How inflation affects Malaysian university students

- 83Shares

- Facebook60

- Twitter5

- LinkedIn4

- Email4

- WhatsApp10

Inflation is real, and we are all affected by it whether we realise it or not.

The issue resurfaced after the government announced back in June this year that some subsidies will be ceased in July, along with the removal of the price ceilings for chicken and eggs. The decision left a great impact on small businesses as they were forced to increase the prices of their products due to the higher cost.

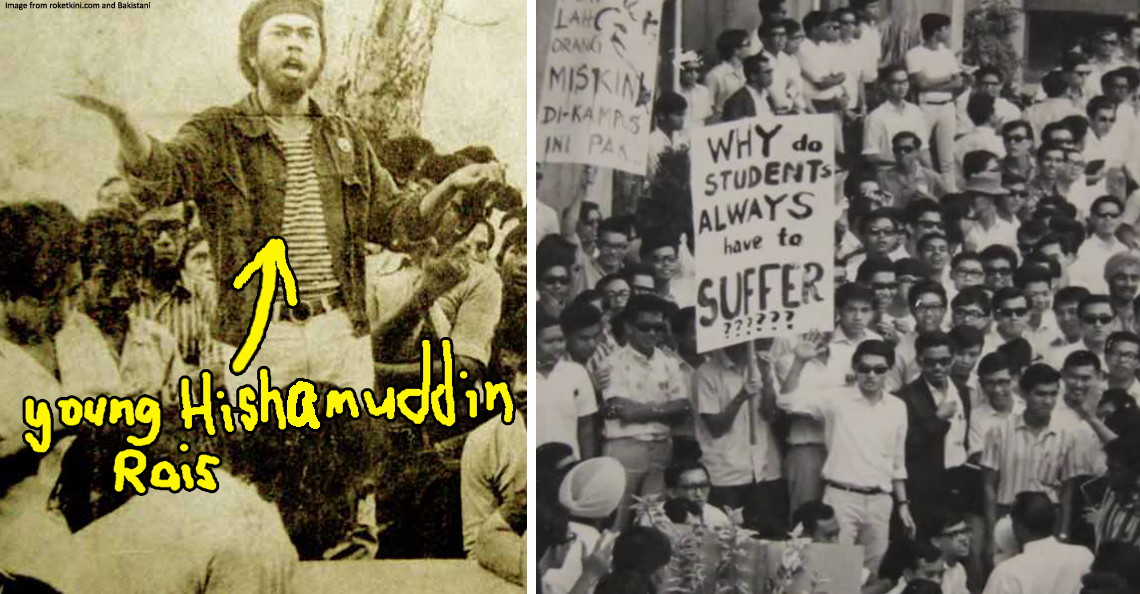

While the focus was put on working adults, not many realise that it is affecting university students just as much as they are also struggling to cope with their daily expenses and needs. Hence, the #TURUN protest was held at Pasar Seni by youth activist groups to address the issue.

Some of the demands highlighted by the groups include for the government to:

“…continue giving existing subsidies, control the prices of goods on campus, provide food security solutions, as well as cut the wages of both ministers and deputy ministers.” – As quoted from Malay Mail.

To better understand the struggles of the youth, we took the initiative to talk to a number of students before attending a forum organised by Taylor’s Debate Club to discuss about inflation and its impacts on students.

All our student interviewees either have, or plan to get part-time jobs for extra money

Note: Names of the students have been changed to protect their identities.

Meet our first interviewee of the day, Alice, who was a law student at Brickfield Asia College (BAC), and is now pursuing her Certificate in Legal Practice (CLP) at Taylor’s University. Upon arriving at the campus, Alice immediately caught our attention as she was eating her waffle alone with her law textbook on the table.

When we spoke to her on the topic of inflation and how it has affected her as a student, she mentioned that she can definitely feel the impact as she has to make some sacrifices when it comes to food.

“Even though my parents are still earning the same amount of money as 5 years ago, inflation has probably increased by 30% now so it’s disproportionate in that sense. With the same amount of allowance that I get from my parents, I am forced to stretch my budget. So I spend less on food to make sure that I have enough to buy books and spend on stuff like printing.” – Alice, to Cilisos.

Bobby and Cassie on the other hand, are classified as more privileged compared to Alice as they admitted that inflation isn’t affecting them as much.

However, Bobby shared that he is taking up a part time job as a tutor to earn extra money with the reason that he doesn’t want to burden his mom who is now paying for his university fees at Taylor’s that cost roughly RM13,000 per semester, especially with the increasing cost of living.

“For me, I take up a part time job because I need some extra money to buy my own stuff without burdening my mom. It feels wrong to ask her for more money.” – Bobby, to Cilisos.

Well, even those on the higher end of the income spectrum can feel the pinch of inflation.

Although Diana comes from an upper income family, she takes note of how expensive her tuition fees are and is planning to find a part time job soon so she could help her parents pay for it.

She also mentioned that her parents have recently increased her pocket money to catch up with the increasing prices of goods, and even that is not sufficient considering her daily expenses and needs.

Students work in their free time, instead of concentrating on upskilling themselves

One of the guest panelists at the forum, Luqman Long, highlighted how the job market is competitive and that there aren’t many vacancies available for fresh graduates, so students today must upgrade their skills to stand a chance to be employed upon graduating.

He also emphasised that many students do not have the privilege of time and opportunity to do so as they are occupied with having to worry about other things that are impacting them, like inflation.

“The government needs to provide more cash assistance and hand-outs, as well as give more alternative subsidies and aids for the students. On top of that, the government should give free online courses for them to gain a new set of skills too.” – Luqman Long, Lawyer & Information Chief of MUDA.

With Budget 2023 that is scheduled to be tabled on Oct 7, assistance for university students are expected to be given accordingly. This is because not all university students have the privilege to be financially independent, as they are equally affected by the economic crisis and Malaysia’s significant increase in inflation.

- 83Shares

- Facebook60

- Twitter5

- LinkedIn4

- Email4

- WhatsApp10