5 Malaysians who left amazing jobs to become… insurance agents

- 8.2KShares

- Facebook7.8K

- Twitter17

- LinkedIn28

- Email53

- WhatsApp256

[Ed’s note: This is part of our 4-part series on insurance as a career, in partnership with our sponsors at AIA. Click here for part 1, part 2. This article was originally published in September 2019.]

Imagine this: two insurance noobs from Cilisos – with very little idea about the industry, mind you – were suddenly thrown into an event filled with THOUSANDS of Malaysian insurance agents left, right and centre. O___O That was us in the recent AIA’s Elite Academy conference!

Now we’re not gonna lie… probably like yourself, we had the same assumptions on agents. Like why on earth are they always SO positive? What it’s like to always have ‘sales’ on their minds? And ultimately, WHY would they choose to do this?! (Cilisos ppl super useless, cannot sell anything one… not even nasi lemak to Malaysians living in Russia.)

So we managed to chat with just a few of these flers to ask them exactly that. One thing that legitimately surprised us was that many came from pretty solid backgrounds. We’re talking engineers to PhD holders! So… why did they leave that for insurance? Well, let’s start with…

1. A former engineer who initially became an agent to impress his GF 😳

Growing up in a family that’s been running an insurance agency for over 20 years, Ng Wei Lun had always wanted to do something outside of insurance. His dream was to work in a lab and he eventually became a processing engineer (which means he did test runs on products).

Despite enjoying his time as an engineer, Ng figured out that engineering was just not for him. And he may not be the only one considering how some engineers chose to leave their jobs for a career outside of their fields.

But he may have thought of leaving his previous job because he wanted to be financially stable so that he could provide for his girlfriend, who’s now his wife btw, and his own family.

“(When you marry a girl, they would) Want to move out (when you get together). This is why I have to think about the future.” – Ng told CILISOS.

To make matters worse, Ng had always felt tired at work as he was doing Over Time (OT) after OT. Meanwhile, his mother and sister have an exciting career and are always travelling around the world! Ng told us that the previous company he worked with allegedly used the Labour Law strictly for their own benefit. 🙁

“Working hours were longer than anyone else. Even compared to now. Last time lunch is only for 45 mins, out of 9 hours of work per day. In addition, OT need 3 hours (if less, it’s not counted). I have to make sure the test run works before I can go back home.” – Ng.

Tired of the endless and unsatisfying routine, Ng finally decided to quit his job and eventually followed his mother’s footstep to be an insurance agent. It’s actually a no brainer that he joins the insurance industry because it is something he has been exposed to since he was young. But on a serious note, he actually wanted to grow as a person and he finds that possible with AIA.

“I specifically join AIA because I feel I can learn and achieve more as a life planner and a person, considering how AIA is known to have the most life planners with MDRT.” – Ng.

Speaking of which…

2. One former govt servant aims to expand his business legacy

Working in the govt might sound interesting to some. Think about all the benefits you can get as a govt servant that you may not get when you work in the private sector: a good 8am to 5pm working hours (with many, maaany breaks) and lifelong pensions.

So it was actually surprising when we talked to Nurazam Azra’ai, a former civil servant, who had jumped into the insurance industry despite having a stable job with good position. Nurazam initially chose to be an assistant medical officer department in the Sultanah Aminah Hospital, JB because he wanted to help people.

And Nurazam, a medical graduate whose studies was sponsored by the govt, really thrived in his previous job. One of his biggest accomplishments was to build up his own unit in his previous workplace. So, what made him jump into the insurance industry?

“I saw a future in this career. Working in the govt may give us income but the economic structure right now is not relevant for the income that I get. In insurance, my children can inherit my business legacy too.” – Nurazam told CILISOS.

Chup, Nurazam is not saying that working in the govt sector got no future ok? But what Nurazam meant by this is that he is able to own a business empire when he opens up his own agency.

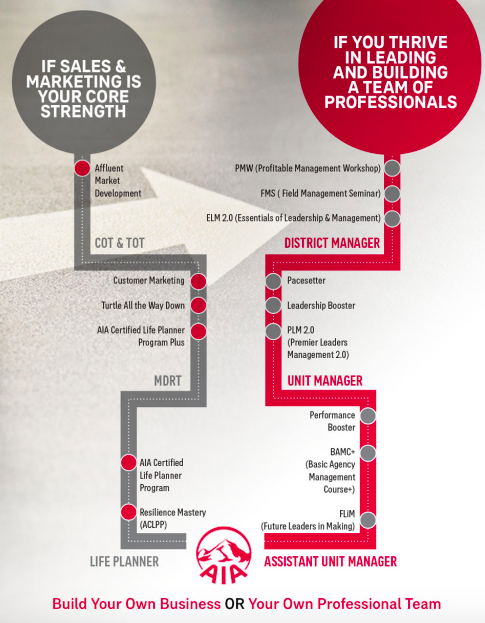

The thing about insurance is that agents don’t only meet people, sell product, service them and repeat. In this industry, especially with AIA’s Elite Academy, each agent has the opportunity to start up their own business by hiring people to form their own insurance agency. And this is how the business empire can be developed and inherited.

3. A former sales rep wanted a career with a good business model

Fong Sin How (Nicholas) had always wanted to start his own business ever since he was young boy. After completing his studies, he joined an engineering firm that produces elevators as a sales representative. And as a fresh grad, he wanted to learn and do more.

“Starting from fresh grad, my main point is to learn and explore more. Even with limited income. I was willing to do more than what I think (job scope).” – Nicholas told us.

Well, he ended up doing admin, after-sales and even… TECHNICIAN’s job!

And, of course he wasn’t being paid for doing something out of his job scope so he felt as though he wasn’t achieving anything or even growing as a person in that company. This can be pretty common for people who do work outside of their job scope. So, he decided to ciaodamao.

As he was finding a new job, his father had actually offered him with RM50,000 worth of capital to open up a noodle shop in Puchong. However, he turned that offer down because he believes that the competition in Puchong is quite intense (this is true, check out the number of noodle shops in Puchong here!). So, he went on with job hunting instead.

“I applied (job to) more than 20 companies before I leave the previous industry, half of them sent me interview invitations, I only attended 6 of them. After I attended the 6th interview, I already know that the following interviews would be the same. Just giving you the same question: expected salary, expectations, etc” – Nicholas.

The insurance industry had never crossed his mind until he met one of his best buddies’ uncle, who owns an insurance agency. Nicholas, who had always wanted to start a business, was inspired by his buddy’s uncle’s success in the industry that he decided to join AIA. He also added that he saw this career as “a business model rather than chasing money” besides being able to see himself grow as a person.

Ok ok, so here comes the plot twist:

“After I decided to join here (AIA), I didn’t get sales from ex-colleagues because they’re all doing part time in the industry.” – Nicholas told CILISOS.

Dun dun dunn!! In fact, his former colleagues sat for the insurance examination (yes, they have to sit for examinations ok) the same time he did!

But he admits that being an insurance agent is not easy. Heck, he had to work longer hours than his previous jobs! Nicholas added that being a part time insurance agent is tougher than a full timer, so some of them were eventually terminated. Nicholas may not be wrong because insurance agents have a certain criteria to achieve yearly, which is monitored by Bank Negara Malaysia btw. It’s called the Balanced Scorecard and we’ve talked more about it here.

Most of the time part time insurance agents have a hard time fulfilling these criteria so they might end up like Nicholas’ former colleagues, who are now his point of referral instead.

4. A former factory engineer wanted to spend more time with his family :’)

Unlike most people who are chasing money or starting their own businesses, Muhamad Razi became an insurance agent just to spend more time with his family. And this is something his previous job as an engineer at a factory that produces polymer pipes cannot provide him with.

“I’ve been living under a rock, I was only doing my own work. My time was mostly spent at work. Sometimes I even have to bring my children and wife to work.” – Razi told us.

But don’t get him wrong tho. He enjoyed working in the factory. Heck, it was his dream job to be a mechanical, electrical and electronic engineer and he was earning a stable income too.

It was only when he was diagnosed with a critical disease that affected his bile, due to the dusty environment in the factory, that he had thought of a career change. It was so horrible to the extent that he went into a COMA! And when he had to frequently visit the hospital after he recovered from coma, the doctor had asked him to find another job.

Coincidentally enough, he was a part time insurance agent after he recovered from coma. So, he instantly decided to be a full time insurance agent when the doctor told him to find a new job.

However, his former boss wasn’t able to accept his decision. So when he tendered his resignation letter, his boss had torn it, ensured the environment in the factory is cleaner and even threatened to take legal actions against him, just to make Razi stay. Wah, so drama wei!

Despite those threats, he went on with his decision to leave the factory to become an insurance agent. Razi told us that he didn’t regret his decision because, nowadays, he get to spend more time with his family.

Yes, we know there are plenty other careers with flexible working hours but Razi felt that becoming an insurance agent suits him the best.

“When I become an insurance agent, I’m not tied to other jobs. Clients meet us up during our free time unlike my previous job. Besides, this career gives me self-fulfillment when I’m able to watch my children growing up, send them to school.” – Razi.

And this may be important as, according to Sumitra Visvanathan, Women’s Aid Organisation executive director, “various studies have shown that children with involved fathers have better social, emotional and cognitive development, and perform better in school“.

5. A PhD holder and former engineer just wanted… recognition for their hard work

Lim Hui Keem (Keem), a PhD holder in Molecular and Cellular biology, was an application specialist in a medical device company. Basically, Keem dealt with medical devices like thermometers and even infusion pumps. She was responsible of training doctors and medical practitioners on how to use new devices besides rectifying problems with the devices if she could. Otherwise, she would have to liaise with technicians and engineers whenever the devices malfunction.

Her job was SUPER important to the medical industry… but her company didn’t really appreciate her. Unlike the sales department in her previous company, she didn’t receive the commission she deserved. So she ciao lor.

Similarly, Muhammad Rinal (Rinal), who was a chemical engineer, told us that he had gone the extra mile to secure a project with a client in his previous job. He told us that when the client had rejected the company’s idea, he made his own presentation and had requested the client to allow him to present.

However, when Rinal, who only took four years to be promoted from junior engineer to assistant project manager, managed to secure the project, the company didn’t even award him with a raise or promotion. In fact, the company didn’t acknowledge his effort to secure the project.

Keem, had joined the insurance industry because of her husband, who is also an insurance agent. She saw how well her husband is doing in this industry and sustainable the career is so after quitting her job as an application specialist, she instantly signed up to be a life planner with AIA.

Rinal, on the other hand, took his friend’s advise to find a job in sales because he was told that he could earn more. So he had listed out possible industries like sales, unit trust, property, direct selling and insurance, and attended talks (yea, those talks y’know) to find out which industries would suit him.

“There are two reasons why I chose to be an insurance agent with AIA: financial -how long and fast I can achieve passive income based on what I do – and client. If I can make my clients happy, then I can be happy.” – Rinal told CILISOS. Translated from BM.

However, it wasn’t all sunshine and rainbow when they first entered the industry. Both Keem and Rinal‘s families were against the idea of joining the insurance industry. In fact, most of Keem’s friends felt like she had wasted her time studying PhD when they found out that she’s gonna end up as an insurance agent. Rinal’s friends, on the other hand, literally unfriended and unfollowed him on social media!

Truth be told… it wasn’t the easiest thing for them to switch to this field

Yea wei. Although this is a sponsored article, we still wanna be truthful to you guys. One thing we realised is that for anyone to thrive in this industry, they have GOT to be prepared for it. There are certain qualities that were apparent throughout all the people we spoke to: hardworking, enthusiastic, driven, and mentally strong.

Some of the insurance agents like Rinal and Ng actually told us that they didn’t really like to approach people to sell stuff. Keem had zero knowledge on insurance and financial planning before she joined the industry. So how then?

Not everyone is born a superstar hustler, so for most times, it all comes down to the training. Our sponsors, AIA, takes all their budding agents through the AIA’s Elite Academy and equips them with all sorts of skills. From learning about the law to medical conditions, growing a business to handling rejection, the module has what it takes to help you succeed in the line. (And that means either as a customer-facing agent, a business owner, or just working in other departments within the company.)

“When I came here (AIA), their training structure is good. They assume that we have no knowledge in insurance so they would train us until we become someone who knows everything (about insurance).” – Rinal. Translated from BM.

BTW, just a bonus point… as we mentioned earlier, AIA’s Elite Academy isn’t only limited for those who wants to be a life planner. If you wanna start your own business empire like Nurazam and Nicholas, then you can do so too! In fact, one famous business tycoon started off as an insurance agent with AIA!

Tan Sri Vincent Tan, who had worked as an insurance agent and was the youngest agency manager at AIA at that time, was equipped with necessary entrepreneurial skills which may have helped him to build his own business empire. His insurance agent career has somewhat became a stepping stone for him to be a successful businessman.

So, if you’re looking for a career change or wanna be the next Vincent Tan, it may not be a bad idea to join AIA 😉

- 8.2KShares

- Facebook7.8K

- Twitter17

- LinkedIn28

- Email53

- WhatsApp256