3 types of investment bros you overhear at mamaks

- 1.2KShares

- Facebook1.1K

- Twitter10

- LinkedIn8

- Email17

- WhatsApp50

Have you ever been at a mamak or cafe, and overheard people from the next table going on and on about their latest investment? Yeah, the ones that go, “Bro, this new investment damn good one, trust me.”

This kepoh writer hears it often, and after months of eavesdropping, he surmised that these bros usually fall into one of three categories:

- Crypt0 bros

- F0rex bros

- Property bros

Of course, while you should never invest blindly without understanding the risk and returns, you might still be curious about what these investment bros are like, what they’re actually talking about, or whether you can take their investment advice for real. Well, you’ve come to the right place – we’re about to showcase three types of investment bros you can’t seem to shake off the mamak.

But before getting into it, a little disclaimer: These are just generalisations made from observations, and every investment bro/sis is unique. If you’re an investment bro/sis, we love you all the same <3

1. Crypt0 bros

In terms of visuals, some crypt0 bros lean toward trendy, oversized tees, while others prefer close-fitting shirts that are tucked neatly into their ankle-length chino pants. Oh, and they love their smartwatches. Can’t forget about those, since they tend to be tech-savvy.

These guys are huge tech enthusiasts, since crypt0’s pretty cryptic if your tech knowledge only goes as far as Excel and PowerPoint. They love using tech jargon when talking to friends, and if someone shows even a hint of interest, they’ll quickly add them to a crypt0 WhatsApp group because they genuinely believe that crypt0 is the future of investment.

You’ll also hear a lot of acronyms coming from them, like BTC, ETH, or USDT, and these are actually the names of crypt0currencies. Another common term you’ll hear is ‘unrealized profits’, which is code for “I just lost a bunch of money cause I was holding on to my investments for so long until it crashed”.

And while it’s fun to take massive dumps on crypt0 bros, there are legit crypt0 sifus out there who know what they’re doing, and won’t immediately tell you things like, “This new coin will be the next BTC, bro, trust”. Major respect to these lot.

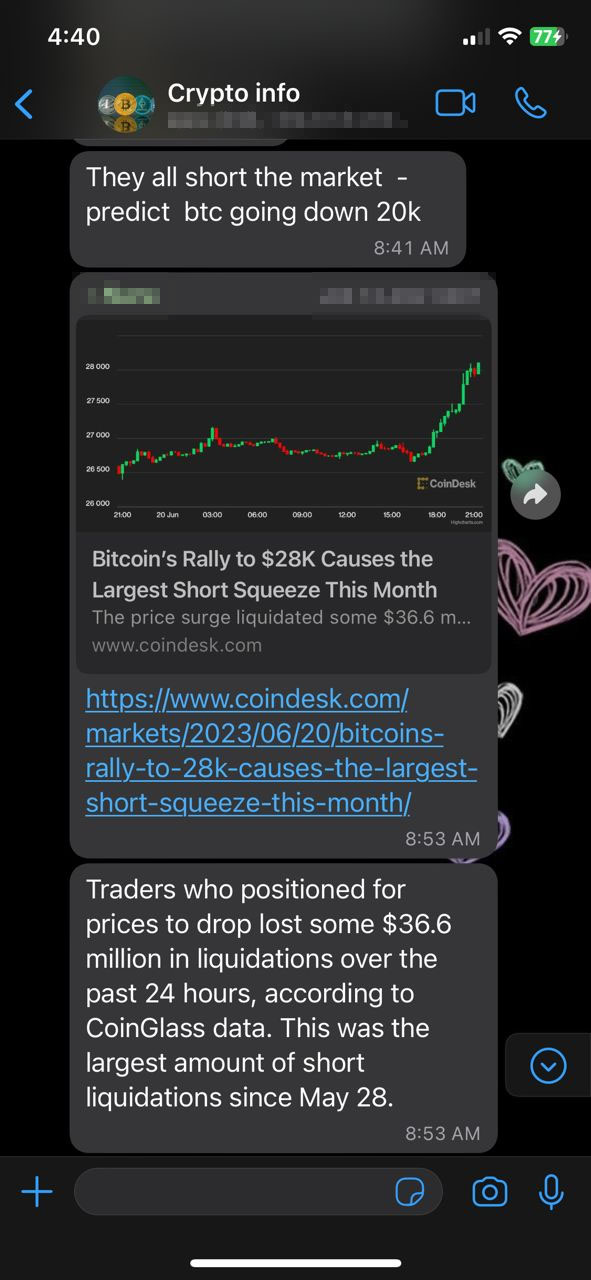

2. F0rex bros

F0rex bros either look like hermits, or CEOs of multinational conglomerates; there’s no in-between. And despite how different these two types of f0rex bros appear, they do have one thing in common: heavy, heavy eyebags.

That’s because they spend every waking moment staring at f0rex charts like there’s no tomorrow. F0rex bros are so afraid that they’ll miss an opportunity to buy low/sell high that they resort to chugging energy drinks so they can keep their eyes glued to their screens.

If they’re on a date, you’ll notice their girlfriend would have already finished a heaping plate of maggi goreng mamak, while the f0rex bro has barely touched any food since he’s too busy keeping up with the market trends. Well, if they have any time for a girlfriend, that is.

Carrying on with the trend of extremes, these guys will either tell you that f0rex is the easiest money-making method in the world, or the quickest path to financial ruin if you go into it with zero knowledge. However, the real bros will usually tell you that the f0rex market is volatile, so you gotta be prepared for the risks before venturing into this wild west.

3. Property bros

For the most part, property bros are indistinguishable from uncles you’ll see at kopitiams. Their wardrobes consist of simple t-shirts or polo tees, short pants, and a pair of selipars.

Don’t be dissing their choice of clothes, though, cause even though you’ll hear them say “I’m a small potato only”, they’ll suddenly follow this up with “oh yaaa that condo is a good investment, I just bought 2 units last month”. Yep, this writer legitimately heard that at a chap fan shop recently.

Property bros also have other catchphrases, including “property value never drop wan”, or “the only regret I have is not buying when it was cheaper”, which might make you think they simply buy properties like buying vegetables.

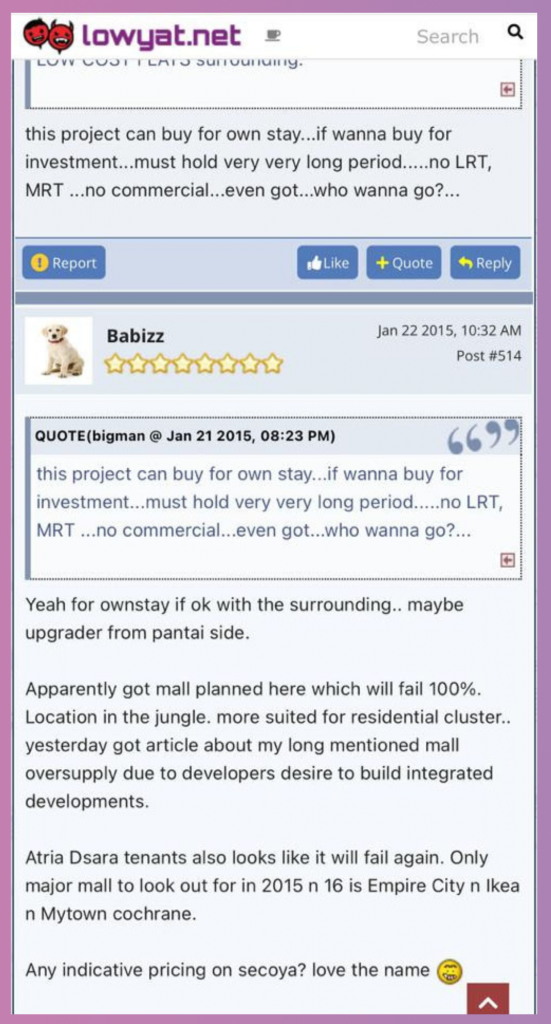

That couldn’t be further from the truth, as many of them do tons of research before investing. Just check out the property section on the Lowyat forums and you’ll see them discussing the risks, ROIs, rental prospects of new projects, the reputation of property developers, or even the best chap fan around new developments.

Consequently, you can usually count on them for sound advice when you wanna invest in a property and its surrounding intricacies, like MOTs, handling defects, or even changing your TNB tariff. In fact, before you consider investing in any property, the real bros will tell you, “Make sure your holding power is strong, bro”, meaning…

Make sure you have enough money in case the unexpected happens

If you’re curious about investing, there’s really no harm in hearing out any investment bros who genuinely want to help you earn some extra cash, because investing is extremely risky if you’re going in blind.

And just like the property bros, you should assess the risk and return of any given investment and make sure you have a basic understanding of the product. It’s best to look for investments that suit your risk appetite, since not everyone has the capacity to jump into high-risk, high-return investments. If you want an added layer of safety, you can also check if the investment is legit and authorised by regulatory authorities like Bank Negara Malaysia or the Securities Commission.

One thing for sure though, it’s never a good idea to invest the money you need for your monthly commitments. Ideally, you should have enough money to pay your bills AND savings to tahan through 6 months without income BEFORE you start thinking of investments. Otherwise, it might be better to just put your excess money into savings or a Fixed Deposit to build that float first. As an additional safety net, the money you save up at the bank is insured for up to RM250,000 per depositor per member bank by PIDM. Conversely, PIDM’s protection does not cover investment products, so that’s something else to consider.

Speaking of PIDM…

If you’re interested in learning about finances and how you can be more financially resilient, PIDM have some resources over at their #SediaPayungKewangan microsite. There, you’ll find tips on financial management, videos, and a money management calculator. In fact, if you suspect your f0rex bro doesn’t have enough savings, send them the website link. Don’t say we didn’t payung ah.

- 1.2KShares

- Facebook1.1K

- Twitter10

- LinkedIn8

- Email17

- WhatsApp50