6 super unexpected things Msian insurance agents are TRAINED to do to get your sales

- 1.3KShares

- Facebook1.2K

- Twitter14

- LinkedIn13

- Email15

- WhatsApp119

Recently, we ran our first ‘Geram Kerja Survey 2019’ to find out what Malaysians think about becoming insurance agents. And guess what? Out of over 2,000 respondents, 29.4% of them actually saw it as just another typical sales job doing sales-walesy things. 13% said it’s just about selling stuff to get more money. 🙁

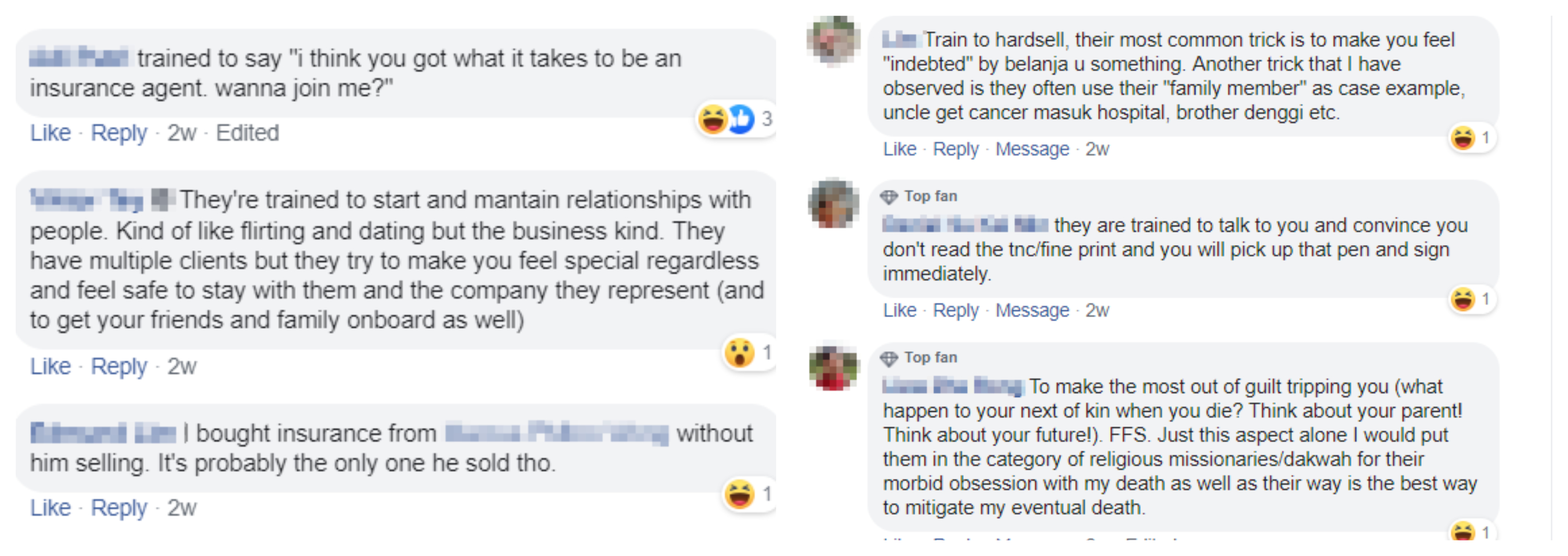

We also asked our readers on Facebook about what they think agents are trained to do, and some believe that they’re con-men who try to scam you into buying things and later persuade you to join them. Yea, that pretty much sounds like a pyramid scheme.

Now, Cilisos would be completely lying if we said we never thought the same way too. We’ve had our fair share of friends calling us out of the blue to yumcha, only to suddenly ask us to buy insurance from them. -__-”

But since we’re buddies with AIA, we took the opportunity to find out… how TRUE are these assumptions? We mean, if it’s so bad, why do people even quit their jobs to be agents? It. Just. Doesn’t. Add. Up.

So to help with that, we got in touch with these gaiz to help complete the picture:

- Esther Heng, 3 years, trainer at the AIA Elite Academy

- Cheng Ji, 1 year and a half, trainer at the AIA Elite Academy

- Kent Yap, 16 years as an AIA life planner and recruiter

- Rashidah Rahmat, 22 years as an AIA life planner and recruiter

1. Surprisingly, insurance agents read law and have medical knowledge!

The assumption: “They don’t know their stuff.”

The assumption, demystified: Okla, obviously agents do learn about insurance but, according to Esther, they also learn about wealth (financial planning), health (like diseases), estate planning, our legal system (because they also handle wills), trusts and investments, among other things. She also adds that the training has a holistic approach, especially towards financial planning. No wonder why insurance agents are referred to as ‘Life Planners’ in AIA, because these agents literally plan out the safety nets to protect every aspect of life.

“We’re not only talking about protection. There are also wealth preservation, wealth creation and debt cancellation.” – Esther told CILISOS.

Normally, these training are provided by external companies but Esther and Kent also tell us that agencies have the responsibility to train their agents too. And when it comes to training modules at AIA, it can be super fun.

Rashidah shares that they also receive basic medical training especially about diseases from doctors. Sometimes, agents are also invited to hospitals for this very purpose! In fact, just the other day, they also learned about fires. “What to do to minimise the risk… Like when your car is on fire, where to put the fire extinguisher,” Rashidah adds. “They taught us things like that so that we can share with the clients.”

Apparently, agents have to frequently go for training throughout their career. We’re not sure about other companies, but Rashidah shares that AIA has a loooooot of training modules. Agents get to choose which modules they wanna participate to enhance their knowledge and skills. However, these modules are not for everyone.

“AIA will give requirement if agents achieve a certain target then they can get these training. This way, those who work hard will appreciate the training they attend.” – Rashidah.

2. Yea, they’re supposed to look good but not… EXTREMELY good

The assumption: “They’re trained to look irritatingly good and positive and sunshiney with rainbows all around.”

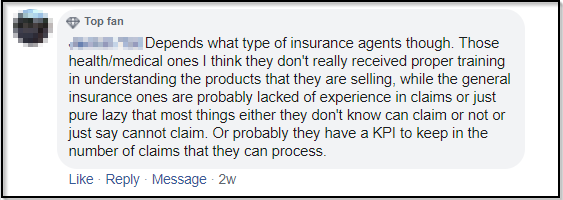

The assumption, demystified: Notice how insurance agents just have… “THAT LOOK”? Y’know, the slick pompadour hairstyle, LV belt, Tory Burch bag, BMW (or Honda City if not so atas), and photos of them with their THUMBS UP?!

JENG JENG! So turns out, agents DO learn about grooming themselves, although some parts of it will surprise you. (We’ll get to that later.) Most often, this would be conducted by an image consultant. They gotta look good la, cos first impression definitely matters in a job that requires agents to meet potential clients face-to-face.

“Character is a result of what you consistently do. When you don’t carry yourself well, then it says something about how you do your work.” – Cheng Ji.

In addition, they’re also trained to be presentable online! We’re pretty sure you’ve come across at least an insurance agent’s social media account and they pretty much look like this:

Cilisos Confession Corner: We’re always secretly making fun of our friends who curate their social media accounts with irritatingly positive quotes and smiles. Tee hee. (Sorry la our lives not that great ok.)

But here’s the shocker. Although they’re trained to build up a positive character online and in real life, Kent tells us that all these super-positive image is a HUGE no-no.

“In our training, it’s a “No” in putting on a sham image social media. We gotta be natural, share who they really are. They need to be genuine and real. People will know.“ – Kent.

3. There’s no specific training on how to handle rejection but…

The assumption: “Insurance agents sure kena turn down more often than me trying to get a date.”

The assumption, demystified: The insurance industry is definitely not for the fainthearted. Kent even calls it a ‘no’ industry because agents are normally greeted with a…

Insurance agents are humans too, and just like all of us, they also have emotions. So, according to Kent, they may need to go through training to have the right mindset when dealing with rejections.

So turns out, there are actually formal trainings which involves five to 10 agents in a class. (We didn’t manage to find out how the class works, but we’re guessing it’s role-playing?) Then there are also field trainings where new agents would follow seniors out for real meetings to experience first hand on how to deal with rejections.

“Junior agents will follow senior agents to meet their clients. They’ll see how senior handle rejection from clients. It’s like when we go to uni, we learn theoretical things, and now they also learn practically.” – Kent.

Esther tells us that there are two types of rejections – mere excuses (like when people say, ‘Aiyo, no money la’) and true objections (like a legit, super plausible, real reason).

If the agent gets a ‘mere excuse’? Agents are advised to move on. But when they get a ‘true objection’? “True objections normally involves certain concerns,” Esther tells us. “So life planners will address these concerns by finding out what happened, then help clients resolve their concerns and realise their protection gap or needs.”

However, Rashidah tells us that there is no such thing as ‘How to handle rejection 101’. She suggests agents to come back to their respective agencies to do a a postmortem and consult their leaders to find out where they went wrong whenever they face rejections because each agent may face different kind of rejections in different situations.

4. Agents have the responsibility of being healthy first before encouraging you to do the same 😮

The assumption: “Agents only remind you about dying.”

The assumption, demystified: Walao. Ever had an agent put fear in you that one day you may get cancer? Or one day you may fly off the cliff while driving up to Genting? Or after you GG, then your family also gotta suffer financially pulak. Wah damn upsetting right these fellers? But actually…

“We’re not Monsters, Inc. We’re not here to scare people.” – Rashidah.

Okla, agents have the responsibility to explain all the risks that you’re possibly exposed to as a living, breathing human being – cancer, accidents, unemployment and even death – but Kent explains that nowadays he prefers using a non-scary approach by setting a good example to everyone.

AIA Life Planners are particularly trained to do this, especially through AIA Vitality, which is its health programme. So they’re not just about selling insurance and only insurance but also encouraging you to be healthy just like them! (Ummm discounts on gym membership?! Heck yeah!!)

“We go to the gym and connect with people and talk about healthy lifestyle, eat healthily and live healthily.” – Kent told CILISOS.

Well, that’s also thanks to the medical training they get from doctors and hospital visits that we mentioned earlier.

Cheng Ji adds that nowadays, agents are sharing their knowledge to you instead of trying to sell you insurance without giving you context. When agents meetup with clients, Esther tells us that they’re NOT encouraged to provide customers with a solution before finding out what customers actually need.

But let’s be real. Not all of them actually practice this.

Some of you out there may have experienced being cheated, probably cause they weren’t transparent in giving you the information you needed before purchasing their products. In fact, according to Rashidah, some agents who may not have received adequate training have the tendency to take your money and ciaodamao… and it seems like that’s why the job “INSURANCE AGENT” makes some people get PTSD.

However, that’s not the case with insurance agents who are adequately trained. Cheng Ji tells us that they have the responsibility to stay with their customers throughout their lives and as long as they’re in the industry. Apparently, life planners are trained to stay in touch with their customers to understand their needs as their life progresses.

“Minimum (insurance agents have to) keep in touch when it’s their (customers’) birthday and festive season. Bare minimum, twice a year.” – Rashidah.

5. Actually… insurance agent’s performance can even be measured by… Bank Negara!?

The assumption: “DODGY. DODGY. DODGY. WILL DO ANYTHING TO GET YOUR MONEY!”

The assumption, demystified: Sure, we all know that agents who hit their target get rewarded with luxe holidays, big bonuses, iPhones, etc. That’s why they’re always so enthusiastic in doing their jobs! But as it turns out, there’s actually a non-salesy reason why they do that… and that’s strict KPIs.

Kent tells us that there’s a standardised tool to measure the KPI of all insurance agents in Malaysia which was introduced by Bank Negara Malaysia last year called the Balanced Scorecard. According to Kent, the Balanced Scorecard measures 5 criteria, including fulfilling 30 hours of training annually, fact-finding on their clients, and even getting zero complaints.

While some of the 5 criteria determine their commission, there are some that determine whether or not the agent gets to keep his/her job! Waitamin, how daheck are they gonna keep their jobs considering how Malaysians generally love to complain??? Apparently, not all of your complaints will be taken into account when it comes to the balanced scorecard.

“Insurance companies take complaints very seriously and will look into every complaints, especially those serious complaints against insurance agents. For instance, taking money from customers but didn’t give it to the insurance company.” – Kent told us.

He adds that this also includes mis-selling, forging customer’s signature and giving out misleading information on a product. Apparently, Bank Negara implemented this to ensure that agents are serious and committed to their work besides rewarding those who perform above and beyond the limit set.

And if you’re a Life Planner at AIA, you’d be rewarded with bonuses if you achieve your KPI. Apparently, AIA Elite Academy has its own tool that oversees their monthly production. According to Rashidah, it tracks their activities such as the amount of hours spend on face-to-face communication with clients and hours spent making cold calls.

Just so you know, agents are paid based on commissions and bonuses so if they don’t achieve their targets on both their balanced scorecard and Elite’s tracker, then GG lor.

BTW… you can actually read more about how much agents earn here. Having said that, the more hardworking insurance agents are, the more bonuses and commissions they’ll get.

6. Insurance agents have to sit for professional papers to get their licenses

The assumption: “No need to study hard or work hard… any dumb, lazy fler can be an insurance agent.”

The assumption, demystified: HOhoho… we couldn’t be more wrong…

To begin with, as a recruiter, Kent tells us that the only two criteria he seeks in a candidate who wishes to be a successful Life Planner are: strong willingness and strong capabilities. We can’t speak for other companies, but from what we know, AIA has a strict process in order to hire the right candidates.

There’s a 7 Step Selection which includes interviews, career choice profiling test, job sampling and… uh… a VIP interview??

So once someone is chosen, they’re required to quit their current job because, according to Esther, the academy only recruits full time life planners. And when this happens, they’ll need to go for examinations to be a licensed insurance agent. There are several examinations provided by the Malaysian Insurance Institute (MII), which is an established professional examination body for the insurance industry, such as:

- Takaful Basic Examination for takaful insurance

- Certificate Examination in Investment-Linked Life Insurance for investment

- Pre-Contract Examination for general insurance

…and many more!

After graduating, Rashidah tells us that it is possible for them to further their studies (yea, something like getting your Masters) by going for the Registered Financial Planner certification which is, according to her, somewhat similar to the ACCA for accountants.

It’s surprisingly a lot more LEGIT than we thought it would be O_O

So we guess what we’re trying to say here is… oops lmao sorry we kept making fun of yall insurance agents all these years 😛

What’s interesting is that AIA actually knows about the negative perceptions and they are consistently working on improving themselves, which is why they’ve begun building a whole new generation of agents which they now call Life Planners. No longer do they wanna be seen as just another salesy people, but as someone who works hard and smart, creating solutions that can genuinely add value to the lives of Malaysians.

But it takes a lot to build this new-and-improved generation, hence why they have the AIA Elite Academy. Actually, all the stuff that you’ve just read above about training and all that, are just one of the many things that budding Life Planners learn in the academy. In fact, the academy isn’t only to train up customer-facing agents – those in the programme can also end up working in a team of professionals in AIA.

And also, lots of different people end up there. Esther and Cheng Ji were initially trainers from the corporate and hospitality industry. Rashidah was from banking, while Kent was a fresh graduate.

So if you’ve ever felt like you needed a change in your career, this may be an alternative you could consider. But just be prepared that it’s a job that requires a lot of hard-work and hustlin’… and sometimes childish taunts from ignorant people like Cilisos 😛

- 1.3KShares

- Facebook1.2K

- Twitter14

- LinkedIn13

- Email15

- WhatsApp119