If they knew it was losing money, why did Khazanah still invest in FashionValet?

- 272Shares

- Facebook232

- Twitter8

- LinkedIn9

- Email8

- WhatsApp15

[This story was initially written in BM by our Soscili sisters. Read here]

Recently, Vivy Yusof and her husband, Fadzaruddin Shah Anuar, found themselves back in the spotlight, though it’s got nothing to do with the infamous RM80 stapler. That’s old news. For those not already in the know, they’re co-founders of the e-commerce platform, FashionValet. And yep, that’s where the buzz is this time.

The drama started when Khazanah Nasional and Permodalan Nasional Berhad (PNB), two major government-linked companies, reported a RM43.9 million loss after selling their shares in FashionValet.

From MPs of opposing camps being on the same page, to netizens going all out on social media, the updates on this case quickly became the talk of the town. And can you blame them? RM43.9 million is such an absurd amount of money that even if you saved RM10k a month, your great-great-grandkids would still need a miracle to inherit that kind of cash.

But of course, the Ministry of Finance swooped in with an explanation:

“Losses incurred from the stake sale were minor in comparison to Khazanah and PNB’s overall earnings for the year. The sale represents a responsible exit by Khazanah and PNB,” — Ministry of Finance, as quoted by The Edge

Still, something about this doesn’t sit right. Although, fair enough, anything tied to Vivy Yusof tends to stir the pot. But what’s really raising eyebrows is this: when Khazanah and PNB pumped RM47 million into FashionValet back in 2018, the company had already been bleeding money for five straight years.

And that begs the question…

Why did Khazanah invest in a company that was already losing money?

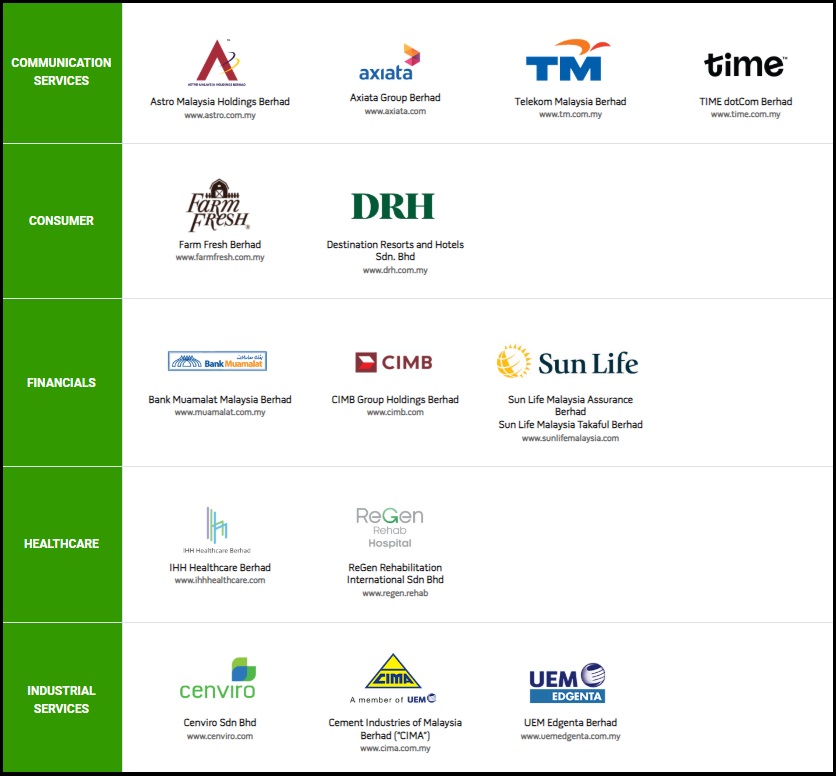

Alright, let’s talk about Khazanah. They’re what you call a sovereign wealth fund, which is just a fancy way of saying they manage government money. So their job is to take Malaysia’s money, invest it, and (ideally) make it grow like some kind of financial durian tree. Though tbh, we’re guessing by now you’re pretty much an expert on Khazanah, seeing as this is, what, the third time we’ve covered them?

“Khazanah Nasional Berhad is Malaysia’s sovereign wealth fund. Incorporated as a public limited company by Shares on 3 September 1993 and commenced operations in 1994, we are owned by the Minister of Finance (Incorporated),”– excerpt from Khazanah Nasional

In layman’s terms, they throw money at companies, both local and global, and hope to cash out through dividends or skyrocketing share prices.

You’d think they’d only invest in companies with potential. You know, the ones that aren’t financially gasping for air… but that’s not always the case.

Take Malaysia Airlines, for example. The airline’s been on a wild ride since it underwent privatisation. And by wild, we mean full of turbulence and frantic searches for the emergency exit. At one point, their debts hit a jaw-dropping RM8 billion. Although Khazanah already had a stake in Malaysia Airlines shortly after its establishment (around 1994 liddat), at the face of adversity, they doubled down hard to buy all the airline’s shares in 2014. To this day, they fully own Malaysian Airlines.

Then there’s SilTerra, the semiconductor company that some people still see as the nation’s biggest flop. Launched in 2001, it only made a profit in four of its 19 years of operation. In 2021, Khazanah had enough and sold it off in parts to a local company, Dagang NeXchange Bhd, and a Chinese company, CGP Fund.

To some, cases like Malaysia Airlines, SilTerra, and now FashionValet might suggest there’s something off with Khazanah’s investment strategy. But before we start pointing fingers, let’s clear something up about government-linked funds. And the thing is…

Not every Khazanah investment has to be a cash cow

Sure, if we treat Khazanah Nasional like any regular investment company, some of their choices might raise an eyebrow. Or two (or three). But if you look closer at their investment policy, you’ll see that Khazanah’s main job is to balance making money with setting Malaysia up for long-term success, through both commercial and strategic investments.

Commercial investments are pretty straightforward, like what most people think of when it comes to investing. But when it comes to strategic investments, Khazanah is entrusted to:

“Undertake strategic investments that provide long-term economic benefits to Malaysia or its citizens, including holding the nation’s strategic assets.”– excerpt from Khazanah’s Investment Policy.

In simpler terms, aside from making money, Khazanah also invests in or holds stakes in companies that are vital to the country or have the potential to drive national progress.

Let’s go back to Malaysia Airlines. It’s no secret the airline’s been bleeding money, but Khazanah still stepped in to save it. Why? Because letting it crash and burn would mean Malaysia’s aviation sector falls entirely into private hands.

“Khazanah might not be generating big (or any) dividends from its ownership of Malaysia Aviation Group, but it generates other more intangible returns such as allowing the state to maintain a measure of control in a critical industry and preventing AirAsia from cornering the market,”– excerpt from The Diplomat

SilTerra, on the other hand, held importance as Malaysia’s sole producer of semiconductor wafers. If fully leveraged, it had the potential to expand the country’s manufacturing sector. While SilTerra was eventually sold, the decision wasn’t made lightly and took years to finalize.

“The selling of SilTerra…by Khazanah has an impact on the nation’s interest. This is because SilTerra has many advantages and is the only company that has the expertise to produce world-class semiconductor wafer owned by the country,” excerpt from Auditor-General’s Report 2019 Series 2 via The Sun

So then, is FashionValet considered a strategic investment?

In theory, yes. When Khazanah and PNB invested in FashionValet back in 2018, the company was expected to help grow Malaysia’s e-commerce sector. And this notion was backed by the platform carrying over 400 brands and 15,000 products.

It was presumed that with the right funding, FashionValet could rake in a solid 60% return every year. And coincidentally at the same time, Khazanah and PNB were also answering the government’s call to support the development of e-wallets and e-commerce in Malaysia.

“Khazanah and PNB invested in FashionValet, which at the time, was a fashion e-commerce platform with potential,”– Amir Hamzah Azizan, Finance Minister II via The Edge

Now, if you compare it to Malaysia Airlines and SilTerra, FashionValet is much smaller and really just a start-up. But it’s also not unheard of for Khazanah and PNB to invest in start-ups

Another start-up, Farm Fresh Bhd, turned out to be a goldmine for Khazanah. It brought in 13 times the returns and a whopping RM800 million in profits. In fact, Khazanah even has a dedicated program under their Impact Fund called the Future Malaysia Programme, designed to support and nurture local start-ups.

And yet…

One bad apple spoils the whole barrel, as they say

If Farm Fresh is the poster child for successful investments, FashionValet is… well, the cautionary tale. But funnily enough, more people seem to know about FashionValet’s troubles than Farm Fresh’s glory.

In any case, Vivy Yusof and her husband are now facing court charges for criminal breach of trust. This comes after they were accused of transferring RM8 million from their investment funds into 30 Maple Sdn Bhd (the company behind the dUCk brand, which is also owned by Vivy and her husband) without board approval.

The trial may have just kicked off, but this whole saga has already somewhat tarnished the public’s perception of Khazanah’s investments in local start-ups. We can only cross our fingers and hope this doesn’t make it tougher for future companies to secure the backing they deserve.

[This article was originally published in December 2024]

- 272Shares

- Facebook232

- Twitter8

- LinkedIn9

- Email8

- WhatsApp15