Got HACKED? Malaysian banks have a quick solution in your banking app

- 79Shares

- Facebook68

- Twitter2

- LinkedIn1

- Email1

- WhatsApp7

We all share the same experience of always getting spam messages and fake links. For example, the classic POS Malaysia address scam:

Unfortunately… sometimes we accidentally click on them, which might leave our personal information or even our entire phone vulnerable to hackers. At worst, these link may automatically download a file that allows someone to access your phone and passwords.

And if you have your banking apps on that phone, that’s going to be a huge problem.

Luckily, banks in Malaysia have a security feature commonly known as a Kill Switch (name could vary depending on the bank) that allows you to temporarily disable your bank accounts quickly.

Why do banks have a Kill Switch?

In Malaysia, 19,165 cases of online banking fraud involving RM94.6 million were reported by customers of financial institutions in the second half of 2022, up from the 9,735 cases totaling RM39.9 million reported in the first half of the year.

In 2022, Bank Negara Malaysia had announced five additional safeguards against financial scams. By the end of that year, OCBC was the first bank in Malaysia to launch the kill switch feature. Followed by CIMB and Maybank in January 2023. The main purpose of the feature is to enhance the bank’s online security.

The feature helps victims of scams and frauds prevent further losses by disabling their accounts and cards. Did you know that there were 14,490 cases of online fraud in first half of 2024, with losses exceeding RM581 million?!

Banks have different names and features for their Kill Switch. For example, AmBank calls the feature a Kill Switch, whereas CIMB calls it Lock Clicks ID.

So if you think that your account has been compromised, ENABLE THE KILL SWITCH.

Here’s how to do it on Maybank, using the MAE app or Maybank2u website…. because we only have Maybank to try it on.

How to deactivate your M2U access via MAE app:

Step 1: Log in to your M2U app, look for Kill Switch under quick actions. Click on Kill Switch.

After clicking on the Kill Switch feature, you will notice two options:

Block Credit Card allows you to deactivate your credit card so no one else can use it. This option should be selected if you believe that someone has your credit card details and are using it to make transfers or perform transactions that aren’t made by you.

Deactivate M2U Access will protect your account by temporarily blocking all login attempts via web and app. You will also not be able to perform online transactions via Maybank2u.

Step 2: Select Deactivate M2U Access.

Step 3: Click Deactivate now.

Step 4: Approve the Secure2u authorisation.

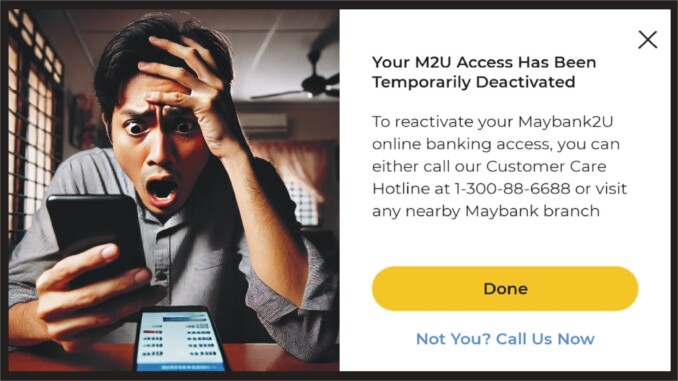

Step 5: You’ve now temporarily deactivated your Maybank2u!!

Step 6: You will receive notifications from the app as well as a confirmation sms.

How to activate Kill Switch via Maybank2u Website:

Step 1: Log in to www.maybank2u.com.my

Step 2: Go to ‘SETTINGS’

Step 3: Click ‘SECURITY’ and select ‘Kill Switch’

Step 4: Select the feature you would like to block or deactivate

Step 5: Read the terms and authorise the transaction via Secure2u

If you are unable to access the Kill Switch, and suspect that your banking details have been compromised, you should immediately contact Maybank for assistance via their 24/7 Fraud Hotline at 03-5891 4744 or MGCC Hotline at 1-300-88-6688.

Here’s what you can and can’t do after deactivating your M2U

To make things more interesting, we decided to test out the effects of the Kill Switch on our M2U access. Here’s how it went…

- you will be completely locked out of your MAE app and Maybank2u website.

- Any form of online transactions will not be possible. For e.g: transferring money out

- you can perform in-person transactions using your cards. For e.g: paying for your groceries in-store using cards (unless you also deactivated your credit/debit card)

- You will still be able to receive funds into your account.

So let’s assume that the emergency is over. It’s time to get back your accounts.

Here’s how to recover your bank accounts!

There are two ways to disable the Kill Switch and get back your accounts. The first and probably the most straight forward way is to go to the nearest Maybank branch and then speak to a consultant there to reactivate your accounts.

The second way is through calling Maybank Group Customer Care (MGCC). Because we decided to get back our accounts via call, here’s a step by step guide to help make things less complicated…

Enabling your accounts via call (MGCC):

Step 1: Call MGCC at 1-300-88-6688.

Step 2: There’s no dedicated option for Kill Switch, so select the Maybank2u option (#4)

Step 3: Choose to speak to a consultant (#0)

Step 4: They will ask for your IC number.

Step 5: They will ask for the last 4 digits of your debit card.

Step 6: Answer the verification questions.

Step 7: Once verified, your account will be reactivated. Reactivation is immediate.

Step 8: Set up your M2U app again. (like you would a new phone)

Step 9: If you think your account had been compromised earlier, it is best to change your password.

Here’s a list of banks with Kill Switch

If you need more information on Maybank’s Kill Switch you can visit their site to find out more. For other banks, here are their respective websites that will take you straight to the information you need:

- Affin Bank

- AmBank

- Bank of China – for personal banking

- Bank of China – for corporate

- Bank Islam

- CIMB Bank

- Hong Leong – Click on Security, then Emergency Lock to find out more.

- HSBC Bank

- OCBC Bank

- Public Bank

- RHB Bank

- Standard Chartered

- UOB Malaysia – Click on the link and then go under Fraud Reporting. It will tell you how to enable the Kill Switch.

Now that you’re all prepped up, remember to stay safe and stay vigilant!

- 79Shares

- Facebook68

- Twitter2

- LinkedIn1

- Email1

- WhatsApp7