EPF keeps solid performance – 5.5% dividend for Simpanan Konvensional, 5.4% for Shariah

- 846Shares

- Facebook712

- Twitter10

- LinkedIn17

- Email54

- WhatsApp53

The Employees Provident Fund (EPF) Board today announced a dividend rate of 5.50% for Simpanan Konvensional, with a total payout of RM50.33 billion; and 5.40% for Simpanan Shariah, with a total payout of RM7.48 billion, bringing the total payout amount for 2023 to RM57.81 billion.

For the year ended 31 December 2023, the EPF recorded a total investment income of RM66.99 billion, a 29% increase from RM51.91 billion in 2022. The amount is net of listed equity write downs recorded for the year. Out of the RM66.99 billion in total investment income, RM5.72 billion were generated from mark-to-market (MTM) gains of securities that have not been realised and will not be part of the dividend distribution. It has been the EPF’s prudent practice of paying dividend only out of realised income.

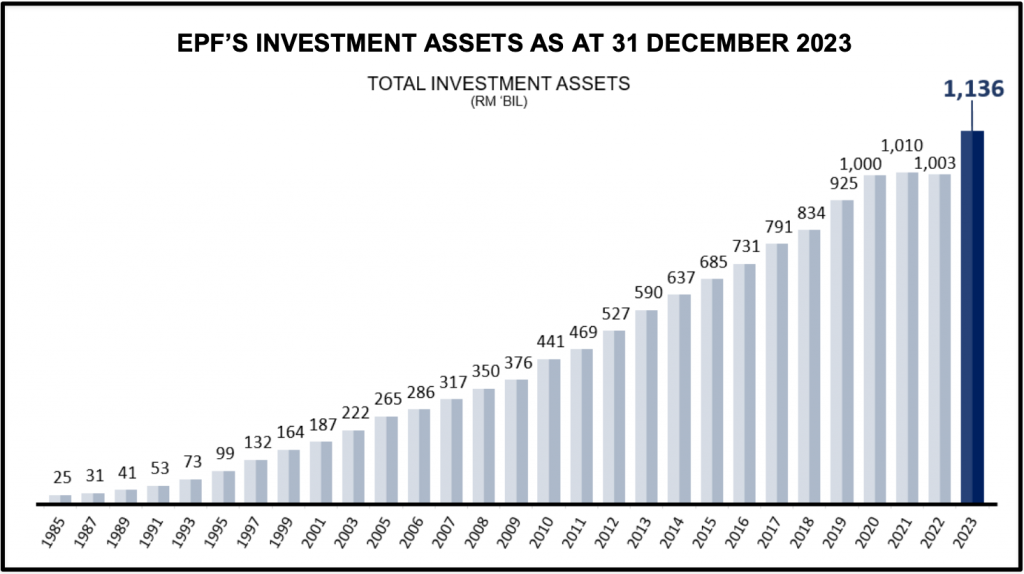

EPF’s investment assets continued to record a strong growth to RM1,135.82 billion, an increase of 13% compared to RM1,002.67 billion in 2022. The increase comprised of income from the portfolio and healthy collection of contributions of RM97.56 billion in 2023, an increase of 15% from RM84.78 billion in 2022.

EPF Chairman Tan Sri Ahmad Badri Mohd Zahir said, “Alhamdulillah, the EPF is able to deliver improved dividends following a resilient performance in 2023, with equities playing a significant role in driving overall performance. Despite the intensifying geopolitical tensions, elevated interest rates, inflation, regional conflicts, and China’s property sector woes, the global economy showcased resilience and fared better than expected. This allowed the EPF to actively manage its diversified portfolio and capture opportunities to enhance returns.

“After netting off the inflation rate, the real dividend for Simpanan Konvensional was 2.89% and 2.51% for Simpanan Shariah on a rolling three-year basis (2021-2023), exceeding the EPF’s strategic target of at least 2% real dividend over the same period. As a retirement fund, it is important for the EPF to consistently deliver long term above-inflation returns in order to preserve and enhance the value of its members’ savings,” he added.

The EPF’s portfolio diversification and active fund management allowed it to deliver improved dividends for 2023. The RM57.81 billion dividend distribution will benefit more than 16 million EPF members, encompassing individuals from both formal and informal sectors.

The year 2023 saw a mixed performance in the global equities market, particularly between the ASEAN against the developed markets. Developed markets equity benchmark indices saw positive growth, even as the US Federal Reserve raised the policy interest rates in its steepest hiking cycle since the 1980s to rein in inflationary pressures. Regionally, the FBM KLCI and ASEAN indices both saw negative growth with the FBM KLCI declining 2.7%. Despite this decline, the EPF actively managed its portfolio to generate earnings from equities.

Tan Sri Ahmad Badri said the overall market volatility in 2023 underscored the importance of the EPF’s robust investment strategy and prudent risk management. He added that the EPF’s Strategic Asset Allocation (SAA) paired with active portfolio management enabled it to achieve the results for 2023.

In line with its SAA and prudent fund management, the EPF’s ability to deliver stable dividends has helped establish its reputation as one of the country’s trusted institutional investors. This has also contributed to members’ savings, ultimately translating into greater financial security during retirement years.

EPF’s investment portfolio performance in 2023

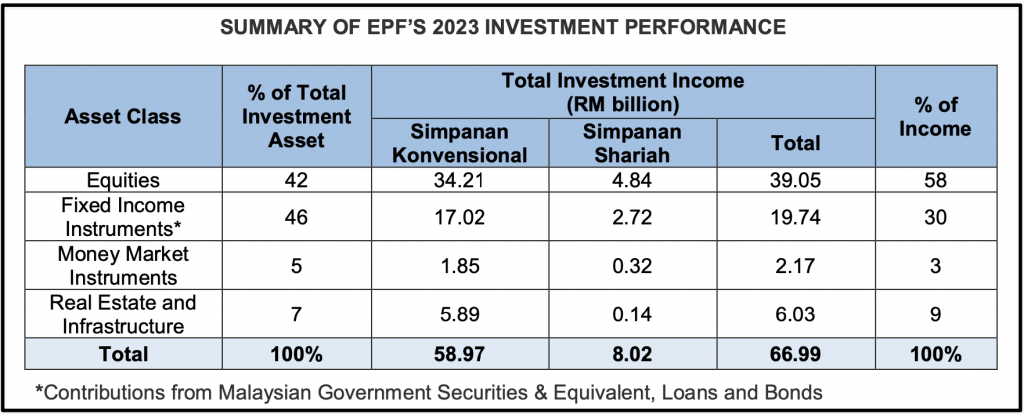

The Equities asset class contributed RM39.05 billion after netting off write downs, accounting for 58% of the EPF’s total investment income with an ROI of 8.68%. The increase in income, higher compared to RM27.12 billion in 2022, was mainly attributed to higher capital gains following better market conditions. Listed equity write downs for 2023 were minimal at RM0.40 billion, compared to the RM3.43 billion recorded in 2022. Private Equity investments generated an ROI of 9.69%.

Fixed Income instruments, predominantly Malaysian Government Securities, continued to be the anchor for the portfolio in maintaining steady returns. The asset class contributed RM19.74 billion, or 30% of the EPF’s total investment income, yielding an ROI of 4.41%. The higher income recorded compared to 2022 of RM18.15 billion is in line with the growing asset size and is mainly contributed by interest and profit income from bonds and sukuk, respectively.

Real Estate and Infrastructure registered an income of RM6.03 billion, 8% or RM0.43 billion higher compared to 2022 income of RM5.60 billion, recording an ROI of 5.04%. Income from Money Market instruments was RM2.17 billion, more than double the income generated in 2022, owing to higher money market balances and foreign currency translation, delivering an ROI of 4.93%.

Fixed Income instruments made up 46% of investment assets, while Equities comprised 42%. Real Estate and Infrastructure as well as Money Market instruments made up 7% and 5% of EPF assets, respectively.

As at December 2023, the EPF’s investment assets stood at RM1,135.82 billion, of which 62% was invested domestically. Domestic investments generated RM31.71 billion, or 47% of total investment income, which provided stability to the overall EPF’s total investment income. Global assets generated income of RM35.28 billion, or 53%, of the total investment income recorded.

A total of RM58.97 billion out of the RM66.99 billion total investment income was generated for Simpanan Konvensional, and RM8.02 billion for Simpanan Shariah. Simpanan Shariah derives its income solely from its portion of the Shariah portfolio while income for Simpanan Konvensional is generated by both the Shariah and Conventional portfolios.

Investment in domestic market remains high

The EPF remains the largest investor in the domestic market with an Asset Under Management (AUM) of RM702.48 billion as at December 2023, compared to RM643.38 billion in 2022. Deployment into domestic market accounted for more than 80% of 2023 investment allocation, providing capital to Malaysian companies and the economy as a whole. As at December 2023, the EPF holds about 28% of the outstanding Malaysian Government Securities (MGS) and Government Investment Issues (GII) issuances and about 12% of the FTSE Bursa Malaysia Top 100 Index market capitalisation.

The EPF’s participation in the Bursa Malaysia in terms of value traded was 23% for FBM100 stocks and 31% for FBMKLCI stocks. This includes trading by domestic external fund managers, which for the past five years have received over RM4 billion allocation for domestic equity portfolios. In addition, the EPF allocation over RM3 billion to external fixed income managers has brought the total allocation to Malaysian fund managers to over RM7 billion. These allocations are part of the EPF’s long term diversification effort as well as to spur the domestic capital market and asset management industry.

Tan Sri Ahmad Badri said, “The EPF’s active participation in domestic equity market is integral to our mission of creating long-term value for our members. The EPF continues to increase allocation to external managers, further diversify its investments while supporting the growth of the domestic fund managers.”

Membership growth indicates positive domestic labour market expansion

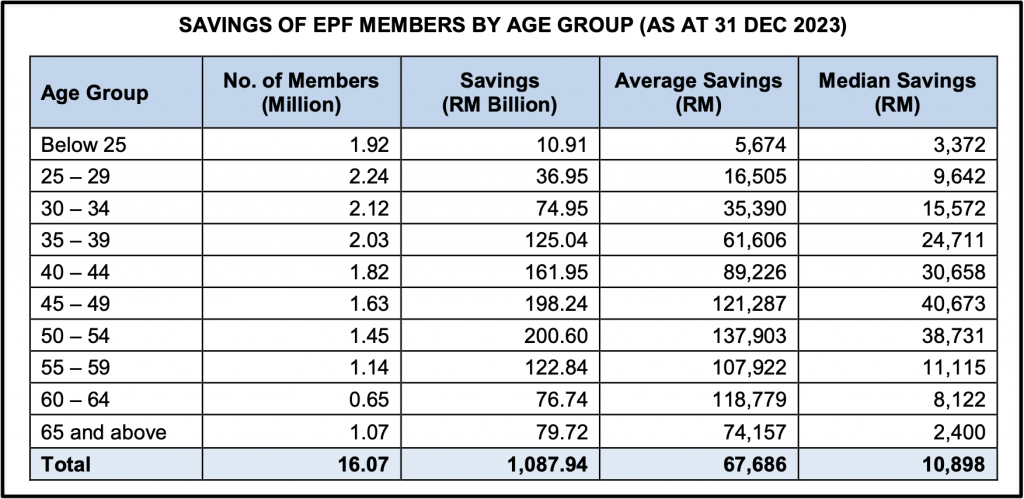

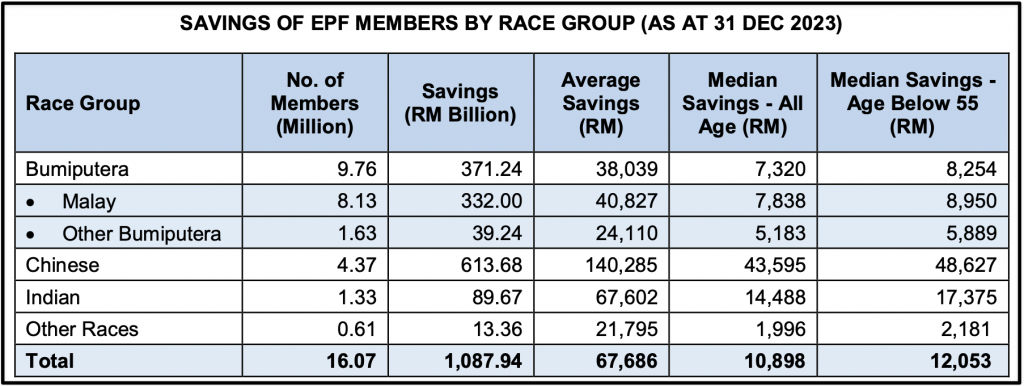

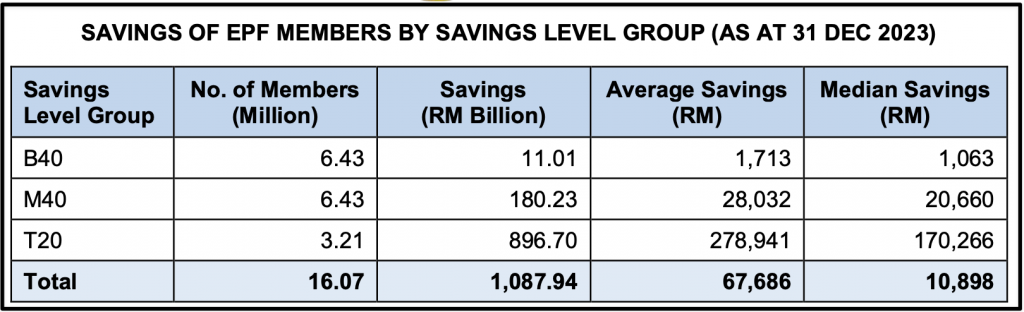

The EPF’s 2023 performance results reported a positive growth in member registrations in line with the continued strengthening of the Malaysian labour market. As at December 2023, the EPF’s new member registrations amounted to 460,447, bringing the total number of EPF members to 16.07 million. Out of that amount, a total of 8.52 million were active members, which now represent 50% of Malaysia’s 17.03 million labour force as at end 2023.

The active member base remained constant at 53%:47% of active-to-inactive member ratio as at December 2023, derived from the ratio of active members of 8.52 million against the total number of members at 16.07 million.

The positive increase in the EPF’s active members over Malaysia’s total labour force was attributed to the EPF’s coverage expansion initiatives. Tan Sri Ahmad Badri said by extending the EPF’s reach, it ensures that more individuals have access to proper social protection and future income security, thereby fostering greater financial inclusivity and resilience across the society.

The EPF’s ongoing efforts in widening coverage can also be seen through the encouraging growth of its i-Saraan programme, which allows workers in the informal sector or with no formal income to save for their retirement with the EPF. In 2023, the number of i-Saraan participants recorded a substantial increase of 31% to 382,983 from 291,743 in 2022.

Overall, total contributions collected during 2023 increased to RM97.56 billion, an improvement of 15% from 2022. The increase reflects improvements in members’ financial capacity resulting from the progressive recovery of incomes, employment, and the economy. It also highlights the continuous trust in the EPF in safeguarding members’ savings.

New employer registrations were recorded at 82,005 as at end 2023, bringing the total number of employers registered with the EPF to 606,187.

Outlook 2024

The International Monetary Fund has projected that global growth will be 3.1% in 2024, below the historical average of 3.8%. Major central banks are expected to begin to lower policy rates as inflation starts to abate.

Bank Negara Malaysia has projected a GDP growth of 4% to 5%, driven by continued growth in domestic demand and a recovery in external demand. Global financial markets remain at risk to geopolitical developments, particularly in relation to ongoing regional conflicts.

Tan Sri Ahmad Badri said, “Views are still mixed on the global growth outlook. Since the pandemic, the world has had several years of uncertainty and countries have demonstrated a real sense of resilience and agility. While the global markets presented formidable challenges, the EPF’s resilient investment approach and unwavering focus on long-term value creation should set the path for it to continue to deliver strong performance and uphold its commitment to its members.”

Starting January 2024, the EPF has separated its Simpanan Konvensional and Simpanan Shariah portfolios in relation to their Shariah-compliant investment, in order to allow each portfolio’s returns to be optimised in the long run with each portfolio having an independent SAA. The separation also ensures that assets under both Simpanan Shariah and Simpanan Konvensional are well diversified across asset classes, geographies, markets and industries to ensure sustainable returns.

Retirement security remains key priority

The year 2024 is set to be an eventful year for the EPF as it embarks on several initiatives to meet the evolving needs of EPF members, ensuring financial resilience and wellbeing during their retirement years. The ongoing trend toward a higher prevalence of informal employment over formal employment will serve as a driving force behind the continued implementation of EPF’s strategic initiatives.

To help members build future income security, the EPF’s range of products and services have been enhanced to tailor to different life stages and financial goals. This includes the enhancement to the EPF’s i-Saraan programme in which the Government’s maximum matching incentive limit for the EPF’s i-Saraan programme has been increased from RM300 to RM500 per year in order to encourage members to continue saving for retirement.

In addition to boosting retirement savings, the EPF’s i-Lindung Phase 2 was launched in February 2024 to allow members to use funds in their Account 2 to purchase insurance and takaful products consisting of life and critical illness protection for their immediate family members. This marks a significant stride in the i-Lindung platform’s evolution, integrating long- term protection products for EPF members and their loved ones.

Concurrently, the EPF’s Outreach Programme recorded positive and encouraging growth in the effort to promote voluntary contributions to build up members’ retirement savings. In 2023, the number of members who made voluntary contributions increased 17% to 905,923 in 2023, compared to 772,687 in 2022.

Tan Sri Ahmad Badri said the EPF will continue to support the implementation of initiatives that seek to catalyse the accumulation and strengthen member’s retirement income, with a view to helping EPF members and future members achieve a dignified retirement. The crediting of the dividends for both Simpanan Konvensional and Simpanan Shariah will be completed on Sunday, 3 March 2024. Members may check their accounts via i-Akaun or get their statement from EPF’s Self-Service Terminal (SST) nationwide.

- 846Shares

- Facebook712

- Twitter10

- LinkedIn17

- Email54

- WhatsApp53