What I wish I knew about emergency funds before I went jobless for 7 months

- 280Shares

- Facebook218

- Twitter5

- LinkedIn6

- Email8

- WhatsApp43

When I left Cilisos in February, I had over a year to prepare – both mentally and financially. By this point, I’d been here for 11 years, and I thought I’d take a whole year off to live my best life or, as they say, be jobless.

For this little “micro-retirement”, I had RM80k in savings to cover any unexpected expenses. Some of you may think it isn’t safe telling the 30 people who still read Cilisos how much money I have… but it’s okay. There’s not much left.

So when my ex-colleagues at Cilisos were asked to write an article about managing finances, the team probably thought “Hey, let’s reach out to our ex-boss to share his experience. He must have some stories.”

And they were right.

Here’s why I thought I was financially prepared to be jobless

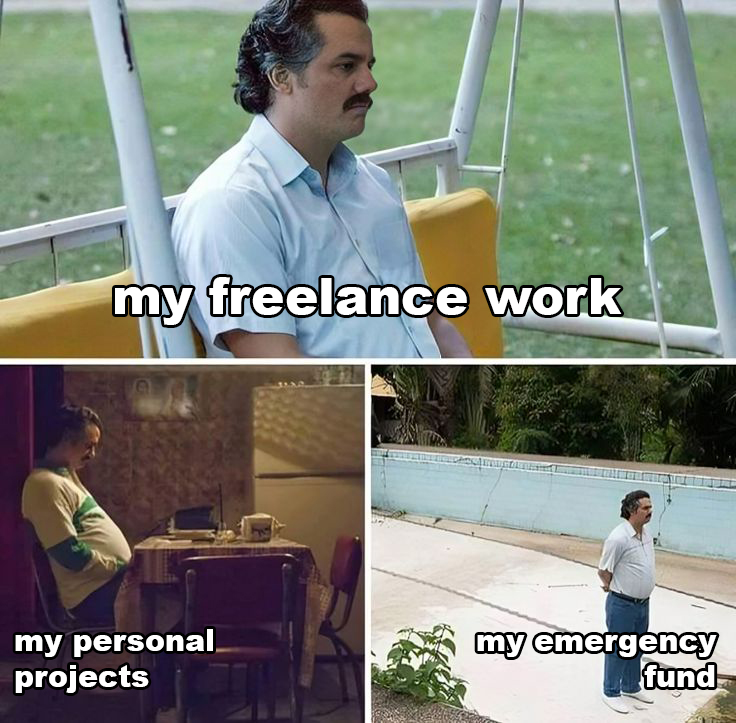

I wasn’t planning to go on some jet-setting holiday around the world. In fact, I just wanted the time to explore freelance work, write a novel about a cowboy in Malaysia, and play video games till my eyes popped out. Little did I know, only one of these would fully come to fruition.

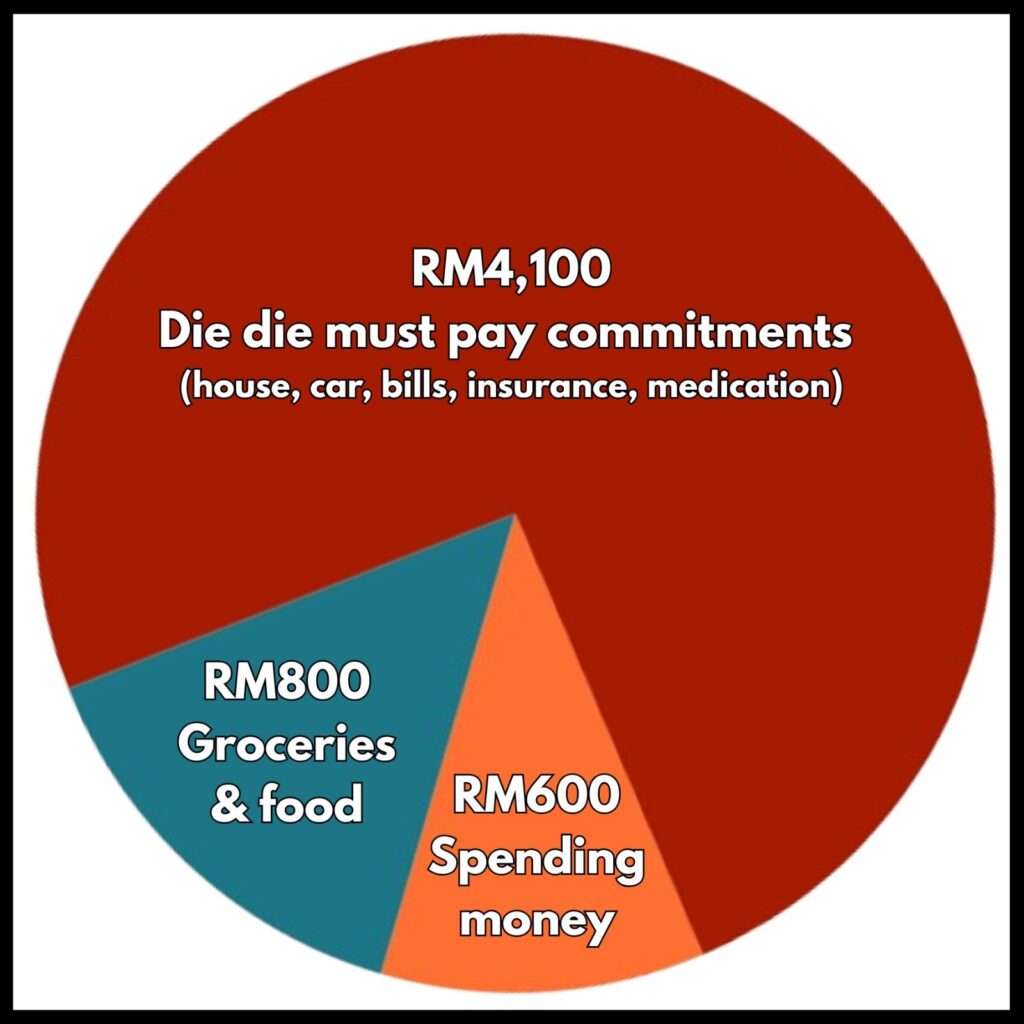

I calculated my expenses to be about RM5,500 a month:

On top of this, I was due to pay RM25k for my wedding, so realistically I only had RM55k in my emergency fund.

My predecessor also told me about the Current Salary + 20% rule for freelancing, which is that you should ideally be earning 120% of your current salary to cover for taxes, EPF, and lost benefits. I already had a few recurring freelance jobs lined up, which would net me RM8,250 a month right from the get-go. It wasn’t 120% of my salary, but it was a strong start.

To recap, I was set to earn more than what I’d spend. I was ready for the big expenses. So I was prepared!

…..Right?

Lesson 1: You might tap into your emergency fund sooner than you think

You know that RM8,250 I was earning? Yeah, that was just for 2 months.

When my biggest client put their project on hold, I was suddenly out RM4,000. This meant I was suddenly in the negative. Unless I got more jobs, I was set to lose RM1,250 each month.

While I did try to look for more work, I’ll admit that it wasn’t as easy as I thought it’d be. I was still resolute that this was a one-year break and, besides, that gave me more time to work on my Malaysian cowboy novel. Perhaps to make myself feel better, I told myself that I could go on for about 3.6 years before the emergency piggy bank went dry.

But juuuuuuuuust to be safe, I started cutting down on my personal spending.

Lesson 2: Penny-pinching doesn’t help… much

It doesn’t take a financial guru to tell you that staying home is free. But I also enjoy being out of the house and working from cafes.

So with my powers of unemployment, I’d walk 25 minutes to the MRT station and head to a mall food court. AEON One Utama soon became the food court of choice. With the 50% off clearance on food, I’d proudly tell my fiancee that I spent less than RM15 for a full day out.

Making these kinds of cuts became addictive, and I brought my deficit down to RM1,000 a month, or 4.5 years of possible joblessness before I need to start begging. They say that sikit-sikit lama-lama jadi bukit, and that’s absolutely true.

Unfortunately it’s also true that it just takes one or two developments to flatten that bukit. Just ask the limestone hills outside Ipoh.

Perhaps due to not driving it as much, my car decided to identify as a paperweight. One tow and a night at the mechanic later, and I was out RM2k. Then, another RM8k in additional wedding expenses. Just like that, I’m now back down to 3.7 years of supported joblessness.

The thing is, saving money on the small things felt good. It felt proactive – like I was making a difference. But it only takes one major expense to undo months of penny-pinching.

Lesson 3: It stresses the people around you

This really depends on your dynamics. Some people would rather not discuss finances with their spouse, some do. In my case, I kept my fiancee (now wife) up-to-date on the ups and downs of my bank account.

While we both agree that this was the most prudent thing to do, it had the unintended effect of stressing her out. I didn’t notice it at first, but we were suddenly going out less, eating at cheaper places. She was offering to pay for things that I usually paid for. It wasn’t until her birthday, when she asked me to hold off on getting her a present, that it all came out.

Even after our wedding, she opted to hold back on the honeymoon. While I felt bad, I was also relieved because I’d totally forgotten to budget for it. As a compromise, we split the cost on a “pre-honeymoon” trip to Bali, setting me back about RM2,000.

At the same time, I also noticed my dad inquiring about my finances more, and double-checking when I offered to pick up the dinner bill.

No matter how much I assured everyone that my finances were fine (kinda), it’s not the best feeling knowing that you’re also making them worry. On reflection, telling them about my penny-pinching adventures (as per the point above) probably reinforced the perception that I was one 50 sen coin away from being homeless.

And, yes, them worrying adds to my financial anxiety. But hey, at least it’s better than finding out that…

Lesson 4: Actual emergencies are really expensive

So, remember when I said I wanted to spend the year exploring freelance work, write a Malaysian cowboy novel, and play video games till my eyes popped out – and only one of these came true?

Yeah, my eye popped out.

Just the year before, I was diagnosed with hyperthyroidism. Luckily, the medication and check-ups average to less than RM120 a month. That was, until people started noticing that my right eye looked larger than the left. One visit to the specialist later, and I found out I have Thyroid Eye Disease which causes one or both eyes to bulge forward. TLDR, if left unmanaged, I’ll look like either one of these emojis: 🤨 or 😳.

In the blink of an eye (pun intended), my monthly medical cost ballooned from RM120 to RM800. If I needed surgery, I was looking at RM20,000 – RM70,000 depending on how bad my eye got. Insurance would cover most of the cost, but it was a sign that it was time to seriously start looking for a job.

Lesson 5: Not everyone gets the privilege to choose when they’ll be jobless

In writing this, I’m fully aware that all these lessons are a result of my own choices. I had time to plan, and only left my job when I felt ready. Some people may not be jobless by choice, or have savings that can sustain them for long.

I knew I’d come out of this with a smaller emergency fund – I just didn’t expect how small it’d get. What started as a “carefully planned” one-year micro-retirement ended six months early because the risk of running out of money was becoming very real. Some from my own mistakes, and some from events I didn’t see coming (even with one bigger eye).

Our friends at PIDM often talk about saving for a rainy day, and now I get what it actually means. It’s really about being prepared for the moments you didn’t plan for. Even when you have the best plans laid out, life has a way of throwing that plan out the window. A sudden emergency or retrenchment can lead to maxing out your credit card or, worse, borrowing money from Ah Longs. Having savings gives you time to recover, to adapt, and to make better decisions instead of desperate ones.

While I clearly didn’t use my savings perfectly, things could be a lot worse. I mean, my bank could gulung tikar and I’d lose all my savings overnight. But this is where PIDM comes in.

Through PIDM’s Deposit Insurance System (DIS), our savings are protected up to RM250,000 per depositor per member bank, automatically and at no cost. It’s one of those things you don’t actively think about when life is going fine, but when you’re jobless and watching your savings shrink month by month, that assurance matters. It means the money you’ve set aside for rent, groceries, and medical bills stays where it’s supposed to be.

If you need a starting point to understanding how your money works, PIDM’s SPK calculator can help summarize your financial standing and suggest a plan to build your emergency fund.

- 280Shares

- Facebook218

- Twitter5

- LinkedIn6

- Email8

- WhatsApp43