5 tips for Malaysian couples to avoid fighting over money

- 1.3KShares

- Facebook1.2K

- Twitter1

- LinkedIn7

- Email22

- WhatsApp86

If you’ve been in a relationship long enough – especially after marriage – you’d find a gradual shift from romance to Ringgit. In fact, fighting over money and financial issues have been identified as a major reason for divorce, and the biggest reason in some years such as 2019 and 2021.

This is to say that, after the romantic dates with your forever soulmate, there will come a time when you’ll have to take off those rose-tinted glasses.

Because roses are expensive sia.

Fortunately, there are some simple tips you can use to prevent arguments over money from happening in the first place; provided by our friends at PIDM and this writer’s past relationships.

1. Make a joint bank account for your shared expenses

Nowadays, it’s common for both spouses/partners to be working and have a general arrangement to split the household expenses. While it might be easier to break down shared expenses as “You buy groceries and I’ll pay the bills”; it can get pretty messy when expenses go up, income becomes unequal, or (especially) if one or both partners are calculative.

Digital payments and online banking have actually provided a simple solution – set up a joint bank account where both of you can contribute money to and pay expenses with. So now, you’ll have 3 bank accounts:

- Mine

- Yours

- Ours

Shared expenses like electricity bills and rent can be paid through the joint account. Meanwhile, for that new handbag or PlayStation you and your partner have been secretly eyeing, each of you can pay through your individual accounts, and nobody gets hurt.

Having at least 3 accounts also comes with added security, since each of those accounts are automatically protected by PIDM for up to RM250,000 in case your bank goes bankrupt. More info on that here.

Another added advantage is that all bank transactions are recorded, so you can each keep track of the expenses and adjust your budget/contributions accordingly, all from the comfort of your phone or laptop.

Now, this leads to a different problem… How much should each partner contribute? Well, there’s a simple solution for that too.

2. You can split costs according to the percentage of your income

Going 50-50 on expenses may work if both of you are earning a similar amount. But when you’re not, then there’s a chance one partner is going to be unhappy or flat broke. Here’s an example:

- Partner 1’s income: RM8,000

- Partner 2’s income: RM3,000

- Total household expenses: RM6,000

If each partner equally contributes RM3,000 then… well… Partner 2 will be flat broke each month. Ouch!

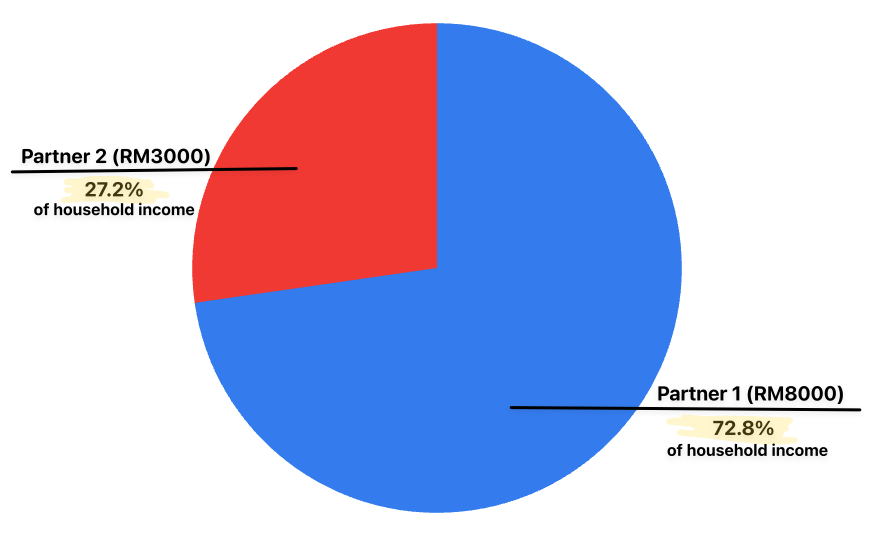

But if we visualise how much each partner contributes to the total household income, we’ll see that Partner 2 only brings in 27.2%, while Partner 1 brings in 72.8%:

Overall household income is RM11,000

Using this as the new benchmark, here’s an alternative way to split the contributions:

- Total household expenses: RM6,000

- Partner 1’s contributions = RM4,368 (72.8% of RM6,000)

- Partner 2’s contributions = RM1,632 (27.2% of RM6,000)

Now, both of them are equally contributing to the household based on how much they can afford. This keeps things fair, with the numbers only changing when expenses go up or (preferably) gaji go up.

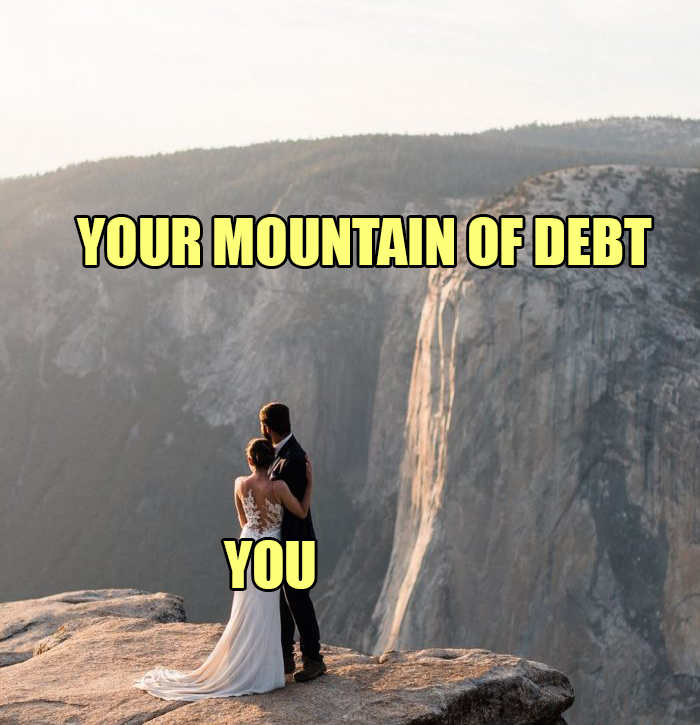

3. Don’t overspend or borrow money for your wedding

While there’s a saying that a wedding needs to have something old, something new, something borrowed, we can strongly say that the “something borrowed” should never be money. Back in 2015, this writer was told in a closed-door presentation that the #1 cause of debt for new families are wedding loans.

It isn’t a small amount either… In 2019, the ASEAN Post estimates that a Malaysian wedding can cost an average of RM50,000. Nowadays, that cost can only be higher.

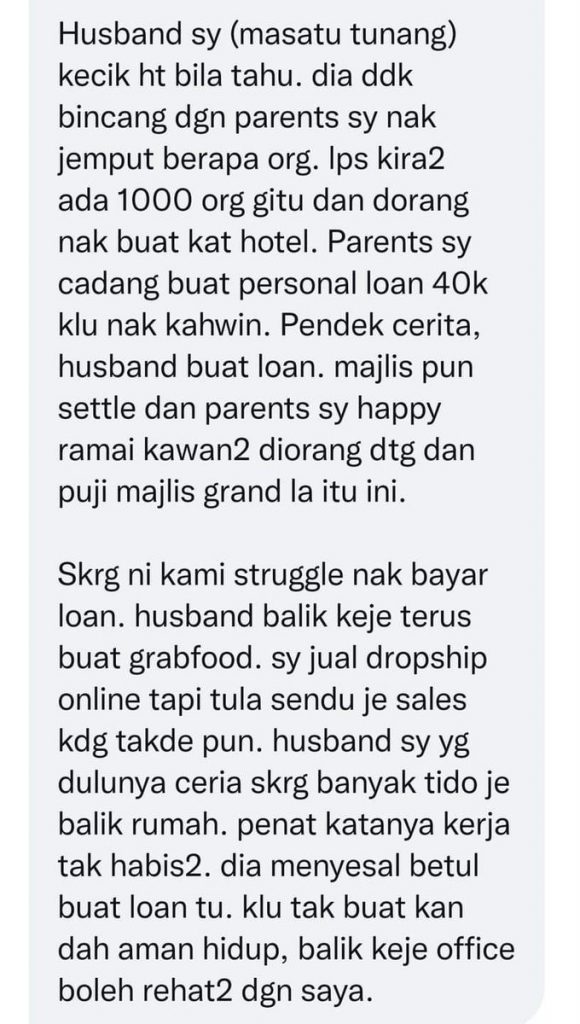

All of this is to say that, if you have to borrow money for a wedding, you’re essentially starting a new life that’s already burdened with debt. Here’s a story we found that illustrates how a wedding loan affected this woman’s married life:

Even if you don’t need a loan, you probably also wouldn’t want to throw all your savings into a lavish wedding. This writer got a life lesson when he received a friend’s wedding invitation… except the guy had already been married for 3 years by that point. When asked about it, he said:

“After we got engaged, I told my wife, look… we have enough to either pay for a wedding or put a down payment for a house. Which do you prefer? She chose the house.”

To address the big red packet in the room, yes, you can recoup the costs through angpaus (especially for Chinese weddings) but it’s still taking a gamble. This Reddit thread has some interesting insights from different races and backgrounds.

4. Have insurance and a will in case you kick the bucket

Not many people like talking about life insurance/takaful and, especially, wills because it’s pantang, However, it’s an important conversation to have because it’s not really about you. It’s about your next-of-kin.

While medical insurance can help out with medical bills, life insurance payouts will ensure your family can financially cope with the loss of a breadwinner – especially when the reaper unexpectedly knocks on your door.

The best part is that life insurance and takaful can be very affordable… There are plans that cost under RM10 a month, but you should definitely shop around for a plan that fits you best.

As an extra reminder, don’t forget to update your beneficiaries! If you bought a life insurance policy or got an EPF account before starting a family, you’d probably want to make sure your wife or children gets the money instead of a sibling or parent.

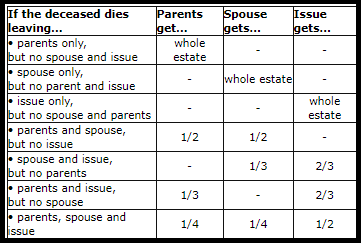

For non-Muslims, you can allocate your property through a will, otherwise your property will be automatically distributed by law, following the Distribution Act 1958 which looks like this:

The Muslim equivalents are Faraid and Hibah, which you can read more about in their respective links.

So again, the important point here is that you should make the necessary arrangements before the worst happens, because you cannot KIV if you’re RIP.

Final depressing fun fact: If you die owing money to a bank, the bank can still come collect under certain circumstances, so you might wanna consider a mortgage insurance like an MRTA or MLTA if you bought a property.

5. Create financial goals together, and be ✨ TRANSPARENT ✨

If you’ve read up to this point thinking “but why must we do it like this” then, this will explain it – ultimately, a couple must be open and transparent about their financial situation before and after marriage. If you have a ton of credit card debt, your spouse needs to know so that you can both work through it together and – more importantly – it’ll be worse if you kept it a secret and they find out when the debt collector comes a-knockin’.

In the end, it’s up to the both of you to decide on your financial goals by calculating your monthly expenses, savings targets, or even supporting each other to pay off a wedding loan if you’ve already taken one. Much like our past article with PIDM about managing credit card debt, there’s no absolute right way, and expert opinions (or even this article) is just a platform to jumpstart new ideas. What’s more important is that you have a system that works for the both of you.

Your spouse is your most valuable asset. But for your bank assets, there’s PIDM

Most people would do anything to keep their husband or wife safe, even if it involves jumping into a pit of rabid hamsters.

And one of the most important ways to protect your partner is by making sure both of you have a financial safety net ready for times of trouble.

So as part of PIDM’s efforts in promoting financial literacy, they wanna help you by giving expert tips and tools to kickstart your family’s financial resilience journey, and in doing so, ensuring happier families. Don’t miss out on these great tips and head over to the #SediaPayungKewangan microsite today.

- 1.3KShares

- Facebook1.2K

- Twitter1

- LinkedIn7

- Email22

- WhatsApp86