RM is stronger in many countries. But why it kena tapau so badly by USD?

- 4.0KShares

- Facebook3.5K

- Twitter31

- LinkedIn27

- Email65

- WhatsApp364

When it comes to money and economy stuff, there are three things that Malaysians have been complaining about the most this year:

- Inflation

- Overnight Policy Rate (OPR) increases

- The weakening of the ringgit against the US Dollar

While it may appear that these are three separate factors that spell gloom, doom, and ekonomi kaboom, there’s good news – they’re actually interrelated factors that won’t seem as bad once you see how they come together.

Because, in contrast to this seemingly negative outlook, there are signs that the economy is actually pretty okay. For instance:

- More Malaysians have been going on holidays overseas since the travel ban was lifted.

- A 6-8 month wait for a new car is pretty common now because new car sales went up in 2022 (although the chip shortage is also a factor)

So…. how does this contradicting information gel? Well, it comes with understanding how each of the three factors above play a role in the bigger picture. So let’s start off with the most complicated one, OPR.

High OPR increases your loan interest rate (but you also get more fixed deposit interest)

Banks make money through interest gained from loans, credit cards, and other investments – but to do all this, they need to maintain a healthy cash reserve or float. When their float falls under a certain amount, they’ll have to borrow money from other banks and pay an interest. This interest, determined by Bank Negara, is what’s known as the Overnight Policy Rate, or OPR.

But if it’s between banks, what does that have to do with us regular rakyat?

Well, if the OPR goes up, it essentially becomes more expensive to borrow money from the bank because they will have to raise their interest rates on their loans to you. But only floating interest rate loans (which can change over time) such as housing loans and some business loans are affected. Fixed-rate ones such as car loans are not affected.

What you may not know, however, is that high OPR also means higher interest rate for fixed deposits. While this would benefit the regular Malaysian with savings, it’s also super attractive for foreign investors as well – keep this point in mind for later.

At this point, you might be thinking, Wahlau Bank Negara… Just make the OPR zero and the rakyat will be less susah lah! Well then, you would have just painted yourself into a corner because…

Low OPR can cause inflation 😨

Generally, inflation isn’t something that a government or central bank can completely control. External factors such as the war in Ukraine and the sanctions against Russia have disrupted the supply of oil and food commodities like wheat, driving up prices. There are also other causes of inflation such as the devaluation of money and a country’s economy doing too well which you can read more about here.

But for now, let’s focus on something a country’s central bank CAN somewhat control – interest rates.

Think of it this way – even if you couldn’t afford it, you went and bought a new iPhone 14 Pro Max because you got a zero-interest loan. Now, imagine if everyone started buying an iPhone 14 Pro Max because they got the same loan. If Apple can’t keep up with this increased demand, the shortage of iPhone 14 Pro Maxes would cause prices to shoot up and…. congratulations, we’ve now got inflation.

This concept applies from Apple to apples, because one cause of inflation is when demand is higher than supply. So by increasing the interest rate, inflation can be controlled because it discourages people from spending unnecessarily. Basically, you’d be less inclined to buy that iPhone if you had to pay 10% interest on a loan.

We can actually see what happens when a country’s OPR is kept low when prices are going up, because Turkey has been cutting their interest rates since July.

Turkey’s Central Bank dropped the interest from 14% to 10.5% in September – with their president Recep Tayyip Erdogan aiming to get it down to single digits by the end of this year. The result has been an inflation rate of 84.3%, with some goods costing triple its price since the beginning of the year. Not just that, the Turkish Lira has also lost about 50% of its value against the US Dollar, which also lost them investments.

This brings us to the third point in the equation – the US Dollar.

The US Dollar went up because they… increased their interest rates.

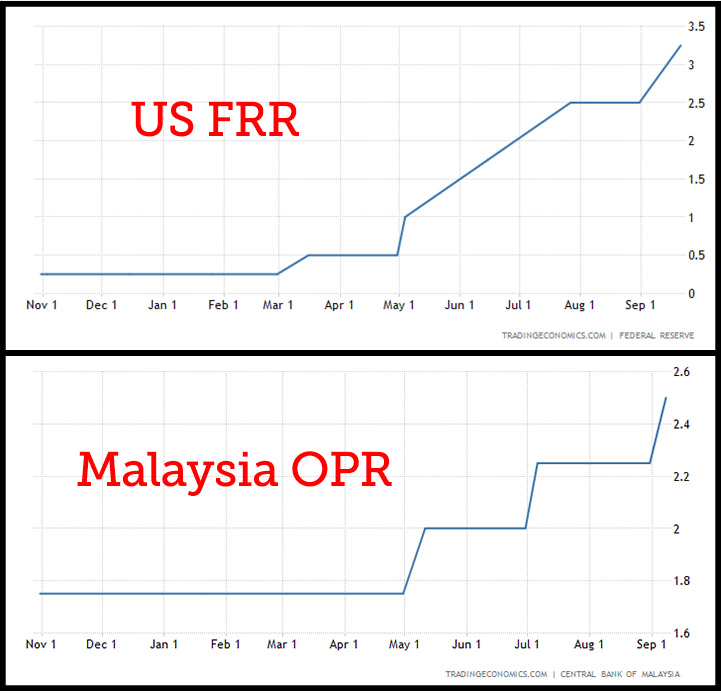

Yup, basically the US increased their Federal Funds Rate, which is the American version of OPR. The US Federal Reserve (their version of Bank Negara) has hiked their interest rate from a range of 0.25% – 0.5% in March 2022 to 3% – 3.25% in September. Here’s what the Chairman of the Federal Reserve’s Board of Governors said:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. […] While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation.” – Jerome H. Powell, as quoted from his August 2022 speech transcript.

Remember the point about high OPR attracting foreign investors we asked you to keep in mind? Well, there are investors (like hedge funds) and traders who have bank accounts around the world, moving their money to whichever country has the best balance between stability and high interest rates – which is currently the US. This movement of money also affects the exchange rate because money going out weakens the currency (because fewer people want it), while money coming in strengthens it.

So in order to attract this money back, we have to – say it with us now – raise our interest rates. And this is where it all comes together:

You cannot have lower inflation and a stronger ringgit without raising OPR

The policies related to OPR in Malaysia are decided by Bank Negara’s Monetary Policy Committee (MPC) which independently formulates and implements these policies at least 6 times a year. The reasoning behind their decisions is released in the form of Monetary Policy Statements, which you can find here.

When they first started raising the OPR in May, their statement indicates that a raise was necessary to combat inflation but, instead of large jumps like the US, the MPC’s strategy was to implement it in “a measured and gradual manner” so everyone (ie, us) can slowly adjust to it. You can actually see this clearly in the graphs below:

Aside from USD, Malaysia’s exchange rate is actually quite stronk

We understood most of the basics of OPR, inflation, and konsep-konsep finance yang sewaktu dengannya from BNM’s FAQ and YouTube videos (videos in BM though); which actually contains more info than we’ve included in this article. One thing that the FAQ pointed out is that Malaysia’s exchange rate is actually doing pretty good – it has appreciated against the Yen, Baht, and Korean Won. Here’s a table detailing the exchange rates from the start of the year to the time of writing:

But all of this being said, it doesn’t mean that our economy is great. In fact, it’s gonna be hard for every country. The International Monetary Fund has forecasted a decline in global growth and an increase in inflation over the second half of 2022, while the World Bank published a 40-page policy note titled “Is a Global Recession Imminent?“ that all but confirms that chances of avoiding a global recession in 2023 will be very narrow, and finances will be tight.

So basically, while the OPR hike isn’t going to be easy for a lot of people, it’s the financial equivalent of bersakit-sakit dahulu, bersenang-senang kemudian. If Bank Negara cuts the interest rates, it will result in higher prices for the rest of us, which will especially harm the B40 and M40 families – just like Turkey. So for the time being, you might want to hang on to your old phone for a little longer, and plonk your money into a fixed deposit account to get a taste of that sweet, sweet interest rate.

We hope you found this article interest-ing!

- 4.0KShares

- Facebook3.5K

- Twitter31

- LinkedIn27

- Email65

- WhatsApp364