4 latest scams that PDRM is warning the public against

- 187Shares

- Facebook149

- Twitter6

- LinkedIn6

- Email6

- WhatsApp20

Any Malaysian that’s old enough to drive will have heard of the more common scams that’s been making the rounds in recent years. Chances are, you’ll have already heard of love scams or Macau scams either from news outlets, social media platforms, or that one uncle who shares everything he sees in your family WhatsApp group.

That’s why when PDRM sent us a pdf of scams to write about, we thought it’d be the same old stuff, but… we were wrong. Turns out, we haven’t come of across some of the scams from the list, so yeah, here’s a heads up for y’all.

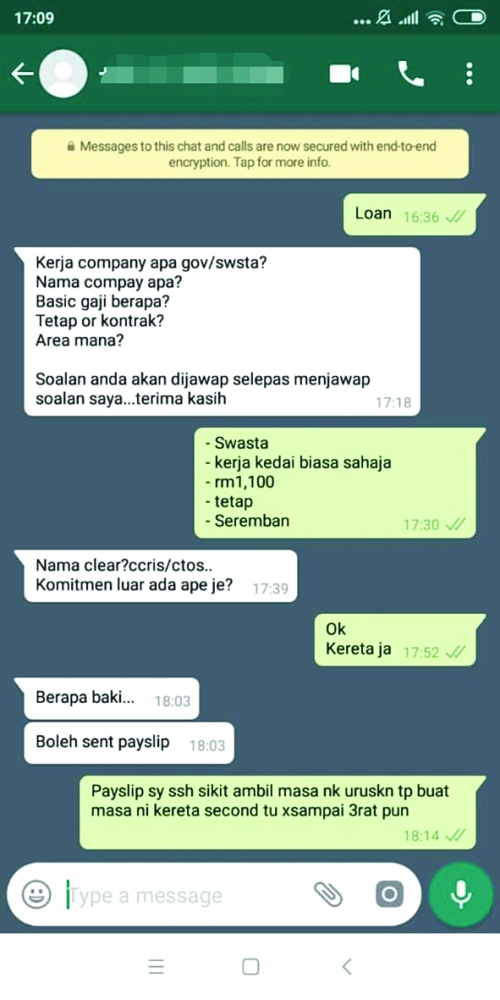

1. Non-existent Loan Scam

How it works: Scammers will put up ads or send SMSes of loans with low interest rates. Victims will then contact the scammers to try to get a loan, but before victims can get the (non-existent) money, they’ll have to pay an amount up front to “secure” the loan first. These upfront payments are usually disguised as stamp duties, legal fees or bank transfer fees. Once the upfront payment is done, the scammer disappears and can’t be contacted any more.

You should be suspicious if: You never see anyone in person to get the loan, or the lender doesn’t have a business address or office. Make sure that the company has a valid license to lend money, and cross check the company name or license number with the Ministry of Local Government Development just to be safe.

2. Crypto Scam

How it works: You download a previously unheard-of cryptocurrency app that promises free tokens, whether it be Bitcoin, Ethereum or other tokens. You connect your crypto wallet to the app, and when you try to sell the free tokens you received, something gets activated on the back end that transfers all the legit tokens you own to the scam syndicate.

You should be suspicious if: A stranger or a crypto app promises free tokens. Always be cautious whenever you check out a crypto app – technically speaking, only 4 crypto apps are officially authorized by the government to do crypto exchange in Malaysia:

- Tokenize Xchange

- Luno

- Sinegy

- MX Global

Also, it’s probably best if you do some research before you start trading in any non-mainstream cryptocurrencies.

3. Fake Money Scam

How it works: So, you’re trying to sell something on an e-commerce platform, like Carousell or FB Marketplace. Someone DMs you and offers to buy your item, and they request to meet up so they can pay in person. That’s not unusual for these types of transactions. Then you guys meet up, the person pays you in cash and leaves. Down the line, you realize they paid you in fake money.

You should be suspicious if: The person asks to meet at a place that’s dimly lit, and they hurriedly rush off after they pay you. To be safe, ask to meet in a brightly lit public place and even safer, ask for QR or bank transfer so you can check that you received the money before the buyer leaves.

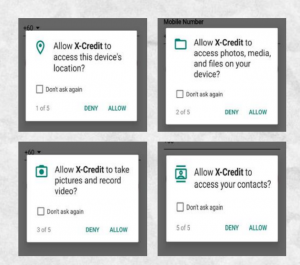

4. Ahlong App Scam

How it works: Apparently, Ahlongs have apps nowadays. When you download the moneylending app, it asks you for permissions to access your phone’s location, data, files and contacts, and the scammer cum ahlong can use photos, videos and other sensitive info to threaten you or your loved ones.

You should be suspicious if: The moneylending app (or any app at all, really) asks for permissions that has nothing to do with its function. Don’t expose your private data willy-nilly.

Here’s what you can do if you kena scam

Obviously, the best-case scenario is that you never get scammed. Before you do anything that involves money transactions with strangers, keep in mind that:

- If something looks way too good to be true, it usually is

- Check reviews of the person or company before doing business with them

- Use SemakMule to check bank account numbers to see if they belong to scammers

If you kena scam already, we’re very sorry, and it’s best if you call your bank, the police and the National Scam Response Centre (call 997) to report the incident. You might think that doesn’t help, but it does. The relevant authorities can start investigating your case, and if you’re lucky, you might be able to get your money back. Besides, making a report can prevent you from losing more money especially if it’s an electronic or online transaction.

- 187Shares

- Facebook149

- Twitter6

- LinkedIn6

- Email6

- WhatsApp20