There are more than 5 KWSP e-pengeluaran categories

- 320Shares

- Facebook77

- Twitter33

- LinkedIn36

- Email78

- WhatsApp96

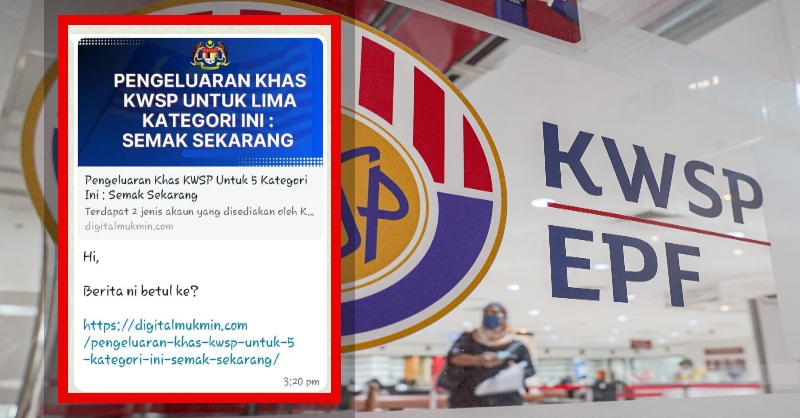

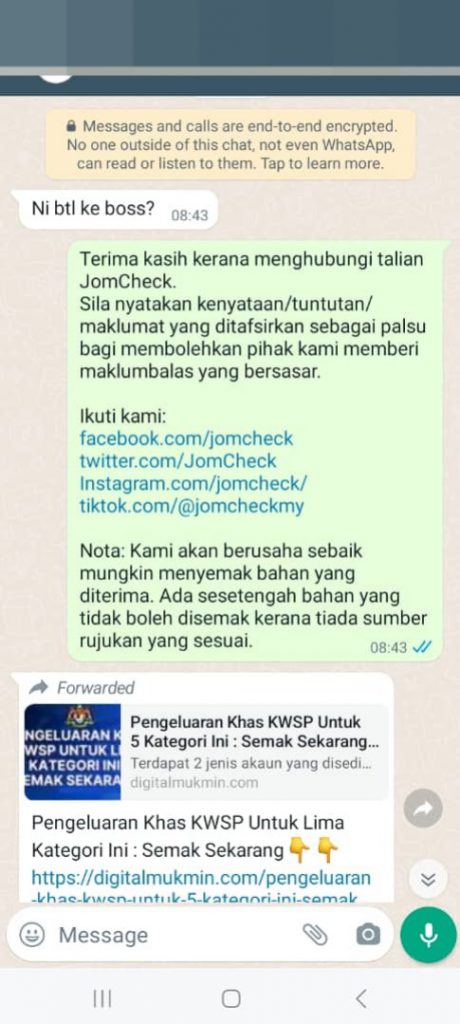

Lately, there’s been news circulating that EPF has provided 5 special withdrawals for contributors. We received a fact-check request from Jom Check regarding an article by Digital Mukmin.

At a glance at the title of the article, it seems like anyone could withdraw from their EPF account under 5 special categories. Further reading reveals that the withdrawals are aimed at contributors aged 55 and below.

In the article published by them, it was stated that EPF contributors can withdraw their money under five special categories:

1. Hajj trips

2. Housing loans

3. Medical bill payments

4. Build your house

5. Upon reaching 50 years old

Upon checking the official KWSP website, we found that the details are indeed true.

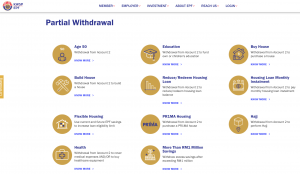

KWSP e-Pengeluaran 2023

As an EPF contributions are divided into accounts 1 and 2.

Account 1 retains 70% of your monthly contribution, while Account 2 holds the remaining 30%. Withdrawals are restricted in Account 1 until you turn 50 years old.

To help lessen financial burdens for those 55 years old and below, EPF offers partial withdrawals from account 2.

There are actually 11 types of withdrawals that a contributor aged 55 and below can make.

Regardless, of the news you read online, it’s always good to check the EPF website to get a better understanding of the terms and conditions and latest updates.

Cilisos.my is part of JomCheck, a fact-checking network of Malaysian media, academia, and civil society.

- 320Shares

- Facebook77

- Twitter33

- LinkedIn36

- Email78

- WhatsApp96