Aunties arrested for helping criminals in Malaysia! But what did they actually do?

- 733Shares

- Facebook624

- Twitter7

- LinkedIn9

- Email30

- WhatsApp63

Just a few days ago, 44 people got arrested this week for being money mules and helping scammers get away with illegal activities. Money muling is when your bank accounts are used as the middle man for transferring money obtained from criminal activities to other bank accounts, similar to money laundering.

Out of the 44 people arrested, 27 are women. Some are Malaysian housewives who knowingly colluded with the scammers, while some of them were tricked into becoming a money mule. Wah… so much news lately with aunties involved! You can read our other auntie-related story here.

Money mules are one of the latest cybercrime issues in Malaysia – Bukit Aman’s Commercial Crime Investigation Department (CCID) director, Comm Datuk Seri Amar Singh said there were 1,072 cases last year. And the number keeps increasing, with more and people getting involved with helping scammers hide their illegal activities. In fact, PDRM said money mules account for 42.6% of cybercrime cases this year alone. All of the 44 people arrested had at least 5 police reports lodged against them for fraudulent online transfers.

“It is a very worrying trend. These scammers are using these bank accounts to channel money obtained from duping victims. It has to stop” – Commercial Crime Investigation Department (CCID) director, Comm Datuk Seri Amar Singh, via the Star

But the problem isn’t simply in Malaysia. It’s happening everywhere, including countries like the UK. Even teens are getting involved in being money mules.

Money mules transfer illegally obtained money to other bank accounts

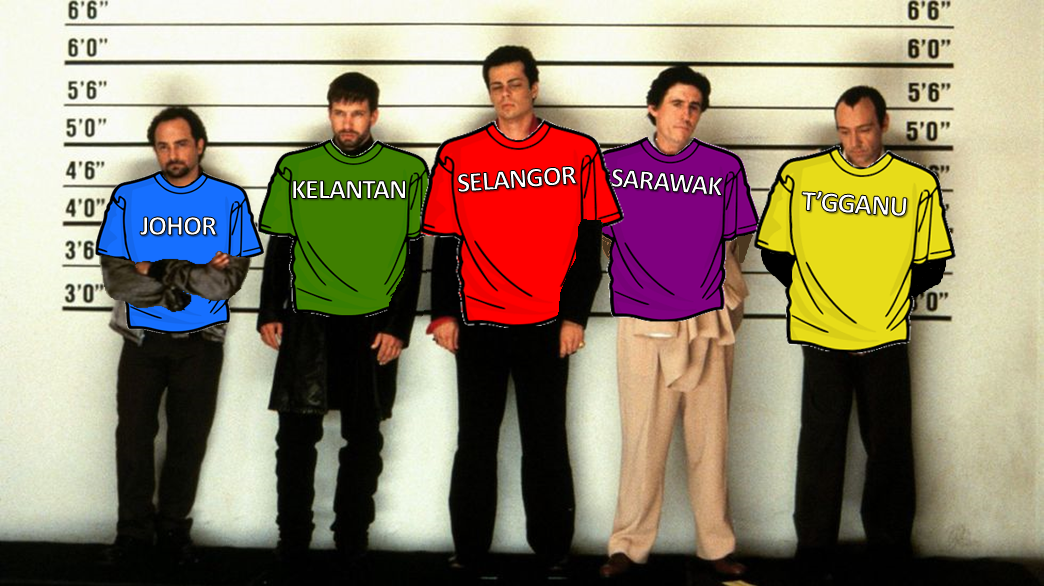

Before we get into how these scammers pull these off, we answer the question: What on Earth are money mules? Are there any actual donkeys involved?

Your bank accounts are the imaginary ‘donkey’ used to transport money from one place to another, usually obtained from various illegal activities. If you’re wondering why they want to use a middle-man for these online transfers, it’s simply a distraction. If you use 6 different bank accounts to transfer RM50k, it’s less obvious than if you transferred the whole amount at once. Think of it like crowd-sourced money laundering, used to hide the not so legal origins of the money. By using several bank accounts, they seem like everyday transactions and not illegally obtained money.

According to Comm Amar Singh, the 44 bank accounts seized by PDRM were used to channel money syndicates obtained from scams. These syndicates are involved with various scams like the Macau Scam, African scam and e-financial frauds.

Buuut scammers is just the tip of the iceberg. You could be helping terrorists or drug traffickers hide their money trail if you act as a money mule. The money you’re helping to transfer could be the product of drug trafficking or could help terrorist groups stay alive.

They recruit money mules by offering them easy, high earning jobs

Ok, we know what you’re thinking… But bear with us as we run through the thankfully short list of how these scammers recruit others to do their dirty work.

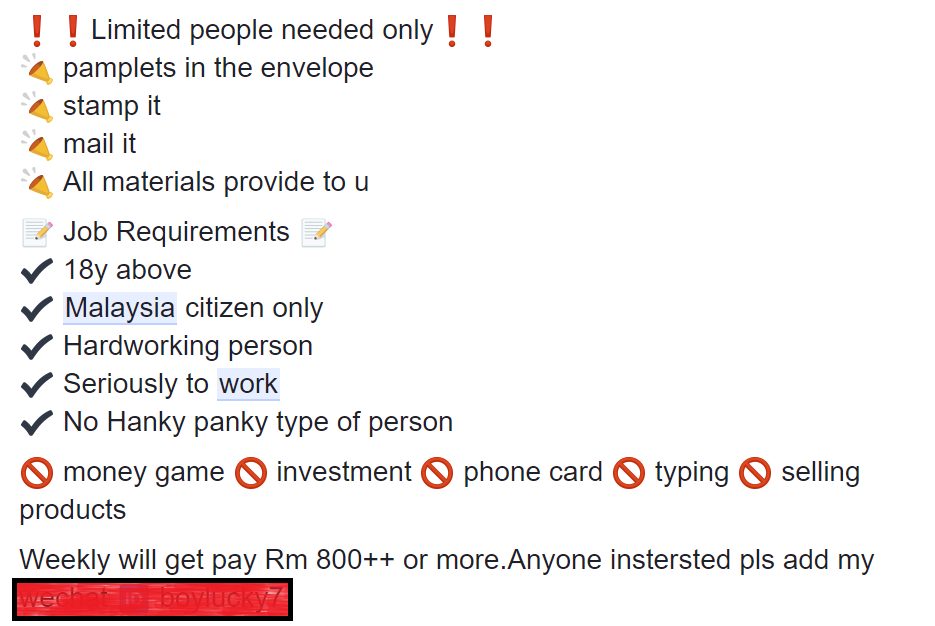

The most common ways to recruit money mules are through work from home ads posted online, shady job offers to work for a foreign company and online love scams. Most of you gais are probably familiar with the countless ads posted online for easy, ‘high paying’ work-from-home jobs so that one is pretty obvious. We’ll spare you the aunty lecture.

Some that ended up becoming money mules thought that they were being hired for legitimate jobs. They were offered a lucrative salary with a foreign company. The company that is supposedly hiring you is deliberately vague about your job scope, even coming up with lots of contracts and other serious-looking documents to convince you they’re a real company. Then they reveal that your job is to transfer funds to other overseas bank accounts and earn a ‘commission’ for your work.

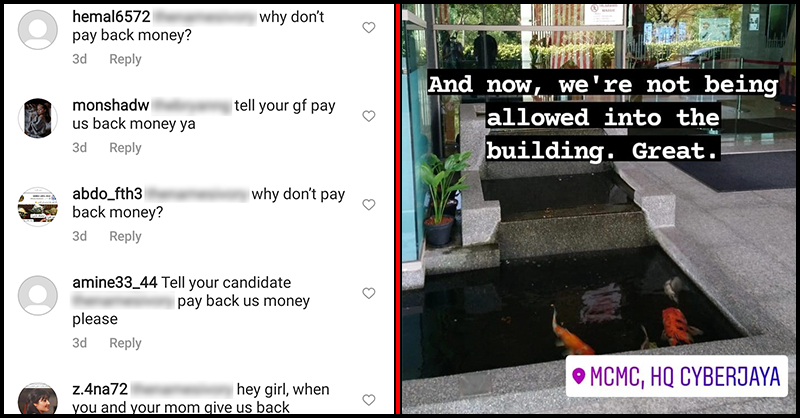

African love scams on the other hand, prey on lonely women by sweet talking them into falling for their charms. Then they’ll eventually claim they need your help to send some funds abroad and you’ll get to keep a chunk of the money. Sweet! Um… not so much. This is where the aunties come in, as many are seduced by these scammers to willingly become a money mule, according to CCID’s director Datuk Amar. These aunties think they’re helping their lovers conduct their business transactions but the reality is a bit less glamorous than what their ‘lovers’ have claimed.

“Don’t be fooled by anyone who promises certain monetary gains in exchange for the use of their bank accounts” Comm Amar Singh, Bukit Aman CCID director, via the Star

Scammers may contact you through emails, ads posted online or even phone calls to offer you ‘great rewards’ if you let them use your bank accounts. So be wary of anyone giving you loads of free money. Many Malaysians often believe those ‘too good to be true’ messages online because they fall for the attractive returns promised by the scammers.

Your bank account can be frozen by Bank Negara

What happens if you kena arrested by PDRM for being a money mule? Your bank account will be frozen by Bank Negara and any legitimate money you have in that account can be confiscated as part of their investigations. And those guilty of money muling could be barred from leaving the country or blacklisted from opening any accounts with other banks.

Don’t hold your breath for any accounts to get unfrozen, because (surprise!) Bank Negara doesn’t have any authority to defreeze any accounts related to illegal schemes.

Money mules can be charged under Section 420 of the Penal Code, which is punishable by up to 10 years in jail, whipping and fine.

If you’re already struggling to make your salary last till the end of the month, chances are it’ll be 10 times harder for you to survive without a bank account. How are you going to pay bills?? You gotta pay for rent, petrol, food, expenses, groceries and etc. that all require money.

All in all, being a money mule is soo not worth it la, gais!

Here’s how to avoid helping criminals launder money

The easiest way to avoid kena tipu into being a money mule: if something sounds too good to be true, it probably is. Where got job pay you RM50k per month one??? Unless you’re a specialist surgeon or a CEO of a big corporate company, that is. Even Najib doesn’t make RM50k a month.

Most importantly, trust your instincts! Because sometimes when you feel like “eh can trust one or not?” Chances are, you’re probably right to be suspicious. You can:

- Do a lot of research into a company before you agree to a job

- Never, ever give anyone your bank details!

- Advise your aunties not to get involved with anyone willing to pay her for access to her bank account

It’s better to be cautious than spend 10 years in jail, right? Or you can click here to use the CCID’s new website (pictured above) if you want to report other accounts as money mules.

- 733Shares

- Facebook624

- Twitter7

- LinkedIn9

- Email30

- WhatsApp63