Our survey shows… 61% of Malaysians don’t wanna depend on their kids after retirement!

- 2.0KShares

- Facebook1.7K

- Twitter18

- LinkedIn20

- Email47

- WhatsApp194

A few weeks back, we asked our readers to help us out by confronting one of life’s biggest questions. Even bigger than where to makan next. The big R…

Gif from Tenor.

That’s right! Together with our friends at Sun Life Malaysia, a life insurance and family takaful provider that offers comprehensive protection, we came up with the Kembara Bersara Survey, where our readers faced harrowing questions like what will they do after retirement (gasp!), how much money they have saved up already (eek!), and whether they’re open to retirement homes (aieee!), among other things.

After three weeks of surveys (from 23 Mar to 11 Apr 2022), we managed to scrounge up 1,853 responses – thanks gais! – and got some interesting results. Before we get into those, here are some background stats for your enjoyment:

- More men (64.5%) than women (34.6%) answered our survey, plus 0.9% who picked ‘others’.

- We have respondents from all age groups, but most are between 30-49 (57.5%).

- The languages spoken by our respondents are combinations of English (82%), Chinese dialects (50%), Malay (27%), Indian dialects (4%), and others (2%).

- Most of our respondents come from Selangor (45%), KL (26%), Penang (7%), Sarawak (4%), and Johor (4%). However, we’ve got answers from every state including Perlis this time! Peghelih represent woot woot!

Now that the formalities are done, let’s start off on a lighthearted note…

1) Most Malaysians (91%) actually want to Pencen-Pencen Malaysia™

Where would you want to spend your retirement years? When we asked that question to our readers, an overwhelming 91% of them chose a Malaysian state. While most of them (61%) chose the same state that they’re currently residing in, the majority of those who wanted to retire in another state picked two states in particular: Perak (16%) and Penang (14%). Well, Perak we can get, with the tranquil limestone hills and all, but we have no idea why Penang. Maybe it’s all the nasi kandar.

Or maybe because old people like to queue. Who knows? Img from Utusan Digital.

Anyway, the remaining 9% who didn’t pick a state were asked to name an overseas country they’d want to migrate to, and the top 3 mentioned countries are Australia, New Zealand, and… Thailand. Chiang Mai, specifically. We regret not asking them to state their reason.

As for how Malaysians want to spend their golden years, the top three dreams they have are:

- traveling (65%),

- catching up on their hobbies (61%), and

- just chillin’ with their friends and family (59%).

However, not everyone is ready to hang up their briefcases just yet: 22% of our respondents still want to work after their retirements. Wahlao such workaholics! Who are these people? Based on the data, it seems that most of them are men (70%), and more of them are Chinese dialect speakers (27%) compared to Indian dialect (22%) and Malay language (18%) speakers.

It might be strange to think that some people would still work at such advanced ages, but maybe not if you consider that…

2) Most Malaysians don’t want to depend on their kids in old age

‘Most’. Gif from Gifer.

It seems that most Malaysians (61%) do NOT want to depend on their kids for retirement. Another 11% see their children as a backup retirement plan, although they still agree that it’s not their children’s duty to take care of them. Only a small portion (4.4%) felt that their kids are obliged to take care of them, and among that, Malay speakers are more likely to answer that (6.6%), followed by Chinese (3.4%) and Indian (1.7%) dialect speakers.

Things are quite different from the other side, though. Even though most Malaysians don’t wanna depend on their children, 96% of our respondents said that they want to take care of their parents, with most of them (74%) doing so out of love and duty. But parents and siblings, be considerate lah hor: 39% said they can only do it if the responsibility is shared between family members, because if they do it alone confirm kenot tahan.

When ah ma asks you to change the TV channel for the 14th time but the remote is right there. Gif from Tenor.

Well, there’s always the option of retirement homes, but Malaysians are split on that one: roughly half (52.2%) reject the idea of retirement homes, and for the other half…

- 34.6% would consider a private retirement home,

- 12% would take any retirement home, and

- 1.3% would consider a government or charity-linked retirement home.

But overall, if you don’t wanna be dependent after retirement, you better have some sort of savings or plan for the future, especially since…

3) 1 in 5 people have made special EPF withdrawals

Take and take. Original img from KWSP.

When asked where their retirement money will be coming from, the top three answers chosen by our respondents are EPF (88%), savings (77%), and other investments they’ve made (57%).

And while 70% of our respondents said they’re not gonna prematurely take out any more EPF savings, quite a number admitted that they’ve dipped into their EPF recently:

- 18% admitted to have made special withdrawals (i-Citra, i-Sinar, i-Lestari, etc)

- 14% were planning to make the special RM10k withdrawal right before Raya (since this survey was held right before Raya Puasa 2022)

- Perhaps most sadly, 4% said they can’t withdraw anymore because their accounts don’t have enough money.

Ain’t that just essentials? Gif from IntoAction/Giphy.

Besides EPF, our respondents also made other preparations for retirement, the most popular ones being:

- insurance and takaful – 45% of respondents

- property investments – 42% of respondents

- unit trusts – 35% of respondents

- stocks – 29% of respondents

- private retirement funds – 27% of respondents

Yep, insurance and takaful for retirement is actually a thing, and our friends from Sun Life Malaysia actually have a bunch of plans that can help you sort out your retirement. A spare tire, so to speak.

“There are many ways to secure your retirement, one of them being insurance and takaful. Think of it as a sort of guaranteed safety net. It protects your hard-earned money so you could live your desired lifestyle when you retire. Additionally, it can also protect the financial future of your family.” – Raymond Lew, CEO and President/Country Head of Sun Life Malaysia.

Retirement insurance/takaful also comes with other added benefits that help you plan and achieve your financial goals, or even leave a financial legacy for your loved ones. It always helps to have a Plan B or C, especially considering that among our respondents…

4) 63% are worried they won’t have enough $$$ to pencen comfortably

Us 5 years into retirement. Gif from Tenor.

If you’ve ever thought about your own retirement, you’re far from alone: 70% of our respondents have thought about it at some point, while those who’ve actually planned their retirements are rarer: only 10%. And while 38% of Malaysians who are still working can’t wait to pencen, retirement does bring about some worries, the top 3 being:

- 63.3% are worried they won’t have enough money to live comfortably,

- 57.5% are worried of getting older and falling sick, and

- 45.7% are worried that they’ll finish their retirement money too soon.

We also have some people who have already retired taking our survey, but their concerns are slightly different:

- 61.3% are worried about getting older and falling sick,

- 57.6% are worried about getting bedridden or disabled, and

- 45.3% are worried about medical expenses.

Us right now 10 years into retirement. Gif from Tenor.

It would seem that for a majority of our respondents, the theme of their concerns is money: not having enough of it, running out of it early, and the possibly of needing more in case of emergencies. And this may not just be a case of people worrying too much, either: a large majority of those who earn less than RM6k monthly (71.9%) picked ‘not having enough money to live comfortably’ as their main concern.

With that in mind, the next question we thought of answering after looking at our respondents’ data is…

5) Can the average Malaysian afford to retire?

While we can’t irrefutably speak for the whole of Malaysia, we did the next best thing and averaged out our respondents’ data. So on average, they are:

- currently 42 years old and want to retire at 60,

- earn about RM13,300 monthly,

- will be spending RM8,911 monthly after retirement (based on the 2/3 last drawn salary rule-of-thumb),

- have RM841,702 in EPF and savings, and

- will leave this world at 76, based on the average Malaysian life expectancy.

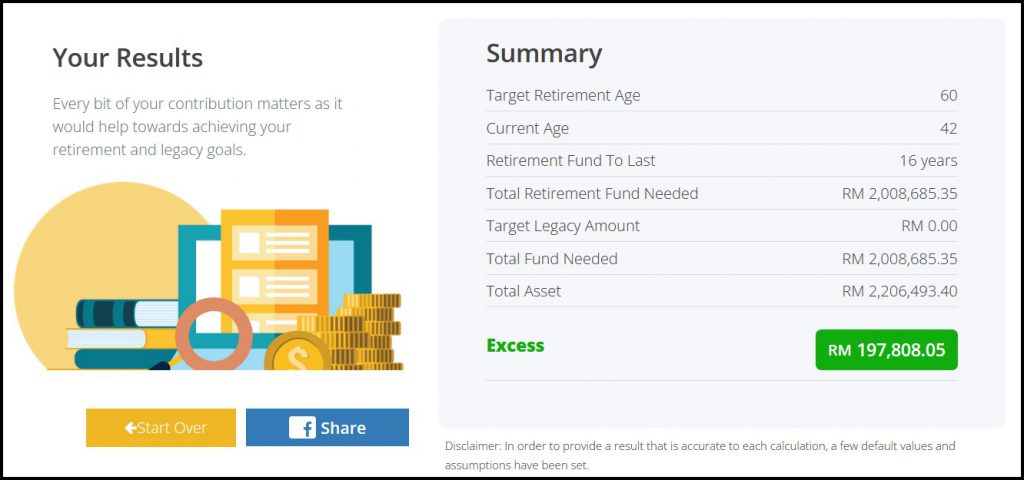

Next, we plugged the data into Sun Life’s retirement calculator, and the results were shockingly good!

Screengrabbed from Sun Life’s calculator.

If this person were to retire using whatever savings they’ve already built (taking into account that their savings will grow based on dividends, and factoring inflation for cost of living), not only do they have enough to retire, they’ll even have RM197k left over!

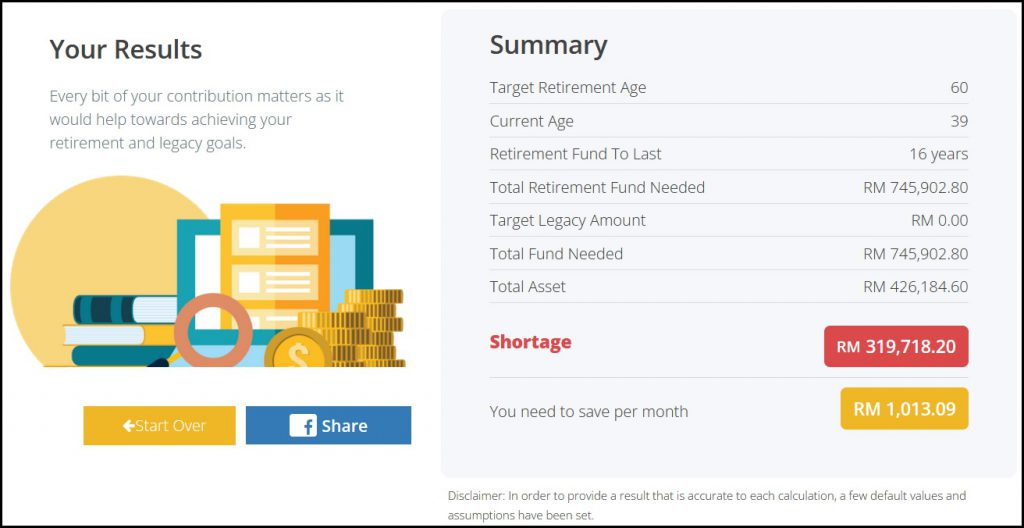

But wait, we know what you’re thinking! This “average respondent” punya stats seems a bit too good to be true, right? Yep, cause we got a lot of respondents who are senior managers and even C-level managers. So to find a more down-to-earth benchmark, we decided to repeat the calculations with the average bottom 40% of our respondents, who:

- are currently 39 years old and want to retire at 60,

- earn about RM4,939 monthly,

- will be spending RM3,309 monthly after retirement (2/3 of last drawn salary),

- has RM138,451 in EPF and savings

From the results, we can see that the lower end of our respondents won’t have enough money for retirement… yet.

Screengrabbed from Sun Life’s calculator.

But based on this calculator, if they can save up another RM1,013 per month, they’ll be pretty much set for a comfortable retirement. And assuming that they’re actively contributing to EPF, they’re already automatically saving RM1,136 monthly (11% + 12% employer contribution). So on the surface level, they’ll be just fine if they’re able to avoid touching their EPF and earning at least the same amount until their retirement.

But of course, this is just a surface level analysis. We assumed that our respondents don’t wanna leave any inheritance behind for their loved ones, and they’ll no longer have house/car loans to pay off after retirement.

Still, seeing that even Cilisos respondents from the lower end of the financial scale are financially secure enough to retire gives us a good benchmark to compare ourselves to. But if you wanna see where you personally stand, you can try out this calculator yourself.

Our colleague Jake’s reactions after realizing his monthly savings + EPF is still RM150 short. Hey not too bad la actually.

There’s also the fact that your circumstances will change as your life progresses, so what’s true about your retirement now may not be true 5 years later: you could get a raise, decide to buy a new house, or have more children. So this calculator can be a good reality check tool to use every few years to see if you’ve made good progress, or perhaps you need to change your retirement strategy.

Everyone’s circumstances are different, so pick a retirement strategy that suits YOU

While it’s interesting to see where we stand compared to other Malaysians through this survey, at the end of the day, our individual circumstances are unique. If you want to retire in the kampung, your plan might be different from someone who wants to travel the world, for example.

Or dance all day with your geriatric buddies. Gif from Tenor.

Figuring out the details on your own might be daunting to some, but these days you can always find resources to help. For example, our friends at Sun Life Malaysia offer legacy planning, which is a financial strategy to help you plan, build and protect your wealth for a financially secure retirement, and also protect your loved ones’ finances should you pass away. These include Takaful protection plans, such as the Sun Legacy-i, Sun Prime Link-i, as well as the Sun Secure Saver-i, which are designed to help you take control of your financial future.

Essentially how it works is that you pay a contribution yearly until a set time (the expiry age). If something happens to you before that time, your family will receive cash; and if nothing happens, you’ll receive the total value of your account once you reach the maturity date.

But that’s not all! These legacy planning solutions are like mix and match combos, and depending on what plan you choose, you’ll get perks like…

- being able to claim some expenses related to writing and editing your wasiat/will…

- having the zakat contribution taken care of (if you’re a Muslim) once your account reaches its maturity…

- the ability to customize your protection, contribution, investment choice, and other things to suit your exact needs…

- having your coverage extended up until you’re 99 years old…

- and more stuff you can read about here, here, and here!

You can also find more info here.

Anyway, it’s time for us to retire from this article. But before we say goodbye, here are some bonus stats for all you data nerds out there:

- 38% of Malaysians will have kids who are still teenagers by the time they’re 50.

- The top three states that people want to move out of after retirement are KL (50%), Pahang (45%), and Selangor/Putrajaya (39%).

- When asked about what kind of house they’d want to retire in, the top choice was… the humble rumah teres (37.7%). Where’s the romance?

- Chinese dialect speakers are almost 2 times more likely to have private retirement funds than Malay and Indian dialect speakers. They’re also almost 2 times more likely to have invested in stocks.

- 10% of our respondents expect to receive inheritance. Wah so nice!

Happy retirement ahead!

- 2.0KShares

- Facebook1.7K

- Twitter18

- LinkedIn20

- Email47

- WhatsApp194