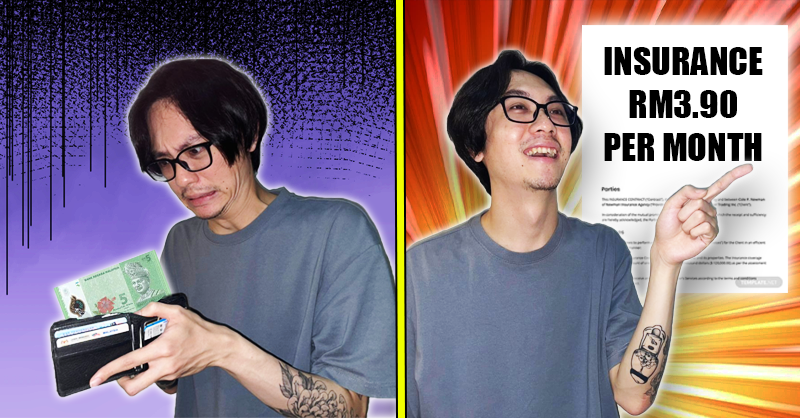

Looking for affordable insurance? This plan costs ONLY RM3.90 per month!

- 300Shares

- Facebook242

- Twitter1

- LinkedIn1

- Email7

- WhatsApp49

Once you hit a certain age in your life, you’ll probably start thinking about getting an insurance plan as a safety net in case something unfortunate happens. If you clicked into this because you’re looking for affordable insurance, you know this is true.

How to go to work liddis.

But you’ll also know that when it comes to insurance, it can be a headache to find a plan that suits you out of the millions of options out there. Gibraltar BSN, one of Malaysia’s most trusted and most established insurance companies, may be the solution you’re looking for because they’ve got flexible, personalized plans that you can get for less than RM10 a month!

What’s more; you’ll stand a chance to win an Apple Watch Series 7 or RM50 worth of GrabFood vouchers if you sign up for any of the plans through their i2u platform below before 31 May.

Can flex insurance AND Apple Watch to your friends.

Wait, before y’all start Googling for Apple Watch straps to buy, we gotta talk about what you’ll be signing up for first, and people who are looking for life insurance will be glad to hear…

Life insurance coverage from RM3.90 per month? Got wor

There’s three things you can’t avoid in life: taxes, the Marvel cinematic universe and death. Gibraltar BSN can’t help you evade taxes, stop an endless stream of superhero films, or resurrect you when you die… but i-FlexCover, their new subscription-based life insurance plan, CAN save your wallet.

This month can naik coverage.

What’s special about i-FlexCover is that you can get it for as low as RM3.90 a month, and the plan lets you increase or decrease your coverage amount any time to fit your budget. If your budget is a lil’ tighter on any given month, you can pay less for a lower coverage amount, and vice versa. More flexible than Mister Fantastic.

In terms of coverage, the plan provides a range of benefits:

- Death Benefit – your loved ones will receive a lump sum in the event of your demise

- Total & Permanent Disability Benefit – you’ll receive a lump sum if you get injured to the point where you can’t work anymore

- Accidental Death Benefit – your loved ones will receive a lump sum if you pass away in an accident

As long as you’re between the ages of 16 and 55, you can apply for the i-FlexCover plan. The plan’s sum assured coverage amount ranges between RM5K and RM150K, and for more info about the plan, check out this link! Also, if ya’ll want a different life insurance plan that provides coverage amounts of up to RM500K, Gibraltar BSN’s got i-Care, and the details for that are right here.

Okay, now that you’ve got your life insurance sorted, it’s probably a good idea to get medical insurance to go along with it.

Medical card with no lifetime limit? Also got

With private hospital bills skyrocketing every year, you’ll want a medical card to soften the financial blow. And while having a regular medical card is cool, you don’t want one with a lifetime limit. A lifetime limit might sound like a good thing, but it’s really not, and here’s why.

“Can I use this RM1million to pay for my medical bills?”

For example, if you have breast cancer (touch wood), this can cost about RM400k to treat and typically comes with many years of treatment. Without a lifetime limit, you don’t have to worry about running out of coverage and can continue to claim the benefits even if the treatment spans across many years.

Fortunately, the i-Med medical card doesn’t have a lifetime limit, and premiums start from an affordable RM41.85 per month. i-Med covers most essential medical stuff, including surgical and outpatient benefits. Even better, the plan allows for cash-free admissions so you don’t have to worry about leaving your wallet at home when you’re being driven to the hospital. Here’s where you can get more details on the plan.

When you have kidney failure but don’t have insurance:

For critical illnesses pulak, i-Protect and iProtect Plus kan ada. Depending on which plan you sign up for, they cover:

- Cancer

- Stroke

- Heart attack

- Heart bypass surgery

- Kidney failure

Again, touch wood, if you’re diagnosed with any of those conditions one day, you’ll be able to claim a lump sum of up to RM500K to help you with your medical expenses. Y’all know the drill by now, click this link to see what i-Protect and iProtect Plus have to offer.

And while you’re on their website, you’ll be pleasantly surprised to find out that…

Wah lau! You can get a quote instantly on their website

In this day and age, everyone’s probably got a smartphone, so Gibraltar BSN has prepared a 24/7 chatbot (that understands BM and English, by the way) to answer any common questions you may have- and you can also live chat with actual, living people to clear any doubts as well. Tak payah drive all the way to one of their branches just to ask a single question.

To cap it all off, that’s not the only convenience factor Gibraltar BSN offers; their i2u platform actually leads to all the insurance plans we’ve mentioned above. After you input your details, a quote will be generated IMMEDIATELY. Even our girlfriends don’t respond to our texts that fast.

- 300Shares

- Facebook242

- Twitter1

- LinkedIn1

- Email7

- WhatsApp49