Wanita sekalian, do you know who gets your stuff when you’re gone?

- 37Shares

- Facebook30

- Twitter2

- WhatsApp5

So you’ve spent your life working hard, saving every ringgit and maybe even picking up a few “investment” handbags along the way (no judgment, we see you queen 💅🏼). But here’s the thing no one really talks about – what happens to all your stuff when you’re gone? Your house, your car, your savings, and of course, those bags we’re 100% sure are investments.

If you don’t have a will (or wasiat, for our Muslim sis sekalian), guess what? The law’s going to step in and make the call. And trust us, it’s probably not going to be how you want things to go down.

Yes, it’s time to talk finance and regrettably, that one topic no one brings up at brunch… 🗣️ estate planning.

Wait, a will? But I’m not a millionaire what…

Okay, real talk. A lot of women think they don’t need a will/wasiat because they either feel they don’t have that much money OR they think their family will sort it all out OR they believe they’re too young to be thinking about wills.

Got terasa anot? 🤧 Well, here’s your reality check.

We won’t go full seminar mode on how the patriarchy lowkey made us think estate planning is only for rich old men, but honestly speaking, if you’ve got stuff and people you care about, then a will isn’t optional. Why? Well, let’s break it down from the basics.

- Women live longer than men. Statistically speaking, Malaysian women outlive men by about 5 years (thank you, longevity). So that means you’ll probably be handling your own finances solo one day and you don’t want to leave things messy when that happens.

- Without a will, the law steps in. You think you can leave all your cash to your bff in rural Perlis? Pff. The law doesn’t care about your personal wishes. If you don’t make it clear, your assets will be split however the law sees fit through something called the Distribution Act 1958 (for non-Muslims) or Faraid (for Muslims).

- Family drama is inevitable. No matter how chill your family is now, money has a funny way of bringing out those Cruella de Vil claws. A will can save you from any potential “Mak cakap dulu ni untuk aku!” fights.

- Your cat won’t get your stuff. Yes, people leave fortunes to their pets (looking at you, Karl Lagerfeld). But in Malaysia, unless you specifically say that in your will, your fur baby won’t get a thing 🙁

And if those reasons haven’t convinced you enough, maybe a professional opinion would. According to Nor Fazlina Mohd Ghouse, CEO of Maybank Trustees, the biggest mistake women make is assuming their families will just “figure it out” after they’re gone.

“I always tell women – if you don’t decide where your money goes, someone else will. And trust me, that ‘someone else’ may be the person you least expect. A Will or Wasiat isn’t about how much you have, but about making sure what you do have ends up in the right hands, as per your wishes.”

Ok, I will make a will. But how do I make a will?

First of all, proud of you. That’s already a big mental hurdle cleared 🫶🏼. But making a will isn’t like scribbling a quick note on napkin and calling it a day. There are some procedures to follow but don’t panic! We gotchu.

- List your stuff. You have more than you think. Bank accounts, properties, EPF, insurance, your jewellery, and yes, even that hidden stash of cash you sorok in your underwear drawer.

- Decide who gets what. Who do you want to inherit your things? Your kids? Your sister? The nice auntie who always belanja you makan? Write it down, so the government doesn’t have to.

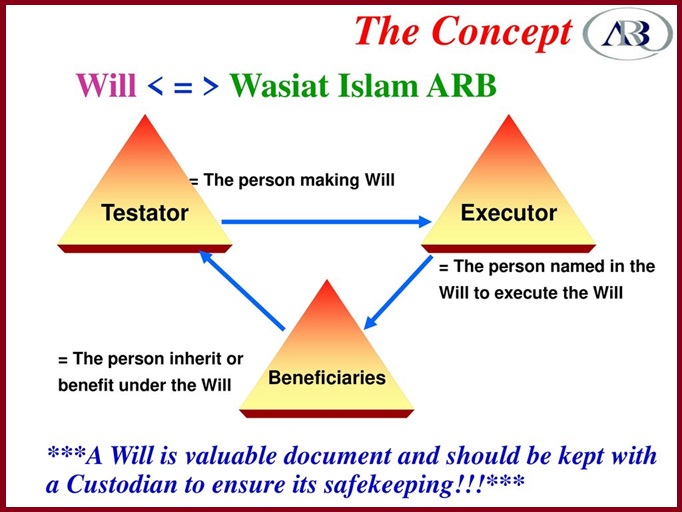

- Pick your executor. This person makes sure your will gets followed. Could be a trusted family member, or if you’re living a real life Kdrama and all your family members are out to get you, then opt for a corporate executor like Maybank Trustees.

- Get professional help. You can’t just cincai write a will and expect the best. There are laws to follow, signatures to get and sneaky loopholes to avoid. Get experts to ensure everything’s legally solid.

- Keep it updated. Think of a will as you would a resume. If something major happens, you gotta update it. Got married? Divorced? Won the lottery? Make those changes accordingly.

So what we’re getting at, at the end of the day is…

Sis, don’t let someone else decide your legacy

Real talk part 2: Having a will isn’t morbid. It’s empowering. It’s you saying “I know exactly who deserves my stuff.” And if you’ve spent years building your life, collecting memories, and earning all your assets, why would you let someone else decide what happens to all that?

So whether you’re 25 or 55, married or not, got two kids or two houseplants, it’s never too early to sort your wasiat or will. Future you (and everyone you love) will thank you for it.

Your legacy, your rules. So in line with the recent International Women’s Day, make sure it stays yours – get your estate planning sorted.

(Article by Cilisos, with insights from Nor Fazlina Mohd Ghouse (CEO of Maybank Trustees), an advocate for financial literacy and estate planning)

- 37Shares

- Facebook30

- Twitter2

- WhatsApp5