Ringgit got stronger against USD. But why ah?

- 1.5KShares

- Facebook1.0K

- Twitter72

- LinkedIn41

- Email90

- WhatsApp224

For the longest time, Malaysians have been complaining that our Ringgit exchange rate is 7 days in Italian. What’s 7 days in Italian, you might ask?

There’s a perception that the exchange rate is a reflection of the economy, in the sense that a strong Ringgit means a strong economy, and a weak Ringgit means econo-mi segera is all the Rakyat can afford. So obviously people haven’t been happy about it.

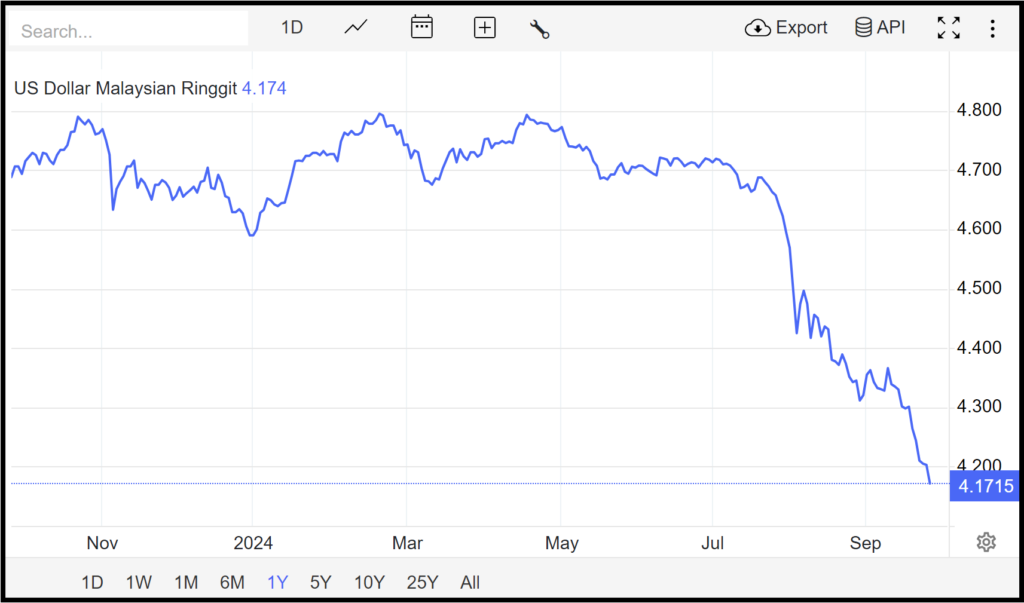

But now, the exchange rate has improved!

The Ringgit isn’t only the strongest it’s been against the US Dollar in months, but forecasts indicate it’ll get even stronger over the rest of the year. Not just that, the Ringgit also outperformed a lot of other currencies against the USD, such as (at time of writing) Singapore, Korea, Thailand, and China.

So, what if we tell you that this doesn’t necessarily mean our economy is improving? And to prove this point, we’re gonna tell you something that’ll get your blood boiling…

The Ringgit could have been strengthened anytime we wanted!??

Yes. You paid extra for your imported goods and cried at the money changer for nothing. There’s actually an easy way to improve the exchange rate – raising the Overnight Policy Rate (OPR).

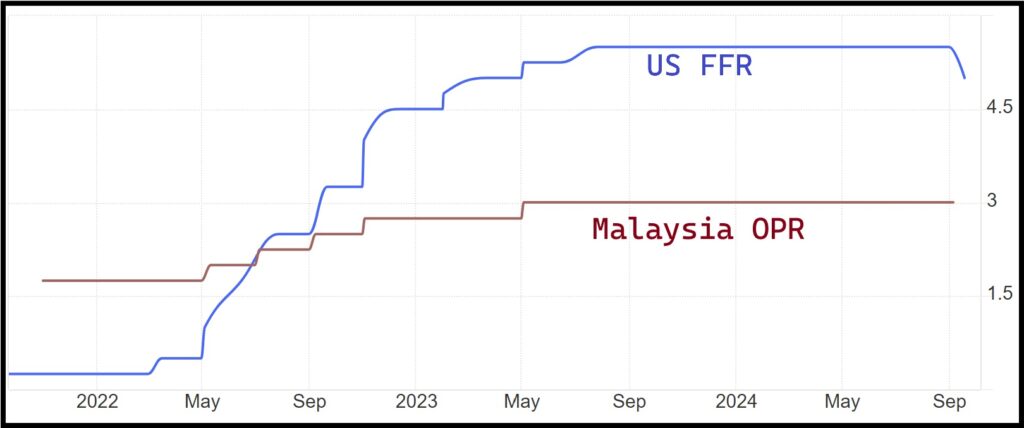

We previously wrote about this in detail but, basically, OPR is the interest that banks pay when they borrow money from each other. And we know that increasing the OPR can strengthen the exchange rate because that’s how the US Dollar got so strong, it had to marry Baela to have a solid claim to Driftmark.

The American version of OPR is the Federal Funds Rate (FFR). The US Federal Reserve (their version of Bank Negara) started hiking the FFR in 2022, where it went from an interest rate of 0.25% in March 2022 to 5.33% in June 2024. Meanwhile, Malaysia’s OPR has been sitting at 3% for the past year.

When a country’s interest rate is high, it encourages international businesses, traders, and investors (like hedge funds) to plonk their money there. This movement of money strengthens the exchange rate because money going out weakens a currency, while money coming in strengthens it.

So why didn’t Bank Negara give the Rakyat what we want and just push that magical OPR UP button?

Well… that’s because hiking the OPR when the economy is growing well can actually cause a lot of businesses to chaplap and a lot of people to cry.

Our central bank maintains the delicate balance between keeping the economy healthy, while ensuring that overall price pressures in Malaysia doesn’t spiral out of control.

Every action taken also has an equal and opposite reaction. While hiking up the OPR might make the Ringgit stronger since it encourages investors to buy Ringgit assets (because high interest rates equals higher returns), on the flipside, it also makes getting loans more expensive, and the cost of running businesses becomes higher.

That’s why increasing the OPR to chase after a stronger Ringgit isn’t the wisest decision, since it can lead to other unintended consequences. That being said, there are times when increasing the OPR is necessary. For example, when the economy is growing too rapidly and people have too much money to spend, prices of goods will start to melambung tinggi, leading to the dreaded high inflation.

Basically, OPR is used as a tool to keep the economy growing sustainably, rather than to rig our exchange rate. And when the inflation and growth rates are steady (like it is now), there’s really no need to hike up the OPR just to increase the Ringgit.

Okay, if we didn’t increase our interest rates then… how did our exchange rate improve?

Other countries are starting to reduce their interest rates

Well, you might be getting the idea that a government or central bank can directly influence the exchange rate. That’s just half the story. There are other factors that are largely out of a country’s control such as war, geopolitical politicking, and unexpected developments in the market.

And this is where strategy and policy come in.

Bank Negara’s Monetary Policy Committee (MPC) decides on the OPR, and explain their decisions in the form of Monetary Policy Statements which you can find here. But TLDR: economy growing, inflation OK, Ringgit recover, no need to increase OPR for now, will continue to monitor.

We don’t know if this was a calculated move or pure luck, but the central banks in advanced economies like the UK and the EU started to reduce their policy rates. Meanwhile, the US itself has recently cut their interest rates by a rate of 50 basis points.

This starts to narrow the interest rate difference, which motivates investors to start shopping around for other places to plonk their money in.

Of course, there are other countries they can be plonking into, so…

What’s making Malaysia more attractive to investors?

A lot of it comes down to our economic prospects improving, and policies that give investors more confidence. For example, our international trade and exports hit double-digit growth in July 2024 thanks to demand for palm oil, machinery equipment, and electrical and electronic products.

On top of that, Malaysia’s economy is on the upswing. Our 5.9% GDP growth in the second quarter beat many analysts’ and market expectations. Households are spending more, exports are bouncing back, and tourist numbers keep rising, fueling our economy.

We’ve also been making investments to support new and emerging technologies like EVs and AI. Cloud computing and Artificial Intelligence require data centers that take up huge amounts of land, energy, and water. With supportive policies, we’ve attracted investments from companies like Google, Nvidia, and Microsoft. Fun fact – Johor is set to overtake Singapore as the largest market in Southeast Asia within 2 years, and Malaysia may be the third largest in Asia after Japan and India.

Another reason would be certain unpopular decisions regarding subsidies and price control. Using diesel as an example, the previous blanket subsidy was costing the government billions a year (RM81 billion in 2023) and opens windows for abuse and corruption.

While people are unhappy with the introduction of targeted diesel subsidies, it saves the country RM4 billion a year – much of it from smugglers who resell our cheap diesel in other countries. Cherry on the cake? It boosts our sovereign credit rating, which can help attract foreign investment. So yes, in a very indirect way, we can strengthen the Ringgit by paying more for diesel.

And remember how we mentioned that investors will plonk their money in a country that gives them the best returns?

The gomen is encouraging GLCs to stop keeping their money overseas

Well, Malaysian companies do the same as well – some being private and some being Government-Linked Companies (GLC) or Government-Linked Investment Companies (GLIC). For example, the EPF dividends you get each year come from investment returns that EPF (which is a GLIC) makes on your behalf. As of June 2024, 38% are foreign investments which generate 51% of income.

Earlier this year, Bank Negara started encouraging GLCs, GLICs, and private companies with excess foreign currency to bring their money home. The idea is simple – money coming in Makes the Ringgit Great Again™️.

Since the interest rates in other countries are decreasing, this also gives more incentives for Malaysian GLCs to invest locally. Win-win.

The Ringgit exchange rate doesn’t always show how good or bad the economy is doing

It can be really tempting to look at the exchange rate and say “Ringgit weak economy bad, Ringgit strong economy good”. But if there’s one takeaway here, it’s that the exchange rate isn’t a very good indicator of how well a country’s economy is doing. One policy change or one market fluctuation, and that rate starts shaking like a Polaroid picture.

Better indicators are actually the long-term fundamentals like foreign investments, high productivity, jobs, good salaries – all the stuff that allow you to live a comfortable life. For better or worse, these can largely only happen with social and political stability, and solid reforms and policies from the government.

Unfortunately, it’s the reforms and policies that get people angry or are politicized to get people angry. We’re not saying that everyone should just keep quiet and accept it, but rather look at it through a broader, long-term lens – and that can be really difficult.

The US Federal Reserve didn’t increase their FFR to raise the exchange rate – they actually did it to fight inflation knowing full well it would financially strain many American households and businesses. They had to make life harder for many people in order to prevent hardship for everyone. And if you’re already having trouble affording groceries, that’s a bitter pill to swallow.

- 1.5KShares

- Facebook1.0K

- Twitter72

- LinkedIn41

- Email90

- WhatsApp224