In 1978, the govt took over Bank Rakyat – now some of its shareholders want it back

- 841Shares

- Facebook787

- Twitter7

- LinkedIn7

- Email16

- WhatsApp24

Gone are the days of your grandpa hoarding his life savings under his mattress, and your grandma keeping her petty cash between her bosom. With banks everywhere in Malaysia, it’s hard to think of a time without them, and for many civil servants, one bank seems to stand out among the rest – Bank Rakyat. It’s been said that because of how well Bank Rakyat’s auto-deduction system works, many have gone to them for personal financing options, making it the country’s biggest Islamic cooperative bank and development financial institution.

But just recently, the bank found itself in a little bit of a pickle when shareholders of Bank Rakyat filed a judicial review against government ownership over the bank. For as long as we’re old enough to understand what Bank Rakyat is, the organization’s been making pretty good money, even netting a profit of RM1.3billion just last year. Okay, so since they’re doing so well with the govt owning Bank Rakyat, why would they challenge the govt’s ownership like this?

We’ll get to that in a bit, but first let’s take a quick look at the story behind Bank Rakyat itself…

Bank Rakyat actually started out as ELEVEN different banks

Bank Rakyat was actually part of the cooperative movement in the 1950s, which was all the rage back in the day. For context, back in the 1900s, the angmohs came up with something called the cooperative movement, a movement meant to gather people and organize them around a common goal, mostly an economic goal. It’s been said that cooperatives are capable of managing and raising the living standards of their members.

It seemed to have become so effective that, in 1909, the British decided to incorporate the movement in colonial Malaya as well – of course they did – basically encouraging existing smaller corporations to come together and mutually help one another. However, in the early days, the locals were not all that welcoming to the idea, because they thought it contained elements that were suspicious.

It was only in the 1920s that the idea of cooperatives was welcome, as there were a lot of people in rural areas facing credit and debt problems. They apparently believed that cooperatives could help them in resolving these issues. As such, cooperatives like the Postal and Telecommunications Cooperative Thrift And Loan Society Limited and Syarikat Kampung Teluk Haji Musa Bekerjasama-sama Dengan Tanggungan Berhad were born.

As a result, Bank Rakyat was born as part of the cooperative movement as well, but it came later in the game in 1954 after the British had set up the Cooperative Ordinance 1948 to regulate cooperatives.

At the time, it was wholly privately owned, a merger between 11 union banks in Malaysia and was even known as Bank Agong Kampong Bekerjasama-sama Persekutuan Tanah Melayu Dengan Tanggungan Berhad at first. Yes, as you can tell, keeping names short and sweet wasn’t the trend in the 50s.

Ironically, the original aim of this cooperative was to cater to the financial needs of other cooperatives. It was only in 1967 that the bank opened up membership to individuals as well, thus renaming itself Bank Kerjasama Malaysia. It also started opening up subsidiaries and branches to better serve their customers and members.

Eventually, it decided to incorporate the word ‘rakyat’ into the bank’s name, making them Bank Kerjasama Rakyat – or Bank Rakyat, in short. It was said that the change in name helped the bank in becoming more popular among the rakyat. It did okay for itself, until…

The bank came across some issues in the 1970s

It’s been reported that Bank Rakyat started facing insolvency and mismanagement issues in the 1970s. We did try to get more info about what exactly went down at Bank Rakyat, but despite our attempts to do a deep dive into its financial history, we couldn’t get any actual documents that describe the exact trouble they faced.

Nevertheless, it was apparently bad enough that the government had to intervene and come up with something called Bank Kerjasama Rakyat Malaysia Berhad (Special Provisions) Act 1978 to take it under government control. From there, Bank Rakyat was placed under the purview of both the Ministries of Land and Co-operative Development and Finance. In short, this act stipulates that:

- The previous board of directors were to be dissolved immediately

- The government has the right to elect or remove directors as they see fit

- The ministers in charge have the right to make any decisions as they see fit

Now to be fair, the bank has done pretty well for itself since the government took over it. For example, Bank Rakyat expanded its operations in Sabah and Sarawak in 1993. Furthermore, with the emergence of the Islamic Banking System, the system’s also introduced in Bank Rakyat in 1993, allowing it to be syariah compliant. They’re even diversifying their business, with ventures into the Islamic pawnbroking business for example under the Ar-Rahnu name.

While the government first took control of Bank Rakyat in 1978, it was placed under the purview of Ministries of Land and Co-operative Development and Finance. However, after that, the supervision of Bank Rakyat actually changed hands quite a few times, such as:

- Bank Negara Malaysia in 2002

- Ministry of Entrepreneur and Cooperative Development in 2004

- Ministry of Finance in 2009

- Ministry of Domestic Trade, Co-operatives and Consumerism in 2009

- Ministry of Entrepreneur Development and Cooperatives in 2018

We suppose you can say that Bank Rakyat kinda went through a lot in its time, but it still did kinda well, all things considered. However, the thing is…

The govt’s control of Bank Rakyat was kinda supposed to have been temporary

Alright, after the whole history lesson on Bank Rakyat’s ownership and supervision, let’s loop it back to what got our attention to it in the first place: the current Bank Rakyat shareholders’ filing for a judicial review on government’s control over the bank.

You can read about it in more detail here, but essentially, it’s been reported that a protem committee that claims to represent over 900,000 members and shareholders of Bank Rakyat intend to take over the bank from the govt. See, according to the shareholders, the Bank Kerjasama Rakyat Malaysia Berhad (Special Provisions) Act 1978 [Act 202] was only meant to be temporary.

“It was stated that the minister in charge of Bank Rakyat can abolish the law once the bank’s finances are back on track.” – Tan Sri Abdul Aziz Zainal, Datuk Mustafha Abd Razak, and Datuk Rahim Yunus, Bank Rakyat shareholders, as quoted from FMT

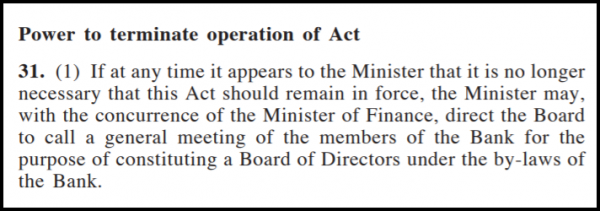

We figured we could look through the act to figure out if it’s true, and here’s what the act says:

So has the bank’s finances been good enough for the law to be abolished? Well we can’t know for sure how well is well enough, but from the numbers published what we do know is that Bank Rakyat managed to maintain a dividend rate payment at a minimum of 10% or more for 20 years, and it’s been recording profits of more than RM1billion per year since 2008. And it seems that to the shareholders, they’ve considered their finances back on track based on that.

The shareholders initially approached the current Minister of Entrepreneur Development and Cooperatives Mohd Redzuan Md Yusof to abolish the act and remove the current government-appointed board of directors, but they said that the minister had refused, which was why they went ahead to file a judicial review.

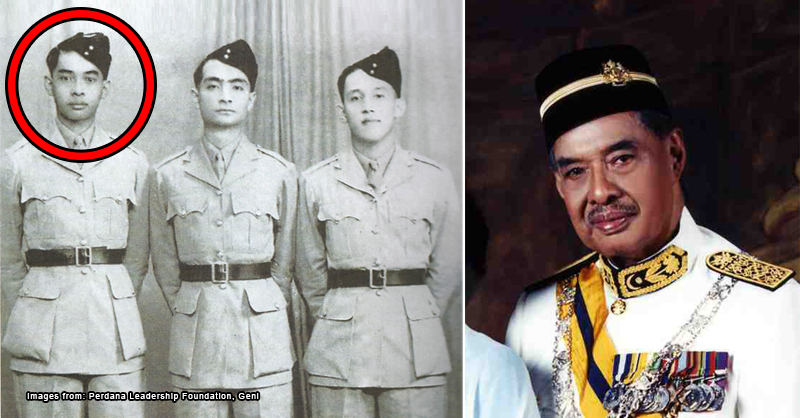

Plus, according to them, the abolishment of the act is per the wishes of the Prime Minister who tabled the act, Tun Hussein Onn. They also claim that Bank Rakyat has already settled debt they had with the govt two decades ago.

“The applicants believe that it is time for the management of Bank Rakyat to be returned to its members so they can manage it without government intervention, as per the wishes of former prime minister Hussein Onn when he tabled the Act.” – Lawyer Mohamed Haniff Khatri Abdulla, as quoted from Malaysiakini

At the time of writing, the government has yet to say anything on the judicial review to abolish the act and remove government control over the bank. In addition, Bank Rakyat’s reassured its customers that business operations will continue as usual. It’s hard to tell if the latest bid to take over Bank Rakyat would succeed, but with it being one of Malaysia’s biggest financial institutions, it’s perhaps fair to say that many will be keeping tabs on its developments.

- 841Shares

- Facebook787

- Twitter7

- LinkedIn7

- Email16

- WhatsApp24