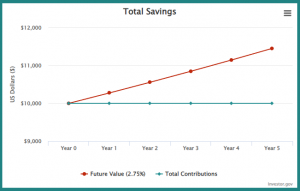

A fixed deposit account is the big boy version of a savings account: you deposit a sum with a bank and agree not to touch the money for a certain amount of time (known as a tenure), and the bank rewards you with a fixed interest rate. Generally speaking, the longer the tenure, the higher the interest rate will be.

Since banks often have promotional interest rates that are higher than what they’d offer for a basic savings account, it’s a legit way to grow your wealth. Here’s the catch: withdrawing money from your fixed deposit account before the tenure is up will cost you. Your bank could either impose extra charges, or in the worst-case scenario, you may need to forfeit the interest that you’re supposed to get.

However, it’s still a good payung because getting your money out in an emergency is as fast and easy as a visit to the bank (or a few taps on the app) AND you will get your initial deposit back, unlike selling a condo where you may need to wait for a buyer and/or absorb the loss if the selling price is lower than what you paid for it. And the icing on the cake is that your deposit will always be protected.

We’re gonna use RM10k as an example here, cause most banks (from our research) won’t take less than RM3k for the initial deposit amount. So, putting RM10k in the account for 5 years with the interest rate at 2.75% per annum, the money will grow to the tune of RM11,452.73. In any case, it’s best to shop around and look for a bank that has a package that’s most suitable for you.

3. Tabung Haji

Although most Malaysians see Tabung Haji (TH) as a type of savings account, it’s technically closer to an investment fund. What makes it similar to a savings account is that your principal is guaranteed by the government, meaning you won’t lose the money you put into TH. So for all our Muslim friends out there, it’s a safe option if you wanna get into investing. Not only will you be contributing to the welfare of pilgrims on their Hajj, y’all get these benefits with TH:

- The interest you receive from TH is tax-exempt

- Your zakat is paid for

Each year, TH announces its profit distribution rate after calculating the zakat received for a given year. For example, TH announced at the end of 2021 that the rate for 2022 would be 3.10% per annum, which is currently way higher than any interest rate for a basic savings account that we’ve seen, and comparable to a fixed deposit’s interest rates. On the other hand, it is possible for TH’s profit distribution rate to be lower than fixed deposit rates, like what happened in 2018, but chances of that happening are fairly low.

At the end of year 5, you’ll see your RM1k grow to RM1,202.10, assuming the profit interest rate is set at 3.75% per annum (the average rate from the last six years).

4. Amanah Saham Bumiputera

Amanah Saham Bumiputera (ASB) is, true to its name, open to Bumiputera citizens of Malaysia. While it’s not a savings account in the traditional sense, it allows eligible investors to buy into a unit trust fund with a fixed price of RM1 per unit. What’s a unit trust? The TL;DR:

- A collection of funds is pooled together by many people

- Professional fund managers invest the pool of money

- ???

- Profit!!!

Each eligible investor can buy a maximum of 200K units (costing them RM200k), and all they have to do is wait for the annual dividends. Apparently, ASB has a fantastic track record – Amanah Saham Nasional Berhad (ASNB) was able to declare positive returns even during the 2008 financial crash. In 2021, the return was 5 sen per unit, which maths out to a 5% per annum dividend.

Taking that interest rate, you’ll land at RM1,276.28 when December of year 5 rolls around.

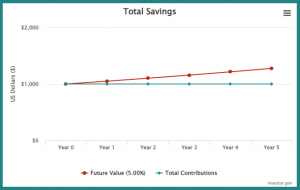

5. Skim Simpanan Pendidikan Nasional

For y’all who do want kids, good news. Skim Simpanan Pendidikan Nasional (SSPN-i) is available to all parents who want to save up for their children’s education in the future. It’s more or less a savings account that’s governed by the PTPTN, and the interest rate has been 4% per annum all the way until 2021 when they dropped it to 3%.

Oh, but the best part – saving through SSPN-i allows you to get a tax relief of up to RM8,000 a year!

With the 3% interest rate, the RM1k you initially saved will grow to RM1,159.27 in 5 years. It seems like you can withdraw from your account via an online application, but you have to leave a minimum of RM20 in there. Here’s where you can sign up for an SSPN-i account.

Savings are still relevant in 2022

A survey done by RinggitPlus last year found that 21% of respondents live from paycheck to paycheck, and 31% had less than RM500 in savings. That means over 50% of them won’t even have RM1k should any emergency crop up. Y’all might be thinking, “No shiggidy, C19 caused thousands of lost jobs. People had to use their savings to survive”, and you’d be right.

The thing is, that only served to highlight the importance of having savings in the first place – C19 was the ultimate manifestation of “sediakan payung sebelum hujan”.

In fact, it’s a really good idea to have at least 6 months’ worth of your monthly commitments in case of retrenchment and unexpected emergencies. This is the money you shouldn’t touch, not even for investment purposes. And if you really must invest, try not to put all your eggs in one basket. To quote the Wu-Tang Clan, “you need to diversify your bonds”.

Lastly, it’s best to invest with the money you have on hand. While taking out a loan for investing isn’t the worst idea in the world, it’s only advisable if you’re really, really, REALLY sure that whatever profit you’re getting from your investment will cover the loan PLUS interest. There’s no sense in making RM3k from investing but paying RM3.5k back in interest, right? And even if the investments flop, at least you can still fall back on your savings.

Building up your savings during sunny days for the rainy days is just one of many good financial management habits that you can kick start today. If you’re interested to know more about how you can be more financially resilient, great! Our friends from PIDM are currently running the #SediaPayungKewangan campaign so, if you’re looking for expert tips and tools to kickstart your financial resilience journey, head on to this page and find out more!

- 388Shares

- Facebook312

- Twitter11

- LinkedIn6

- Email13

- WhatsApp46