Tengku Zafrul got roasted by CEOs on LinkedIn over… Malaysia’s DDI and FDI? Apatu?

- 3.4KShares

- Facebook3.1K

- Twitter21

- LinkedIn18

- Email32

- WhatsApp150

Recently, we’ve been covering a lot of Twitter drama, like when people discovered MCMC’s old tweets, or when people started saying that Malays can eat pork now that it’s darurat (they still can’t, btw). Well, hope you liked those, because this time we’re doing another drama, but it’s from… LinkedIn.

Yes, LinkedIn, probably the only social media you don’t have the app for on your phone right now. Anyways, this drama involved the Finance Minister supposedly getting roasted by the business community over a posting he made:

Some people have been sharing the post on Twitter, implying that there’s a burn somewhere from one particular response commonly attached to it.

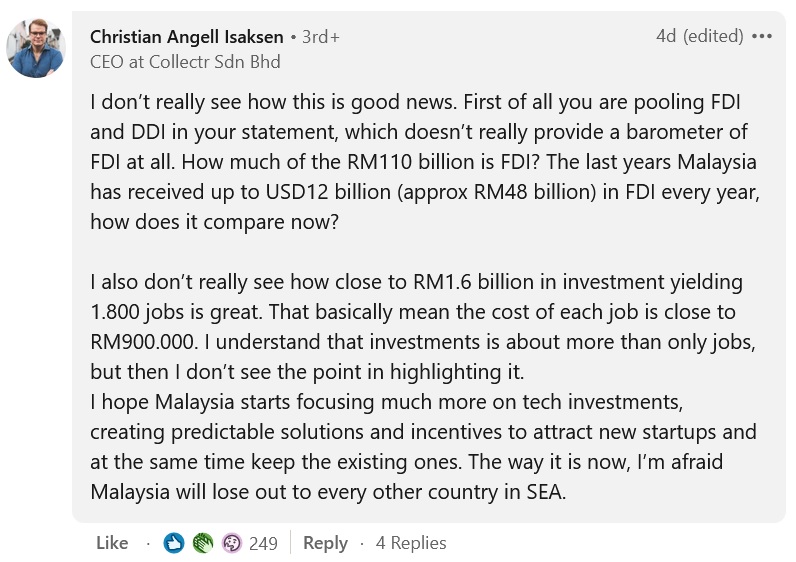

In case you didn’t catch what’s going on here, essentially Tengku Zafrul was all like “How’s that for investors’ continued confidence in Malaysia?”, and one of the CEOs of Eurocham Malaysia was all like “Sorry, not really.“, which is kinda bad since Eurocham is like Malaysia’s link to European businessmen/investors. And it’s not just him, either. Some of the other comments weren’t so supportive:

Ooof. These are kind of harsh, but does he deserve this roast session, though? Well, that’s what we’re trying to find out today. And since economic terms may give some of you the same migraines as it did to us, we’ll start by addressing…

What is this FDI DDI thing, and why should we care about them?

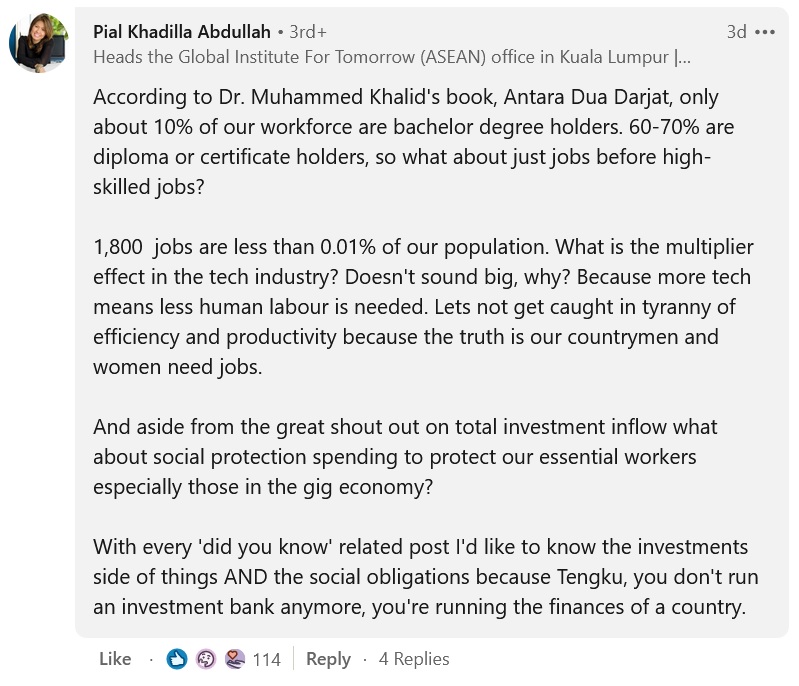

Okay. From the responses, we can summarize the roasting into three pillars:

- Doubt over how good the FDI and DDI numbers he quoted were

- Concern over how little jobs were created

- Investors not actually being confident in Malaysia

These three are pretty much linked together by the first one, so let’s address the elephant in the room first: FDI and DDI. You probably don’t see these letters being thrown into casual conversation every day, but with the economy the way it is right now, you’ve probably heard something along the lines of the government needing to attract foreign investments and such. FDI has something to do with that.

Say that you’re a foreign investor looking to put your money into Malaysia. Generally, there are two ways you can do this, either through

- Foreign Direct Investments (FDI), or

- Foreign Portfolio Investments (FPI)

Very simply, with FPI, you use your money to buy things like stocks and bonds in the local market. You can expect to profit/lose relatively quickly, and you can just sell off your stocks whenever you want and be done with it. FDIs, on the other hand, needs more of a commitment: you essentially set up your business (or a part of it) in the foreign country. This can be done by either setting up a subsidiary in the country, buying out enough stocks of a local company to control it, or merging your business with a local one, to name a few ways of doing it.

Often, FDI involves not only money coming into the country, but new things like technology and systems as well. They can also create jobs for locals, and because they also involve a massive amount of commitment (think building factories and warehouses in the country), FDIs are also generally more stable than FPIs. This way, it’s easy to see why we would want FDI, and how it can improve the economy. But what about DDI?

Domestic Direct Investments (DDIs) are much like FDIs, just, well… domestic, or local.

It’s hard to say whether FDIs or DDIs are more important to the economy – strong DDIs may attract FDIs, and strong FDIs may develop DDIs – but based on 2019’s numbers, it seems that DDIs made up about 60% of private investments (umbrella term for DDIs and FDIs), while FDIs made up the remaining 40%. It was said that this ratio ‘reflects the Government’s aspirations for domestic investments to assume the role of driving Malaysia’s investment agenda‘, so we can assume that the government wanted more DDIs.

So now that we’ve known a little bit about FDIs and DDIs, let’s get back to the concerns surrounding Tengku Zafrul’s statement. You can say that if investors aren’t confident enough to commit to an FDI/DDI in Malaysia, the numbers will drop. When the numbers drop, there will be less jobs than there could be.

To be fair, Tengku Zafrul had been quite specific in saying that 1,800 high-skilled jobs will be created from the Penjana Kapital, so we’re assuming that this doesn’t include mid- and low-skilled jobs as well as jobs created from other initiatives, so the concern over the low number of jobs is kind of moot. As for the Direct Investments…

Despite the cheery tone in the LinkedIn status, our FDI/DDI haven’t been looking good lately

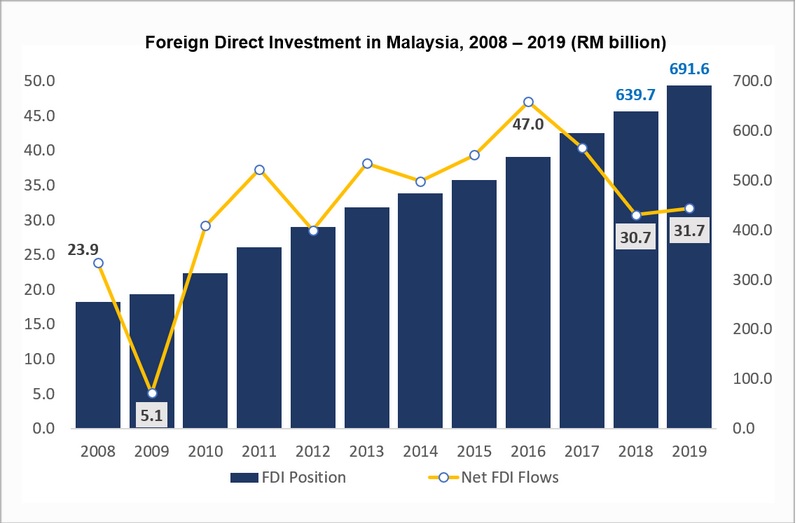

First, take a look at this graph we filched from the Statistics Department. It was published in June 2020.

The data only includes information up until 2019, but even then, it’s enough to see that something happened starting 2018. The graph showed two things: FDI position, and net FDI flows. FDI position (aka FDI stock) is the cumulative amount of FDI we’ve got at the end of any given year, while net FDI flows show the final amount of money we’ve got from FDI-related exchanges for that year. That’s the drooping yellow line up there, which we’re guessing can serve as a gauge to see whether foreign investors are still interested in us.

So looking at 2019, the number 31.7 means that after taking away local money going out from the amount of foreign money coming in, we ended up with RM31.7 billion for 2019. For 2020, we had to look at the net FDI flows from the first three quarters of 2020, it seems that up until September last year, the amount was a relatively small RM7.8 billion. Interestingly, the third quarter recorded a net FDI flow of negative RM0.8 billion, noted as the first time since 2010 that investors from Malaysia spent more money in foreign countries than foreign investors spent on us.

So unless we somehow had an FDI inflow of RM24 billion in the last three months of 2020, the net FDI flow for last year definitely dropped, which is quite likely. Malaysia’s DDI and FDI flows had slowed down even before the pandemic came around, and some of the reasons behind it include ‘rising trade protectionism, political and policy transition since 2018, and external uncertainties.’ In fact, while 2019 was said to be a good year for FDI in most of the SEA countries, Malaysia only managed to maintain its FDI levels due to some huge deals in healthcare and mining, which is cutting it a bit close.

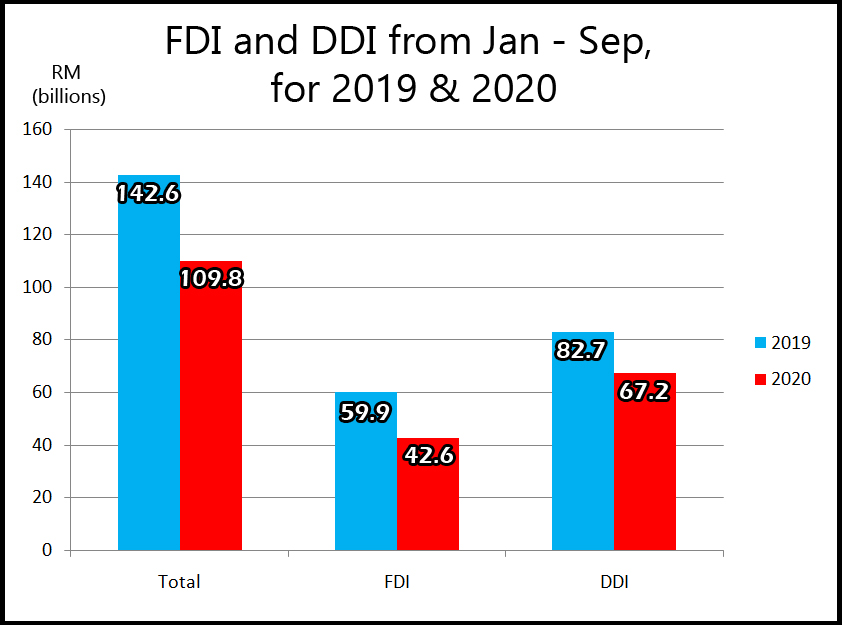

So where does Tengku Zafrul’s RM109.8 billion figure come in? Well, that’s approved investments, which is essentially the total value of the investments we’ve secured during the time period he mentioned (Jan-Sep 2020). Some have complained that the figure lumps together FDI and DDI, but a quick search showed that DDI made up 61.2% of that amount (RM67.2 bil), while FDI made up the remaining 38.8% (RM42.6 bil).

Based on news reports, for the same period (Jan-Sep) in 2019, the value was RM149 billion, and in 2018 the value was RM142.6 billion. So while from 2018 to 2019 the approved investments for the first nine months had an increase of about 4.4%, from 2019 to 2020 the amount dropped by 26.3%, which was quite a steep dive. Both FDI and DDI were affected.

The numbers may not seem great at first glance, but if you consider the current climate, one may think that the government managing to get RM109.8 billion in investments is still pretty impressive. However, something still needs to be done about the dropping numbers. Perhaps it’s because of these things that…

The government’s been trying hard to get investors

How attractive is Malaysia to foreign investors right now? Based on Sven Schneider’s comment (from the start of the article), not very much. But if you didn’t want to listen to a single guy’s opinion, there was a survey called the Kearney’s 2020 FDI confidence index, which listed the top countries that commanded the most investor confidence. Malaysia didn’t make it into the top 25 countries listed, but maybe you’ll be glad to know that Singapore’s at 12th place.

Perhaps to address that, the government now seems to be doing plenty to attract investors, as evident in Tengku Zafrul’s roasted posting, as well as another one he made in response to the initial roasting. We won’t list them out word-for-word (you can check them out through the links), but there seems to be a lot of tax-related incentives in addition to allocations of special funds designed to encourage investments. For all we know, this could be a good move, as tax rates and ease of paying taxes seem to be one of the biggest appeals to foreign investors.

But perhaps the best way of finding out what investors really want is by asking them directly, through engaging them in discussions. This seems to be Sven Schneider’s main point of contention, as the Minister had supposedly failed to meet up with them to discuss stuff. In his reply, the Finance Minister had revealed that they have indeed been talking to the stakeholders… but maybe not people from Eurocham yet.

“There is no window dressing when I say this: last year alone, despite hurdles presented by the Covid-19 situation, between March and December, the Finance Ministry team and myself had directly engaged with more than 125 business-based associations, interest groups and chambers of commerce (both local and foreign), as part of our engagements in creating the four economic stimulus packages, and Budget 2021,” – Tengku Zafrul, as reported by MalaysiaKini.

As for Eurocham, another comment had since been made by the Chairman himself, saying that while they have yet to speak with the Finance Ministry, they have engaged with other ministries, like the Ministry of Trade and Industry (MITI).

Based on a comment on his most recent posting as well, it seems that Eurocham corporate people have already engaged with the Ministry of Finance as well, so that’s some closure to the drama.

As for whether the Finance Ministry’s strategies can eventually get our FDI and DDI back up… that’s for us to guess until the Statistics Department’s next publishing date.

- 3.4KShares

- Facebook3.1K

- Twitter21

- LinkedIn18

- Email32

- WhatsApp150