Can CTOS actually give out credit scores? We ask a lawyer

- 99Shares

- Facebook39

- Twitter7

- LinkedIn7

- Email8

- WhatsApp38

In a recent court case, businesswoman Suriati Mohd Yusuf made headlines by accusing CTOS of providing her with an inaccurate credit rating. According to the court’s ruling, CTOS really messed up, and she ended up walking away with a RM200,000 compensation. Now, some of you may have never heard of CTOS before and there could be several reasons for that:

- Your parents buy you everything

- You’re too young to take out a loan

- You’re balling so hard, you throw down cash like a bo$$

But let’s jump ahead to a potential scenario: you need a loan, and suddenly this news hits you. Why is it a big deal? Because CTOS plays a super crucial role in loan approvals. Many have actually been denied loans due to not-so-great CTOS reports.

So, can CTOS really be trusted? How can a system that decides something as important as a loan make such a blunder? These are all pressing questions and we’ll get into them in a bit. But first, for all of you who didn’t know CTOS even existed, here’s a quick run down on who they are.

CTOS is your financial resume that helps you secure a loan

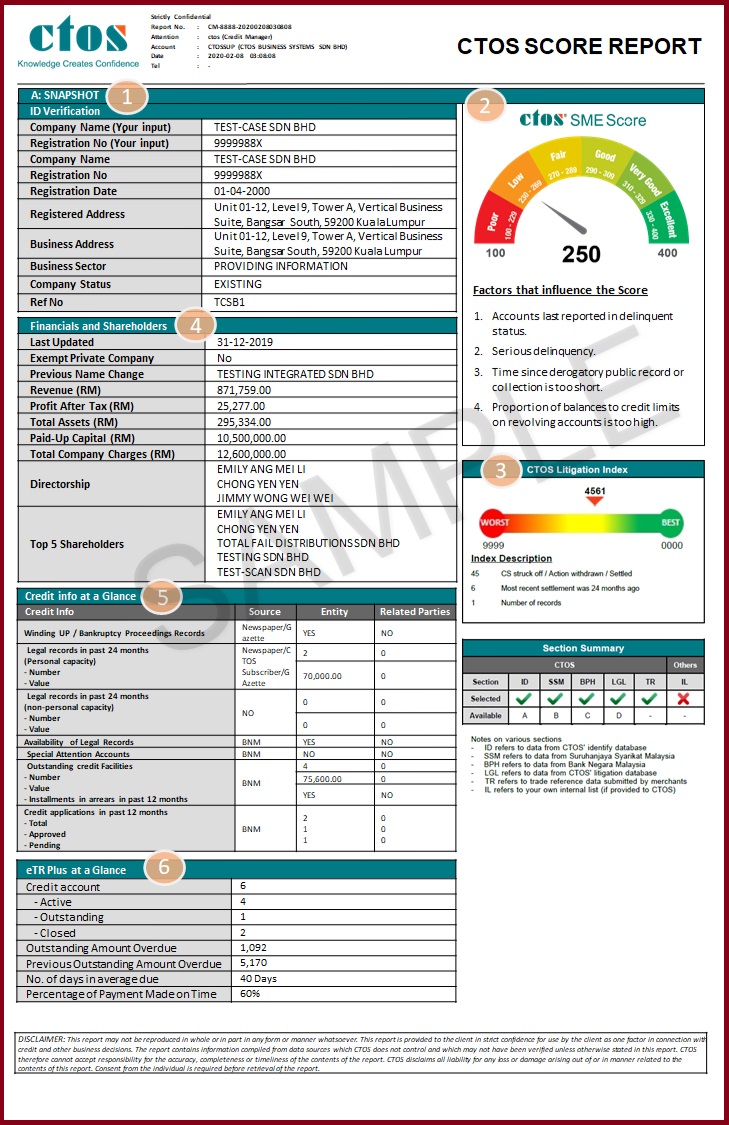

According to their website, CTOS is a credit reporting agency that’s owned by CTOS Digital. So what exactly do they do? Simple, they collect data from a number of public sources and compile them all nice and neat into a credit report.

“As a registered CRA, CTOS merely collect and compile data available from legitimate public sources, such as newspapers (legal proceedings, bankruptcy notices and litigation records) and authorised government agencies,”–excerpt from CTOS website

CTOS works both ways— you can check your own report to make sure your finances are solid, while companies (like banks) can refer to your report to see if you’re a good match for loans or credit cards. Among other things, this report would contain stuff about your business and legal issues (if got lah), your banking payment history and the all-important credit score—which helps banks decide if you qualify for a loan or not.

Fun fact: Your bank payment history is something they pull from CCRIS, which is another credit report system that’s run by Bank Negara Malaysia. The thing is, CCRIS relies solely on bank information, and none of those public stuff. (CCRIS is also free while CTOS is a paid service, but that’s beside the point). This is a super vital difference that sets the two systems apart, because those public sources that CTOS uses? Well, sometimes, they can— oops, tersilap.

CTOS ignored a request to change wrong information

Here’s something you should know: it’s actually your job to correct the inaccuracies in your CTOS report, as evident by the dispute protocol on their website. The problem is, if you’re not a CTOS subscriber, you might not even know about these errors until you apply for a loan and get rejected. And by then, the damage is already done!

So circling back to Suriati’s case against CTOS, here are the important details:

- In May 2019, Suriati applied for a car loan and got a big fat no because of her CTOS report. CTOS claimed she owed WEBE some money (which she insisted she didn’t).

- Suriati wrote to CTOS asking them to update their information. They allegedly ignored her.

- As a result, Suriati suffered both financial and personal losses.

Now, here’s the catch. Before Suriati’s lawsuit with CTOS, she actually had another legal tussle with WEBE over that debt she owed them. In short, WEBE let her off the hook, but the court ruled that even though the debt was forgiven, it still legally existed.

Despite CTOS updating her report with this new information, according to High Court Judge Datuk Akhtar Tahir, they should’ve either put Suriati’s info on hold until it was verified or informed everyone involved that they were checking it out. And that’s strike one.

As for strike two– turns out, CTOS doesn’t even have the right to dish out credit scores.

What determines the CTOS score?

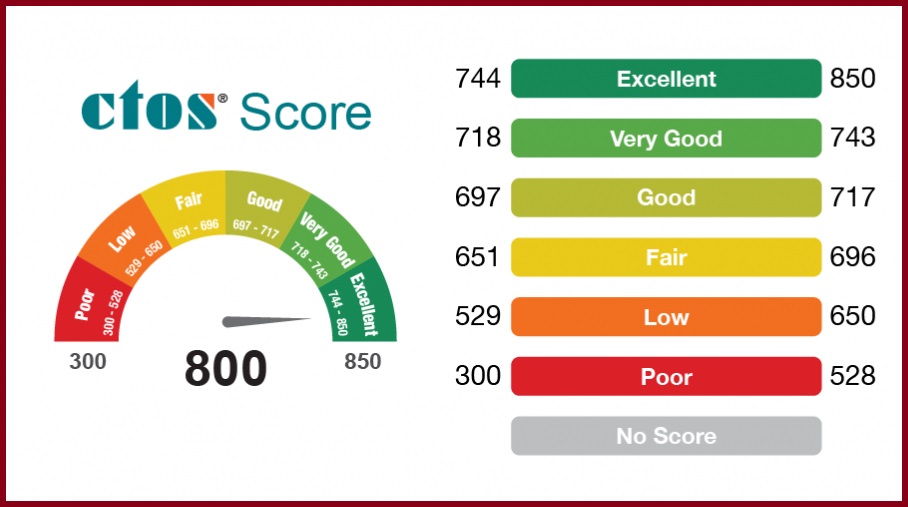

Just to be clear, the image below is the credit score we’re referring to:

A credit score typically ranges from 300 to 850, with 850 being the puncak gunung. But how do these numbers even get decided? Well, it all boils down to the reporting agency’s algorithm. And the biggest factor that contributes to that is your payment history. So if you’ve been consistently paying your bills on time, your score starts looking pretty good. But slip up a few times, and you might find yourself in the moderate or high-risk zone.

And now for the shocking part: Citing the Credit Reporting Agencies Act 2010, the judge pointed out that CTOS doesn’t have the power to come up with a credit score.

“CTOS’s main role is to collect, record, hold and store the information received. The company is also empowered to disseminate the information to its subscribers, and this includes financial institutions. By formulating a credit score, CTOS has gone beyond its statutory functions,”– Datuk Akhtar Tahir, High Court Judge via NST

Well then, is that not a damning statement or what? So, with ample time on our hands and nothing better to do, we delved into all 86 pages of the Act to see if CTOS had truly overstepped their bounds.

What does the law say? Or rather, what does it not say?

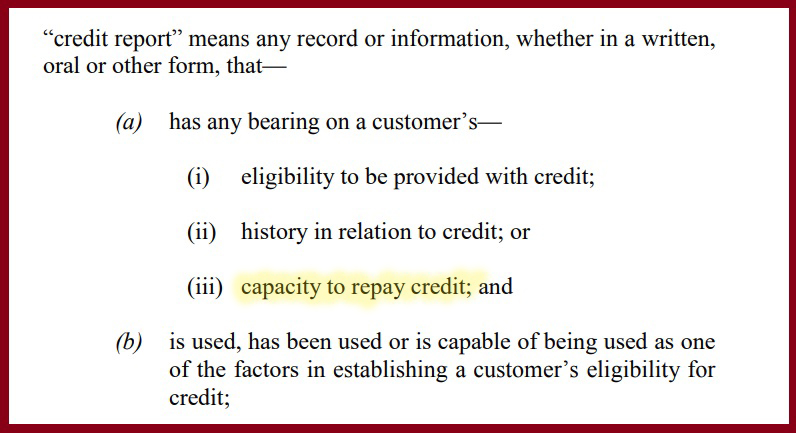

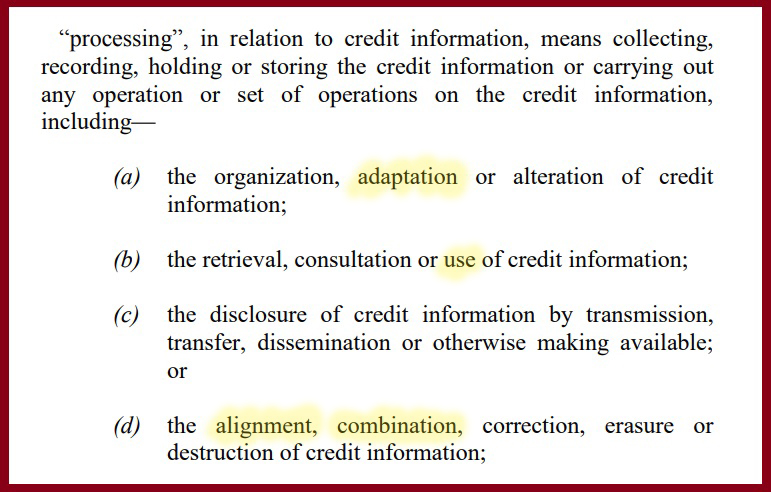

Surprisingly, there was no mention of credit scores or anything similar in the entire document. But we did uncover two snippets that might shed some light:

Snippet 1:

Snippet 2:

You might have caught on by now that these are the exact sections the judge was referring to. And while it spells out what credit reporting agencies should do, there’s actually A TON of room for interpretation.

Like here’s a thought: Can a person’s ‘capacity to repay credit‘ be measured by a credit score? It kinda seems like a lower score would mean a lower capacity, right? Conversely, a higher score would suggest the opposite. Plus, when you look at keywords like ‘adapt’, ‘use’, and even ‘combine’ in the definition of how they handle information, it sure looks like these agencies have free rein to churn out a score if that’s how they wanna showcase their data.

But ofc, this would all be rubbish to you guys, since we’re not legal experts in any way. So we consulted one. And according to lawyer Fahri Azzat, these agencies may indeed have the freedom to create credit scores, given the definition of ‘processing’ and ‘credit report’ in the 2010 Act.

“I think the court’s decision lacks nuance and a consideration of the act as a whole and the definition of processing. [I think given the definition of credit report also suggests that a credit score can be given.] To give a credit score is not unusual. In fact, it is helpful because it gives an indicator so we get a sense of the person’s credit worthiness quickly,”– Fahri Azzat, lawyer boss at Fahri, Azzat & Co (edited by Cilisos for clarity)

But just to throw it out there, CTOS also has a disclaimer on their website saying they don’t do evaluations. As to what the term ‘evaluation’ means and whether or not it indicates a score– we’ll leave that up to you.

At the end of the day though, the lingering question on everyone’s mind is, can CTOS be trusted? And perhaps knowing what the rakyat is saying may help you come to a better conclusion.

CTOS needs to own up and take full responsibility

As the news of CTOS’ misconduct spread like wildfire over the internet, netizens came out in droves to applaud the court’s decision. The general consensus was that CTOS had screwed up, and so they should be held accountable.

But that’s not all they had to say.

According to Former Law Minister, Zaid Ibrahim, a private company like CTOS which is owned by both foreigners and local institutions, shouldn’t be the one deciding who gets a loan. And this is largely because people with lower incomes and minimal savings are unlikely to ever meet CTOS’s criteria, thus will never get a loan, and thus (x2) will never break free from poverty.

“…(If) Foreigners who understand nothing of the socio-economic background of their customers (…) decide if financial help should be extended, then the poverty cycle will never be broken.”– Zaid Ibrahim, former Law Minister via NST

And while that’s an honorouble sentiment to have, it’s worth noting that banks don’t only rely on CTOS. There’s CCRIS, the bank’s own database and in fact, other credit reporting agencies that they also consider.

- 99Shares

- Facebook39

- Twitter7

- LinkedIn7

- Email8

- WhatsApp38