Msian tax expert says SST necessary to step up social services

- 46Shares

- Facebook44

- Twitter1

- WhatsApp1

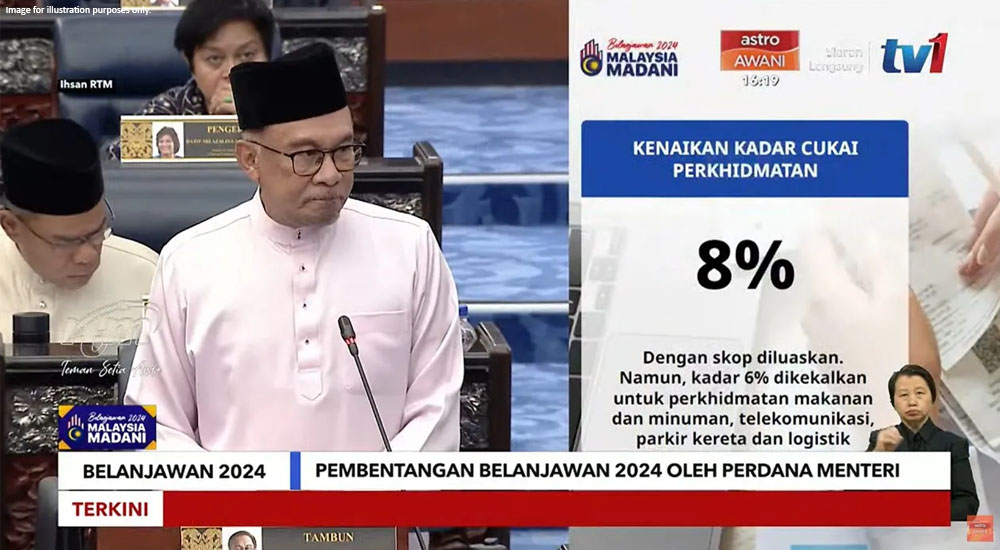

The last time Malaysia saw an increase in service tax rate across the board was when it rose from 5% to 6% back in 2011, said Jagdev Singh, one of the nation’s leading tax experts. In an interview with Free Malaysia Today, he said:

“In recent times, neighbouring countries have increased the size of their budgets, and this is usually accompanied by an increase in consumption taxes or introduction of indirect taxes in specific areas,” – Jagdev Singh, PwC tax leader

He added that Singapore had raised its goods and services tax (GST) rates by 1% in 2023 and another 1% this year, and Indonesia will be increasing their value-added tax to 12% in 2025. He likened our government’s situation to walking a tightrope, as…

The government might be in financial hot water if not for the SST hike

Img from Daily Express

Without the additional revenue brought by the tax hike, says Jagdev, the country might have to hold back on development expenditure, and that’s a no-go since the government was obliged to step up social services to improve the overall standard of living, deal with a widening income gap and keep inflation at bay.

“Many countries have had to grapple with income inequality as the world emerged from C0V1D. Quite a number of them, including our neighbour Singapore, are giving cash aid to low-income earners,” – Jagdev Singh, in an interview with Free Malaysia Today

While necessary, Jagdev said the SST increase is not perfect, and there will be issues to be ironed out.

“Until we are prepared to adopt a broader-based tax, the government will need to find ways within the existing tax system… A broad and multi-stage tax such as GST, which is transparent across each stage of the supply chain, remains the better alternative to deliver a sustained source of revenue and balance the country’s over-reliance on corporate income tax,” – Jagdev Singh, on GST’s place in Malaysia

Jagdev Singh, PwC tax leader. Img from The Edge Markets

Universiti Sains Malaysia’s tax academic Lim Tan Chin said the country’s debt hit 60% of its gross domestic product (GDP) following the Great Virus Attack of 2019, and that a lot of money will be required to service it, bence the tax hike.

“It is like a credit card bill. If we end up defaulting (or do not) pay the full amount and interest, we can go bankrupt,” – Lim Tan Chin, on Malaysia’s fiscal deficit

She emphasized, however, that our country still has solid financial fundamentals, and we as a country won’t be going bust anytime soon.

- 46Shares

- Facebook44

- Twitter1

- WhatsApp1