5 lessons I learnt about credit card debt after becoming “bankrupt” at 32

- 3.1KShares

- Facebook2.9K

- Twitter20

- LinkedIn23

- Email26

- WhatsApp168

Just admit it, you clicked into this article so you can smile to yourself thinking that this kind of thing will never happen to you. Well, this is an article written by someone who used to read articles like these thinking that this kind of thing will never happen to him.

But first, a bit of context.

I’m UiHua, the current Editor-in-Chief of Cilisos. Back in the year 2009 B.C. (Before Cilisos), I got myself a credit card at the mall because the free travel luggage set looked really nice. It came with a credit limit of RM14,000.

I maxed it out in a span of 5 years, spent another 2 years paying a credit card bill that would automagically max itself out at the end of the month, and almost another year secretly eating nasi bujang because I was unable to afford anything else. My savings were gone, my paycheck was eaten up before the month even started.

By all accounts, I was technically “bankrupt”. The right term is insolvent, but tell that to my relatives and they’ll say “pokai means pokai lah”.

When our friends at PIDM reached out to us for an article about managing finances, it triggered a whole bunch of emotions because what many articles about debt don’t tell you is that the worst part ISN’T being in debt. I discovered that the worst part was the toll on my mental health and personal relationships. But that’s for later. For now, lemme tell you how I started my trip down to Debtor Town.

If you can only afford to pay the minimum, you’re in trouble

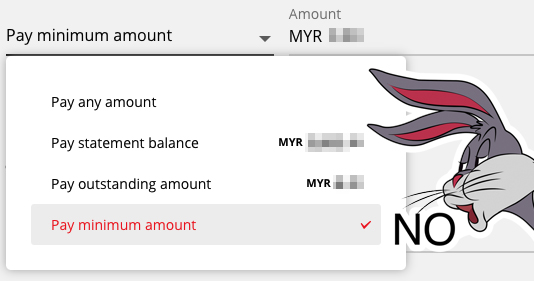

In every credit card payment statement, you’ll see three amounts that you can pay:

- Statement balance – The amount owed when the credit card statement was prepared by the bank

- Outstanding balance – The total amount you owe the bank

- Minimum payment – The bare minimum you have to pay (5% of your balance or RM50, whichever is higher)

You should always aim to pay off the Outstanding balance, and paying off the Statement balance is (for the most part) pretty safe as well. But what you really don’t want to do is to pay the Minimum.

This is because paying the Minimum only means that you’re paying enough to remain in good standing with the bank (i.e., they won’t blacklist or send debt collectors after you) but it also means that you’ll be charged interest on the balance. We won’t get into how it’s calculated (you can read more on that here) but the interest rates are between 15% – 18% per annum (year). This means the monthly interest is 1.25% – 1.5%.

When I was a writer at Cilisos, my take-home salary at the height of my “bankruptness” was RM3,600 and my debt was RM14,000. Taking out all my other commitments, I could pay a maximum of RM800 monthly. This meant that:

- The interest on the remaining RM13,200 = RM198 (at 1.5%)

- The debt I’m actually paying off is RM602

And yes, this probably triggered a whole bunch of finance experts out there, because I know the calculations are not exactly accurate… it’s likely much higher. But the point is this – when you only pay the minimum, there’ll be a tipping point where a significant portion is actually paying your interest rather than your actual debt.

Easy payment plans keep you in debt

Of course, paying RM602 and not spending on the card means I could have paid it off within a 2-year period, which is correct if not for two factors that kept me as a trapped hiker on Mt. Tingdebt. The discovery of easy payment plans (EPP), or otherwise known as installment plans.

It sounded like a great idea… I pay a small amount every month for 12 months to get something nice AND get points or cashback for it! Well, EPPs and Auto Debit payments make it seem like small manageable amounts, but not when you have 8 or 10 of them.

RM120 a month for a Playstation 3? I can afford that. RM350 a month for insurance? Sure why not. Add on a few more of these kinds of decisions and, as the saying goes, sikit-sikit lama-lama jadi bukit tak beruntung.

Even when I stopped using the card, these automatic deductions didn’t stop. Worse, the amounts exceeded my limit so the payments wouldn’t go through, incurring extra interest and forcing me to use up whatever savings I had just to pay those off.

Shame prevents you from getting help

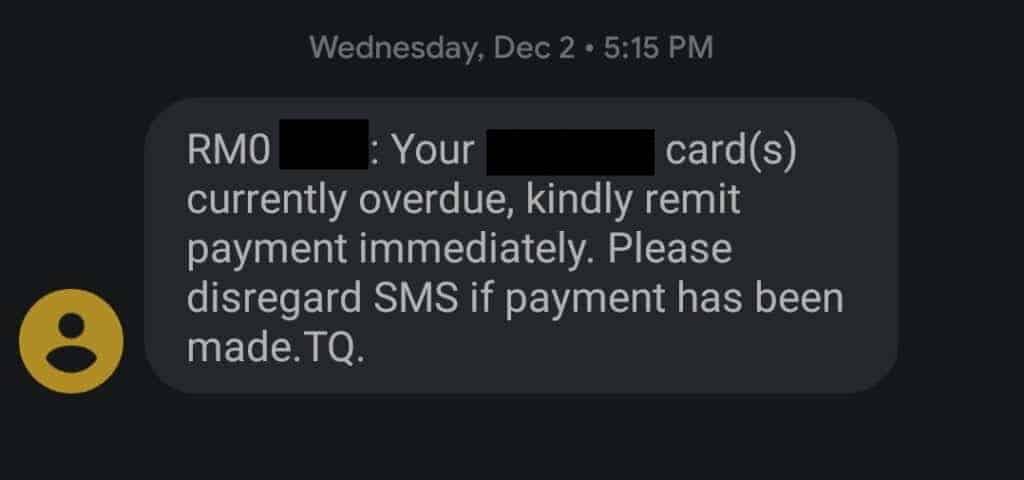

If you’re wondering why I don’t have any statements or proof of this debt, it’s because at the bottom of the great pyramid of debt runs the river of denial. After a few months, I actively avoided looking at my bank statements and ignored calls from my insurance agent asking why my payments didn’t go through. I even blocked SMSes from the bank telling me that I’d maxed out my credit limit again.

I didn’t want to acknowledge the hole I dug myself into, and the denial made things worse.

When I first got the card, my dad gave me a speech which I’ll paraphrase as “With great spending power comes great responsibility”. And of course, my (internal) reaction was Pfft. I’m not 12 okay. I’m a strong independent man who don’t need no daddy to tell him what to do.

So while I could have asked him for a loan to settle the debt, I didn’t because I didn’t want to admit to him – but mostly to myself – that he was right. I also kept it a secret from friends, coming up with excuses to not go for meetups or movies because I couldn’t afford it. I could only afford petrol to get to the office and back.

Even when I was hospitalized with dengue, a part of my fevered brain was syukur-ing because I didn’t have to worry about money for two weeks (yay for the insurance that I paid with credit card!)

Regaining control is an important first step

I did try a few times to get myself out, but I kept giving up because I couldn’t understand interest rates and all those complicated financial calculations I was reading. Finally in 2016, it clicked in my head that I didn’t need to know how the system worked.

I just needed to come up with a system that I could understand. In short, I:

- Got a piece of paper and laid down all my expenses, cutting down unnecessary ones.

- Worked out a daily budget of RM15 a day for myself, and carrying only that amount with me each day

- Put the unspent amount into a jar for petrol

- Used cash so I could keep physical track of the money – I didn’t even trust myself to use a debit card.

It was a slow process, but having that sense of awareness and control did wonders for my mental wellbeing. In 2017, I was offered the role of Editor at Asklegal which came with a salary bump; but the actual savior that brought me out of debt was…. the bank itself.

Different banks have different names for it, but the lady who called offered me a loan for the remaining RM10k+ debt with a lower interest rate. Essentially, the bank pays off the debt, charges you a small interest, and you pay the amount off over a period of 6, 12, or 18 months. But you CANNOT miss a payment.

Alternatively, you can also reach out to AKPK, an agency under Bank Negara who can also help you restructure your finances.

There are some mistakes that can never be fixed

They say that hindsight is 20/20 and, after paying it off, I cancelled my original card because the terms were heavily against me. So if you’re looking to get a credit card, please do some research beforehand because different banks (and cards) have different interest rate structures, terms and conditions, and annual fees. Always look at the fine print and NOT the free iPad or luggage bag they’re giving away.

But I’m still learning even as of 2022, where I found out that some banks charge a foreign transaction fee for credit cards so I had to switch to a bank that didn’t.

I settled the last payment in mid-2018, but the PTSD is still there. My brain still calculates my bank balance whenever I buy something and I’ve never been able to enjoy nasi bujang since. Here’s how I’m currently managing my finances… it’s simple but, hey, it works for me:

- 2 credit cards to keep my personal and business expenses separate

- Prioritize using cash and debit card

- Paying the outstanding amount even if I’ll have less money for the month

- Putting a portion of my salary into my savings before anything else

But what cannot be fixed is that I’ve lost almost 10 years of financial opportunities. At 38, I’m not looking at investments or growing wealth… I’m just rebuilding my savings so that I can tahan an unexpected hospital bill or pay my bills for 3 months if I ever lose my job.

In a certain ironic way, I’m making PIDM’s life easier because I’m nowhere close to the RM250,000 that PIDM automatically insures when you open an account at a member bank. But that’s not the point – PIDM is sponsoring this article because a large part of their work involves financial education, so that every Malaysian will be financially prepared for a rainy day.

In other words, don’t do what I did.

- 3.1KShares

- Facebook2.9K

- Twitter20

- LinkedIn23

- Email26

- WhatsApp168