7 simple questions any Malaysian can ask 1MDB’s board :) [Update]

- 1.5KShares

- Facebook1.5K

- LinkedIn1

- Email3

- WhatsApp4

Before we begin, if you’re reading this and you’re still not very sure about what exactly 1MDB is, we highly recommend reading another article that we’ve written here.

If you’ve followed the news on 1MDB, you may have heard that its CEO, Arul Kanda Kandasamy, gave a breakdown of the RM42 billion debt of 1MDB.

In his statement, Arul Kanda shows us how much was invested in what. He shows us that the debt did indeed reach a total of RM42 billion (RM41.8 to be exact). He shows us that we owe people a lot of money. Then he says this.

“We trust this clarification will help to clear any confusion on this matter.” – 1MDB CEO, Arul Kanda, as quoted by The Malay Mail Online

So we know we owe a lot of money is involved, we know we have a lot of debt, and we know where all this debt is from. Unfortunately, for most of us, these numbers are just numbers. We don’t know what they mean, we don’t know how they affect us, and we sure don’t know what’s at stake.

So Arul Kanda’s answers mean nothing to most Malaysians. (Full disclosure: Arul Kanda was also the school captain at our editor’s college)

Tony Pua (the guy who first brought all of this to light) stated that the answers from Arul Kanda do nothing to quell our curiosity but raise more questions and suspicions. And we agree, because we at CILISOS want to ask more questions as well.

So here are 6 reaally basic questions that should be answered by 1MDB to the rakyat.

1. Has 1MDB made any real money?

First, let’s define the term “real money”. Well, it’s money that came from actually providing a sale or a service. Meaning that it earned something by providing value to someone else.

A couple of news articles have pointed out that while 1MDB has been posting profits in their annual reports, these have not been due to selling or providing anything but from revaluation. Revaluation is basically the process of increasing or decreasing the value of assets ‘in case of major changes in fair market value of the fixed asset’ (click to read more).

How much of an impact does the revaluation have on the profits? Well, The Star reports that (as of 2014) 1MDB’s profits for the last 2 years have mainly been due to revaluation of their assets.

“For instance in 2013, 1MDB recorded a net profit of RM778.24mil, helped largely by property revaluation gains of RM2.7bil.” – The Star

Okay, but what about other profits? Has 1MDB made profits from anything other than the revaluation of their assets? So we tried looking for documents that talked about 1MDB’s profits.

First we found that Arul Kanda stated that the company’s earlier venture with a Saudi Arabian company called PetroSaudi had earned them RM1.78 billion. But then Tony Pua said that this money never came back to Malaysia. You can read how Tony Pua talks about where this money went here. So no real money there.

Besides that, news portal Malaysiakini has tried to obtain the financial reports of 1MDB’s profits but all they got were reports saying that there were profits. But honestly, what we want to see is what the profits are!

And aside from these two, nothing else. So the point is that we still can’t find any profit that was, in a sense, real.

2. Why did 1MDB invest so much money when it was already in debt?

Before we go into that, let us just clarify something with ugaiz. Contrary to popular belief, 1MDB is not a Malaysian sovereign wealth fund.

According to investopedia.com, a sovereign wealth fund is usually formed when a nation has excess money. Instead of keeping this money in the central bank (i.e. Bank Negara), a sovereign wealth fund utilises the surplus via investments.

(Ironically our other sovereign wealth fund, Khazanah Nasional, also doesn’t refer to itself as a sovereign wealth fund so we’re not entirely sure that we actually have one.)

1MDB’s official website states a major difference between them and a sovereign wealth fund is that a sovereign wealth fund is funded by the gomen and invests on its behalf. On the other hand, 1MDB, while fully owned by the gomen, raises and invests its own capital.

But for a company that has to raise and invest its own capital, to be RM42 billion in debt is a crazeeee situation to be in. How in the world does anyone even end up with a RM42 billion debt when you start off with nothing? As we’ve just talked about, 1MDB is NOT a sovereign wealth fund and has to raise its own capital.

So the thing here is, 1MDB did not have any capital to begin with.

In regards to whether or not investments companies generally borrow to invest, we spoke to a guy who wants to be known as FreeLunch, (a former auditor whom we last spoke to here and whom now we owe 2 free lunches) and he had this to say.

“Most funds don’t take debt to invest. One of the Norwegian funds use profits from oil sales to invest globally on behalf of the government.

Funds like hedge funds accept money from individuals/corporations to invest, generally no debt. Private investment funds like those run by rich families take on surplus funds and use it to invest.” – FreeLunch

Which basically means that investment companies rarely if not never invest using debt. So why did 1MDB invest on debt?

3. Why everything involved with 1MDB either very cheap or very expensive?

See, it’s not just a question of how much debt this company has. It’s also about why the prices involved in every deal so gila extraordinary. And CILISOS isn’t the only one asking this question, okay. Check out what others have asked here, here, here, and here.

But allow us to just focus a bit more on the article by TK Chua (which we feel articulated these issues very well).

Basically, TK Chua mentions how the only things that was not overpriced were 1MDB’s more important assets were purchased for only RM1.7 billion (the lands in TRX, Bandar Malaysia and Penang which according to Tony Pua’s video, was sold cheap to them). However, these next few things were terribly overpriced.

- 1MDB purchased overpriced power plants at RM12-13 billion and these assets brought about an inherited debt of RM6 billion.

- 1MDB paid a 10 percent (RM4.5 billion) commission to this bank, Goldman Sachs which is a lot higher than the average industry commission

- There are these other investments (RM6.1 billion in Brazen Sky + RM4.2 billion in Aabar Deposit + RM5.1 billion in GIL Funds) that we know nothing of.

So if you wonder why your girlfriend/wife/mother spend soooo much money on yet another handbag, you should also feel the same way about this (if not more kancheong). All the numbers you read basically showed that 1MDB paid wayyyy more than it should have for many, many things.

But unlike your girlfriend/wife/mother’s comprehensible appreciation of fine Italian leather, this 1MDB thing just doesn’t make any sense and we want to know why.

4. Will 1MDB benefit the rakyat like investment companies of other countries?

On 1MDB’s website, it is stated 1MDB’s task is ‘driving the sustainable long-term economic development and growth of Malaysia’. It then goes on to say this.

“We are the master developer of the Tun Razak Exchange (TRX) which will be Kuala Lumpur’s first financial district upon completion. The 70 acre site TRX is being transformed into a world-class financial centre, only minutes away from the Petronas Twin Towers.

Similarly, we have acquired and intend to transform the land around the old Sungai Besi airport into a new urban mixed-use development that we envisage will serve as a benchmark for sustainable communities in the region.” – 1MDB’s website on its purpose.

To simplify, 1MDB basically has 2 big projects that vaguely describe how they will benefit Malaysia.

But how does that eventually flow down to the rest of the country?

But do sovereign wealth funds (or government investment companies since 1MDB is not a SWF) generally benefit the public? So we spoke to FreeLunch to help us understand sovereign wealth funds better.

He used the Norwegian Sovereign Wealth Fund as one illustration.

“The Norwegian fund which invests on behalf of the government then rolls some of the profits back to the country for public good like education, healthcare, roads etc.” – FreeLunch

So we went and checked this Norwegian SWF out. Lo and behold, the moment you open their website, you see a live counter showing you how much their fund is worth. Like quite literally rising every second.

So our hands also got itchy and we tried to do our own calculations of 1MDB.

If you took RM42 billion and divided it by the number of days it has been in existence (so between time of writing (11/6/2015) and when 1MDB was announced (22/7/2009, 2150 days), 1MDB has actually lost close to…

RM20 million a day

.

.

…..!!!

Anyway tell us if our calculation wrong la. #sorrymathsnotsogood

But that aside, we found out that they are a country very similar to Malaysia. Like Malaysia, Norway is a country that is petroleum rich and has used the revenue from oil to majukan their country. We won’t go into details about them but Norway’s fund website mentions this.

“The fund was set up to give the government room for manoeuvring in fiscal policy should oil prices drop or the mainland economy contract. It also served as a tool to manage the financial challenges of an ageing population and an expected drop in petroleum revenue.” – Norges Bank Investment Management’s official website (a bank that manages the fund on behalf of the Ministry of Finance, which owns the fund on behalf of the Norwegian people)

So the people of Norway actually know the purpose of their fund. It is to help aide their aging population. The people know (or at least are able to find out) what their country is investing in. They are even assured of how it will benefit them.

And we would like to know the same about 1MDB. We really would like to know how are 1MDB’s investments going to eventually benefit the nation and the people?

5. Who will be paying 1MDB’s debt if it goes bankrupt?

We can only dream that Malaysia has financial management at Norwegian levels. Alas all that we know now is that a government company owes people a lot of money. And that the debt doesn’t look like its going away anytime soon.

Thus, our next question to the 1MDB CEO is this: who bears the cost?

This was a press release by 1MDB last year (we talked about it in our first ever article about 1MDB) that said the gomen is not liable for 1MDB’s losses. Which is good right? Because the gomen’s money comes from us. But aside from being the record holder for world’s shortest Press Release, there’s an even bigget twist: THE PRESS RELEASE IS GONE!

No seriously… we checked.

In November 2014, Deputy Finance Minister, Ahmad Maslan, has said that the gomen has an explicit guarantee in 1MDB of RM5.8 billion. Meaning they agreed to pay ‘only’ RM5.8 billion of the debt if needed. This figure differs though, because it seems that he texted (yes he texted) another news portal saying this amount was USD3 billion.

But then this means we actually still don’t know who is responsible for the debt nor do we know how much is the gomen covering them for!!!

But the truth is, no one really knows who is the guarantor of 1MDB. But hear what our friend FreeLunch gave his opinion on the matter.

“If 1MDB goes bankrupt, it’s hard to say coz of the conflicting information. If it’s true that it’s government owned, then the government is liable for the debt, which at the end of the day, means you and me. ” – FreeLunch

He goes on to say that we may have to pay via credit, meaning that we repay more over a longer period of time. Just like a credit card. The problem with that is that the entities we owe money to pretty much have a lot of control over us.

“They may say things like “Ok, you owe me RM1 billion, no need to pay back lar, you give me ownership of your electricity plants/rice fields/oil reserves etc. and we call it even”. Terms like these look good because no cash repayment but very risky since with ownership of key assets, the grip on (our) balls becomes even tighter.” – FreeLunch

And that is something Arul Kanda has to answer. Who in Malaysia is going to bear the burden of this RM42 billion debt, and how in the world would said person go about it?!

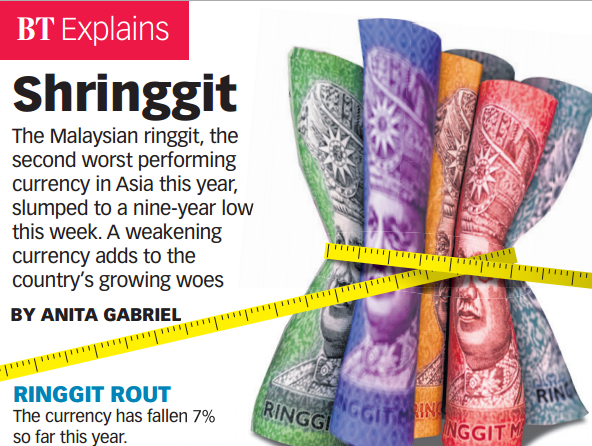

6. How to get rid of all the bad 1MDB press that is making our ringgit shringgit?

Unfortunately, you can’t charge foreign press with sedition – and it’s costing Malaysia dearly. If you haven’t heard, the value of the Ringgit is dropping considerably. A 9-year low to USD in fact.

Our second finance minister Datuk Seri Ahmad Husni Hanadzlah, recently said that if the issues surrounding 1MDB’s debt weren’t dealt with, our currency could drop to the levels from the 1997 Asian Financial Crisis. Some people have been crediting this to the 1MDB scandal scaring investors away from Malaysia.

“Although the NFP outcome and the resumption of US dollar appetite among traders would have pressured the ringgit, it is the reports of a scandal at a Malaysian state-backed fund that have accelerated the decline in the currency.” – Jameel Ahmad, chief market analyst at FXTM (an international forex broker), as quoted by The Sun

We had a look at how some international news portals perceived the Ringgit and we have to say, it’s not very good.

Damn sad la! Basically people don’t think very highly of Malaysia’s economy right now la. Hence, we would like to know what is 1MDB doing about it. Are they actively seeking to change this perception that people have of Malaysia?

7. Why take so long for investigators to find something wrong with 1MDB?

We believe that the story of 1MDB’s massive debts first came to light when Tony Pua talked about it back in November 2014. Public outcry has been steadily increasing since then and 1MDB is currently being audited by the Auditor-General (who initially said that there was no need to) while the police were conducting investigations of their own.

Since then, the PAC (Public Accounts Committee) has stated that the Auditor-General’s interim report will be out later this month (June). Oh and up till today, the police have said that they are still investigating.

But these answers do not tell us anything about the status of the investigations. The rakyat don’t know what exactly is being investigated, and thus we don’t know how long will it be before we have answers.

“What’s important to ask is WHAT is being investigated. If it’s just who’s signing the documents, very fast. If they know what names to look out for (e.g. Jho Low), also very fast.

If they just wanted to find out who is liable for the money in case of bankruptcy, the Ministry should be able to answer in a heartbeat. But if they don’t say what they’re looking for, then it’s hard to estimate how long they would take.” –FreeLunch

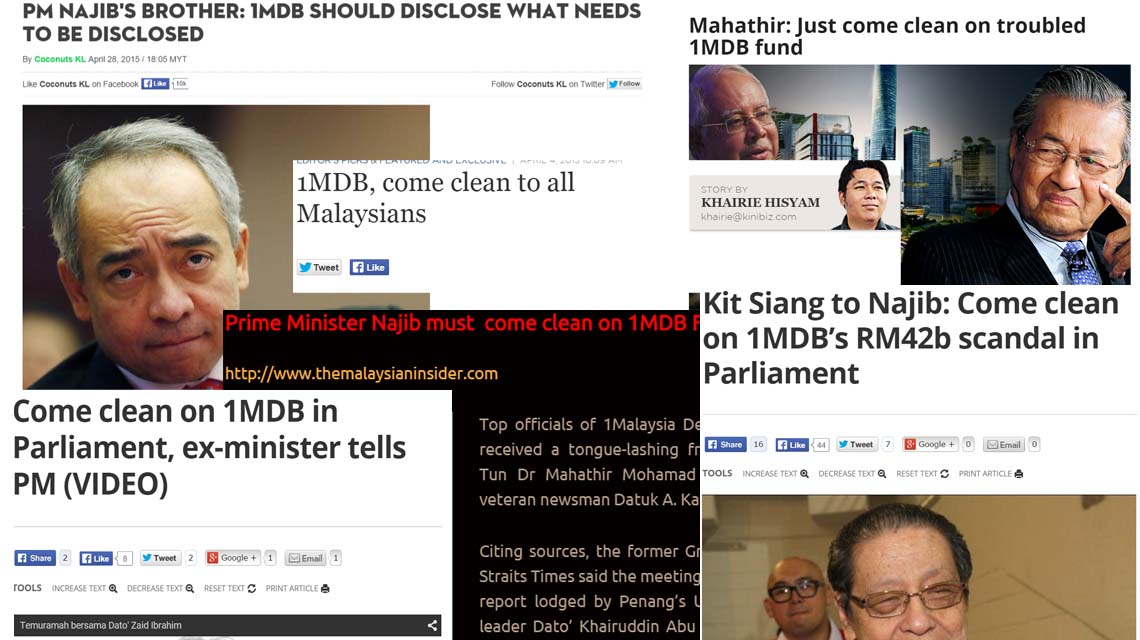

But really, all this can be avoided if 1MDB would just stop being so secretive with us all.

Would a little transparency be too much to ask for?

Sorry, we mean a lot of transparency. At this stage, 1MDB can only come clean to take steps to solve the situation. And we’re definitely not the only ones saying this.

So it’s not CILISOS‘ words when we say we want more transparency, it’s the words of many Malaysians who are very, very concerned about 1MDB and the country of Malaysia. And we highly doubt these questions are going to die down.

So 1MDB, would you please, please make this easier for all of us and answer some proper questions the next time you release a press statement?

[Update 12/11/15] Recently there was a lot of news going around about how Tony Pua of DAP was supposed to debate with 1MDB CEO, Arul Kanda. In the midst of all this, Tony Pua also released his own set of 10 QUESTIONS that he would ask Arul if they had the debate. And guess what? Arul Kanda said yes! Heck RTM also said that they would air the debate if it took place.

So what are we waiting for???

Supposed to la. Debate was cancelled because Tony Pua was on this committee (Public Accounts Committee) that was already investigating 1MDB, and gomen say that if he wanted to debate Arul Kanda he had to leave the committee.

Since then, Pakatan Harapan elected Rafizi Ramli to replace Tony Pua in the debate. But then, both RTM and Arul Kanda said that since it’s not Tony Pua anymore, then they dun wan the debate to jalan di.

So yea, more questions, but still waiting for answers. #hereshoping

- 1.5KShares

- Facebook1.5K

- LinkedIn1

- Email3

- WhatsApp4