We found a promo that lets you earn cashback (and maybe RM50k) just by using your bank account

- 147Shares

- Facebook146

- Twitter1

If only you got a sen for every time you tap your debit card, you’d probably be swimming in cash by now.

Well… what if that actually happened?

Thanks to Alliance Bank’s Cash Me If You Can Rewards Campaign, your everyday tap-tap and QR scans could earn you juicy cashback, and maybe even make you one of the lucky winners of a RM150,000 prize pool.

The campaign runs from now until 30 November 2025, and to win, you don’t have to do anything extra. Just keep doing what you already do – spend money, save money, use your account – and you could walk away with up to RM208 in cashback, and maybe a slice of that RM150,000.

But before you sprint to your nearest Alliance Bank, here’s what we found out

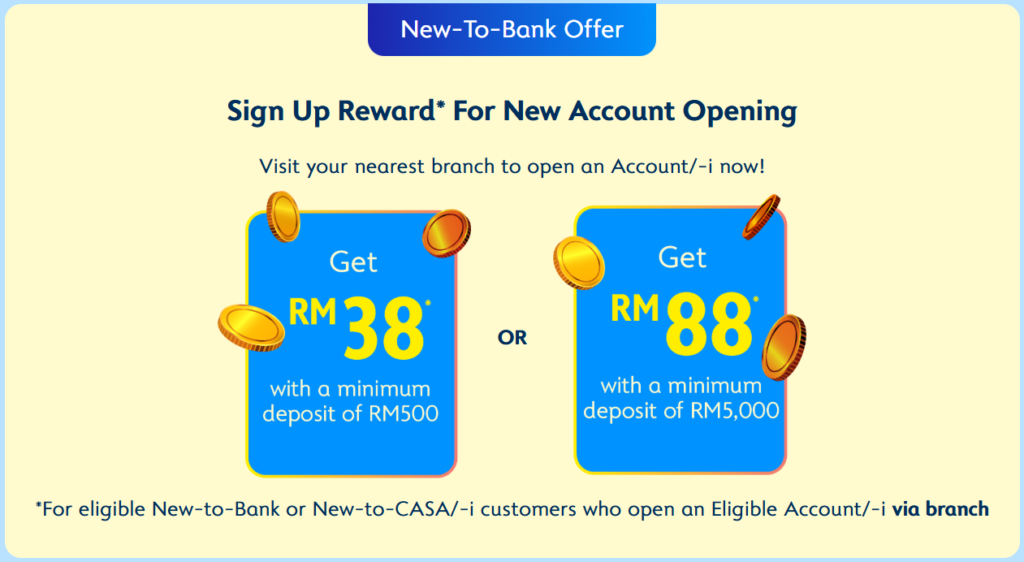

New customers get rewarded just for signing up

If you’re already an Alliance Bank Current/Savings Account/-i holder, skip this portion – your part’s coming.

But if you don’t have an Alliance Current Account or Savings Account (CASA/-i) yet, here’s your chance to cash in.

All you need to do is pop by an Alliance Bank branch (yup, this one’s strictly in-person), open your new account, and activate both your debit card and allianceonline mobile app.

Once that’s done, bam! The rewards kick in:

- Deposit RM500 and maintain it until the end of your account opening month = get RM38 cashback; OR

- Deposit RM5,000 instead = get RM88 cashback.

It’s as simple as that! However, note that this sign-up reward is a one-time offer per person, so no trying to “catch ’em all” by opening 12 accounts ya.

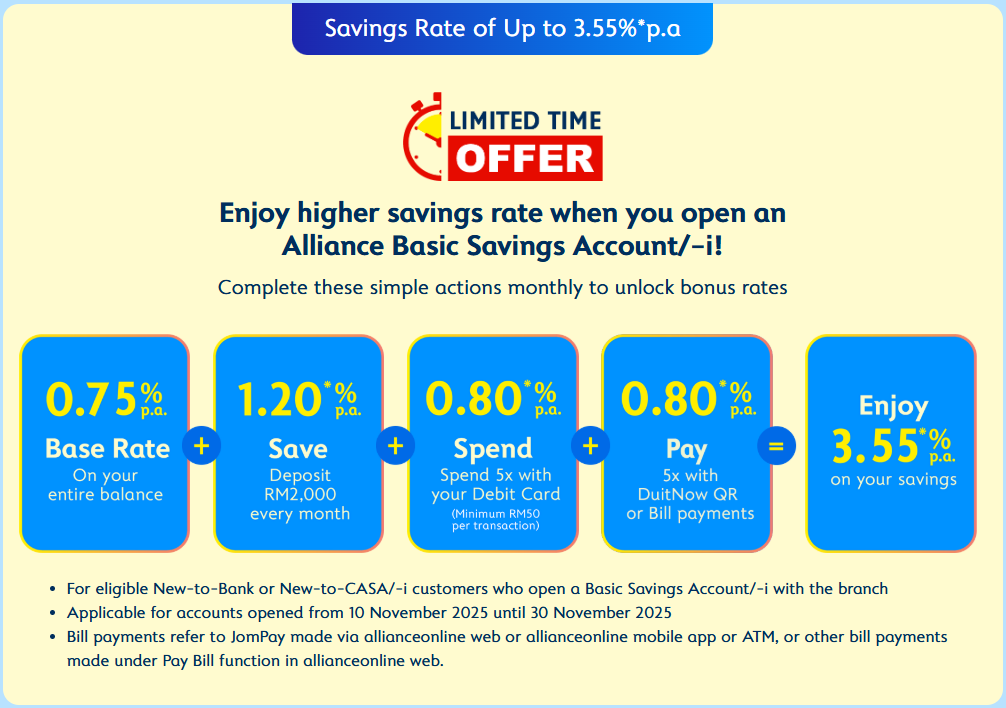

Oh, and here’s a little bonus: for a limited time, you can enjoy high interest/profit rates up to 3.55% p.a.* when you save, spend, and pay using a Basic Savings Account/-i that you open during this campaign period.

*Terms and Conditions apply

That means while you’re busy racking up cashback and contest entries, your savings are quietly working overtime in the background. And that’s not the only perk you get now that you have an Alliance Bank account, because you can…

Just spend like you normally do and get paid by Alliance Bank

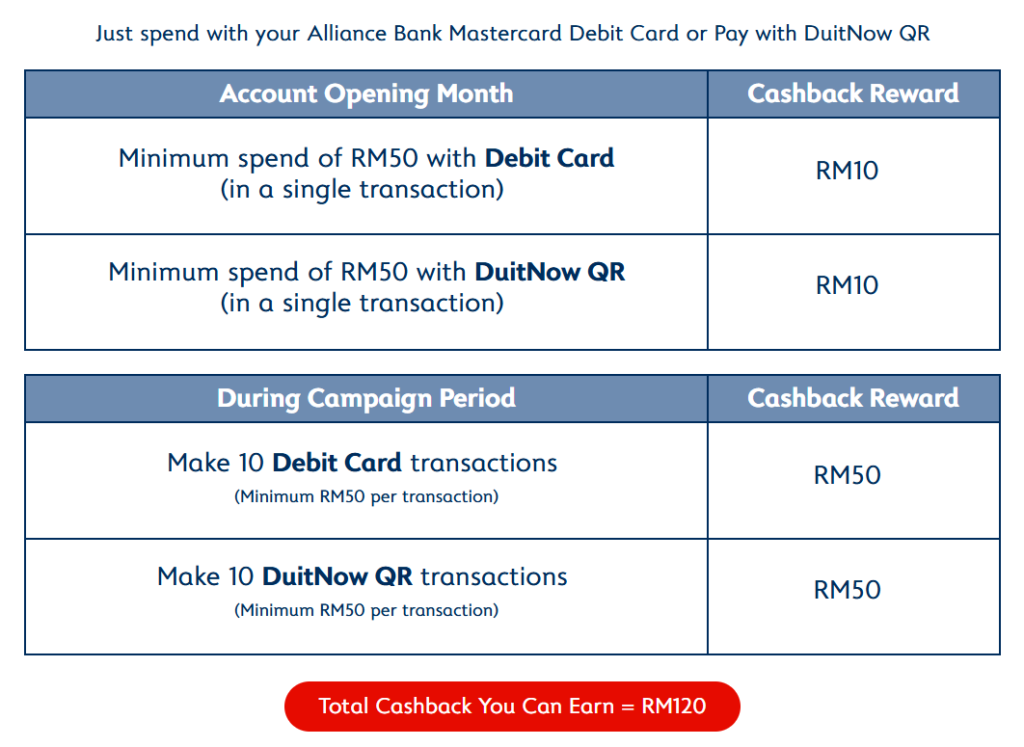

Here’s where things get more syiok for new Alliance Bank account holders. From now until 30 November 2025, Alliance Bank will reward you for just spending money.

Once you’ve made 10 debit card transactions (minimum RM50 per transaction), you’ll get RM50 cashback. Do the same with DuitNow QR, and that’s another RM50 straight into your account.

That’s a total of RM100 in cashback for just paying for your usual stuff! Groceries, bills, and maybe that matcha milk tea you told yourself you wouldn’t get.

And during your account opening month, Alliance Bank is extra generous. Just spend a minimum of RM50 on a single transaction with your debit card or DuitNow QR, and they’ll throw in RM10 cashback for each method. Easy money.

Now, before you start tapping like a maniac, here’s what we found in the fine print: not all transactions count. So things like government payments (taxes, fines, postal services), gambling, or charity donations are excluded. Basically, just stick to regular daily spending and you’re good.

Another thing, the cashback isn’t instant. Alliance Bank will credit the sign-up cashback within 12 weeks from your account opening month, and the spending cashback will go up to 12 weeks after the campaign ends. So yeah, don’t panic if the cashback doesn’t show up immediately.

And while cashbacks are nice, there are even bigger prizes up for grabs!

You can win up to RM50,000 CASH PRIZE!

Apart from cashback, Alliance Bank’s running a prize draw with actual cash prizes. We’re talking:

- 🥇 RM50,000 Grand Prize

- 🥈 RM30,000 Second Prize

- 🥉 RM20,000 Third Prize

- 50 x RM1,000 consolation prizes

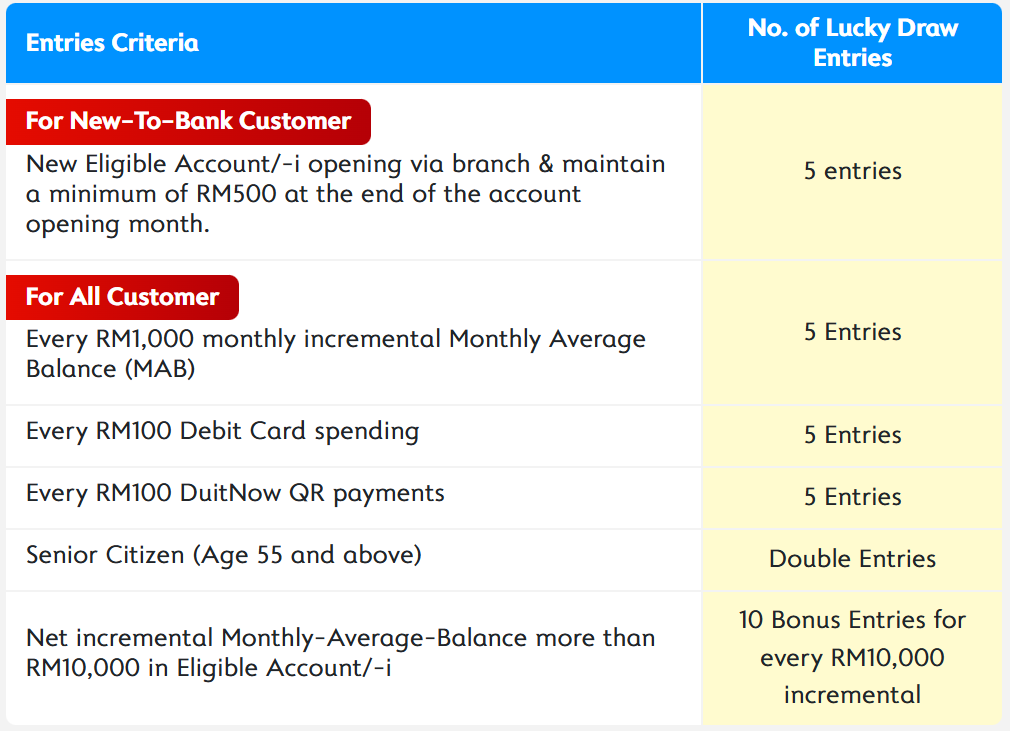

The best part is, the same things you’re already doing for cashback also earn you entries to the prize draw. For example, depositing RM500 into your newly opened CASA/-i account not only gives you RM38 cashback, it also gives you five entries to the main prize draw.

Besides that, here are some other things that get you entries into this content:

Basically, you earn entries through your spending and saving behaviour (and if you’re 55 or above, you get double entries).

Winners will be notified by 15 March 2026, so you have time to manifest, save, and spend. Who knows, maybe RM50,000 decides to “Cash Me If You Can” into your account.

Alliance Bank Malaysia Berhad & Alliance Islamic Bank Berhad are members of PIDM.

Protected by PIDM up to RM250,000 for each depositor.

- 147Shares

- Facebook146

- Twitter1