This China government rule is stopping PRCs from starting a settlement in Johor

- 2.5KShares

- Facebook2.3K

- Twitter17

- LinkedIn29

- Email36

- WhatsApp108

OMG did you guys know we came this close to having a new Chinese settlement in Johor!? By that we mean PRCs…not Malaysians of Chinese ethnicity who’ve been born here for generations.

Have you heard of Forest City? It’s basically a whole new CITY (read: property development) in Johor Bahru, built on four man-made islands that can menampung 700,000 people………700(bleeping),000. If you have Enochlophobia (fear of crowds) you might want to grab a paper bag now.

The scale of the project is madness! The 1,400ha city, which is about three times the size of Singapore’s Sentosa Island, won’t just have houses, but office towers, parks, hotels, shopping malls and an international school as well, all draped with greenery. Construction began in February 2016 and it is expected to be completed over the next 20 years. In fact, developers are betting that this spot in our southern state is gonna be the next Shenzhen.

But why did they choose Malaysia?

You probably know the hooplaboopla about PRC mega corporations investing massively in Johor right? The *brace yourselves* RM443 bil (US$100 bil) Forest City is one of ’em. Currently, it is the biggest of 60 projects in the Iskandar Malaysia zone, and by far the most ambitious one undertaken by its Chinese developer, Country Garden Holdings Ltd (CG).

“These Chinese players build by the thousands at one go, and they scare the hell out of everybody.” – Siva Shanker, Head of Investments at Axis-REIT Managers Bhd., Bloomberg

*P/S: Axis-REIT is a real estate investment trust.

Judging from the artist impression, Forest City seriously looks like it’s gonna be the Michelangelo of houses!

BUT why did the Chinese choose Malaysia?

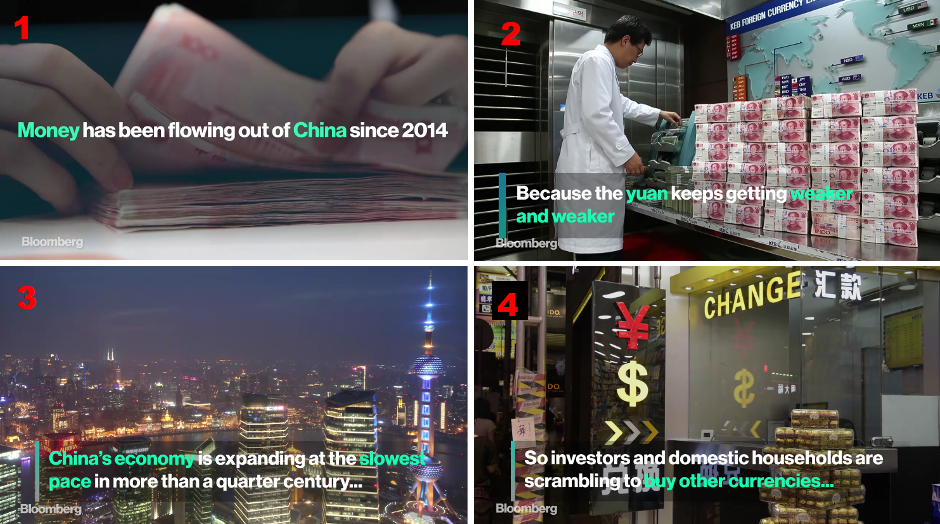

Let’s put it this way… we’re not the only hot slice of pizza in town k. In other words, PRCs are also buying houses in countries all around the world. As a matter of fact, the cash-rich Chinese are freaking famous for their passion for foreign property as they are for buying Louis Vuitton handbags. Last year alone, they spent a record $33 bil (RM146 bil) on property overseas.

FYI, the US is their top destination at the moment, followed by Hong Kong, Malaysia, Australia and the UK. Wokey… so, Malaysia is no.3. Not sure if we should feel flattered, but one thing’s for sure, that’s A LOT of monehh coming into the country.

This shopaholic tendency can be traced back to the early 2000s, when China joined the World Trade Organisation, signalling its entry into the real world…er, we mean into the global economy.

During the economic spur, demand for housing in major cities throughout the country rose tremendously, prompting developers to build colossal high-rise residences to meet to the demand. Now that their economy appears to be slowing down, these developers, are seeking greener pastures in other countries to continue building.

Unfortunately, now it seems their dreams to settle in Malaysia are dashed

Two weeks ago, a WeChat group was created by Leo Wang from Hunan, one of the buyers of Forest City property. Since then 40 other PRCs have joined the group, with one thing in common – they had all made down payments for Forest City apartments.

“We thought it was a good and affordable deal to invest in overseas property, without thinking of the possible risks, and even signing the agreements in English even though we don’t know the language.” – Leo Wang, buyer, quoted on Malay Mail

One member Laura Zhang was super thrilled to own property in Malaysia. She, her friends and relatives, total 20 people, purposely flew to Johor to see the project. The price of a property she liked was a quarter of that in downtown Beijing – we found out that a studio apartment will cost RM500,000, while the villa will cost RM3.5 mil (not the kind of prices an average Malaysian can afford). They were even told they had a chance to apply for the Malaysia My Second Home programme, that would allow them to live here on long-stay visas up to 10 years.

“I was very interested in buying an apartment abroad for my child’s education or possible emigration in the future. Besides, the Forest City project is very famous among Chinese as you can see its advertisement everywhere in China.” – Laura Zhang, buyer, South China Morning Post

To date, around 8,000 apartments have been sold, the company reported, 70% of which are PRC buyers. Laura herself had paid RM63,500 with her bank card as a 10% down payment on a 59 square metre apartment. And then their world turned upside down…

Which brings us to the second thing in common all 40 members of the WeChat group have in common – they all want to QUIT Forest City and they are demanding for REFUNDS! Oh no, what happened? The house got rat infestation ke?

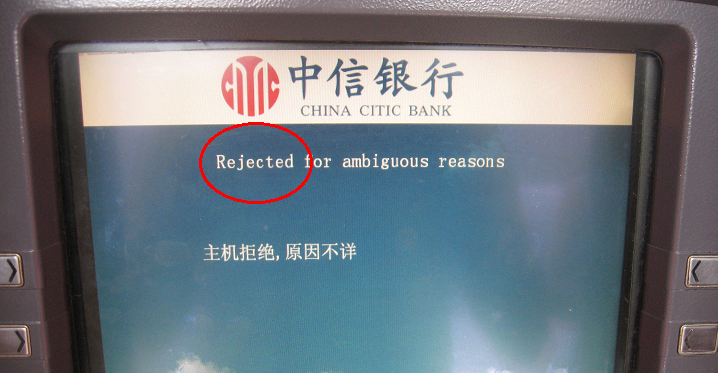

NO banks would lend them the money to pay for the Johor properties!

Laura had managed to pay up to 20% of the amount she owed for the property, then suddenly this year, she found out that no Chinese bank was willing to give her (as well as the other PRC buyers) any more loans.

There is nothing wrong with Forest City or Johor properties. Neither are Malaysia and China fighting. It’s just that Chinese banks have had to tighten their loan policies in regards to buying FOREIGN property. It is actually the Chinese government’s decision because the country is facing a problem – too much cash outflow. Throughout 2016, they’ve been implementing various invasive measures, such as forcing people to provide details on why they were spending money outside the country.

“Now we understand all further instalments need to be paid abroad. But this is not allowed due to the foreign exchange controls from the Chinese government. If we do so, we will be put on the government’s blacklist.” – Vicky Wu from Guangzhou, Forest City buyer, South China Morning Post

Peng Peng, a Senior Economic Researcher with the Guangzhou Academy of Social Science, said that buyers were investing overseas partly as a way to protect themselves against the depreciating yuan.

“But actually it’s full of risks for these Chinese small investors since most of them know little about laws and markets overseas… They blindly believe overseas property markets will soar in the same way as the mainland market.” – Peng Peng, as quoted on Malay Mail

So now you’ve got an army of PRC home buyers suddenly short on cash. This not only affects Malaysia, but other countries too, from London, to Silicon Valley, to Sydney. It is threatening to cause property bubbles all over the globe!

Oh shoot! Is Forest City going to become a ghost town?

So how now brown cow? If the buyers can’t get the money to pay for their property, is Forest City going to become an abandoned project? Just as tensions are flying high, suddenly there was scary development…

The developer Country Garden SHUT all its sales offices in China, it was reported on 10 March. When Straits Times attempted to call them, the phones lines for its Beijing and Shanghai offices had been terminated. Everyone at first thought they KO already… 🙁

Doesn’t that leave the kesian buyers like Laura, Leo and Vicky in the lurch. What can they do to salvage their Malaysian investment?

Hoo Ke Ping, economist and author of several books on international economics suggested that the developer’s best hope would probably be to seek the help of the Chinese ambassador to Malaysia, Huang Huikang. Ask him to appeal to China to relax regulations for Forest City buyers by allowing those who have already repaid half of their loans, to continue servicing them, however he admitted it’s unlikely the Chinese gomen might layan.

Later on 13 March, half the salesrooms reopened with Country Garden saying they had overhauled their marketing strategy and that they are now targeting buyers from Australia, the Middle East and Europe. They added that they have galleries in Jakarta and Singapore, and plan to open more in India, Cambodia, Laos and Dubai soon.

“When we went to their property talk in Johor, more than half the room were Singaporeans.” – Magdelin Tan, General Manager of PropSocial (our sister company 😀 )

Whew. With over 70% of Forest City’s initial buyers potentially backing out, or not being able to service their payments on one of the biggest property developments Malaysia has ever seen, it’s nice to have friendly neighbours. *wink wink.

Er……we’re friends right, guys?

- 2.5KShares

- Facebook2.3K

- Twitter17

- LinkedIn29

- Email36

- WhatsApp108