This is why Malaysian banks joined forces to prevent scams

- 78Shares

- Facebook62

- Twitter4

- LinkedIn4

- Email4

- WhatsApp4

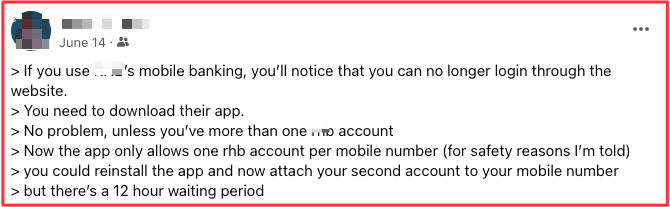

In the past year or so, you might have run into some… inconvenient problems with your Malaysian banking apps like this guy:

But it worked just fine before! So why did they make it worse?

Well, the simple answer to that is scam protection. Earlier this year, the banking industry banded together to implement several key security measures that you would definitely have noticed, such as:

- Migrating from SMS One-Time-Password (OTP) to secure verification/secure authentication

- Tightening fraud detection rules

- Imposing a cooling-off period for first-time online banking registration

- Restricting secure authentication to a single device

- Setting up dedicated fraud hotlines for customers

In fact, we were invited by our friends at Maybank to attend the launch of the refreshed #JanganKenaScam awareness campaign. This campaign was collectively launched by banks under the ambit of The Association of Banks in Malaysia (ABM) and Association of Islamic Banking and Financial Institutions Malaysia (AIBIM); along with other stakeholders such as the PDRM and MCMC as part of their commitment to combat financial scams.

#JanganKenaScam is part of their efforts to drive forward a singular message on scams, which is to…well…jangan kena scam. According to 2023 survey on scam awareness for bank customers conducted by Rakuten Insights, while 9 out of 10 customers read scam alerts, only close to 60% feel prepared to fight financial scams. Not just that, close to 80% of customers surveyed believe victims inadvertently revealed their banking credentials in scams.

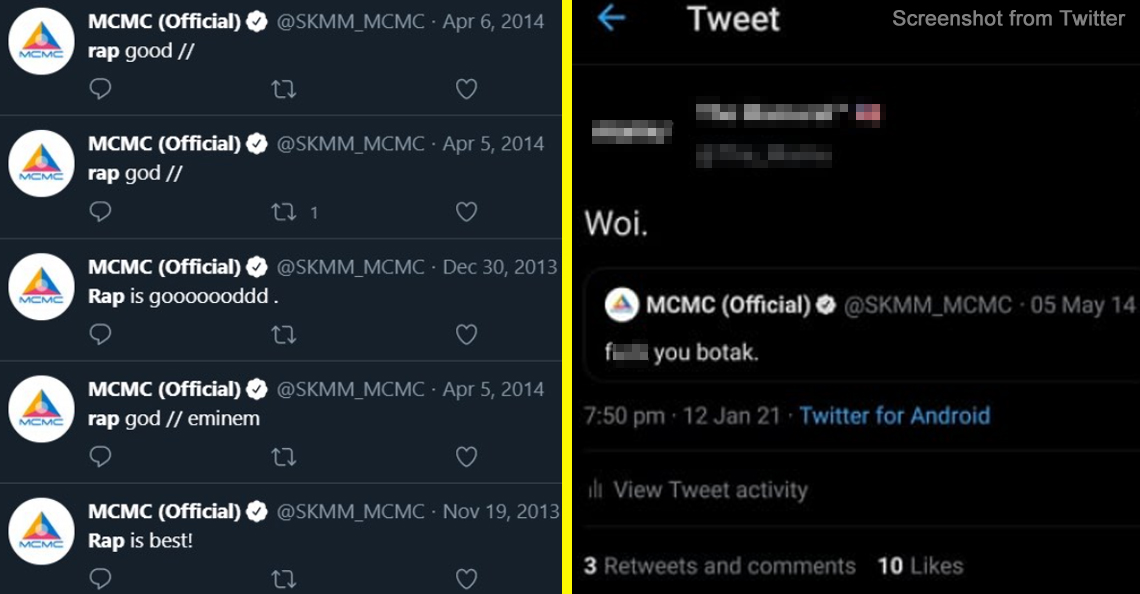

At a media briefing, Derek John Fernandez, the Commissioner of the Online Harms and Network Security Committee under the MCMC said that 2.5 billion calls have been blocked between 2018 to August 31st 2023,, while 237,999 phone lines associated with scams have been terminated between 2021 to August 31st 2023. But even then, it was mentioned that the number of scam attempts could be 7 times higher because many go unreported.

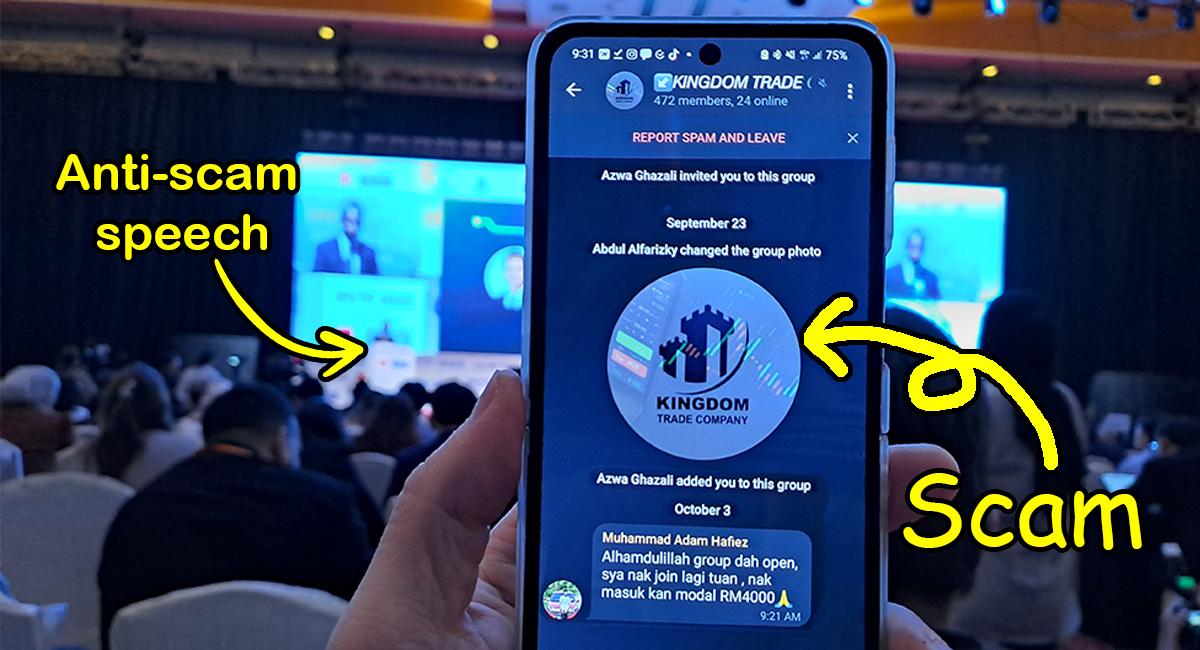

But fancy numbers aside, perhaps nothing illustrates the problem better than a video of this writer receiving a freelance job scam message while Bank Negara Governor Datuk Abdul Rasheed Ghaffour was delivering his speech on the importance of educating the public against scams.

If JanganKenaScam sounds familiar, it’s because this is a refresh of the 2022 campaign, but on a much greater scale than before. There will be a nationwide roll-out of the #JanganKenaScam Fest in urban and suburban areas, featuring experiential booths and informational exhibitions to equip Malaysians with practical anti-scam knowledge so they can easily identify and protect themselves from scam tactics. In the words of ABM Chairman Dato’ Khairussaleh Ramli:

“To fight scammers, we first need to learn their language. […] We encourage the public to take up this fight with us so we can defeat scammers together. Customers should remain alert at all times, and not share their banking information with anyone.”

Also, Hairul Azreen brings an action hero vibe to the campaign, as #JanganKenaScam’s official brand ambassador. He’ll be at selected legs of the #JanganKenaScam Fest which, as we mentioned earlier, will be held at various locations nationwide – starting with the Minggu Saham Amanah Malaysia (MSAM) in Bertam, Penang from now until 8 October 2023, and in 1 Utama Shopping Centre in Petaling Jaya from 15 to 19 November 2023.

We got to try some of the attractions in the festival and let’s just say it’s something you’d want to bring your kids and maybe your I-will-click-on-every-link-my-friend-chat-group-shares family members (Hi Dad).

If you’d like to know more about the Fest or get tips on how to recognize and combat scams, head on over to their website which is – yes you guessed it – www.JanganKenaScam.com

- 78Shares

- Facebook62

- Twitter4

- LinkedIn4

- Email4

- WhatsApp4