This 3-year-old Malaysian toddler has to pay income taxes?! Is that even legal?

- 2.3KShares

- Facebook2.1K

- Twitter8

- LinkedIn20

- Email48

- WhatsApp75

If you are one of those people who follows the local entertainment news, you might have heard about Lara Alana, who is the daughter of both actor Awal Ashaari and actress Scha Alyahya. Lara, who is three years old this year, had a sort of a reality TV show on Astro Ria where she… does stuff.

As to why there are 16 episodes of these, Awal Ashaari had stated that

“Before this, a lot of people can’t get enough of Lara on Instagram. So, with this show, the fans may feel a bit closer to Lara. There will also be a few exclusive video clips that were never shown before. Interestingly, in this program we also share tips on raising children,” –Awal Ashaari, translated from Tehsirap.com.

And it seems that people really can’t get enough of Lara, as she did some 2.7 million followers on Instagram, with enthusiastic fans eagerly waiting for every update, which is not creepy at all. Regardless of the public’s opinion of her, Lara is a success story, as at the tender age of three she is qualified to pay income taxes.

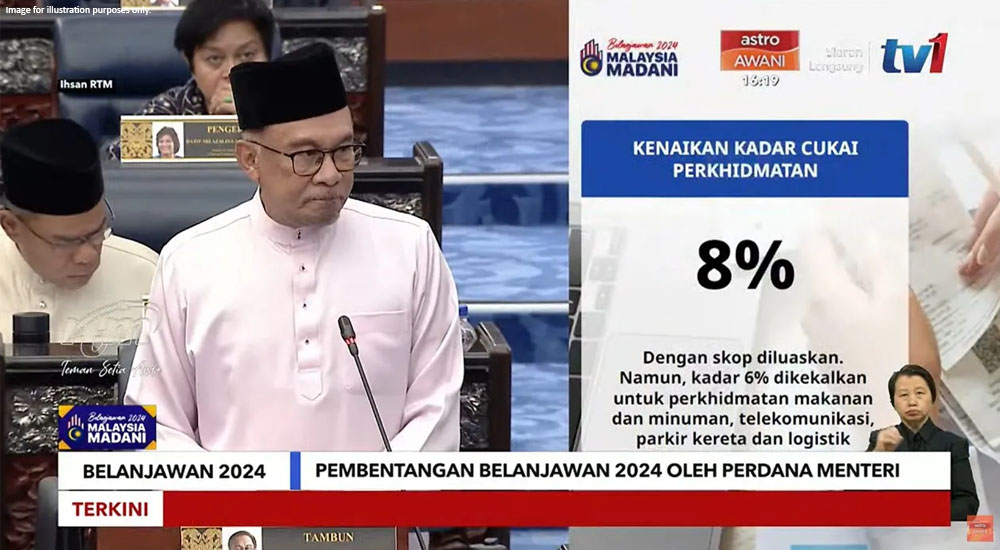

That’s right! According to her mother, Scha Alyahya,

“Lara already has her own income tax file with the Inland Revenue Board and will start paying this year,” – Scha, for The Star.

While the three-year-old’s taxes will be handled by an agent hired by her parents, it doesn’t seem quite usual to hear of a toddler who can barely talk having to cough up a part of their income to the gomen. Or that she had an income that warrants a tax, either. Can you really ask a three-year-old girl to pay taxes?

Actually, there’s no reason why she shouldn’t pay taxes

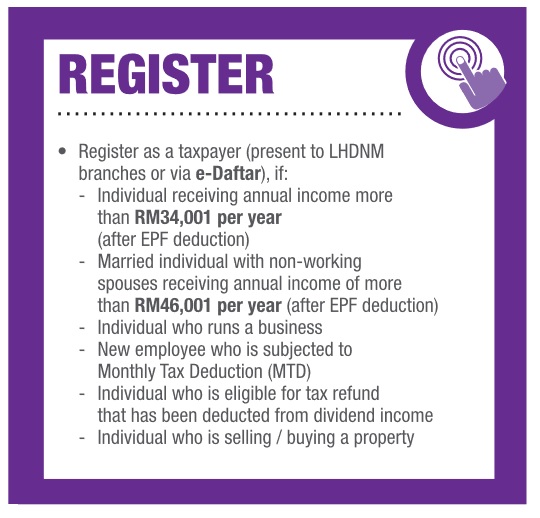

As we have covered in a previous article, if your monthly pay is somewhere below RM2,833 or you earn less than RM34,001 last year, you don’t need to pay your income taxes. 3-year-old Lara, on the other hand, have to pay taxes. This means that she earns more than that amount. Although having to pay taxes sounds like something an adult should care about, the thing is nowhere was it stated in the Income Tax Act that an individual have to be within a certain age to pay income taxes.

Consequently, this also applies to people past the retirement age. As long as your pensions amount to more than RM34,001 per year (or RM46,001, if you’re married), for example, you still have to pay taxes on that. Basically, based on Section 4 of the 1967 Income Tax Act, you have to pay taxes if you receive any of the following:

- Profits from a business.

- Profits from a job.

- Dividents, interest or discounts.

- Rents, royalties or premiums.

- Pensions, annuities or any other periodical payments not mentioned previously.

- Any kind of profit from anything else this Act forgets to mention.

Which pretty much includes any money that may roll your way, however you may get it. That is, as long as you get more than the currently set amount, which is again RM34,001 for individuals. While 3-year-old Lara may be the youngest celebrity taxpayer yet, she isn’t the only one. Another example would be Mia Sara, the 11-year-old actress from an Astro Ria comedy drama “Strawberi Karipap” who are also paying taxes from her acting profits as well as her own shawl business, MS Couture.

But… what happens if they don’t pay their taxes?

If you have read our previous article on taxes, you would know by now that according to the Income Tax Act, Section 114, if you purposely avoid paying taxes or give false records or information regarding taxes, you can get up to 3 years jail and up to RM20,000 fine.

What if it’s a 3-year-old who avoids paying taxes? The fine may be doable, but we can’t put a 3-year old in jail… can we? To answer that, we spoke to Zen Chow, Executive Director of K K Chow Tax Services Sdn Bhd. According to Chow, the important factor in this case is who is the one really earning the income. While some of you might roll your eyes at that question, the answer is a bit more complicated.

The badges of trade, or the circumstances under which a trade can take place, will have to be examined. Chow had stated that one of the circumstances is that the taxpayer must have the intention to make profit from his or her activities. Therefore, the question is more towards who wants to make money from the whole endeavor, rather than who gets the money.

“In this case, there could be an argument to say that the income rightfully belongs to the daughter, hence the daughter should be taxed as an individual. But as she is still a minor and cannot make decisions on her own, it will be the guardian’s (the administrator) responsibility to file and pay the income tax.” – Chow, in an interview with Cilisos.

So if a minor who is earning enough to pay income tax doesn’t file their taxes, they won’t really kena la. Provided that they aren’t old enough to make decisions on their own, it will be the parents or guardians who will kena. Phew. Being a celebrity sure is tough, isn’t it? However…

About 50% of Malaysian celebrities did not file their taxes

According to a sampling analysis done by the Inland Revenue Board, IRB (or Lembaga Hasil Dalam Negeri, LHDN), an estimated 50% of all celebrities in Malaysia, which includes actors, radio deejays, models, and directors, did not submit their Borang Bs, or tax return forms.

As to why there’s such a large number of tax-evading celebrities, Datuk Freddie Fernandez, the president of the Malaysian Artistes’ Association (Karyawan) had suggested that they are afraid of consulting the LHDN for fear that more taxes could be imposed on them. According to him, celebrities are also terrible at record-keeping. They do not think keeping receipts and payment vouchers are important at all.

However, he also entertains the possibility that some of them thinks that they can get away from the taxman just because they are stars. This seems to be what the general populace thinks, as last year Nora Danish incurred the wrath of netizens when she suggested that the LHDN give tax exemptions for celebrities because staying beautiful is, like, really expensive.

“For me as Malaysians, it is our responsibility [to pay taxes]. But what I hope is for a little exemption for celebrities like us. It is just that, in the current times we are paying a lot for our appearances. So, this is part of our career and perhaps it can be counted as our occupational cost.” –Nora Danish, for The Malay Mail Online.

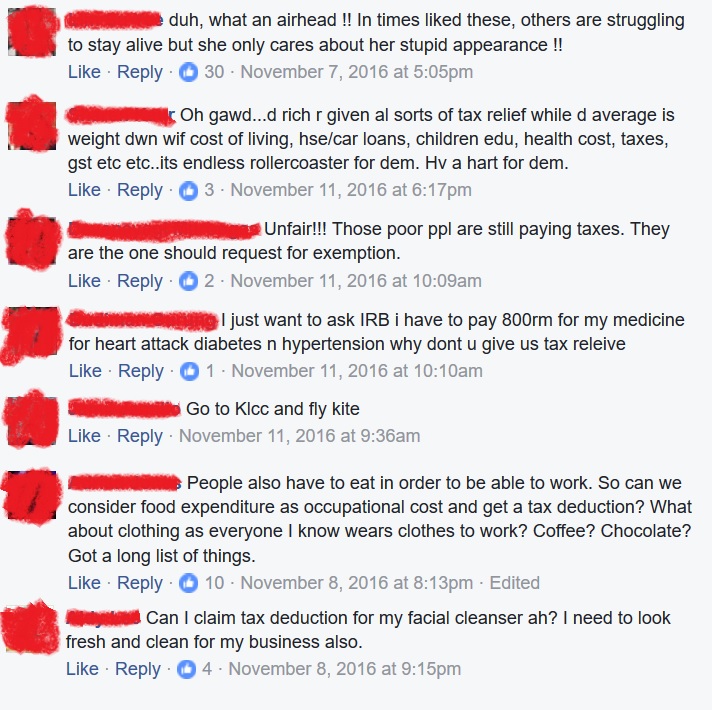

Income tax for celebrities are a little different, as they receive tax exemptions for stuff like makeup, management, advertising and beauty stuff. While Nora had later clarified that she only asked for an increase in these exemptions and not immunity from tax altogether, the statement did struck a nerve with the common people, who asked for tax exemptions for their careers as well, and these:

While Nora’s lifestyle may seem lavish on her Instagram, according to Persatuan Seniman Malaysia’s (Seniman) president, Zed Zaidi, only like 10% of all celebrities are living in the fast lane. The other 90% are barely scraping enough to get by. As there are no stable incomes for actors and actresses, things can get quite confusing.

“Artists are only talented in acting and singing, but we have no talent in calculating payment. In this art, when we got an offer, we get like RM15,000 for three months. In those three months, we have to deduct the costs of our costumes, makeup, petrol and others. So the worst we can get in those 3 months is just RM3,000 to RM4,000. After that, there’s no offers for the next three months. How to calculate that?” – Zed Zaidi, for Suara.tv.

So living in TVland isn’t really all limousines and red carpets for most. Turns out they’re as unemployed as us mortals after all. However, if you star in a long drama series…

You should probably not post that on Instagram.

- 2.3KShares

- Facebook2.1K

- Twitter8

- LinkedIn20

- Email48

- WhatsApp75