Explainer: How Axiata lost RM6.3 billion in Nepal

- 251Shares

- Facebook100

- Twitter13

- LinkedIn9

- Email14

- WhatsApp115

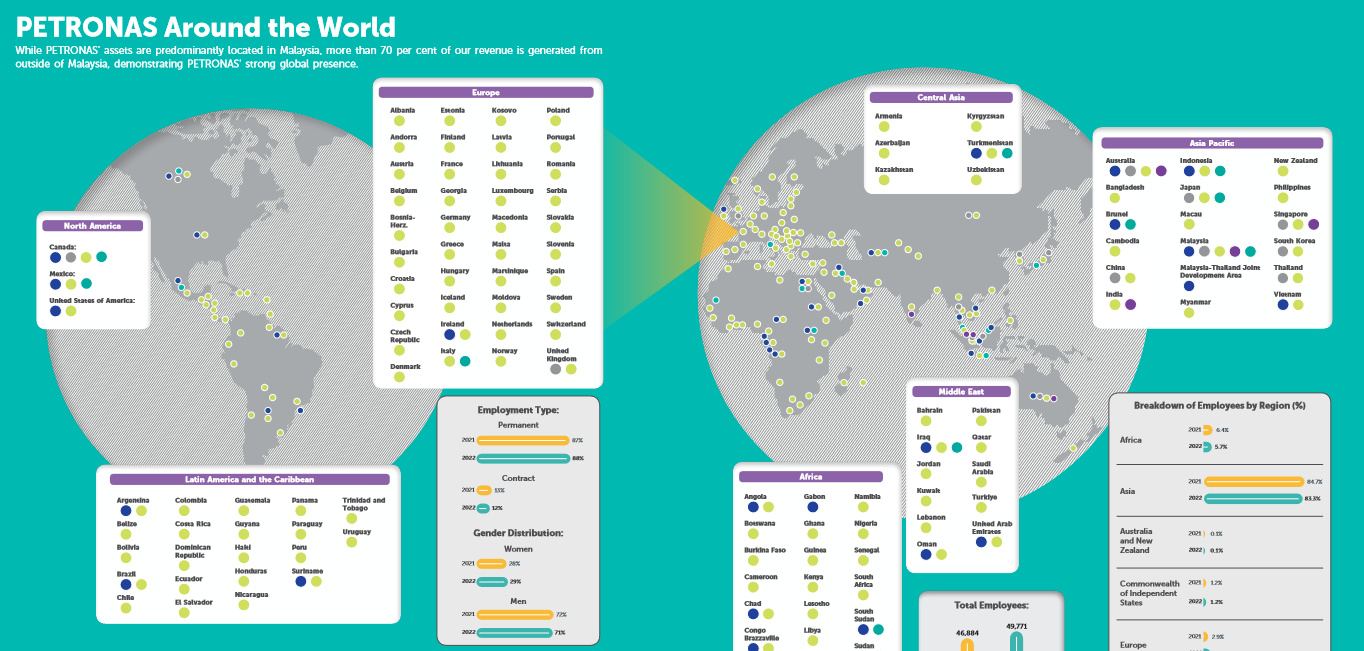

This might be surprising to y’all, but our government generally makes pretty smart decisions when they make investments with our tax money overseas. Usually. Take Petronas, for example. They either partially or fully own companies in dozens of countries all over the world, and seem to be doing fairly well.

But not every investment is gonna turn out great – in fact, our government, by proxy, just lost about RM6.3 billion in Nepal last year. To put that number into perspective, that’s roughly RM3.6 billion more than the amount Najib pocketed in the 1MDB scandal. That’s pretty wild, and…

It all began with tax issues when Axiata bought Ncell in 2016

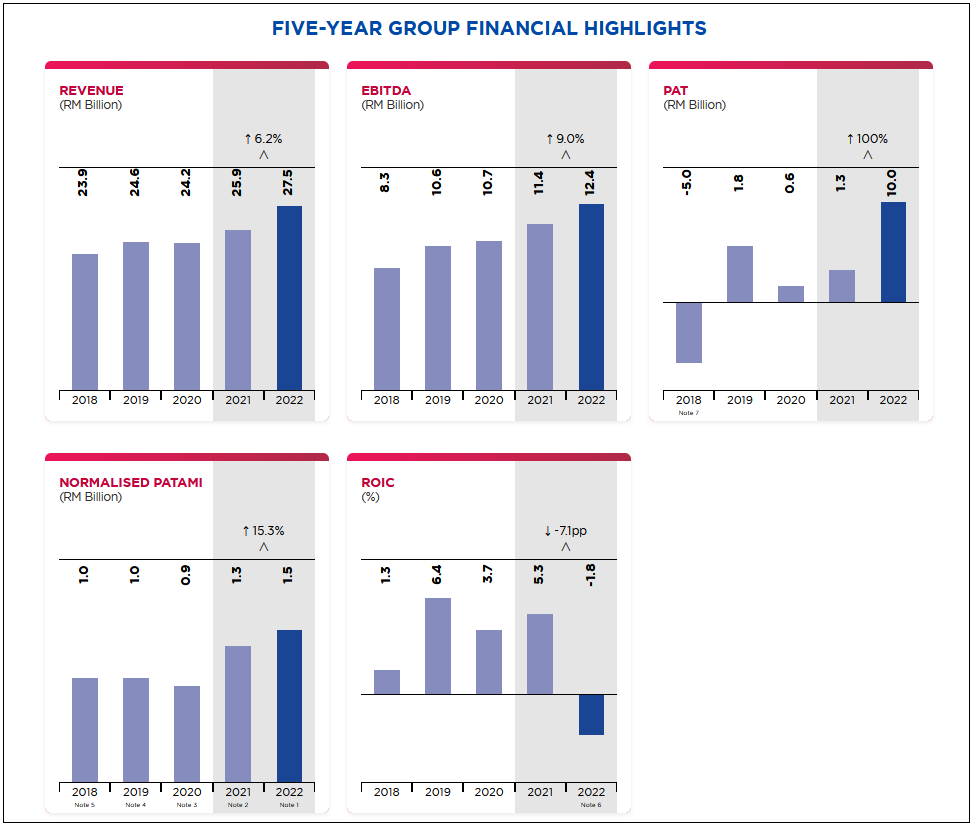

So a bit of background info: Axiata Group Berhad is a government-linked company that at one point was the main owner of Celcom, and now they’re a major shareholder of CelcomDigi. Looking at their financial performance in the last five to seven years, they’ve been doing pretty good.

The same cannot be said for their venture into Nepal back in 2016, which began with Axiata’s purchase of Ncell, Nepal’s biggest telecomms company from TeliaSonera for US$1.37 billion (roughly RM6.5 billion). The transaction had, according to Axiata, the approval of all relevant authorities from both Nepal and Malaysia…

…or not, because one month after Axiata acquired Ncell, Nepal’s taxmen claimed that Axiata failed to pay capital gains tax for the purchase, even though TeliaSonera should be responsible for those taxes. That’s super weird, but what’s even weirder is that Axiata went ahead and gave an advance payment for the tax anyway!

The Star called the move ‘unusual’, with the Nepali Times highlighting the sus-ness of the whole thing:

“A transaction of this magnitude could not have been pulled off without the involvement of top bureaucrats, regulators and politicians,” – Shristi Karki, ‘The Year of Scandals’

And then there’s the problem of how…

Ncell had an expiring license, and Axiata bought them anyway

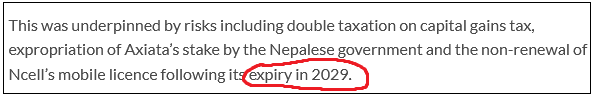

See, in Nepal, mobile service providers get 25 years to operate, and since Ncell was awarded a license in 2004, that license will expire in 2029. Plus, any telecomms company with over 50% foreign ownership (Axiata at the time held 80%) has to be handed over to the government once the license expires. A fresh license can be issued if the company pays the government its own value to ‘buy’ the company back from the government

When Axiata bought Ncell in 2016, they had 13 years of the license to go. Not that bad, right?

Well, Axiata would have to pay couple more billions to the Nepalese government come 2029 to maintain ownership of Ncell, so surely that had to be a concern. And it seemed like it was, given how they allegedly tried to ‘influence’ the government so that they’d be exempt from the 25-year limit. They apparently even tried to transfer some of their shares to a ‘non-resident Nepali’ to circumvent the law, but no dice.

The question here is: why’d Axiata decide to buy Ncell in the first place if the license was such a big concern? Regardless, everything eventually came crashing down, as…

Axiata sold Ncell in 2023, losing RM6.3 billion in the process

Having tried all they could to get around the 25-year license thing, Axiata ended up selling Ncell at the tail end of 2023. For what reason you ask? Continuing operations under the ‘current conditions of unfair taxation and regulatory uncertainties’ was no longer sustainable for the company.

And it’s hard to call this sale Axiata’s attempt at recouping losses, cuz they only managed to sell Ncell for a mere US$50 million (roughly RM235 million), netting them a ball-busting loss of RM6.3 billion.

If you think that’s a kick in the nutsack, get this – they had to raise funds by issuing bonds (meaning they had to borrow money from investors) to purchase Ncell. Think about that.

Oh, and also there’s the small issue of Axiata selling Ncell to Spectrlite UK, whose owner is the husband of the owner of Sunivera, the company with an existing 20% stake in Ncell. TL;DR, now husband has 80% of Ncell’s shares, and his wife has the remaining 20%. This, plus the previous point about Ncell’s expiring license, makes the deal seem more suspicious than a man walking into a bank with a balaclava on.

But hey…

Could this have been an honest mistake by Axiata (and our government, by proxy)?

Like we said in the beginning, not every investment will result in a jackpot. Given how the allegations of tax evasion, kickbacks and backroom dealings are mere speculation, it’s entirely possible that the Ncell affair was an honest mistake by Axiata (and our government, by proxy).

After all, Axiata’s total revenue has been rising on a yearly basis… except for 2023, where they lost RM2 billion as a whole for the financial year. Axiata might’ve had to cut their losses in Nepal before things got worse, plus analysts said the sale of Ncell wasn’t that bad despite the low valuation as the loss was partially cushioned by the RM2.2 billion made from the deal throughout 2016 to 2023.

But what do y’all think? Was there anything shady going on with this deal, or is it just a catastrophic business blunder?

- 251Shares

- Facebook100

- Twitter13

- LinkedIn9

- Email14

- WhatsApp115