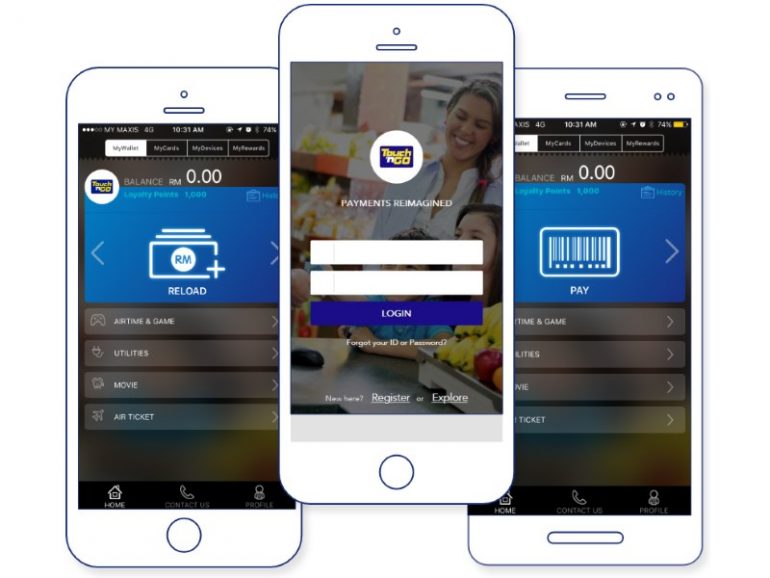

Soon Malaysians might be able to use Touch ‘n Go on their phone for small payments

- 8.6KShares

- Facebook8.5K

- Twitter7

- LinkedIn2

- Email8

- WhatsApp26

Nowadays we are more likely remember to bring our handphones when we go out than wallets. Maybe cos our phones are always in our hand. We’re so attached to them, it’s automatic. But what if we told you that soon, we may not need wallets any more because we can use our handphones to replace them?

Well, Touch ‘n Go wants to make this happen. On 24 July 2017, they announced that they’re collaborating with Alipay to launch this new technology called an e-wallet (electronic wallet). Alipay is a third-party mobile and online payment platform kinda like PayPal, founded by Alibaba Group and Jack Ma.

Whoaa this could change the way we pay for things in Malaysia. Heck this could totally change our lives!

In future Malaysians can pay with handphones at pasar malams and kuih stalls

As its name suggests, money, cards, receipts, and if you’re really aunty, vouchers too, will be stored electronically in an app in our handphones, so that we would no longer need to carry the physical items around. For the Touch ‘n Go e-wallet scan the seller’s QR code to a make payment.

However, the TnG e-wallet is not a mobile extension of the usual TnG cards that many of us have. It’s important not to confuse the two. They are separate products altogether and users will not able to utilise the credit balance in their cards through the e-wallet. For TnG e-wallet users will be able to top up credit via online banking services.

Additionally, users can transfer funds from their balance to another user. Not forgetting, the service has its own loyalty programme where users can redeem rewards through points that they accumulated from purchases using e-wallet. Watch this video to know more:

Actually, e-wallet (aka digital wallet and mobile wallet) technology is not NEW. In fact, Malaysia has seen e-wallets launched by Maybank, CIMB and Telenor in 2016. And even way before that, we’ve been paying for online purchases, Grab rides with our phones. But what’s significant about it this time is that Touch ‘n Go wants to turn the whole country into a cashless society at even very small merchants such as pasar malam vendors, hawkers and kuih stall operators:

“Our vision is to introduce this cashless payment system deeper at the community level, not just at the city centre or shopping malls, but also at retail outlets close to the community. We will be launching this platform and we will see the reaction from the users by then.” – Syahrunizam Samsudin, Touch ‘n Go Sdn. Bhd. CEO, quoted from The Star

YASSS NO MORE COINZz!! No need to make sure we have exact change when we buy kuih.

Earlier in May, Alipay had already worked with 7-Eleven to launch its e-wallet app at nearly all of the convenience store’s outlets nationwide. Touch ‘n Go is expecting its e-wallet to escalate quickly considering the widespread use of their existing cards – there are about 17 million cards issued. Not to mention, NO MORE COINS! 😀

A pilot project for the Touch ‘n Go e-wallet was launched in Taman Tun Dr Ismail earlier this year and ended in April 2017. TnG worked with retailers, restaurant operators and market traders – anyone was welcome to participate. Response was reportedly positive in terms of the system’s stability and user-friendly function. As far as we know, this tech does not support public transport and tolls.

“We are in the process of improving the eWallet app based on all the feedback that we had gathered from the trial. We aim to launch the eWallet app soon. Stay tuned for further updates.” – statement on TnG e-wallet official website

E-wallets are being used in India’s pasar malams already

E-wallets are being used in other countries already – more Asian countries than anywhere – albeit at a slow pace due to, yup security concerns. A 2015 MasterCard survey on 8,500 adults aged 18–64 showed 45% users in China, 36.7% users in India and 23.3% users in Singapore – the biggest adopters of digital wallet.

Meanwhile, Indian consumers are leading the way with 76.4% using a smartphone to make purchases, which is a drastic increase of 29.3% from previous year. So funny to see even the smallest vendors in India using PayTM, their brand of e-wallet. PayTM stands for ‘Pay For Modi’, named after their Prime Minister Naredra Modi (lol).

In China, companies like Alipay and WeChat are beginning to dominate the payments industry. Almost everyone in major cities is using a smartphone to pay for just about everything. At restaurants, a waiter will ask if you want to use WeChat or Alipay before bringing up cash as a third, remote possibility, reports The New York Times.

“It’s what I’d call a late development advantage. China doesn’t have a really lucrative credit card system. So the Chinese just skipped credit cards and went to mobile payments.” – Gu Yu, Co-founder of Mileslife (a new payment app), CNN Tech

Malaysia might become like India and China in the next 5 years

So are we moving towards a cashless Malaysia? There are a couple of roadblocks to a becoming a totally cashless society, one being security. While the idea of ditching cash, coins, cheques and cards for handphones is too irresistible, be mindful that a our personal information is permanently stored in the e-wallet – name, customer card numbers, secret PIN, net banking credentials and so on. But of course there are ways to protect our security (read here and here).

However, an economist has forecast that our country will get there in 5 years. Yeah Kim Leng, Professor at Sunway University Business School, said the process could be sped up if companies beef up security measures to curb cybercrime and allay people’s concerns against it.

“There are still concerns about cyber security. But mobile payment is slowly gaining control as people feel secure, compared to other modes of payments at the moment.” – Yeah Kim Leng, Sunway University Business School Professor, Free Malaysia Today

But now with the joint venture between TnG and Alipay, other experts are expecting it might speed up things as the Professor suggested. “TNG will replicate the success of Alipay in China in Malaysia, because TNG already has its foundation in Malaysia and in various businesses. What they need is just a tweak to complement the business, such as this joint venture,” a banking analyst told The Sun Daily.

TnG CEO said its e-wallet is currently undergoing several evaluation processes before it could be introduced to the public, so let’s see how soon it will be before we start buying kuih with our phones.

- 8.6KShares

- Facebook8.5K

- Twitter7

- LinkedIn2

- Email8

- WhatsApp26