Here’s why your gaji tak cukup even though you earn more than minimum wage

- 21Shares

- Facebook11

- Twitter1

- LinkedIn1

- Email3

- WhatsApp5

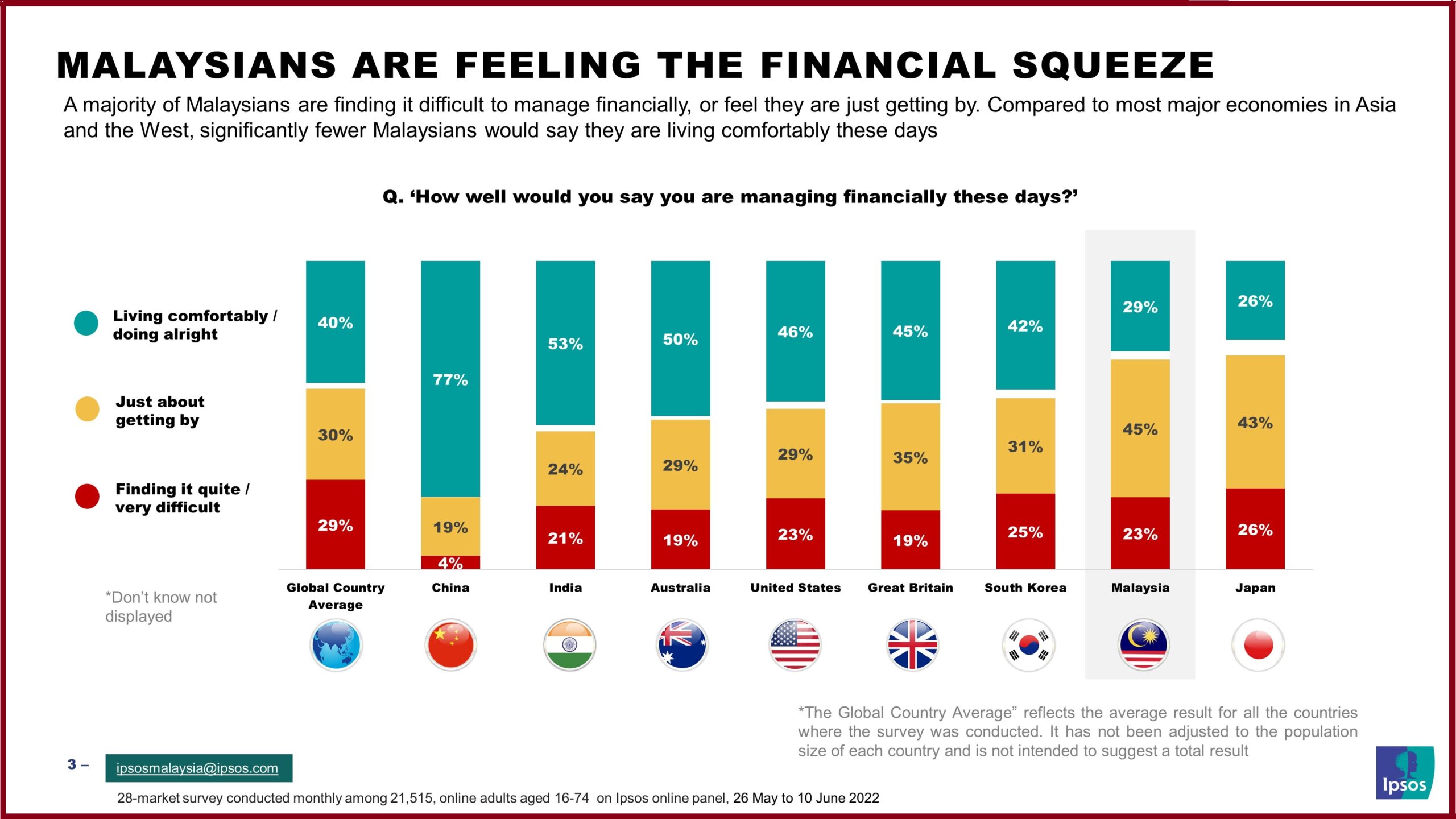

Ever felt like no matter how much you work, your gaji is barely enough to cover the bills? Yeaaaaaaaah, you’re not alone. In fact, most Malaysians are in the same boat.

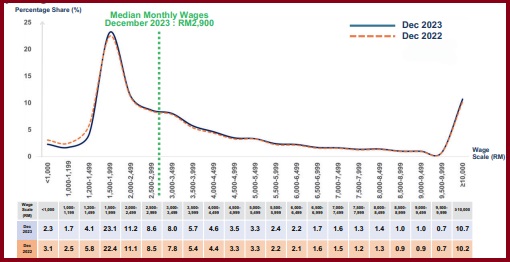

According to the Department of Statistics Malaysia, the median monthly wage of Malaysians working in the formal sector is RM2,900. Let’s break that down. This means half of the people working in jobs like banking, teaching, medicine, engineering, and even writing for Cilisos, are earning less than RM2,900 a month. And while the other half might be doing a tad better, that’s not the real issue here.

Yes, feast your eyes on the graph. That’s the real issue. It’s not just the fact that half of Malaysians are earning under RM2,900, it’s that most of them are earning RM1,500. If that number sounds way too familiar to you, it’s because it’s our minimum wage.

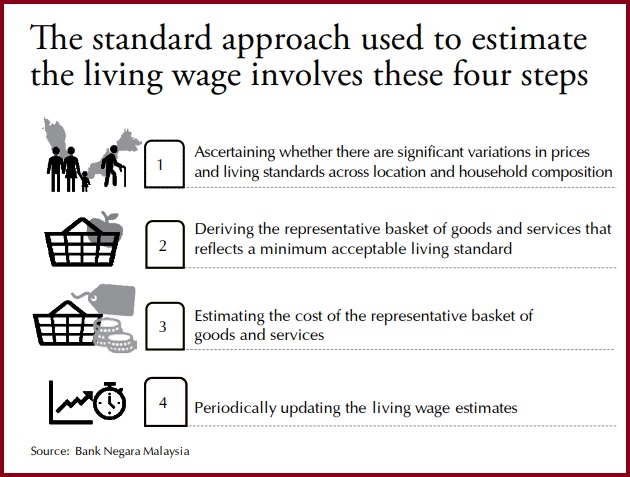

Now, we’re not ranting just for the sake of it. This has nothing to do with a person’s education, work ethic, or ability to climb the corporate ladder. Even Bank Negara thinks our wages are too low, which is why they introduced this liberalist, futuristic concept called the living wage. As the name implies, it’s the wage a regular Mamat needs to live a decent life.

The only problem is that the gap between the minimum wage and the living wage is HUGE. And that’s sus. Why is our minimum wage kept so low? Are we being shortchanged? Should we be worried? This are all questions we’ll get to in a bit, but first, for those who aren’t very familiar with the topic…

What’s the difference between living wage and minimum wage?

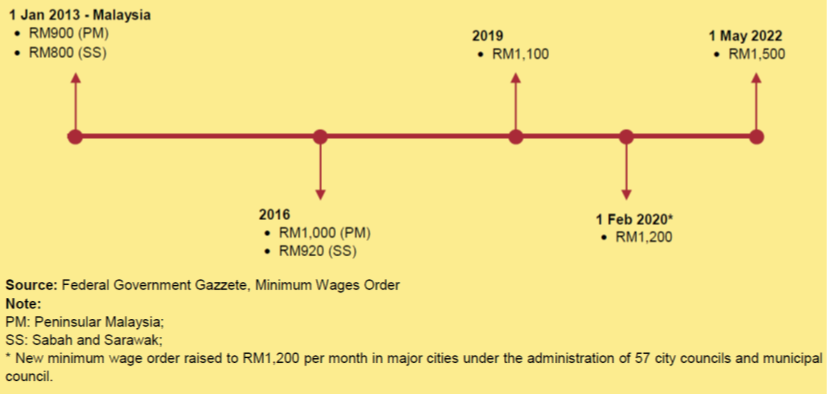

Alright, so the minimum wage is basically the lowest amount your boss can legally pay you, which is set at RM1,500 in Malaysia. Just so you know, this isn’t a number that’s randomly plucked out of thin air and doodled onto your paycheck. It’s actually derived from a mathematical formula which we’ve discussed in a previous article.

On the other hand, Bank Negara’s living wage is more of a recommended target. For a single person, it’s pegged at RM2,700, and for a couple with two kids, it’s around RM6,500. This is the amount you actually need to live comfortably, covering basics like rent, food, healthcare, and maybe a bit of lepak with friends. According to Bank Negara, it should be enough for you to not freak out over your bank balance when you’re craving some late night maggi goreng.

“[The living wage] includes the ability to participate in society, opportunities for personal and family growth, and freedom from severe financial stress,” — excerpt from BNM, The Living Wage: Beyond Making Ends Meet

It’s crucial you get the difference because it highlights the mismatch between what you actually need to live comfortably and what you’re actually getting. Minimum wage might look like a decent starting point, but it often falls short.

So now the question, why the big gap between living and minimum wage?

To put it bluntly, everyone’s out here just protecting their own interests. What do we mean by that? Well, businesses don’t want to pay their workers more because it cuts into their profits. You’ll hear SMEs saying they can’t afford the extra costs, but for the big companies, it’s really about squeezing out as much profit as they can. From a political standpoint, there’s this worry that if the minimum wage is raised too much, it could drive up inflation.

The whole thing is simply a case of cause and effect that involves these two parties. When wages rise, so do production costs, and naturally, the prices of goods will follow suit. The only problem is that businesses love passing down the costs. Meaning to say, if wages increase, guess who ends up footing the bill? Yep, us– the consumers– who face a pricier everything.

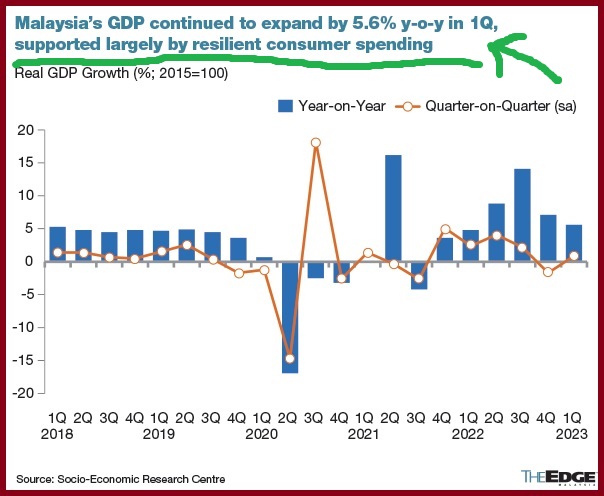

But here’s the thing, prices will go up anyway. In fact, inflation (at least, a moderate amount) is a sign of a healthy economy. Those of you born in the 90s can probably remember skipping to your school canteen for a bowl of bihun sup that costs less than RM1. Seeing that price now would be impossible. All this to say, we’re a growing country with a growing population. And a rise in output and demand will always lead to inflation.

So then it’s a question of how we manage the rise in prices, and to that we put forth: raise the minimum wage. After all, it’s not exactly a novel idea.

“A cost of living raise for employees is… [a] pay increase given to counteract inflation and help employees maintain their earning power,” — excerpt from Paychex

How is our low minimum wage affecting the economy?

To understand the bigger picture, we first need to address a common misconception.

Foreign workers often get a bad rep in this country for ‘stealing’ our jobs. But let’s be clear, the real issue lies with those in power who allow this to happen. When businesses opt for cheap foreign labour, what they’re really doing is avoiding paying higher wages to locals. In fact, in most cases, they’re even underpaying their foreign workers. Not only is that illegal, but it also harms the overall economy. Why? Because when people can’t spend, there’s less money circulating in the economy.

Let’s break it down further. When people earn low wages, they have less disposable income. Imagine trying to survive on RM1,500 a month. After rent, groceries, and bills, what’s left? Nada. This limited spending power means that people can’t afford to buy more than the basics, and that impacts businesses across the board. From the kedai runcits to your taman’s pasar malam, everyone will feel the pinch.

Let’s say everyone’s paycheck got a little extra oomph ✨ What happens then? Well, you’d get to afford more things like that handmade rattan basket you’ve been eyeing or a fancy dinner out. This increased spending would stimulate businesses, which could then afford to hire more workers and pay better wages. For example, if a Mak Cik selling nasi lemak could earn more, she might spend extra on fresh ingredients, new equipment, or even add a few more stools to her stall. Her suppliers would see a boost in sales, and if she hires more help, she’d be supporting her community as well!

So, the moral of the story is simple: low wages create a ripple effect that stifles economic growth. Conversely, when people earn more, they spend more, and that spending helps the economy grow and prosper.

So where do we go from here?

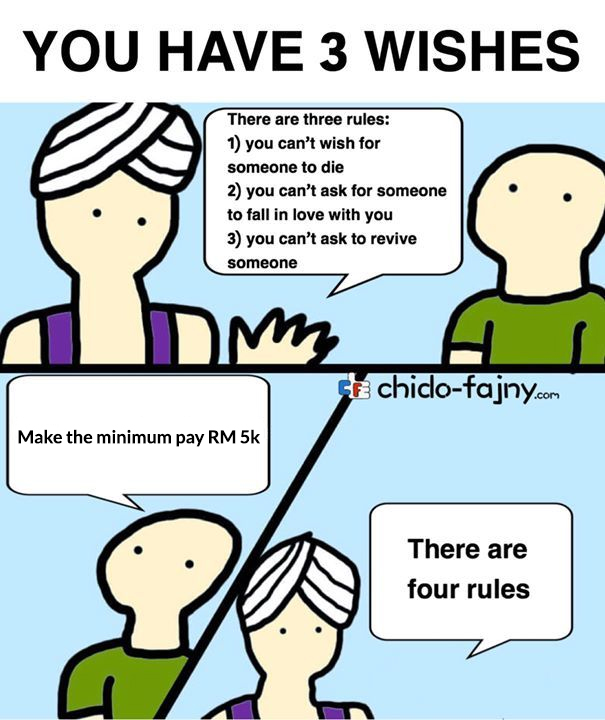

To say we need better wages is an understatement. The good news is that the idea of raising the minimum wage is currently being considered. According to Human Resources Minister Steven Sim, the government will review the numbers this year, even though many are already against it.

“It is speculated that the government will raise the minimum wage by as much as 33% to RM2,000 from RM1,500 currently in response to the rising cost of living in Malaysia,” –excerpt from The Star

And while that’s definitely something to celebrate, beyond just raising the minimum wage, we kinda have to reconsider how we’re going about this whole thing. On top of our minimum wage being low, we also rely a lot on subsidies to offset living costs, plus cash handouts to feed the poor. Interestingly enough, a Unicef report found that the poor prefer higher (and fair) wages over relying on government aid.

So while the government is already stepping up their game, it wouldn’t hurt to step it up a bit more. We’re no economic experts, but just to throw a few ideas out there, maybe they could offer tax breaks to businesses that pay higher wages or strengthen labour laws to protect workers. Businesses should see this as investing in their employees and, ultimately, in their own success. Sure, there will be challenges, like fears of increased costs, but the long-term benefits i.e. happier, healthier workers and a boost in the economy, are worth it.

- 21Shares

- Facebook11

- Twitter1

- LinkedIn1

- Email3

- WhatsApp5