Here’s a guide to Tabung Haji for people who don’t know what it’s for

- 441Shares

- Facebook406

- Twitter2

- LinkedIn5

- Email2

- WhatsApp26

So some of you guys have probably seen or heard of it by now – Tabung Haji is currently in a crisis of sorts.

Long story short, the trouble for the Tabung Haji began back in late November, when the company board members lodged a police report against former chairperson and UMNO MP for Baling Abdul Azeez Abdul Rahim. The police report comes after board members said that RM22 million meant for Yayasan Tabung Haji was misused, allegedly for political activities.

Things then went further south for Tabung Haji as just over a week later, Minister in the PM’s Department Mujahid Yusof Rawa made a statement revealing that Tabung Haji has a RM4.1 billion deficit in assets. However, Tabung Haji still paid out dividends, which according to the law, is illegal. It’s gotten so bad in fact that for every RM1 in liabilities, Tabung Haji only has 80 cents in assets to match.

However, this article isn’t about mainly about the current scandal surrounding Tabung Haji. Instead, we’ll be looking into what Tabung Haji even is in the first place, as many of us – non-Muslims especially – don’t seem to know what exactly Tabung Haji is let alone what it does.

Tabung Haji is a company that helps you save up for Hajj

Once in their lifetimes, a Muslim is supposed to do the Hajj pilgrimage to Mecca. You can read more about it here, but to our dear non-Muslim friends, just know that it’s not cheap – it takes days, multiple flights and is pretty costly too. Also, one important factor is that the money used to pay for the Hajj needs to be pure i.e. free from riba – usury, or used for loans with interest (which is viewed by Islam as exploitative).

Ok, so that ‘interest’ bit kinda rules out usual banks la, which is why Tabung Haji was formed – kinda like a ‘pure’ savings account for people to perform the Hajj. It began way back in Sept 1963 with just 1,281 people depositing a total of RM46,610. It started from a proposal made by prominent economist Royal Professor Ungku Abdul Aziz. If you remember that name, then you’re kinda showing your age laa.

With his proposal, the then govt decided to form the Perbadanan Wang Simpanan Bakal-bakal Haji (PWSBH), also known as the Prospective Hajj Pilgrims Savings Corporation. Eventually, the PWSBH would be merged with the Hajj Affairs Management office in 1969, forming the Lembaga Urusan dan Tabung Haji. By 1995, it would be renamed again, this time to its current moniker, Lembaga Tabung Haji.

Tabung Haji is a bit different from a typical savings account. Muslims can put money in, and if you have enough in your account, Tabung Haji subsidises your first Hajj. Its main job after all is to help Malaysian Muslims perform the Hajj, and so cuts the fee of performing the Hajj to less than half of the usual price. That comes to around RM400 million just for Hajj fees subsidies in 2018 alone, and Tabung Haji has been keeping the fees the same since 2009 too, making the total amount spend on helping Muslims perform the Hajj at around RM1.1 billion since 2009.

Wait, so who’s paying the rest of that amount?

These days, Tabung Haji is more than just a place for Malaysian Muslims to save up money for the pilgrimage. Tabung Haji actually has various subsidiaries dealing with a variety of other industries. You can click here to check them out in more detail, but long story short, Tabung Haji has subsidiaries in property, services, financial institutions, information technology and plantations too. They’ve even dabbled in hospitality services, opening up their own line of TH thotels hotels too.

Since Tabung Haji is using your money for investments and businesses, the profits are shared by Tabung Haji’s own discretion through the form of dividends. It’s not all just for money-making tho, as in 2016, Tabung Haji also established the Yayasan Tabung Haji as a charitable foundation. It provides aid and contributes to those in need and underprivileged.

Now, because of the importance and significance of Tabung Haji to many Malaysian Muslims out there….

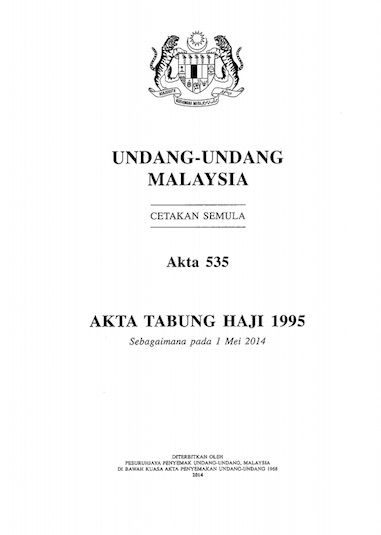

There’s actually a special law just for Tabung Haji to make sure it’s behaving

So remember how earlier on we mentioned that in 1995 Lembaga Urusan dan Tabung Haji became just Lembaga Tabung Haji? Well coinciding with that, there was also a new law passed called the Tabung Haji Act 1995, where Tabung Haji the company falls under. Thanks to our friends over at AskLegal, we know that according to the law, Tabung Haji can only use their funds for the following purposes:

- Paying back depositors who withdraw their money

- Paying back their loans and expenses

- Overhead costs in managing and carrying out investments

- Paying their employees’ salaries

- Loans and advances to officers and servants of Tabung Haji

That being said, part of the current problem, as mentioned earlier, is that allegedly some of the funds had been used by the former chairperson for political activities.

On top of that, it’s also part of the law that Tabung Haji can only pay dividends out, if it meets certain conditions. These conditions are:

- Tabung Haji has more assets than liabilities

- Tabung Haji has a Reserve Fund

- The Reserve Fund must have more money in it than total deposits and dividends combined

This is again troubling, as Tabung Haji has been paying out dividends even tho it did not have more assets than liabilities since 2014. A 2017 audit on the company’s financial accounts found that while Tabung Haji has assets of around RM70.3 billion, it had RM74.4 billion in liabilities, leading to Datuk Seri Mujahid Yusof’s statement regarding the RM4.1 billion hole in Tabung Haji’s accounts.

“That is a deficit of RM4.1 billion as of December 30, 2017 and TH has been paying out dividends since 2014 by contravening the Tabung Haji Act 1995. The hole is getting bigger. This cannot be sustainable,” – Mujahid Yusof Rawa, as quoted by Malay Mail

But the part that probably affects all Malaysians, not just Malaysian Muslims, is that part of the Tabung Haji Act says that Tabung Haji’s funds are kinda guaranteed by the govt. This pretty much means that in the event Tabung Haji’s financial problems really does worsen, there’s no need for any depositors to panic, as the govt will then step in to provide Tabung Haji with the funds necessary to pay back depositors. However, recent reports do state that there are plans to limit govt guarantees for depositors to only RM200,000 in an attempt to lighten the govt’s burden.

But in any case….

The warning signs were there for Tabung Haji

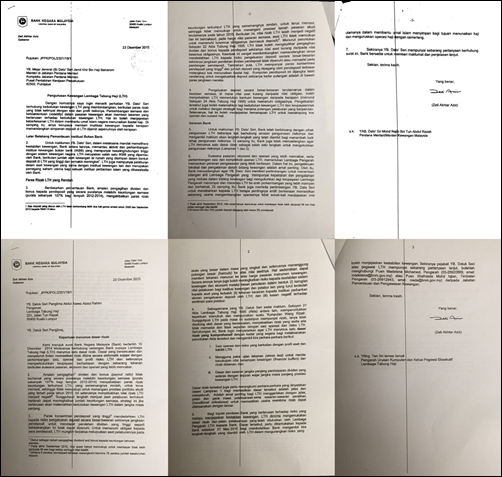

In early 2016, we actually covered news about leaked letters from the then Bank Negara Governor Zeti Aziz to Tabung Haji. These letters were warnings that Tabung Haji’s reserves were deep in the red and the situation then wasn’t improved when Tabung Haji confirmed it.

Now this was cause of concern, however, the then-govt responded to the leak by blocking the blog that leaked the letters. Tabung Haji would also later go on to announce a 5% dividend for investors, despite the supposed trouble it’s reserves were in.

Sadly, judging from the eventual trouble that Tabung Haji now finds itself in, it probably didn’t do much despite the literal warning signs from Zeti. That being said, no one really wants another financial scandal to happen in our country, especially one that may affect the mandatory religious duties of Malaysian Muslims. For the sake of the 9.2 million Tabung Haji depositors, we can only hope that the govt manages to find a way to turn things around for Tabung Haji.

- 441Shares

- Facebook406

- Twitter2

- LinkedIn5

- Email2

- WhatsApp26