If you’re already 18, congrats! You’ve been registered for cukai with LHDN.

- 258Shares

- Facebook188

- Twitter8

- LinkedIn8

- Email8

- WhatsApp46

If you’re 18, chances are you were old enough to vote in the last GE15. But do you know what else you’re old enough for now? INCOME TAX!!! And in case you dunno what the hecc that adult-sounding phrase is, here’s a visual explainer:

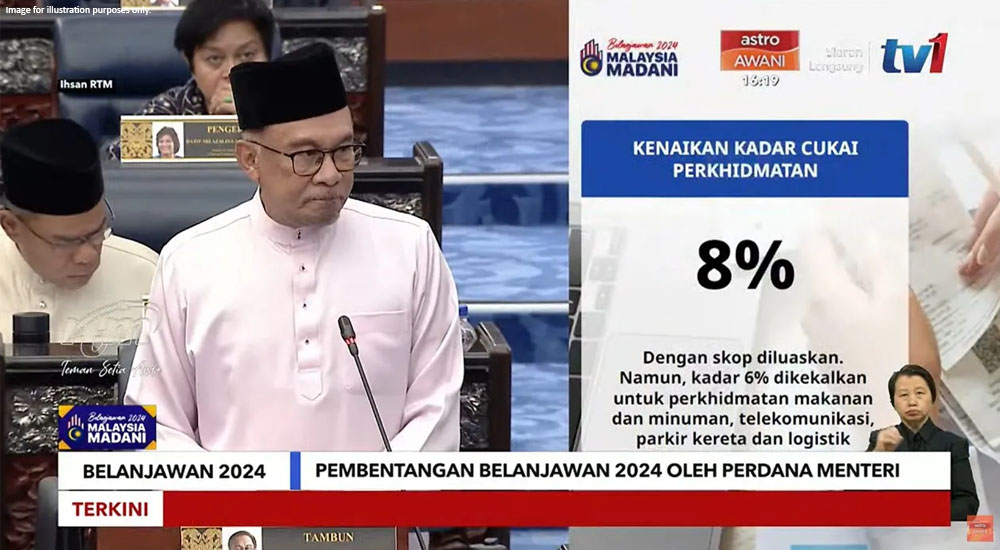

That’s right! If you missed 2022’s budget speech (which you shouldn’t have since you’re a big boi/girl now), you should probably know that…

Everyone over 18 now automatically gets an income tax number!

We dunno how it was for everyone else, but back in our day, taxes was a whole rite of passage. You had to find a job first, then go to a Lembaga Hasil Dalam Negeri (LHDN) office and wrestle with forms and signatures to register for income tax. This eventually gets you an income tax number, transforming you from a simpering fresh grad into a full fledged adult.

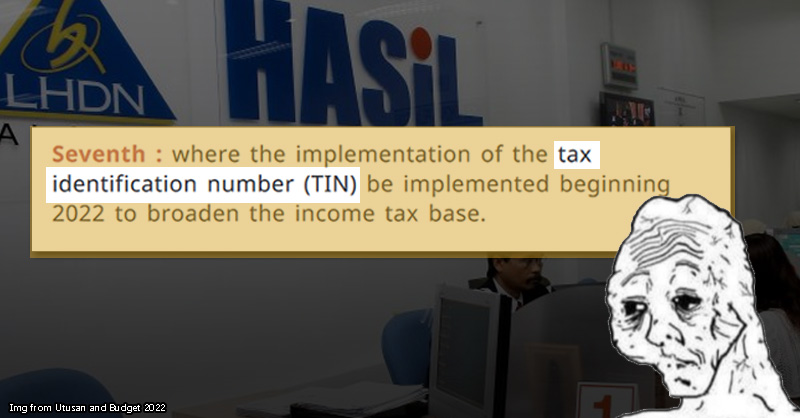

Well, no more wrestling with forms at the LHDN office, because starting last year, all you have to do to get an income tax number is… be a Malaysian and turn 18. In Budget 2022, to ensure the country’s revenue’s sustainability, several changes to the tax system were made (see pages 56-57 of the budget speech). One of them is widening the tax base (read: making more people taxpayers), and this is done by automatically signing up people for income tax.

Therefore, if you’re over 18 or have a company that’s registered with SSM, you already have something called a Tax Identification Number (TIN), which is what they’re calling the income tax number now. You will need your TIN for all things tax-related, including but not limited to:

- paying and filing your income tax,

- matters related to real property tax gains (for when you sell a house or property), and

- stamp duties for documents and instruments (for when you make a loan, hire purchase, rental agreements, apply for scholarships, transfer ownership, and other assorted legal documents)

Yeah, very adult stuff, so if you skimmed all that, the main point here is that you need a TIN to basically start living a life. So if you’ve recently turned 18, you might be wondering…

“Splendid! How do I get my TIN number?”

If you already have an income tax number, that’s your TIN: it’s just a name change. For new taxpayers though, unfortunately, it’s not as straightforward as finding out where you’re voting last GE – you can’t just enter your MyKad number on a website and have it pop up. Depending on how you go about it, it can get pretty mafan…

But you have options! To get your TIN number, just contact LHDN through any one of these avenues:

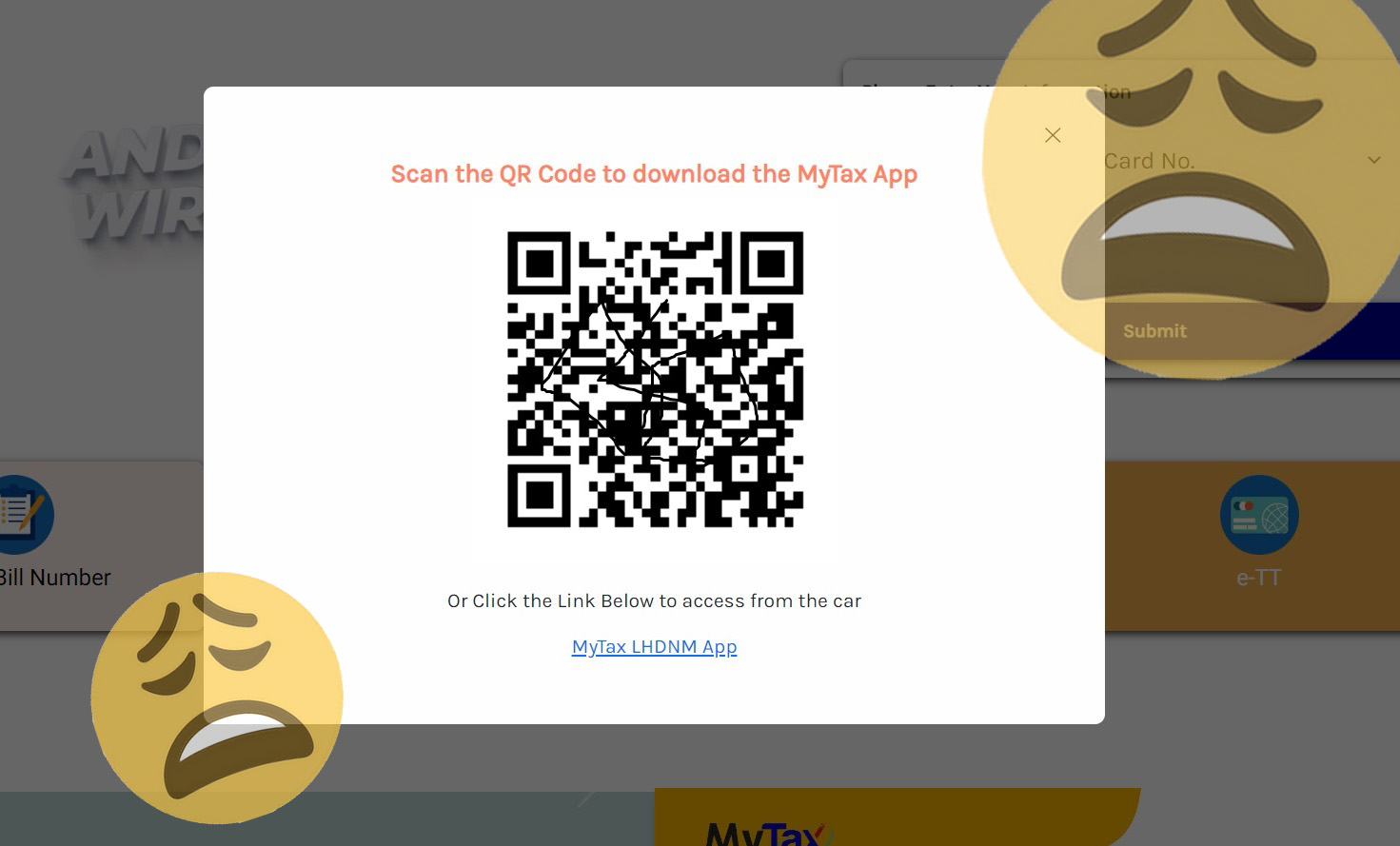

- Enter your details online through their MyTax site [click here]

- Start a HASiL Live Chat on the LHDN main site (click the floating “Chat” button on the right hand side of the page) [click here]

- Ask their customer feedback form [click here], or

- Call the Hasil Care Line at 03-8911 1000

- Speak to the tax people at an LHDN branch, which can usually be found in UTCs

There will be some process to verify your identity, and it could take some time for them to respond, but eventually you’ll get your TIN number. Our intern tried the first one and got her TIN number the very next day.

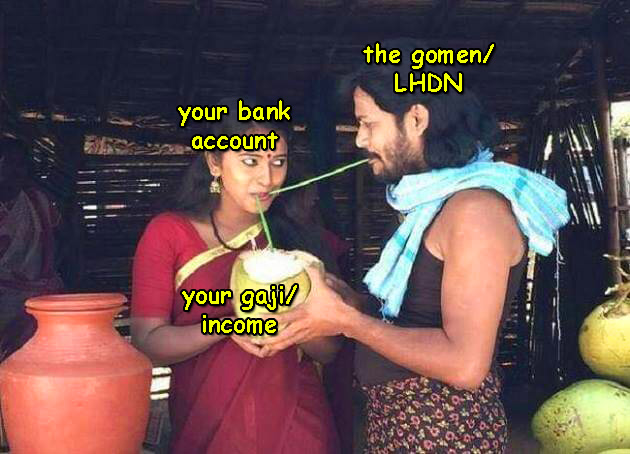

So now that you have a TIN number, do you have to start paying taxes? Not necessarily, because you only pay income taxes once you start earning enough money. It doesn’t matter how you earn that money: you could get a monthly salary, get income from your brownie business, get paid for being an influencer, or even get dividend from your stocks. As long as you earn

- more than RM34,001 a year for most people (or roughly RM2,833 a month), or

- more than RM46,001 a year if you’re supporting a non-working husband/wife (or roughly RM3,833 a month),

after EPF deductions, you have to start paying taxes. If you don’t earn that much, no need to worry! Just get your TIN number and show your mom that you’ve grown up!

- 258Shares

- Facebook188

- Twitter8

- LinkedIn8

- Email8

- WhatsApp46