This M’sian lost his life savings in the LUNA crash… but still believes in crypto

- 850Shares

- Facebook764

- Twitter8

- LinkedIn15

- Email13

- WhatsApp50

We’re admittedly no experts on investing and cryptocurrency, but the ripple that shot through the world during the recent Terra/Luna crash was difficult to ignore. TLDR; the stablecoin TerraUSD (UST) and its sister coin Luna (LUNA) collapsed overnight by about 98%, dropping to below $1. Some investors had poured their life savings into the coin, leaving many with nothing:

Reports of 22 People Committing suicide over Luna failure. 10s of DM which tell a horrific story.

A perfect Ponzi was designed in the name of a stable Coin to lure the retail.

A blot on crypto that can't be undone. I hope Do Kwon is prosecuted and pays for it.

— Emperor👑 (@EmperorBTC) May 12, 2022

We won’t go into the details as to how stablecoins work (for that, see here and here), but we wanted to get a better picture of the situation, so we reached out to two crypto investors/NFT creators. The first is Nova (not his real name; named after the giant cat that belongs to DOTA 2 hero Luna), who, like many, lost pretty much everything in the crash. The second is David Yeo, who avoided the same fate as he claims to have ‘seen it coming’.

Nova began buying stablecoins as the blue chip coins were becoming volatile

In normal speak, the term blue chip (which comes from poker games, as blue chips are the highest in value) essentially means “well-established” or “financially sound”. In crypto terms, this usually refers to the established coins like Bitcoin (BTC) and Ethereum (ETH). So when the big names started to fluctuate, Nova swapped them for an algorithmic stablecoin (which are pegged to other assets, like the US dollar or Euro).

In the case of TerraUSD, it was pegged 1:1 to the US dollar and was supposed to maintain this peg through a complex algorithmic process involving its sister coin Luna (which we won’t go into, because it’s really complex). Because of this supposedly ‘safe’ mechanism, its price is supposed to be more ‘stable’, hence the name ‘stablecoin’.

By the time of the MCO in 2020, Nova, an award-winning commercial photographer and successful full-time NFT artist, had already depleted much of his savings from buying and rebuilding his house. Being a relatively new and careful crypto investor (he claims to have only learned about staking in January 2022), the allure of a coin with the word ‘stable’ in it was too much to resist. It was also promising unbelievably high returns, which further enamored him:

“UST was offering almost 20% APY (annual percentage yield) so I opted for that. “Why not right, it’s a stable coin!” I thought.” – Nova

Oh, how wrong he was.

Because you see, while TerraUSD/Luna was slated to be the next big thing for crypto, critics called attention to its susceptibility to market attacks. However, its South Korean founder Do Kwon had put too much faith into his creation, challenging billionaires on the internet to try and take it down. In fact, he was so cocky that he even accepted an $11 million bet wagering that Luna would trade at $88 by next year.

Probably the most retarded thread ive read this decade.

Silence is a perfectly acceptable option if stupid.

Billionaires in my following, go ahead, see what happens https://t.co/wtt9OhX4kg

— Do Kwon 🌕 (@stablekwon) November 28, 2021

Well, as Count Dooku said in Revenge of the Sith: “double the pride, twice the fall”. And fall he did, and hard.

The value of Luna suddenly plummeted, and Nova was left penniless

If there’s one thing we’ve learned over the years, it’s that you should never challenge the internet to do anything, because they will do it. Not long after Kwon issued his challenge, an unknown entity sold $285 million worth of TerraUSD, which de-pegged TerraUSD from the US dollar, shorted Luna, and led to a mass selling of Luna by panicked holders. The dominoes continued to fall, and as of writing time, Luna stands at $0.000201 (RM0.000880).

With almost his entire wealth tied to crypto, Nova, like many others who bought TerraUSD/Luna, was left empty-handed, and has practically no money left:

“Right now I don’t really want to think about it otherwise I might get depressed and stress-eat (and I don’t have money to stress-eat). Already too much other sh*t is happening in real life before this even happened.” – Nova

As for the TerraUSD/Luna that he still holds, Nova says he’s holding on to it as he believes there’s a chance the coin will repeg itself to the dollar. Not that there’s much he can do besides that anyway, since trading on Luna has been suspended as of the time of the interview.

David, our other crypto bro interviewee, briefly summed up the entire Terra/Luna fiasco in two sentences:

“It was purely market manipulation by the 1%. And Do Kwon was a cocky b@stard who didn’t listen to the public.” – David

(Note: Many, including South Korean authorities, believe that Terra/Luna may have been a Ponzi scheme due to the unsustainable yields offered. Do Kwon is currently under investigation for this.)

It's never too late to send an apology @stablekwon

0x8C32eC42453925Cd95ef82900e597dE2D629b18E https://t.co/VlZzCAVuXU

— FreddieRaynolds (@FreddieRaynolds) May 10, 2022

But where was David during all of this? Well, while he does believe stablecoins can be extremely profitable, he avoided TerraUSD/Luna altogether as he had seen other projects which had followed the same trajectory as TerraUSD/Luna because of their over-reliance on the peg. In other words, if X is good, Y is good; if X is trash, Y is trash, meaning that it falls victim very easily to market manipulation:

“Happened to Forgiving’s 2omb, happened to Harry Yeh’s Tomb, Devil Finance, Kitty Finance, Piggy Finance. Algorithmic stablecoins work only if people play nice, but it is highly susceptible to whale manipulation. One rich bad actor and you’re done.” – David

But with all that being said…

Both Nova and David still have faith in crypto

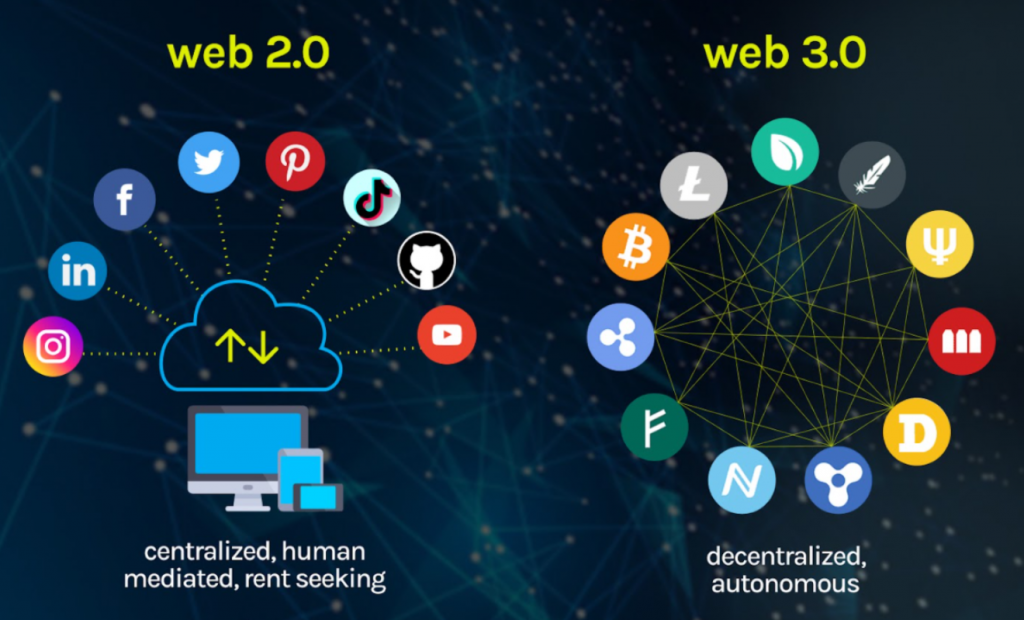

Yes, even after all that, believe it or not, both of the crypto bros we spoke to still believe crypto (or rather, web3) is the way of the future. Both are looking to continue focusing on their crypto/NFT/web3 projects going forward:

“Buy. Historically cryptos are volatile, but they’re always higher in value the next year (and I have been looking at this aspect)… The NFT project I am currently building has a very big potential for growth.” – Nova

“F*ck yes. As Gary Vee (entrepreneur) says, we’re 3 years into a 45-year plan. This technology (web3) will f*cking change the world, dude. Web3’s growth is exponentially faster than the internet’s growth since its inception.” – David

(Note: Web3 is a new idea for the internet which is based on blockchain technology; NFTs and crypto fall under web3. Or in David’s words: “if crypto is Pikachu, web3 is Pokemon”.)

However, both stress that any kind of investment carries some amount of risk, and with crypto, says David, the main factor behind its instability is in the fact that it’s still a new technology that’s prone to manipulation, as the Terra/Luna crash clearly demonstrated:

“It’s new as f*ck, and there’s a sh*t ton of bad actors and rugs. It’s too damn young that it’s still in its embryonic stages.”” – David

As for the overarching lesson here, we feel Nova provided the best one to end things:

“Do your own research, and my advice is: don’t buy sh*t coins.” – Nova

- 850Shares

- Facebook764

- Twitter8

- LinkedIn15

- Email13

- WhatsApp50