Even if you don’t have harta, you still need to do legacy planning. Here’s why

- 1.3KShares

- Facebook640

- Twitter181

- LinkedIn162

- Email130

- WhatsApp213

Contrary to popular belief, legacy planning isn’t just for the Datuks and Tan Sris of the world. Even if all you have is a cat, a loan, and an EPF account that refuses to grow, as long as there are people you care about, it matters. In simple terms, legacy planning is really about making sure what you’ve earned (and what’s left of it) goes to the right people.

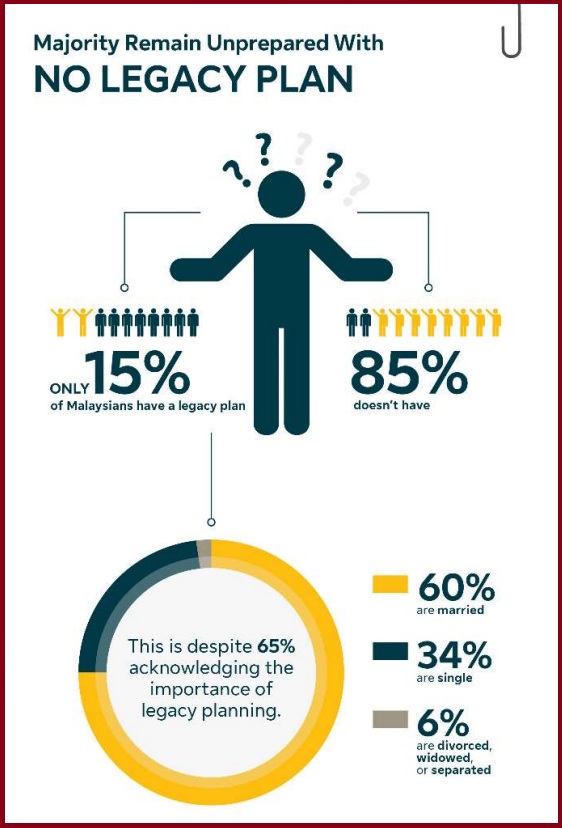

Sounds straightforward enough, right? But here’s the kicker: most Malaysians still aren’t doing it. Sun Life Malaysia’s Insure or Unsure Insurance Literacy Survey 2025 found that while 65% of us already know legacy planning is important, only 15% have actually put a plan in place. Which means the other 85% are basically leaving behind a ticking time bomb for their families.

It’s serious enough that Ho Teck Seng, the President and Country Head of Sun Life Malaysia, is calling it a wake-up call.

“Legacy planning is really about care. It’s making sure the people you love don’t get left with uncertainty. The fact that 85% of Malaysians don’t have a plan is a wake-up call. Starting early can make all the difference, no matter how much or how little you have.”

So what’s stopping Malaysians from getting their legacy planning act together? Well, mostly three big misconceptions.

Reason #1: “Assets? What assets?”

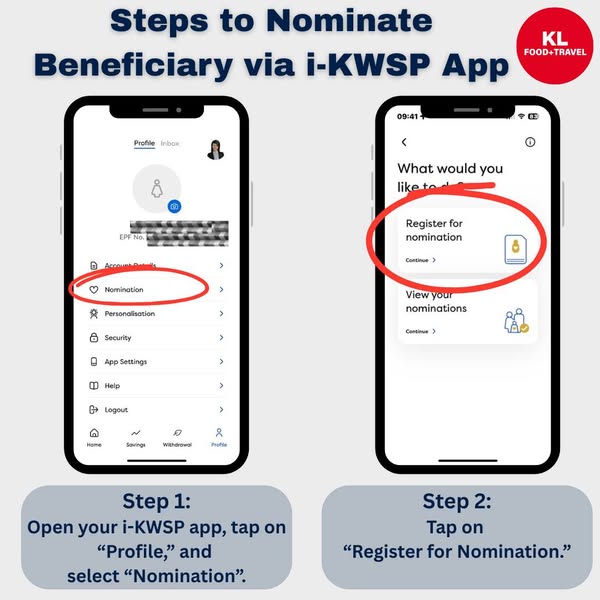

You might think you have nothing worth passing on, but for most Malaysians, EPF is literally the biggest pot of money we’ll ever leave behind. But did you know it doesn’t automatically go to your family, rather the person you put down as your nominee?

The problem with that is that some people never nominate anyone, and plenty just forget who they picked years ago. Insurance and takaful work the same way. You buy the policy or participate in the takaful plan, thinking it’ll protect your parents or kids; but if you don’t name anyone, the money can get stuck, or worse, disappear into legal limbo.

And beyond money, there’s the non-financial side too. Like who’s legally in charge of your kids if you suddenly pass away, or whether part of your assets should go to charity. So even if you don’t have much, it’s still worth sorting these things out. A little effort now can save your loved ones a whole lot of paperwork drama later.

Reason #2: “I’m too young to think about this”

Death isn’t exactly something you bring up over dinner, so it’s no surprise then that less than half of the working population have written a will. In fact, we tend to brush off wills as “old people business”, but the truth is, life doesn’t wait until you hit uncle/aunty age.

Accidents, sudden illnesses or even temporary disability can happen anytime. Just look at the EPF’s i-Lindung data – by Sept 2024, around 144,000 members had already pulled out RM44.2 million to get life or critical illness insurance/takaful coverage. The good news here is that planning early isn’t as tedious as you may think. A basic will, a Hibah plan, nominating an executor, or simply updating your insurance/takaful nominations can cover a lot of ground.

Sun Life’s survey also found that culture and faith influence how Malaysians handle legacy planning. Many Malay respondents, for instance, prefer using Islamic inheritance tools like Hibah (a gift) and Wasiat (Islamic wills) that follow Shariah principles.

All this to say, starting young is just a matter of future proofing. And once it’s out of the way, you can get back to living.

Reason #3: “It’s too expensive and complicated”

Unless you really are a Datuk or Tan Sri, the basics are nowhere near that dramatic or pricey.

With EPF, for example, nomination is free and can be done online. The same goes for insurance policies or takaful contracts, which usually let you name your beneficiaries upfront. (For takaful, you can choose between nominating a person as a Wasi or as a Hibah beneficiary.)

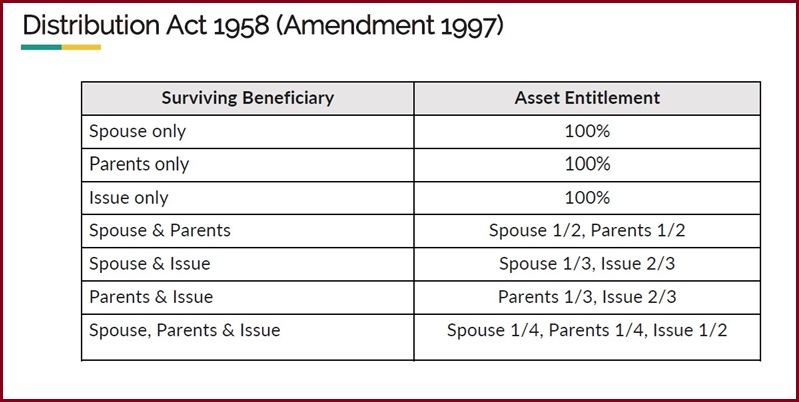

But if it’s left blank, families may be forced into lengthy proceedings with Amanah Raya and the civil courts just to unlock the money.

Forget the myth that you need a 30-page will. A simple will that’s properly signed and witnessed is already legally valid in Malaysia. To keep costs low, you can turn to NGOs, legal aid services, or online platforms that guide you through the process. For Muslims, options like Wasiat or takaful Hibah can also simplify inheritance matters under Faraid law.

The reality is, most Malaysians actually care about legacy planning… we just malas to start

Remember that Sun Life survey we mentioned earlier? Well, the Insure or Unsure Insurance Literacy Survey checked in with 1,040 Malaysians to see how we’re handling insurance, takaful and legacy planning.

And as you already know, a strong 65% of us say legacy planning is important. So the intention is there. The real spotlight issue is that people are just not moving their bum bums to get their paperwork sorted which is why only 15% have actually started, leaving a huge 85% gap.

But here’s the interesting bit: when people do finally get moving, more than half (54%) head straight to professionals for help. Which kinda shows that once we actually know where to start, we’re not that averse to taking action after all.

And on that note, here’s a simple checklist to get you on the road:

- Protect your dependents and avoid messy family disputes

- Prepare for medical emergencies or incapacity

- Think about passing down values, not just wealth

- Use affordable tools like EPF nominations, insurance / takaful or a basic will / wasiat

These days, there are also plenty of platforms, advisors, and even digital tools that make the process way less scary than it sounds. So if you wanna stop procrastinating, just hop over to Sun Life Malaysia’s website or better yet, schedule a talk with their advisors to learn firsthand. At the end of the day, this is all to make sure you and your family can live with peace of mind.

- 1.3KShares

- Facebook640

- Twitter181

- LinkedIn162

- Email130

- WhatsApp213