Malaysia spent RM2 billion to pikat foreign investors. We check whether it paid off

While Budget 2022 was focused on rakyat-helping initiatives such as the announcement of the various tax incentives and other forms of financial assistance, you may have missed the mention of a RM2 billion fund set up to attract strategic Foreign Direct Investment (FDI).

If you’re not familiar with FDI, it’s a broad term to describe long-term investments by a foreign multinational corporation (MNC) in a country. The word ‘long term’ is pretty important here because it only counts as an FDI when the foreign company actually takes an active role in their investment – such as by directly managing it or opening a new factory. This would be in contrast to more passive investments like buying shares and waiting for a payoff.

FDI is super important to many countries not only because it provides yummy tax income for the government, but also other advantages such as:

- Creating a transfer of technology to improve domestic businesses

- Creating new jobs

- Training locals with new/enhanced skill sets

- Opening up export opportunities into new markets

This basically means that countries would also compete with each other for FDI, usually offering skilled workers, tax incentives, or other benefits as a way for MNC-senpai to notice them. So, let’s start off with how Malaysia’s faring in 2022:

Malaysia’s FDI in 2022 is actually pretty good

Screencapped from DOSM’s International Investment Position, 2nd Quarter 2022.

According to the Department of Statistics Malaysia, we attracted RM47.4 billion in FDI during the first 6 months of 2022. This means that, in 6 months, we’ve almost beat the RM48.1 billion achieved in the whole of 2021. Either way, you’d be comforted to know that we’re doing pretty well in this post-recovery period considering our FDI in 2020 was RM13.3 billion.

Looking at the sources of these investments, you might think that the main country investing in us is China, the US, or maybe even the UK (because, ha-ha, colonialism) but the actual answer is…. Singapore.

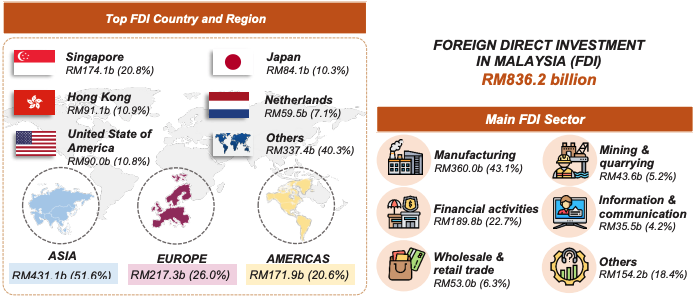

As of the second quarter of 2022, our FDI assets are sitting at a total of RM836.2 billion, with Singapore making up 20.8% or RM174.1 billion of that amount. This is followed by Hong Kong (10.9%) and the United States (10.8%). Our 3 main FDI industries are:

- Manufacturing – RM360 billion (43.1%)

- Financial Activities – RM189.8 billion (22.7%)

- Wholesale and Retail Trade – RM53 billion (6.8%)

But what about the reverse though… like, which country has Malaysian companies been throwing their money at the most?

Malaysian companies invested the most money in Singapore

If we’re looking from a country’s perspective, the opposite of FDI is DIA (Direct Investment Abroad), which essentially refers to Malaysian MNCs investing into foreign countries and contributing to their FDI. The Ministry of Finance published a paper assessing the relationship between FDI and DIA which you can read here, but for purposes of this article, the main advantages of DIA are that it can:

- provide access to natural resources not available back home,

- open up overseas markets for other Malaysian products; and

- establish reputations in the global market – kinda like how we think all German cars are amazing because of Mercedes-Benz and BMW

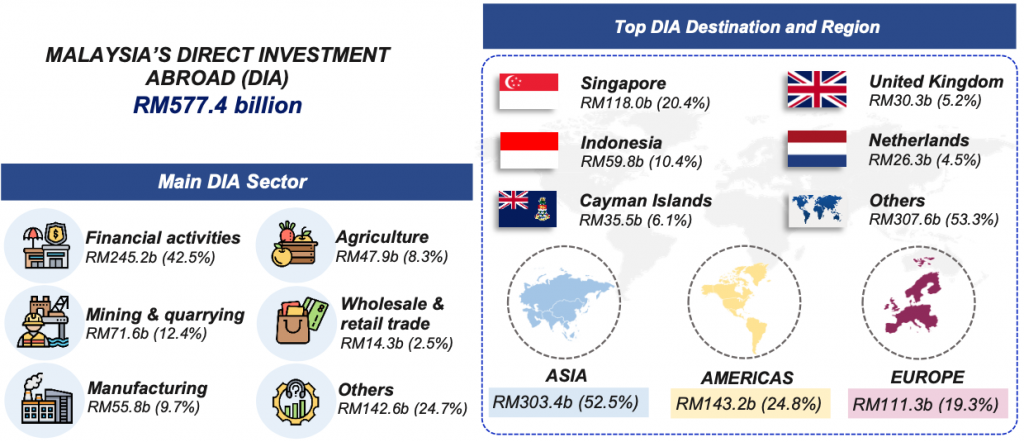

The merlion’s share of our DIA was invested into Singapore, at RM118 billion (20.4%). Considering they’re also the largest source of Malaysia’s FDI, you might say we’re the BFFs of FDIs (BFFDI?). While Indonesia comes in second with RM59.8 billion (10.4%), you might be a little surprised to learn that the third-highest investment was to the Cayman Islands at RM35.5 billion (6.1%).

The MOF hasn’t responded to our question asking for more information about the nature of investment in the Cayman Islands, but it’s very likely that Malaysian MNCs have incorporated their companies there for the the same reason as other international companies like Tesco or even Manchester United – the Cayman Islands is a “tax haven” with very relaxed taxation and company laws.

The global economy outlook for next year (2023) is pretty bleak

The second half of 2023 is lower than this writer’s self-esteem

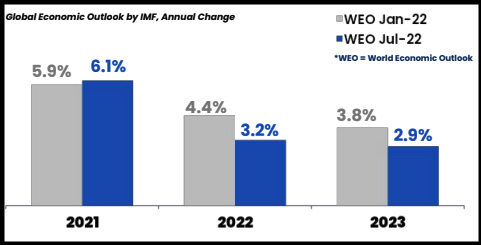

While our FDI and DIA numbers are encouraging, we aren’t out of the economic woods yet. The International Monetary Fund has forecasted a decline in global growth and an increase in inflation over the second half of 2022, mainly due to the Ukraine invasion and the lockdowns + real estate crisis in China. You can see the change of tone yourself in their World Economic Outlook updates:

“A tentative recovery in 2021 has been followed by increasingly gloomy developments in 2022 as risks began to materialize.” – Quoted from World Economic Outlook, July 2022 update.

And if you want even more reasons to get nightmares of being chased down by an empty wallet, here’s a 40-page policy note titled “Is a Global Recession Imminent?“. The takeaway? Chances of avoiding a global recession in 2023 will be very narrow, and finances will be tight.

Budget 2023 will likely contain strategies to keep us afloat

Even though we’ve kinda made light of it before, the RM25 million allocated under Budget 2022 for Trade and Investment Missions seem to be paying off, with news of a RM9.3 billion investment from Japan in September 2022. But beyond that, hundreds of millions of Ringgit has been spent to train and support the workforce and/or Malaysian companies in high priority fields such as aerospace, drone technology, oil and gas, and mechatronics to attract MNCs.

It’s not to say local companies have been forgotten either, with various grants and assistance given to SMEs and other local industries. But more importantly, Budget 2023 also has to consider a much wider field to make Malaysia more attractive to investors, such as social and political stability through policies related to welfare, subsidies, and tax – which benefit us a little more directly.

The sneak preview for Budget 2023 addresses that the government is aware that 2023 will be a rough ride, and that measures will be taken to jaga not just businesses but different socioeconomic groups within the rakyat as well. So with Budget 2023 set to be tabled on October 7th, we can only hold our breaths (and our wallets) to see what’s in store.