So who actually gets more money, EPF members or gomen pensioners?

- 121Shares

- Facebook108

- Twitter1

- LinkedIn2

- Email2

- WhatsApp8

Can yall believe it’s April already? Relatively still early in the year but we’ll hedge our bets that this whole EPF can-withdraw-early-cannot-withdraw-early thing will be our biggest slowburn debate of 2023. To put it simply, PM Anwar won’t allow it, saying that the rakyat’s savings are in total shambles with majority having less than RM10k. Meanwhile, the people who are pushing for the withdrawals are digging deep into their wallets just to put food on the table.

Ugh, even Prince William and Kate Middleton didn’t drag on like this!

But all this talk about EPF savings actually brought us back to something our parents used to say– better work in gomen la… then get pension and everything settle dy. And now that we think about it, is having a pension actually better than an EPF? Instead of conferring with financial experts or economists, we got in touch with a couple of retirees from both sides, since you know, they actually talk the talk and walk the walk.

- Mr. Baskran | Teacher | Pension : RM5,000/month

- Mr. Perumal | Police officer | Pension : RM4,200/month

- Mr. Paneer | Banker | EPF : RM1 – 2 million (lump sum)

- Mdm. Kala | Assistant manager | EPF : RM400k (lump sum)

So we’ll cut straight to the chase and answer the #1 question on everyone’s mind…

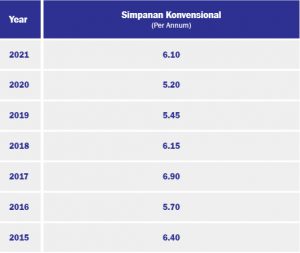

EPF will give you more money… if your salary is high

In Malaysia, EPF retirees should have a minimum of RM240k in savings by the time they hit 55. But that’s really a conservative estimate, kinda like how a basic salary is just enough to cover your necessities. Mr. Paneer, who has about RM2 million in EPF savings, tells us that to live comfortably in this day and age, a person should have at least RM1 million. Eeep. And that amount is meant to cover a period of 20 years, since Malaysia’s average life span is around 75 right now.

On the other hand, Mr. Baskran gets about RM 5k for his pension and while we can’t directly compare this with an EPF lump sum, we can sorta estimate that value with a bit of Maths. That’s RM5k x 12 months x 20 years = RM 1.2mil. A pretty healthy number! So what we can say here is that a gov pension is nothing outrageously lavish, but it certainly won’t have you counting your sens. And that’s exactly what Mr. Baskran said about the adjustments he’s had to make post-retirement.

“The money is enough but we’ve definitely cut costs here and there. The tuition classes I give now is mostly to keep myself busy and alert but I won’t deny that earning that extra income gives me a bit of a cushion to spend more,” — Mr. Baskran, ex-teacher

So here’s where it stands: if you’re a high flyer and you have that capacity to earn more, the returns with EPF are very very high.

With a government pension, you’ll have a lesser amount, but it’s certainly appealing if you’re guaranteed that monthly payment, which brings us to our next point…

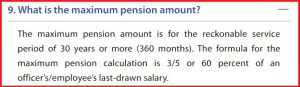

Pension is more secure… but $$ depends on years of service

A quick ask around the office and we’ve got ourselves a common misconception 👁️👄👁️ Many are under the impression that all gomen servants are guaranteed a pension at the maximum amount. But that’s not true!

You actually need to serve a minimum of 30 years to get the maximum pension amount, which is 60% of your last drawn salary. Anything less than 30 years gives you a lower amount. For example, 25 years of service gives you only 50% of your salary.

Mr. Perumal also debunked this popular myth where yes, a pension is secure and consistent, but it’s tied to the length of your service.

“Security-wise, pension is better. But if anything happens and you suddenly need to quit your job, then you’re done for. Whereas with the EPF, that money is always going to be yours,” — Mr. Perumal, ex-police officer

Meanwhile with the EPF, whatever money you have in your account is the exact amount you’ll get at the end of the day. Security here has less to do with the income itself, and more to do with how you actually spend the money.

According to Mdm. Kala, it takes discipline and a whole lot of financial planning to make sure she doesn’t overspend.

“You cannot simply spend that money just because you have it. Yes, I can go on holiday, but how will that effect my expenses for the next month? So you need to jaga-jaga a bit,” — Mdm. Kala, ex-assistant manager

Now that we’ve talked about how much money you get with both options, let’s move on to the side benefits.

Pension has more benefits… period

Pensioners get free public healthcare, travel discounts, bank loans at special rates, discounts with companies registered under the Ministry of Domestic Trade… oof almost ran out of breath there and that’s not even all the benefits on offer. Perhaps the biggest perk here is a thing called derivative pension, where if the pensioner passes away, their income can be transferred over to their husband or wife!

But Mr. Perumal pointed out that just because these benefits exist, doesn’t mean they’re actually accessible.

“Back then, I was living in a rural area and the closest clinic was a private one. So pensioner or not, I still had to pay out of pocket,” — Mr. Perumal, ex-police officer

EPF benefits on the other hand, don’t stack up very well. You’ll have your EPF 2 account, which allows you to make early withdrawals for house payments, education and healthcare… ye lmao, that’s it. You won’t have to deal with all of that tedious interest stuff or worry about paying back loans, but you do have that risk of running your retirement fund to the ground. And that’s something both Mdm Kala and Mr. Paneer cautioned us about.

“You cannot get away with not withdrawing early. One way or another, you will have to pay off some loans, so I made sure to only take money out for only what was necessary, like my car,” — Mdm Kala, assistant manager

At the end of the day, it comes down to how much you earn

At the end of our interview, we had one final question for our retirees, just to see if they think the grass is greener on the other side– if you could choose between an EPF or pension, which would you prefer?

- Mr. Baskran (pension) : No answer

- Mr. Perumal (pension) : EPF

- Mr. Paneer (EPF) : EPF

- Mdm Kala (EPF) : Pension

Perhaps then it’s fair to say no answer is the right answer, after all it all depends on circumstance. Not everyone has the freedom to choose whether to work in the public or private sector. And once you’re in either stream, it can be hard to switch, regardless of what’s better on the other side.

So we’ll put it this way la, EPF favours the rich on the condition there are no early withdrawals. And pensions favour stability, so you get to enjoy your guaranteed minimum of RM1k a month. It’s also worth noting that either way, it’s how you manage your money that matters most. In the wise words of YoungBloodZ:

“I got my mind on my money, my money on my mind.”

- 121Shares

- Facebook108

- Twitter1

- LinkedIn2

- Email2

- WhatsApp8