5 things from Belanjawan 2025 that got people arguing on Reddit

- 138Shares

- Facebook119

- Twitter2

- LinkedIn2

- Email2

- WhatsApp13

Just last Friday, on October 18, PMX Dato’ Seri Anwar Ibrahim unveiled the latest Belanjawan 2025 measures. So instead of ushering in a relaxing TGIF moment, it sparked a weekend of heated debates across social media and internet forums alike.

If you were one of the lucky ones who kicked back and enjoyed your weekend without worrying about how the latest petrol subsidies might hit your wallet next year, don’t sweat it, we’re here to spill the tea on the hot topics that got everyone chatting about Belanjawan 2025, starting with…

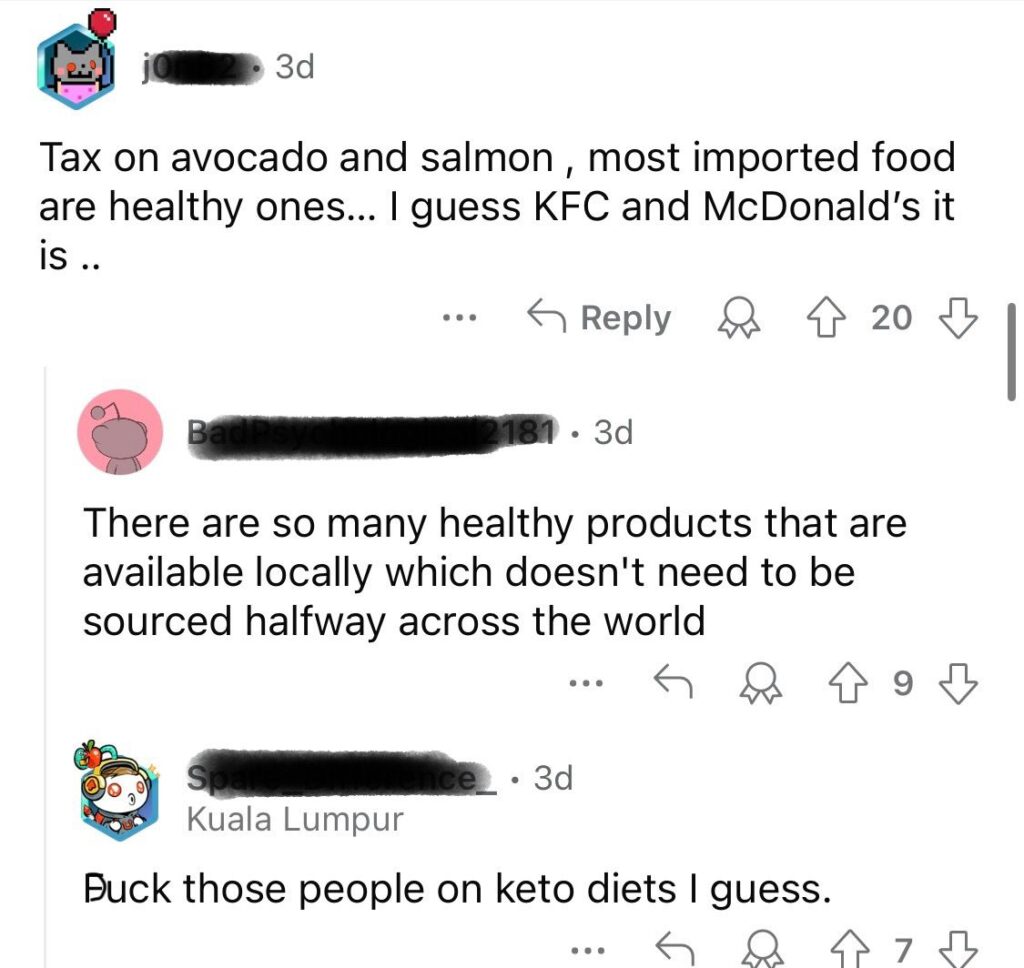

1. New taxes for avocado toast lovers

Nothing gets the rakyat shaking more than new taxes, and Belanjawan 2025 has got plenty to go around:

- Sales tax is going up on non-essential items like imported premium goods (i.e. salmon and avocado) starting May 1.

- Service tax is expanding to cover more commercial services, including fee-based financial services.

- The full implementation of the expanded SST is set for May 1, 2025.

- 2% tax on dividend income of more than RM100,000 for individual shareholders, kicking in with the 2025 assessment year.

- A carbon tax is coming for the steel, iron, and energy industries in 2026 to push them toward using low-carbon technology.

Aside from sounding like a personal attack on salmon avocado maki lovers everywhere, we have so many questions here. What constitutes “non-essential”? Does the humble trout, which sometimes tricks you into thinking it’s salmon, also get the tax hike? Is almond milk not considered essential when you are lactose intolerant?

As for how much these new taxes will affect prices, we’ll have to wait and see. The government did say that some of the revenue will go towards increasing cash aid and improving healthcare and education services. But until then, it looks like we’ll be eating more kangkung starting in May.

On the flip side, there are also some tax reliefs in Belanjawan 2025 to help balance things out. Keep an eye out for our annual article on How to Pay Less Income Tax coming out in April, but here’s a sneak peek:

- Individual income tax relief for education and medical insurance premiums raised to RM4,000.

- Tax relief for savings in the National Education Savings Scheme (SSPN) extended by three more years.

- Additional tax relief for disabled couples raised to RM6,000.

- Additional tax relief for taxpayers with unmarried disabled children raised to RM8,000.

- Additional 50% tax deduction for employers who hire women returning to the workforce.

- Tax exemption on foreign-sourced income extended until Dec 31, 2036.

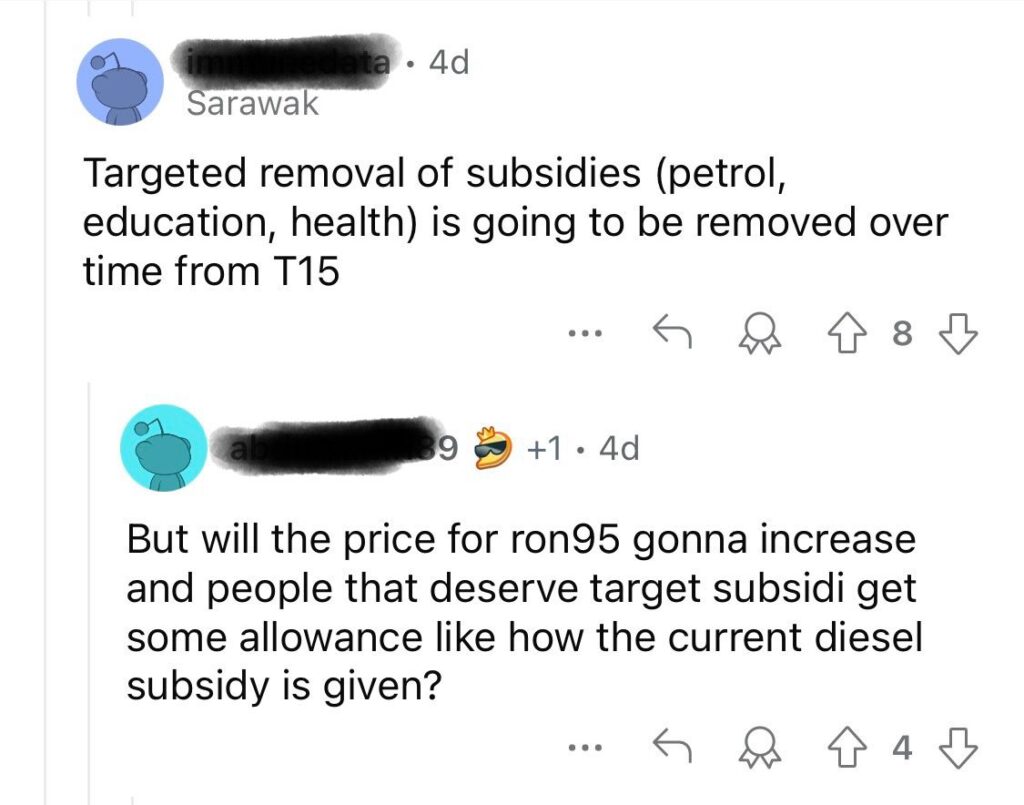

2. Belanjawan 2025 is cutting subsidies for the Top 15%

If new taxes don’t get your blood boiling, the revised subsidies might do the trick—especially if you’re among the top 15% (T15) of Malaysian earners.

In short, the government is planning to cut or reduce subsidies for the highest income group. To be specific:

- RON95 subsidy: Targeted subsidy rolling out in mid 2025, which means no more petrol subsidy for the T15 and foreigners

- Healthcare subsidy: Targeted health care subsidies, meaning the T15 will have to pay “slightly more” for public health services

- Education subsidy: No more education subsidies for the T15 community who enrol in fully residential schools (Sekolah Berasrama Penuh) and public institutions of higher education

Okay, hear us out. As dramatic as the last one sounds, there are a couple of key points to keep in mind:

- The cost of essential schooling (Standard 1 to Form 5) in regular day schools will not increase for the T15.

- Fully residential schools were designed to help students from rural areas and disadvantaged backgrounds, and they cost the government significantly more to operate than regular day schools.

While T15 parents may be in a better position to afford tuition and other educational support for their children, less privileged families – especially in rural areas – often lack access to those resources, making it tougher for their kids to compete academically.

Currently, about 30% of students in fully residential schools come from high income families. So in a way, removing subsidies for the T15 could open up more opportunities for students from disadvantaged backgrounds to get access to better education and keep up with their more privileged counterparts.

BUTTT, and this is a big BUTTT, another important question is “what the heck is a T15?”. According to the DOSM 2022 survey, anyone earning more than RM10,960 monthly falls into the T20 group. But obviously, RM10k a month in Pakan, Sarawak will look vastly different than RM10k in Kuala Lumpur. So, will T15 be defined differently based on states? Is it the state where you work in, or the state in your IC address?? And how will they verify income levels when people pay for these services???

It’s no surprise that many are calling on the gomen to clearly define what T15 means before making changes to these subsidies. We’re definitely hoping they have a solid plan in place to do this without opening the door for people to exploit loopholes.

3. A whopping RM2 billion for Islamic affairs

If you think RM2 billion is a lot, brace yourself, cause that’s not even the full picture. On top of the RM2 billion blanket allocation, there are also plenty of other budget allocated for things like:

- RM170 million for Islamic finance

- RM45 million for the halal industry

- RM35 million for KAFA teachers, and more

Again, many questions here. Aside from the RM150 million allocated to maintain Islamic educational infrastructure, where else is the blanket allocation of RM2 billion going to? Is it all to finance JAKIM? If so, in what way?

We decided to dig into JAKIM’s annual report to get a sense of how last year’s RM1.9 billion allocation was spent. And, surprisingly enough, some of it went to projects like Ilaj Home, a safe haven for Muslims living with HIV/AIDS. Definitely not what we expected!

Beyond that, funds were also used to upgrade infrastructure and systems, including efforts to expand the halal industry. Hopefully, more of the Belanjawan 2025 budget will go towards boosting Malaysia’s halal economy as well.

With Malaysia exporting over USD 8 billion in halal products every year (that’s 5.1% of our total exports) and the industry projected to hit USD 113.2 billion by 2030, it makes sense to invest in growing the talent and infrastructure needed to keep this momentum going.

That’s the ideal scenario, of course – but until we know for sure, all we can do is pray for the best.

4. Higher minimum wage and new salary guidelines

First thing’s first, the minimum wage will increase to RM1,700 per month, effective Feb 1, 2025. This means a lot of Malaysians are gonna be very happy next year, because according to the DOSM, 10.2% are still earning below the RM1,500 minimum wage.

When it comes to minimum wage though, opinions always get very divided. There are people who think the government shouldn’t set a minimum at all because it might lead companies to hire fewer workers due to budget constraints. Then, there are those who think RM1,700 is not enough, and those who worry that new hires will get lowballed with the minimum wage since the government is saying, “pay at least RM1,700 ahhh.”

Welp, lowballing might not fly anymore, as the Human Resource Ministry will start publishing guidelines for starting salaries across all employment sectors, giving workers a clearer idea of what to expect. For example, the starting salaries will be set at RM2,290 for Industrial and Production Technicians, RM3,380 for Mechanical Engineers, and RM2,985 for Creative Content Designers.

And a bit of silver lining for smaller companies, the government has decided to postpone the enforcement of the RM1,700 minimum wage for companies with fewer than five employees for six months, starting August 1, 2025. It’s not a long delay, but it’ll give them a bit more time to plan.

5. No mega projects, more mini projects under Belanjawan 2025

While a lot of PMs are remembered for their mega projects, Anwar doesn’t seem to want to take the same route through Belanjawan 2025, saying:

“Now is not the time to implement mega projects. The country’s development will focus on projects that benefit the people and infrastructure that supports industrial areas based on state priorities.”

PMX

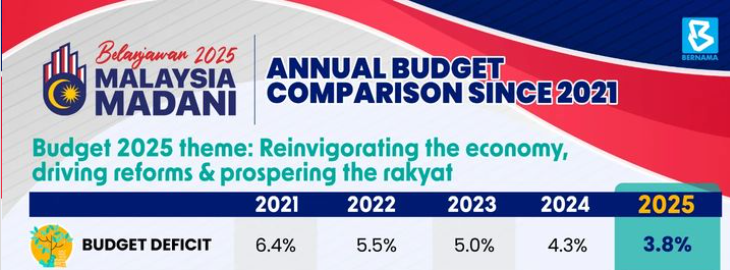

This move isn’t that surprising, since Anwar has been promising to reduce national borrowing, minimise our budget deficit, and bring Malaysia to a healthier debt-to-GDP ratio. Make sense, because our country is still spending more than it makes.

Projects like the ECRL and MRT 3 are still ongoing, but for the most part, it seems Malaysia won’t be getting new, record breaking skyscrapers in the near future. Hopefully we’ll get other useful things like better pedestrian walkways, jejantas, and bus stops instead.

But more importantly, at the end of the day…

Can this government walk the talk?

This year’s Belanjawan isn’t all that different from last year’s, with a general theme of reallocating wealth to benefit the masses. There are plenty of measures in Belanjawan 2025 that focuses on the people and social welfare, like:

- RM13 billion for Rahmah cash aid initiatives, compared with RM10 billion this year, benefitting 60% of the adult population.

- 4.1 million households will get RM100 in cash aid a month, compared with 700,000 households this year.

- Singles earning RM2.5k or less will get RM600 each.

- Social welfare department to get RM2.9 billion, compared with RM2.4 billion in 2024.

- Senior citizen aid increased from RM500 to RM600 a month.

- Low-income families get RM250 in aid for each child aged six and under; RM200 for each child aged seven to 18, capped at RM1,000 per family.

- RM250 million to enrol more low-income individuals in the People’s Income Initiative (IPR), and more

On top of all that, there are also initiatives to boost revenue through economic investments, tourism activities, and reducing leaks in our country’s finances.

So if last year’s budget is any indication—with a strengthening ringgit, the lowest unemployment rate since the pandemic, and a significant GDP boost—let’s hope that Belanjawan 2025 can keep that momentum going!

- 138Shares

- Facebook119

- Twitter2

- LinkedIn2

- Email2

- WhatsApp13