The 3rd Generation Rule: Why the Chinese believe that grandkids would destroy the family fortune

- 8.4KShares

- Facebook8.3K

- Twitter8

- LinkedIn18

- Email15

- WhatsApp80

CNY is just round the corner! And while you’re getting excited thinking of all the angpaos to collect (or to give, in which case sorry cannot help you lol), we wanna bring you guys back to reality for juuuust a second.

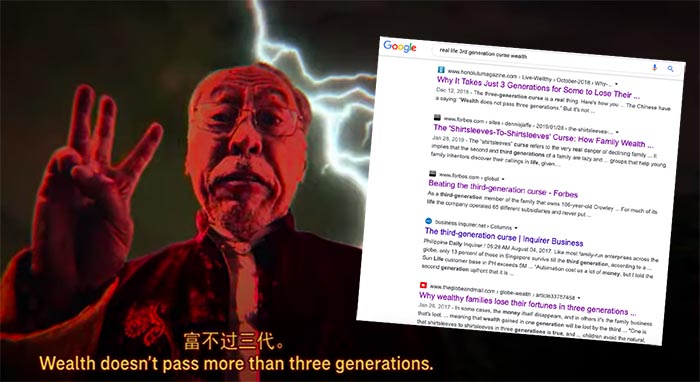

Have you heard of this thing called the “3rd generation rule”? It’s actually a pretty popular Chinese belief that “wealth doesn’t pass the third generation”. (P/S: We actually came across this in a recent CNY video from our sponsors at AIA.)

To illustrate, imagine this – if your grandfather grew a huge business empire in his time, all that would be ruined when it gets passed down to your generation. You’ll go from eating 7-course omakase meals every weekend, to choosing between curry or kongpou chicken at the chap fan shop.

Not we say one ar :

Aiya… is there even any truth to this?

Actually, there’s one part of our headline that isn’t really true: it’s not just popular in the Chinese community. This rule is as woke as a Netflix original series, and applies to every other race and nationality. #nodiscrimination. Just that angmoh got more angmoh saying la: “shirtsleeves to shirtsleeves in three generations“… err, sure, whatever that means.

A much-cited study by Williams Group wealth consultancy says that 70% of wealthy families lose their wealth by the second generation, and 90% by the third. Walao imagine all the lost gold ingots wei.

There was also a survey conducted by the U.S. Trust on super atas people, which found that 78% of them feel that the next generation isn’t financially responsible enough to handle inheritance. 64% also said that they revealed little to nothing about their wealth to their children. Why? Various reasons, including: “people were taught not to talk about money, they worry their children will become lazy and entitled, and they fear the information will leak out”.

Guess what else we found out. Apparently, when someone receives an inheritance, it only takes them an average of 19 days until they buy a new car! And that does back up a very strong reason for the generational rule – that these heirs don’t know the value of money, or how to handle it.

“They have grown up with plenty of money and are a step or two removed from the work ethic and drive of the people who made it for them.” – excerpt from writer Augsta Dwyer’s article /The Globe and Mail

To be fair, there are other reasons also la: taxes, inflation, bad investment decisions, and even dilution of assets from being shared among other heirs. But, as grim as it sounds…

… there’s a way to stop this, and apparently it helps normal people too!

Nope, doesn’t involve getting a true love’s kiss before midnight or reading some sacred mantra. Not that exciting, sorry.

The remedy is pretty dry, but as with most things in life, you HAVE to work hard to reap bountiful benefits. Or in this case, to keep that wealth and/or grow it.

Financial planners have listed so many ways to avoid the rule: getting the kids involved in the business from young, giving the bulk of the inheritance to the most entrepreneurial heir, or even DISINHERITING them so they know the value of money… but our friends at AIA tell us that it all boils down to 3 main pillars:

- You gotta plan well if you want to prosper financially. If you wanna grow your wealth, you need to know how your money should be used for expenses, investments, and other stuff.

- You also gotta save well, which includes managing your money wisely. Develop good habits and save up, so you’ll have sufficient help to prepare you for the future.

- And lastly you gotta also live well. Not by buying yourself 10 sports car and all – it’s about having a healthy body and mind, so you can enjoy the fruits of your labour. No point having all that juice and not being able to reward yourself for it.

Actually, if you think of it, these don’t only cater to rich folk – it’s also something we poorfolk at Cilisos can use for our lives. Thankfully AIA has all sorts of tips for n00bs like us to grow our measly paycheck, including stuff like tracking our spending to save more, how to plan for our retirement wisely, and common mistakes couples make when getting married.

And if you’re interested, there’s also the A-Life Wealth Care, an investment-linked plan which provides you with a high coverage amount and acts as a safety net for your family if you – choyyyyy – are no longer around. For more info, click here.

As for Cilisos, we know what to do as a start to better finances, at least for most of our staff:

- Visit eevvvverrybody and collect angpao. Maybe wear red and hopefully get thicker envelope

- Gather all the money and put into bank account. Must save well right?

- Plan how to use it. Only use 30% for upcoming Valentine’s Day date with GF k?

- And lastly, live well by getting buff for your Valentine’s date! (Even if kena dump still got a nice body right?)

Till then, gong xi fa cai everyone! Don’t simply spend your angpao money all k?

- 8.4KShares

- Facebook8.3K

- Twitter8

- LinkedIn18

- Email15

- WhatsApp80