Which car insurance add-ons waste your money? We do the math

- 814Shares

- Facebook566

- Twitter17

- LinkedIn18

- Email26

- WhatsApp187

Are you paying extra for car insurance add-ons you don’t actually need?

Car insurance add-ons, also called riders (fitting, since it’s car insurance), offer you optional protections not covered under the basic policy, but at additional cost. Some of the more popular ones are windscreen replacement and flood damage coverage.

Many of these add-ons sound kinda necessary – you’ll be thankful you bought that windscreen coverage when a truck kicks a stone into it. But if you really think about it, when was the last time you cracked your windscreen?

Depending on how and where you drive, some of these add-ons may be a waste of money – especially since you have to buy them every year. So, using the insurance renewal service from our friends at Pos Malaysia, we crunched the numbers across their 12 panel insurers to see which ones are really worth it.

Let’s start with the most popular one…

1. Windscreen repair and replacement insurance

While a comprehensive policy can cover windscreen damage, it’ll cost you your NCD (No-Claim Discount), which is a yearly discount you get for not making claims. This add-on lets you make that claim without losing your NCD. Some versions even cover your windows and moonroof.

The cost? 15% of your windscreen’s price for one replacement per year. After that, you’ll have to buy a new add-on.

Using the Myvi as an example, here’s a panel workshop cost of a windscreen replacement versus the price of the windscreen insurance add-on:

It’s one thing if your daily route involves driving through a warzone of pebbles with an intense hatred of glass. Otherwise, this means that the add-on is only worth it if you actually break your windscreen and replace it at least once every 6 years.

At the same time, windscreens are not a big deal if you drive a budget car… but if your windscreen costs as much as a downpayment on a house (hello, Aston Martin), the add-on suddenly makes a lot of sense.

So TLDR is…

✅✅✅The windscreen replacement add-on may be necessary if you:

- Travel on highways a lot

- Drive on industrial areas a lot

- Like to drive behind lorries or trucks, and/or

- Drive an expensive car

❌❌❌ On the other hand, it may not be all it’s cracked up to be if you:

- Drive an older car

- Drive a car with cheap cheap windscreen price (which you can check from sites like Windscreen2u)

- Mainly drive in the city

And in the event of an accident, well, you’ll probably be claiming against the other driver or lose your NCD regardless.

2. Named Driver insurance coverage

After getting your first car, you may have been warned by your parents to not “simply let your friends drive your car”. For one, your friend might be a vehicular menace. Second, if they crash your car, “the insurance won’t cover it”.

Well, this is somewhat true. Depending on circumstances, the insurance company might reject the claim, or honor the policy but ask you to pay a compulsory excess (a fixed amount you pay out of pocket) of RM400.

But what if this other driver isn’t a friend, but a spouse or child? Well, that’s where Named Driver coverage comes in.

Basically, Named Driver (also called Additional Driver) coverage extends your car insurance coverage to a second, nominated driver. They just need to fulfill 3 conditions:

- Have a valid license and be legally allowed to drive

- Have your permission to drive the car

- Meet the terms and conditions of your insurance policy (always read the T&Cs!)

The only downside to this add-on is that you’ll have to buy each add-on separately, and it doesn’t account for one-off situations where someone else has to drive your car. Each add-on costs RM10, though some policies include one or more Named Driver(s) free of charge. Here’s an example of one we found from Pos Malaysia:

However, a much better option is the All Drivers / Unlimited drivers add-on. As the name suggests, it covers anyone who drives your car as long as they fulfill the 3 conditions mentioned above. Price-wise, the All Drivers add-on costs between RM20 – RM40, which is a much better deal. Some policies include this free of charge as well.

Unless you’re a bachelor or the kind of person who die-die won’t let any other person drive your car, this add-on is…

✅✅✅ Worth it if:

- You co-own or regularly share your car

- Your kid occasionally borrows your car

- You like to be the boss in your car and let other people drive (In which case, definitely opt for All Drivers rather than Named Drivers)

❌❌❌ But it might not be needed if:

- You’re the sole driver

- You don’t plan to let anyone else touch your steering wheel

3. Legal Liability to Passengers & Legal Liability of Passengers

Legal liability is a fancy way of saying pay compensation because it’s your fault. There is a long legal explanation for this but, in a nutshell, there are two types of passenger liability coverage:

- To Passengers – Protects you if your passenger sues you. Example: You rear-end someone, your passenger breaks their leg, and they sue you for negligence.

- Of Passengers – Protects you if your passenger causes damage to others. Example: They open your car door without looking and a motorcyclist crashes into it.

In this case, both add-ons will help to cover the cost of that compensation. Legal Liability to Passengers typically cost 25% of your Third-Party Insurance premium, while Legal Liability of Passengers is a flat rate averaging RM7.50.

Since Malaysian’s aren’t the suing type (at least not yet lah), you can probably go your whole driving life without ever needing this add-on. If you decide to get it, it’s more for peace of mind just in case. This is because, if your passenger actually sues you after an accident, you may be on the hook for thousands of Ringgit.

The only ways we see this add-on being ✅worth it is if:

- You tend to car pool with lawyers

- Have particularly careless passengers, or…

- Plan to drive to Singapore where Legal Liability to Passengers insurance is required for all cars entering Singapore.

4. Waiver of Betterment

So picture this. You’re driving a 7-year old car and it’s beginning to show its age. The engine sounds like a death rattle, and your front bumper is held on by glue and a prayer. Then you get into an accident that trashes the entire front of the car – which is good news because it means your car insurance will cover a new engine and front bumper… right?

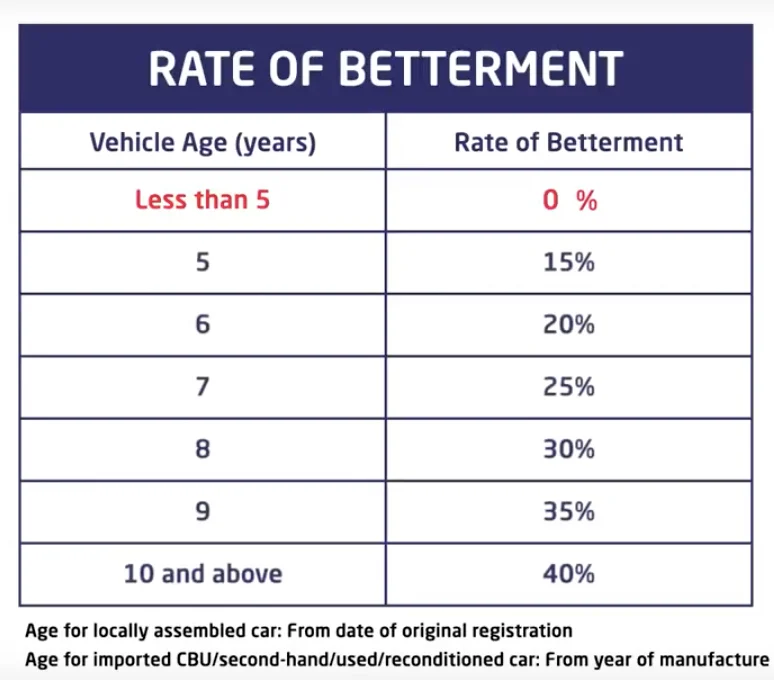

Actually it doesn’t. For cars that are 5 years and older, the insurance will only pay for second-hand parts. This is because the idea of insurance is to return you to your previous condition before the accident, not to improve it. So, getting a brand-new engine and bumper would be considered an upgrade (or betterment), hence the name.

If you want new and original parts, you’ll have to pay a betterment charge which ranges from 15% – 40% of the cost.

This means that, if you insist on a new engine that costs RM8,000 for your 7-year-old car, you’ll have to pay RM2,000 out of pocket while the insurance company pays RM6,000.

However, if you have the Waiver of Betterment add-on, you won’t need to pay the betterment charge. That being said, this add-on is only available with a comprehensive car insurance policy (not third party) and subject to approval from the insurance company.

This add-on isn’t exactly cheap. Premiums can hit RM400 or more a year depending on your car’s value and age. So this add-on is…

✅✅✅ Worth it if:

- Your car has sentimental value

- You want genuine parts only

- You’re not planning to upgrade your car anytime soon

❌❌❌ But probably not needed if:

- You’re okay with used parts

- You’re planning to sell or upgrade soon

5. Special Perils

True story – when this writer met his friend’s dad, the first thing he said was “Your car got special peril car insurance ah? Must get ah!”. It was a strange first meeting, but it made sense when we found out he lost a brand new Mercedes when a parking lot in KL flooded. And no, he didn’t have Special Perils coverage.

Floods are particularly common in Malaysia but, sadly for your car, it’s not normally covered by insurance.

Special Perils is an add-on that protects your car against natural disasters such as floods, landslides, earthquakes, and even volcanic eruptions.

Price-wise, it’s typically 0.3% to 0.5% of your car’s insured sum. In return, you can make repair claims or be reimbursed the insured amount if your car is ever submerged in water, smashed by a fallen tree that was caused by a storm, or falls into a sinkhole.

Given Malaysia’s unpredictable weather and frequent monsoon seasons, we think you should…

✅✅✅ Definitely consider Special Perils if:

- You live, work or balik kampung in flood-prone areas

- Regularly park in basements or low-lying areas

- You often park near trees

- You don’t want to learn the hard way like that guy with the flooded Merc

Pos Malaysia will help you find the best car insurance… easily!

So whenever your road tax renewal comes around, just remember that not all add-ons are made equal. Some memang berbaloi, but some just burn your duit. Before you hit that “renew” button, think about how you drive, what car you’re driving, and whether that extra cost really makes sense. Prioritise your needs… and skip the fluff.

| Insurance Add-on | ✅ Worth it if… | ❌ Not so worth it if… |

|---|---|---|

| Windscreen repair and replacement | Your windscreen breaks at least once every 6 years | You have a budget car or only drive in the city |

| Named Driver | You share your car with a spouse or child | You never let anyone touch your steering wheel |

| All Drivers | You like to let friends drive your car | A true lone ranger |

| Legal Liability to Passengers & Legal Liability of Passengers | You’re worried of getting sued / have careless passengers | |

| Waiver of Betterment | Your car has sentimental value | You plan to change your car soon |

| Special Perils | You drive in flood or storm prone areas |

And even if you’ve already narrowed down what you need, finding the right car insurance can still be pretty time-consuming since insurance providers have different T&C and prices.

But with Pos Malaysia, all you need to do is key in your car plate number. It automatically finds offers among their 12 car insurance panel partners for you to compare. Best of all, you can also renew your road tax with Pos Malaysia as well.

If this newfangled online stuff isn’t for you, you can also head over to any of Pos Malaysia’s 700+ outlets nationwide and renew your insurance and road tax with an actual human being!

If you need to renew your car insurance soon, here’s a little bonus – Pos Malaysia regularly runs exciting campaigns where you can win cash and cool prizes just by transacting at their touchpoints! Just follow them on social media to stay in the loop. Trust us, you don’t wanna miss out!

So watchu waiting for? Hurry up and head on to Pos Malaysia to get both your insurance and road tax sorted quickly and easily. You wheel not regret it!

- 814Shares

- Facebook566

- Twitter17

- LinkedIn18

- Email26

- WhatsApp187