9 ways Malaysians can pay less income tax in 2024

- 1.7KShares

- Facebook1.2K

- Twitter24

- LinkedIn26

- Email42

- WhatsApp402

There are two things in life we cannot escape: death and taxes. Not much we can do about the ‘dying’ part, but we can reduce the amount of income tax we pay every year with tax relief… as long as you keep your receipts, that is.

With that being said, many of us who’ve been paying taxes for years might not realise the breadth of tax benefits one can claim, especially since there are usually new changes every few years.

Together with our friends over at Versa – one of Malaysia’s top digital wealth management apps and a Private Retirement Scheme distributor – we’re here to share 9+ types of tax relief that can help you pay less in income tax, with the first one being…

1. Private Retirement Scheme

A Private Retirement Scheme (PRS) is basically like the private version of EPF. These schemes help you invest that money, so you’ll get all of your savings plus returns from investments when you retire.

Since EPF alone might not be enough for our golden years, the government incentivises us to set aside additional money into PRS. Malaysians who contribute to their PRS will get a tax relief of up to RM3,000.

So how much less tax will you be paying if you contribute into PRS? Let’s say you make RM100,000 per year, which puts you in the 19% income tax bracket, according to this nifty table by Versa:

If you put RM3,000 into PRS, less of your income will be taxed, and you’ll get RM570 in tax savings in addition to having more retirement funds. Win-win!

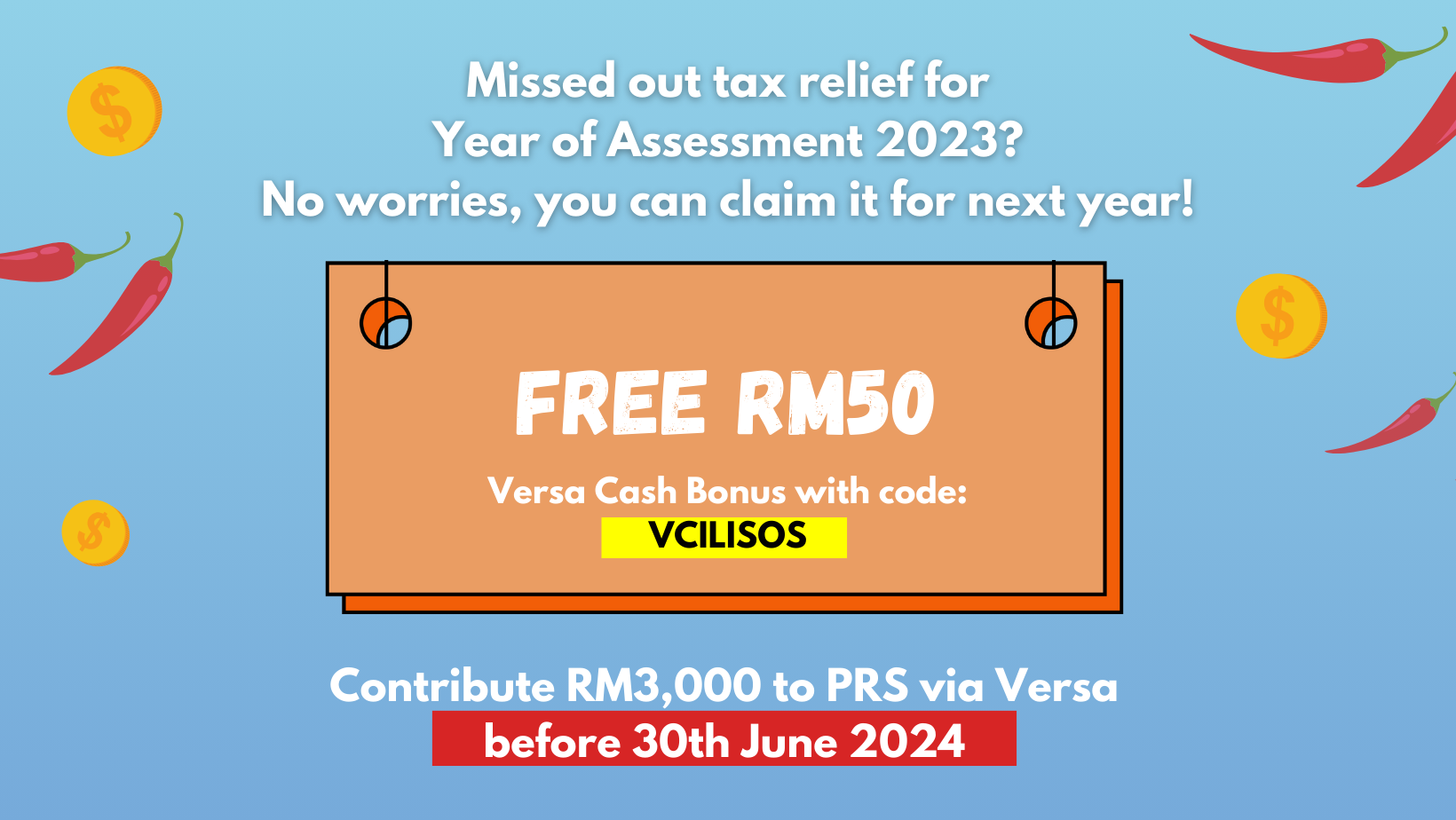

But that’s not the only great news for Cilisos readers!

If you already menabung into PRS in 2023, great! But if you haven’t, it’s not too late to do it for the Year of Assessment 2024 (meaning you file the tax in 2025). And specially for Cilisos readers, our friends at Versa are giving ugaiz a RM50 cash bonus when you contribute to PRS via Versa.

Just make sure you use code VCILISOS when you contribute RM3,000 into your Versa PRS fund, and you’ll receive your cash bonus within 30 working days. Now it’s a win-win-win!

2. Medical expenses

Previously, tax relief for the treatment of serious illnesses for yourself, your children and/or your spouse was capped at RM8,000, but it’s been raised to RM10,000 for the Year of Assessment 2023. This includes illnesses like AIDS, Parkinson’s, cancer, kidney failure, leukaemia, and heart attacks. In addition, fertility treatments (i.e. IVF or IUI) are claimable under this category.

Within that RM10,000 limit, here are some new medical expenses that’s now claimable under this tax relief:

- RM1,000 max for qualified vaccinations. This includes HPV, C0v1d-19, influenza and more

- RM4,000 max for diagnosis and intervention of learning disabilities for your child below 18 years old. This include ADHD, Autism, Down Syndrome, and more

- RM1,000 max for mental health consultations, C0v1d-19 tests, purchase of C0v1d-19 test kits, and for full and thorough medical examination as defined by the MMC

3. Books, gadgets, internet & sports

Y’all can get tax relief of up to RM2,500 on personal lifestyle spend for yourself, your spouse and/or children, including:

- Books, journals, newspapers, or other similar publications (both physical and e-books)

- Personal computer, smartphone or tablet

- Sports equipment and gym membership

- Internet subscription

Since 2021, you can get an ADDITIONAL relief of up to RM500 for purchasing sports equipment for certain sports activities (no, sports shoes don’t count), entry/rental fees for sports facilities, and registration fees for sports competitions. You can find the exhaustive list here, just search for “First Schedule [Section 2]”.

4. Family & childcare

This covers a broad array of tax reliefs, but we’ve grouped them together for your ease of understanding.

Childcare

- Mothers who are breastfeeding a child aged 2 years and below can claim a relief of up to RM1,000 if they’ve purchased personal breastfeeding equipment, including breast pump, ice packs, cooler bags, and more. This deduction can only be made once every two years of assessment

- Parents can get a tax relief of RM2,000 for each child of theirs under 18 years old. Only one parent can claim this, so make sure you don’t double claim yeah!

- Parents can also claim tax relief for each unmarried child above 18 who is receiving tertiary education. For those undergoing preparatory courses such as foundation, A-Levels, or matriculation, the tax relief is RM2,000. And for those receiving a diploma or higher, the tax relief is RM8,000

Children’s education

- Parents with children aged 6 and below who are in daycare centres or kindergartens can claim a tax relief limited to RM3,000 for the fees. Only one parents can claim this

- Parents who make a deposit into a Skim Simpanan Pendidikan Nasional (SSPN) account are eligible for a relief of up to RM8,000 for their annual net savings (total deposit in 2023 minus total withdrawal in 2023)

Medical Care for Parents

- You can claim a maximum of RM8,000 if you’ve paid for your parents’ medical treatment, special needs, and caretaker expenses

5. Education & personal upskilling fees

Thinking of getting that Master’s or PhD you’ve always wanted? The good news is that you can claim up to RM7,000 in tax relief for the course fees if you’re paying out of your own pocket. This applies to any Master’s or PhD course at a recognized higher education institution.

The scope’s a bit tighter for people who want to pursue an undergraduate degree or lower (i.e. diploma etc), you’ll have to pick courses in law, accounting, Islamic financing, technical, vocational, industrial, scientific or technology to be eligible for tax relief.

As part of the RM7,000 tax relief for education fees, those looking to pick up or further develop their skills can also claim a maximum of RM2,000 as tax relief for the cost of upskilling courses (courses must be recognized by National Skills Development Act 2006). This has been increased from RM1,000 to RM2,000 for Year of Assessment 2023.

6. Disability relief

To help out those who are disabled or caring for disabled persons (registered with the Department of Social Welfare), there are multiple tax reliefs applicable to you.

For starters, if you’ve purchased special support equipment for yourself, your spouse, children, or parents who are disabled, you’re eligible for tax relief of up to RM6,000.

If you’re a disabled person yourself, you’re eligible for a further deduction of RM6,000. Meanwhile, if you have a disabled spouse, you can claim a relief of RM5,000.

Parents with an unmarried child who is physically or mentally disabled, regardless of their age, are eligible for a tax relief of RM6,000.

Additionally, there’s an exemption of RM8,000 if parents have an unmarried disabled child pursuing a tertiary education. This deduction is an add-on to the disabled child relief if they are:

- Pursuing a diploma and above in Malaysia; or

- Pursuing a degree level and above outside Malaysia; or

- Serving under articles or indentures in a trade or profession in Malaysia

7. Insurance

Here are the latest reliefs effective Year of Assessment 2023:

- You can claim up to RM3,000 for your contribution to life insurance premiums, takaful, and/or additional voluntary contribution to EPF. If you pay for your husband/wife’s life insurance, you can also claim this relief.

- You can claim an additional RM3,000 for medical and/or education insurance. If you pay your husband/wife/children’s premium, you can also claim this amount.

For those of you taking an all-in-one insurance plan which includes life & medical coverage, be sure to check your insurance statement to know the actual split between life and medical insurance across your plan.

Let’s not forget the RM4,000 tax relief for your EPF contributions, be it mandatory or voluntary.

8. Electric vehicle expenses

While there’s no relief for buying an electric vehicle (EV), those who own an EV can claim costs related to EV charging facilities of up to RM2,500, including installation, rental, hire-purchase of equipment, or subscription fees.

The government is encouraging people to switch to EVs, so they’ve extended this relief to the year of assessment 2027.

9. Donations

Yep, you can get tax deductions of up to 10% of your aggregate income if you make certain cash donations, such as to:

- Approved institutions and organisations, including the Government, a State Government, and local authority;

- Sports activities approved by the minister or to any sports body approved by the Commissioner of Sports (under the Sports Development Act 1997),

- Projects of national interest approved by the minister.

But hey, don’t forget to donate to your future self…

Save for your future, get tax relief, and more cash bonuses from Versa

Ultimately, there are many ways to save on your taxes. Our friends at Versa not only want to help you pocket more of your hard-earned money, they also wanna give you extra rewards for your savings!

When you save RM3,000 into PRS via Versa by 30th June 2024 and use our code VCILISOS, you’ll be getting that sweet RM50 cash bonus. If you’re intimidated by the process of opening a PRS account, fret not, as Versa allows you to open an account using their app, without the need for complicated paperwork.

Versa is also regulated by the Securities Commission, and their funds are managed by AHAM Capital, one of Malaysia’s top 3 independently-managed, institutionally-owned asset management firms, which means security and credibility is guaranteed.

The best thing about Versa is that there are 0% sales fees cuz you don’t have to go through any agents, and they’ve got 6 different funds for you to choose from, depending on your investment risk appetite. Plus, there are 3 Shariah-compliant funds available, so you can invest and save while staying aligned to your values! If all of that sounds good to you, do check them out here, and use code VCILISOS to grab that FREE RM50 in cash bonus before 30th June 2024!

And of course, if you wanna see the full spectrum of tax relief, including the ones we didn’t cover in this article, you can get all the details from LHDN’s tax relief page right here and here.

As a final reminder, all of the expenses and purchases should have been made before the end of 2023, and any expenses made starting January 2024 (including any PRS contributions) will only be claimable in 2025. Happy filing!

- 1.7KShares

- Facebook1.2K

- Twitter24

- LinkedIn26

- Email42

- WhatsApp402