Bank Negara released a study about how Malaysians are paid less for the same work

- 960Shares

- Facebook864

- Twitter8

- LinkedIn10

- Email18

- WhatsApp29

In the past week or so, there’s been quite a bit of hoohah over Bank Negara Malaysia’s (BNM) latest annual report. While in it is your usual stuff like GDP growth percentages and average inflation rates, one piece of detail from the report has polarised social media:

However, this article won’t be touching on the “fresh grad vs employer” debate that’s going on #sorrywedisappoint. Instead, when we took a look at the BNM report, we found a subsection detailing a pretty interesting statement – as a whole, Malaysian workers are not being paid enough.

Now we don’t mean this as in your typical ‘aiya boss ask overtime but never pay back’ kinda underpaid, we mean that according to the BNM, across all aspects of Malaysian industries, workers are being paid significantly less than what they should be.

Malaysia may be less productive than other nations cos we also pay workers less

Alright, so if you paid attention in your college economics class (congratulations, that makes one of us) feel free to click here and read the full BNM annual report yourself. But in traditional Cilisos fashion, we’re still going to try and simplify it for easier understanding for the Ah Chongs, Alis, and Muthus out there.

So in BNM’s report, there’s a subsection on page 35 called ‘Are Malaysian Workers Paid Fairly?: An Assessment of Productivity and Equity’, which is an article about – you guessed it – whether Malaysians are being paid fairly or not. It starts of simple enough, pointing out the ‘nationwide goal’ for Malaysia to reach a high-income nation status soon enough. But sadly, it also points out that a 2016 study found that over a quarter of KL households don’t earn enough for meaningful participation in society or for developing themselves. They then add that, as a whole, Malaysians aren’t earning enough in relation to the amount of value that they produce.

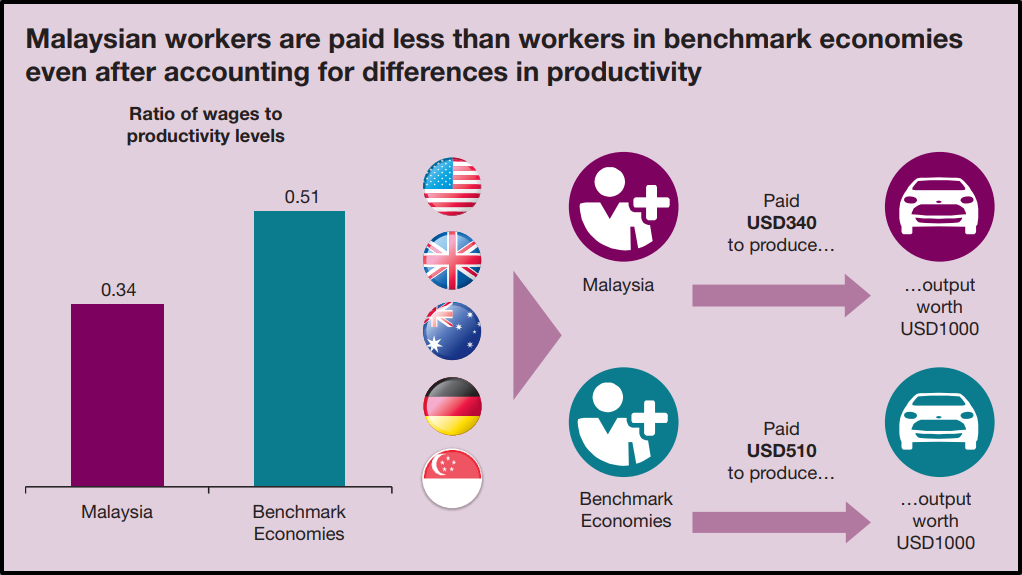

We know it’s getting a lil technical, but bear with us here kay. The general idea has been that countries who pay their workers more tend to get more productivity out of them. While some might argue that we’re being paid less cos we produce less, BNM found that when we compare the “pay-per-productivity” between us and developed countries, Malaysia is far behind when it comes to paying our workers fairly. So to get to that conclusion, economists basically have a standard amount of value produced and how much the worker is being paid for it, kinda like the Big Mac Index but less popular.

Here’s the example:

- In developed nations, for every USD1,000 of value created by a worker, that worker is paid USD510

- In Malaysia, for every USD1,000 of value created by a worker at his job, that worker is paid USD340

But being paid less than other countries is just one problem BNM found. Another issue they had was that…

Malaysian bosses put in less, but also pay their staff less

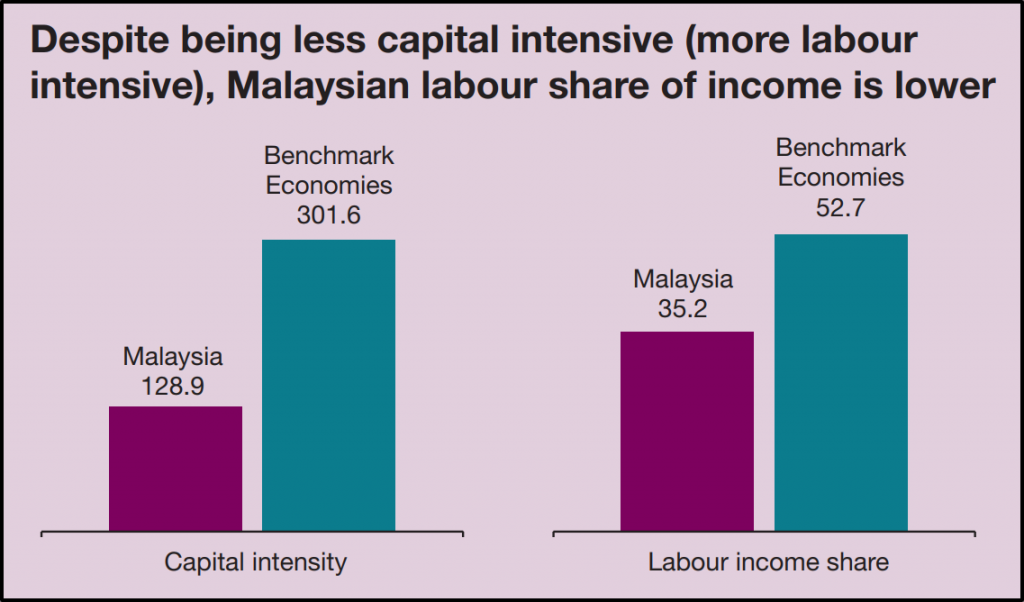

Okay so now we know that Malaysian workers are being paid less, but that’s not the only issue BNM points out. See, there’s also this thing called the ‘labour share of income’, which is basically a fancy way of saying the percentage of national income that is used to pay workers in the form of salary. Basically if the labour share of income is high for a country, it means that more of a country’s income is going to the workers who helped get said income.

However, BNM found that for Malaysia, we have a pretty low labour share of income. Sure, it’s technically been on the rise over the years, but that’s because we have more low-skilled workers affecting the data – and in any case, our labour share of income is still far behind the countries whose economies we’re trying to emulate.

Now here’s where BNM’s report gets even more damning. They introduce another term – ‘capital intensity’, which is basically how much funding and equipment is needed from the employers to carry out a business. In super simple terms, low capital intensity USUALLY means high labour share of income and vice versa. Mining for example needs a lot of expensive equipment from the company’s side, so the workers typically get a lower share of the income since the money has to be used by the company to buy and maintain the aforementioned mining equipment.

But, BNM discovered that across Malaysia, capital intensity is generally lower than most other nations, and yet Malaysia’s labour share of income is also lower than others! This is perhaps saying that while there’s less money going into the production process, the excess money isn’t exactly going into the salaries of those who are working either.

And while none of this makes for good news and may prompt some of us to seek better distribution of wealth, there are probably some who aren’t so convinced about BNM’s report just yet.

Can BNM’s report on underpaid Malaysians be trusted?

Going back to the BNM article, they defined productivity as “GDP per worker” – it seems to claim that workers aren’t being paid enough based on this GDP-per-worker figure. The problem tho is that the Gross Domestic Product (GDP) has been widely criticised in recent years for being outdated and no longer an accurate measure of economic growth.

For a start, it’s perhaps important to note that our GDP may be slightly inflated due to the nature of Malaysia’s economy. Malaysia is still quite a resource-based economy, meaning to say that its GDP may be significantly affected when stuff like oil prices rise and dip.

One could very much make the argument that the “pay-per-productivity” for Malaysian workers would be a lot better during an oil price crash, seeing as that would mean our GDP is lower. As such, that could alter the GDP-per-worker levels to be a lot more in line with the pay that Malaysians are getting. On the flip side of the coin, one could also say that the GDP for this year has been low enough to alter the results – to the point where BNM’s data isn’t showing the full extremes of how badly paid we are.

And then of course, some might argue that it was unfair for BNM to measure us against well developed nations such as Singapore, Australia and Germany. In some cases, when compared to neighbours in our region like Thailand, we’re doing better in terms of labour share of income. But of course, as the BNM article states in the beginning, Malaysia has high hopes of reaching the ‘high-income nation’ status, so one could argue that it’s only fair we pit ourselves against the top nations then.

But to be fair to BNM tho, GDP remains one of the most widely used methods of determining economic activity and is still one of the best indicators when it comes to tracking the economic health of a nation. Furthermore, it’s hard to say that BNM’s claims aren’t good for the people – if anything, they seem to be doing their job in highlighting issues with the economy and to advise the govt on the problems that plague the nation, which in this case appears to be the low pay of workers.

You may be complaining that the govt might tax stuff like Netflix soon, but for 1 in 3 Malaysians, things such as having to live paycheck to paycheck are a bigger concern. By BNM’s estimates, a single adult needs at least RM2,700 a month just to survive in KL, which is two and half times the national minimum wage. Heck, even Mahathir recently called for employers to pay their staff better.

In a country so rich from natural resources, it’s perhaps quite a shame that many Malaysians are still unable to get a slice of the pie.

- 960Shares

- Facebook864

- Twitter8

- LinkedIn10

- Email18

- WhatsApp29