The government is right to stop special EPF withdrawals. Here’s why.

- 343Shares

- Facebook324

- LinkedIn3

- Email2

- WhatsApp14

Today, our deputy Finance Minister, Ahmad Maslan, announced that the government will not be allowing a new round of EPF withdrawals despite calls from various parties for said withdrawals. For those of y’all lookin’ to take out a fresh RM10K for that car or house down payment, that’s bad news… right?

What if we told you that for many Malaysians, these withdrawals can potentially make a massive crack in what was supposed to be their retirement nest egg? Yes, yes, taking out money and spending it means you’ll have less money. Anyone can tell you that… but what they might not be able to tell you is how much an EPF withdrawal will set you back financially. And since us writers at CILISOS are hopeless at math, economics and the like, we rang up Professor Dr. Hafezali, the Head of Research at the Faculty of Business and Law from Taylor’s University, to ask him just that.

Before we go into the math, though, let’s talk about…

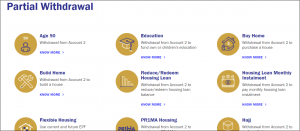

How do EPF withdrawals work?

Even before schemes like i-Sinar, i-Lestari or i-Citra were introduced by the government, people were allowed to withdraw from their EPF accounts all along. The application process differs depending on the reason for said withdrawal, but it usually involves filling up an application form and submitting relevant documents. For example, if you’re trying to get some moolah from your EPF account to fund your Masters degree, they’re gonna need letters from your education institute, on top of application forms. Check out this link for a full list of allowed withdrawals and their specific requirements.

Right, now that we’ve done away with the bureaucracy bulldoodoo, it’s high time we tell you that…

Withdrawing RM10K now will cost you RM37.5K in the future

Sure, you probably won’t see any immediate effects of withdrawing RM10K now, especially if you’re in need of the money. In the long run though, it’ll cost you because it’ll take a while to put back the RM10K back into your EPF account, and you’ll lose out in terms of compounding interest. We know you hate as much as we do, but stick with us. Let’s say you’re an average Ali, Ah Hock or Muthu living in Malaysia:

- You’re 30 years old

- You’re making a very average RM2,062 – the median monthly income of Malaysians (as of 2020)

- For whatever reason, you’re withdrawing RM10K from your EPF

Assuming that your salary stays the same, inflation is nonexistent (one can dream) and your monthly contribution to EPF is 11%, it’ll take you about 2 and a half years to put RM10K back in your account. We’re gonna go one step further: say you DON’T replace the RM10K you’ve taken out. It’s only RM10K, right? Not exactly. Due to compounding interest, you’re potentially losing out on roughly RM37.5K.

Didn’t expect that, didja? Img from Twitter

Here’s how it breaks down – EPF pays their contributors a certain amount of interest every year. The current rate sits at 6.1%, but for the sake of our example, let’s set it at an average of 4.5% per year. The RM10K will, had it been left untouched in your EPF account, grow like this with compounding interest:

- RM10,450 after the first year (RM10K + 4.5% of that)

- RM10,920.25 after the second year (RM10,450 + 4.5% of that)

- RM11,411.65 after the third year (RM10,920.25 + 4.5% of that)

…And so on, and so forth. That figure will land in the ballpark of RM37.5K after 30 years. According to Dr. Hafezali, people in lower income brackets who make EPF withdrawals are hit particularly hard – a lower income leads to less money leftover from financial commitments, which in turn leads to a longer time taken to replace whatever amount they’ve withdrawn in the first place.

TL;DR: EPF withdrawals can and will affect how much you’ll end up with come retirement age, and it’ll affect you more if you’re in a lower income bracket.

That’s not to say EPF withdrawals are a bad idea for everyone, though, because…

You CAN invest EPF withdrawals somewhere else, but…

We don’t usually think of the chunk of money that’s taken from our salaries and dumped into our EPF accounts as a form of investment. Maybe it’s the mandatory nature of the deduction, but Dr. Hafezali brought up the fact that EPF has consistently provided fairly high returns at minimal risk – all you have to do is not touch the money, and you’ll get guaranteed returns:

Despite the uncertainty and challenges facing Malaysia’s markets, EPF has performed and is performing well. Even in extremely bad years, EPF has to maintain a dividend rate of 2.5% by law, which they have exceeded in the past 10 years.

That being said, taking the money from your EPF savings and investing it somewhere else is an option… if you can afford it. We interviewed a young married couple, Susan and Ken (both pseudonyms), who took out some money from their EPF accounts to pay for the down payment on their matrimonial home. When asked whether they thought they made the right decision, they said:

We planned it out, and while we knew the withdrawal might set us back in the short term, we’re forking out this money for our first home. Plus, we’re quite sure that the property will appreciate in value in the future, moreso than what EPF’s interest can give us.

Even though it worked out for Susan and Ken, there’s a catch: they belong in the upper M40 income bracket. They have enough discretionary income to put into other avenues of investments; in fact, Susan had enough to set up an retirement fund that’s entirely separate from EPF. Looking at the eye popping figures published by EPF themselves (6.1 million contributors have less than RM10K in their EPF accounts), it’s probably safe to say that for many of us who are in the lower M40 or B40 group, leaving our EPF accounts alone is the best bet.

Then again, it’s understandable that…

Many of those who withdrew from their EPF had no choice

Susah cakap bro.

In Dr. Hafezali’s article, EPF Withdrawals: The Problem of Income Inequality, he cited the fact that RM101 billion were made in withdrawals over the last two years. That staggering number speaks to how much the impact of both the Great Virus Attack of 2020 and the series of floods that hit multiple states at the end of 2021 had on scores of Malaysians. It’s unsurprising that people had to withdraw from their EPF just to survive for however long they can. It also doesn’t help that an ever-widening income gap exists between the have and have nots.

At the end of the day, it has to be said that the EPF is there for our benefit. It’s a form of social security that helps fund our golden years that are yet to come. If you are in dire straits financially, it’s possible to talk to your bank about restructuring your loan repayments or seek help from them for general financial advice.

P.S.: We’d like to give a shoutout to Professor Dr. Hafezali and Kirtana from Taylor’s University for taking their time to have a chat with us on the subject of EPF withdrawals. Thank you!

[This article was originally published in March 2022 and updated in February 2023.]

- 343Shares

- Facebook324

- LinkedIn3

- Email2

- WhatsApp14