The strange way telur murah last year are contributing to higher OPR now

- 36Shares

- Facebook34

- Twitter1

- Email1

Last Friday, Bank Negara announced that Malaysia recorded a GDP growth of 5.6% in the first quarter of 2023— a pretty impressive feat considering Singapore only naik by 0.1%.

When we win against Singapore and it’s not food related

The good news is that we can expect this trend to continue for the rest of the year. There were, however, 2 statements made by Bank Negara’s governor, Tan Sri Nor Shamsiah Mohd Yusof, that caught our attention.

- Blanket subsidies cause inflation (make prices so high)

- The recent OPR hike to 3% is to make sure Malaysia’s inflation stays under control.

And here’s where it gets interesting. Tho the 2 statements seem independent of each other and lowkey contradictory at first glance, they’re actually more closely related than your go-to roti canai and teh tarik combo at a mamak. So much so you could say our current predicament with inflation and OPR hikes is a result of the events that unfolded over the past 3 years.

And that’s because…

To help the struggling rakyat, gomen provided a subsidy bonanza in 2022

From petrol to cooking oil, to flour and electricity, the total bill came up to roughly RM80 billion. And that’s because The Great Virus of 2019 did such a number on us with unemployment and inflation that the government simply had to step in, or else Malaysians wouldn’t have been able to buy even a Teh C Kosong. Which is bananas when you think about it cos even with a sugar subsidy, we still couldn’t afford tea with no sugar 😭

What’s more, that RM80 billion was a massive jump from our 2021 subsidies worth RM13 billion (which in itself was already inflated). So now you see the scale, right? The thing is tho, while these subsides helped a lot of people who were really struggling, they came at a cost– a cost which we’re finally seeing now cos…

Subsides are like gold diggers– expensive, fake and confirm will make you pokai

The law of demand is simple: lower the price and demand should rise. The issue here is that when prices are forcibly lowered with subsidies, demand doesn’t rise in a natural way. And that creates a bunch of problems like supply shortages and resources misallocation. Big words that basically describe disaster la.

In other words….

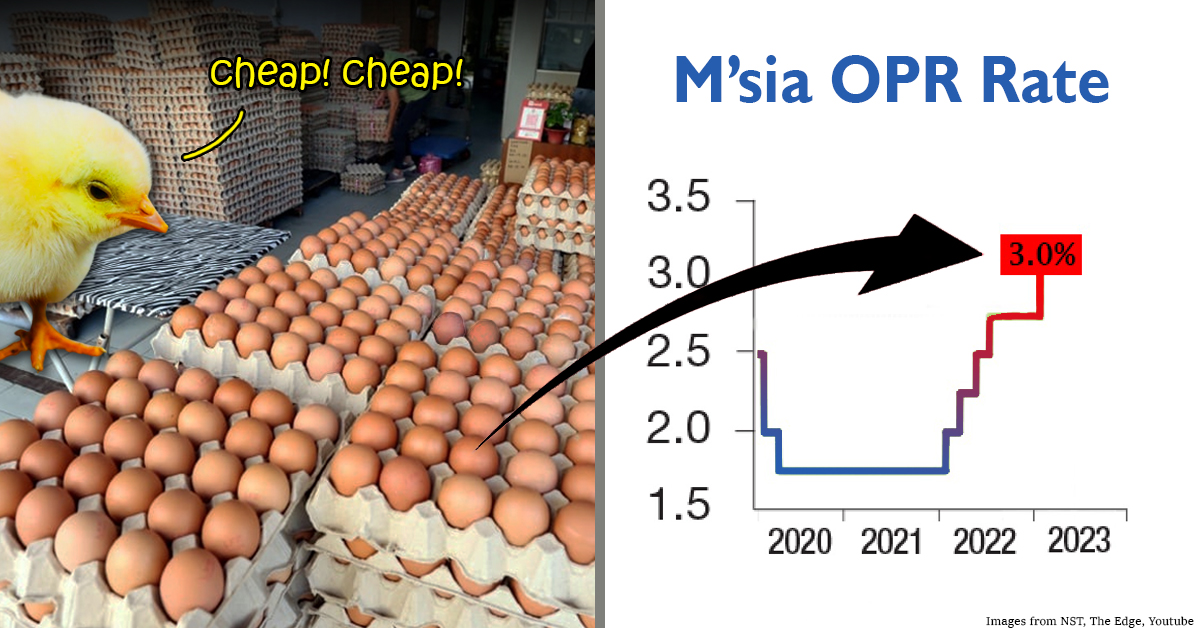

Just look at Malaysia’s egg shortage. For a long time now, supply costs have been rising. By right, this should cause egg prices to also rise and demand to eventually fall, but that’s not happening cos of the subsidy. So now we got local suppliers who are struggling to keep up with this artificial demand. In fact, it’s escalated to the point where we’re even subsidizing eggs from foreign suppliers. Any guesses on how much it’s costing us? Ha, RM 1.2 billion! And just for eggs!! Huhuhu

And since gomen gotta pay for all these subsides, the money has to come from somewhere, right? Whether it’s raising taxes, shuffling budgets around, or even resorting to printing more money (which, btw, not a great idea), each of these options sets off a domino effect that ultimately leads to inflation. It messes with the value of money and causes overall prices to go up.

Now guess what controls inflation?

OPR is the guru disiplin who will keep you in line when you overspend

OPRs are complicated, so for a more thorough read, you could head over to this or this Cilisos article. But essentially, the Overnight Policy Rate (OPR) determines how much interest a person should pay for their bank loans. Usually, a higher OPR will encourage people to save more and that’s how it controls inflation.

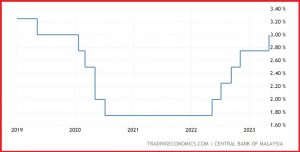

The latest figure is 3% and that’s pretty damn high considering 2 years ago, we were only at 1.75%. But as you can see from the graph below, we were originally at 3-ish% a couple of years back.

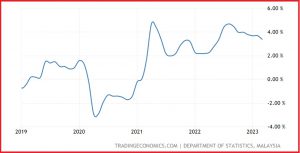

The reason the OPR fell so sharply was cos of a massive spike in inflation during the Great Virus (as you’ll see in the graph below) that pretty much put a pause on economic activity. So Bank Negara had to lower the OPR to encourage borrowing and spending, thus allowing the economy to gradually recover.

You might be wondering why we can’t just shimmy our way through life with a low OPR… And that’s cos if people have easy access to low-cost borrowing, they’ll just spend and borrow and spend and borrow which will obviously lead to a whole set of problems.

Now if you’ve been following closely, you would’ve noticed the interesting coincidence that…

The biggest OPR hikes were in the same year Malaysia dished out the most subsidies

Just to be clear tho, we aren’t saying that the subsides are the sole reason for the recent OPR hikes. But considering the fact that these last few years were marked by super exorbitant subsidies, the substantial OPR hikes can be said to counterbalance all that spending. As the great Justin Timberlake once said, what goes around comes back around.

In fact, this connection was also addressed by Tan Sri Nor Shamsiah, who emphasised the need to review and adjust existing subsidies to combat inflation. Ofc, the aim is not to scrap subsidies altogether, but to target them towards vulnerable groups, striking a balance between increasing OPR and controlling inflation from the other side.

“There are still vulnerable groups that require financial assistance so it needs to be more calibrated. It can’t be too broad (as in the past) and if we do it in a more controlled and targeted environment, the inflationary impact won’t be as strong,” — Tan Sri Nor Shamsiah, Bank Negara Governor

- 36Shares

- Facebook34

- Twitter1

- Email1